TIDMBMS

RNS Number : 1667G

Braemar Shipping Services PLC

09 May 2011

BRAEMAR SHIPPING SERVICES PLC

9 May 2011

Preliminary results for the year ended 28 February 2011

Braemar Shipping Services plc ("Braemar", "the Company" or "the

Group"), a leading international provider of broking, consultancy,

technical and other services to the shipping and energy industries,

today announces full year results for the year ended 28 February

2011.

FINANCIAL HIGHLIGHTS

-- Revenue GBP126.1m (2010: GBP119.0m)

-- Pre-tax profit before amortisation GBP14.8m (2010:

GBP15.0m)

-- EPS before amortisation 53.84p (2010: 53.22p)

-- Cash at 28 February 2011: GBP25.6m (28 Feb 2010:

GBP27.9m)

-- Final dividend 17.0p per share (up 5%), full year 26.0p

(2010: 25.0p) up 4%

-- 8(th) successive year that the Company has increased its

dividend

OPERATIONAL HIGHLIGHTS

-- Purchase of the business and certain assets of BMT Marine and

Offshore Surveys Limited

-- Shipbroking profits 7% ahead

-- Successful consolidation and relocation of our businesses in

Singapore

-- Integration and re-branding of our technical services

businesses with an improved outlook for the year ahead

-- Estimated forward order book deliverable in 2011/12 - GBP23m

[US$36m] (2010/11 - GBP28m [US$42m])

Commenting on the results and outlook, Sir Graham Hearne,

chairman of Braemar Shipping Services plc, said:

"Our markets in shipping and oil and gas services have had a

turbulent year and against this backdrop the performance of the

Group has been robust.

Braemar, across all divisions, is a first-class company and

among the leaders in its various markets; it is this that underlies

my confidence that Braemar will continue to play a leading role in

the markets in which it operates."

ENDS

For further information, contact:

Braemar Shipping Services Tel +44 (0) 20 7535 2650

Alan Marsh Tel +44 (0) 20 7535 2881

James Kidwell

Pelham Bell Pottinger Tel +44 (0) 20 7861 3139

Damian Beeley Tel +44 (0) 20 7861 3961

Zoe Pocock

Elaborate Communications Tel +44 (0) 1296 682356

Sean Moloney

Arbuthnot Securities Limited Tel +44 (0) 20 7012 2158

Nick Tulloch Tel +44 (0) 20 7012 2106

Henry Willcocks

Notes to Editors

Braemar Shipping Services plc is a leading international

provider of broking, consultancy, technical and other services to

the shipping, marine and energy industries. The business is

organised into the following segments: Shipbroking, Technical,

Logistics and Environmental.

It is listed on the Official List of the London Stock Exchange

in the Industrial Transport sector.

Principal businesses:

Shipbroking

Braemar Seascope provides chartering, sale and purchase and

consulting shipbroking services to international ship owners,

charterers and financial institutions operating in the tanker, gas,

chemicals, offshore, container and dry bulk markets. There are

shipbroking offices in the UK, China, Australia, Singapore, India,

Italy and Monaco.

www.braemarseascope.com

Technical

Braemar's Technical division provides a range of specialist

marine services to the maritime sector and includes:

Braemar Steege: Specialist loss adjusting and other expert

services to the energy (oil and gas), marine, power and other

related industrial sectors. It has offices in London, Houston,

Singapore, Calgary, Lima, Mexico City and Miami.

www.braemarsteege.com

Braemar Falconer: specialised marine and offshore services. It

has offices in the UK, Australia, China, India, Indonesia,

Malaysia, Singapore and Vietnam.

www.braemarfalconer.com

Wavespec: consultant marine engineering and naval architecture

services to the shipping and offshore markets. A new office in

Houston was opened in 2009.

www.wavespec.com

Logistics

Cory Brothers Shipping Agency provides port agency, freight

forwarding and logistics services within the UK and Singapore.

www.cory.co.uk

Environmental

Braemar Howells provides pollution response and advisory

services primarily in the UK and Africa and is continuing to

develop an international presence.

www.braemarhowells.com

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 28 FEBRUARY 2011

CHAIRMAN'S STATEMENT

Overview

Our markets in shipping and oil and gas services have had a

turbulent year and against this backdrop the overall performance of

the Group has been robust. This is testament to the quality of our

employees, their experience, and their ability to respond in a

challenging environment. Group revenues grew 6% to GBP126.1m;

pre-tax profits before amortisation were GBP14.8m compared with

GBP15.0m in 2009/10 and pre-tax profits after amortisation were

GBP13.2m compared with GBP13.5m in 2009/10. Basic earnings per

share (EPS) were 48.41p (2010: 47.93p) and EPS excluding

amortisation were also similar to last year at 53.84p (2010:

53.22p).

We saw the continuation of the global economic recovery during

the financial year and this was particularly strong in Asia.

Alongside that shipping continues to enjoy a growth in demand for

raw materials which has provided good support to the dry bulk

sector, despite the delivery of new tonnage. Similarly the tanker

market is being sustained by growing oil demand from the East at a

time when the economies in the United States and Europe remain

sluggish.

Asia

For some years we have been building our presence in Asia which

has become the world's most important region for international

shipping. This year we successfully consolidated all our businesses

in Singapore which now employs 110 staff in a single office. From

this base we are expanding in the region, particularly in

shipbroking where we have opened new tanker chartering and sale

& purchase broking desks. One of our executive directors, Denis

Petropoulos, has relocated to Singapore to lead this important

development.

Operations

Over the past few years we have acquired a number of

complementary technical businesses. We are announcing today the

integration and re-branding of these businesses under a common

name, Braemar Technical Services, with a geographic management

structure. This will support the marketing of our marine surveying,

engineering, energy loss-adjusting and consulting disciplines to

our international client base and consequently reinforces the

leading market position we have in this division.

We are also pleased to announce today the purchase of the

business and certain assets of BMT Marine and Offshore Surveys

Limited for a cash consideration of GBP2.4m. The businessprovides

hull and machinery, P&I and Marine Warranty survey services

around the globe; clients operate primarily in the insurance,

shipping and offshore industries. In its last financial year it

reported normalised EBITDA of GBP0.9 million. This acquisition

enables our Technical division to deliver a truly global service to

our clients.

Dividend

I am pleased to announce that the Directors are recommending for

approval at the Annual General Meeting a final dividend of 17.0

pence per ordinary share (an increase of 5%), to be paid on 27 July

2011 to shareholders on the register at the close of business on 1

July 2011. Together with the 9.0p interim dividend, the Company's

dividend for the year will be 26.0 pence (2010: 25.0 pence), a rise

of 4%. The dividend is covered 1.86 times by earnings. This is the

eighth year in succession that the Company has increased its

dividend.

Board changes

During the year, Alastair Farley was appointed to the Board,

bringing with him a wealth of experience in the shipping

industry.

Richard Agutter will retire from the Board later this year

having completed over nine years of service. I would like to thank

him for his outstanding contribution over the years.

Outlook

While economists and politicians continue to debate the speed

and extent of the recovery, both in the UK and globally, we are

well placed in our major markets and enter the new financial year

with a healthy pipeline of business. Our estimate of the

shipbroking forward order book deliverable over the course of the

financial year 2011/12 stands at GBP23 million (US$36 million)

compared with GBP28 million (US$42 million) at 1 March 2010. We

also expect to see an improvement in the performance of our

Technical division in the coming year.

Braemar, across all divisions, is a first-class company and

among the leaders in its various markets. On behalf of the Board, I

would like to express our thanks to all our staff throughout the

world for their commitment over the past year; it is this that

underlies my confidence that Braemar will continue to play a

leading role in the markets in which it operates.

Sir Graham Hearne

9 May 2011

CHIEF EXECUTIVE'S REVIEW OF THE BUSINESS

Overview

The Group's strategy is to maintain and grow its international

marine and energy services businesses.

Braemar is a people business built on the quality and

professionalism of its staff and the strength of its client

relationships. We have always made a substantial commitment to

recruitment and training. I am delighted that many of our recruits

have developed into skilled professionals and we are able to send

them to parts of the world that do not have the same pool of

available talent, where they can put their high level of

professionalism to effective use.

Our global network of offices provides a strong platform from

which to serve our clients. Over the past 12 months all over the

world we have all seen incidents or sudden changes in

circumstances, not least the BP Macondo incident, the earthquake

and tsunami in Japan and the recent political turmoil sweeping

North Africa and the Middle East. It is our job to help our clients

respond to such events, which we do with shipbroking as well as

with bespoke shipping research, marine surveying, loss-adjusting

and engineering consulting.

Divisional review

1. Shipbroking - Braemar Seascope

Shipbroking profits (before amortisation and tax) were up 7% in

a year when global freight rates have been turbulent.

On 1 March 2010 the Baltic Dry Index stood at 2,760 and by the

end of our financial year (28 Feb 2011) it was 1,251 having reached

a high of 4,209 on 26 May 2010 and a low of 1,043 on 4 Feb 2011.

The average for that period was 2,497 and on 6 May 2011 it stood at

1,314.

Freight rates in the cape market were constrained by the

continuous additions to the fleet and in our final quarter the high

volume of coal shipments from Queensland, Australia was

significantly disrupted by high cyclonic rainfall which damaged the

mines and rail infrastructure to the ports. Supramax and handysize

markets were remarkably resilient and steady, with little

volatility in either the Atlantic or the Pacific basin. Underlying

cargo demand remains strong but freight rates are being suppressed

by the effect of new tonnage, and freight futures indicate that the

market will remain soft. Our Dry Cargo teams in Australia and India

have had a strong year with good support from the offices in

London, Beijing and Singapore.

The influx of new tanker tonnage to the fleet continues to have

an adverse effect on chartering rates. Commissions are being

impacted by lower freight rates but we are pleased to see an

increase in our volume of transactions, largely offsetting the

lower rates. Our strategy of developing business with China and

India has been beneficial and we have concluded significant VLCC

business with both countries.

The refined-products shipping markets are also suffering from an

over-supply of tonnage but volumes remain good. Since the terrible

events in Japan, product distribution has grown, particularly in

the larger sizes, and the added tonne miles have resulted in

greater activity both for our London and Singapore offices.

The crude oil price has risen sharply as both Chinese and Indian

demand continues to grow. The unrest in Libya and other recent

tension in the Middle East, combined with the increase in demand,

have made both crude and refined oils the currency of speculators,

with traders anticipating further price spikes. This has had a

direct impact on the cost of fuel oil used as bunkers, which is now

some US$200 per tonne higher than last year, putting pressure on

owners' returns. This, in turn, means the repayment of the capital

cost of the asset comes under strain, placing further pressure on

owners to consider their strategy. Our dedicated projects section

is often involved in assisting clients in those strategic

discussions and as a result our period charter book continues to

remain strong.

Our specialist chartering teams both in chemicals and liquid

petroleum gas (LPG) have extended and added further contracts with

large clients resulting in both desks ending this year ahead of the

one before. It is also encouraging that the LPG physical product

broking section has grown its client base and continues to be a

valuable addition to the division.

The liquid natural gas (LNG) market is maturing and many power

projects have now been completed or are nearing completion, and the

vessels delivered ahead of the completion of these projects have

been absorbed. This has meant that freight rates are now at a level

which returns a profit, although many owners have some way to go to

make up for earlier losses suffered in previous thin markets. We

have been active in this sector during the year particularly in the

provision of consulting services.

The market for offshore supply vessels was relatively subdued in

2010, but the rising oil price is stimulating drilling activity and

investment, which we expect will lead to higher demand and better

vessel use. Our offshore team, based in London, Aberdeen and

Singapore has had a good year both for chartering and project

business.

The process of inventory re-stocking during 2010 by many

businesses fuelled a resurgence in demand for container tonnage in

a quest for market share and further gains on profitable routes.

The competition for market share caused a rapid increase in charter

rates although the subsequent additional tonnage being pushed into

the market ultimately put more pressure on freight rates, which

have been steadily falling over the past quarter. Our chartering

team has succeeded in transacting a good level of longer term

business during this period.

The container sale and purchase market remains extremely tight,

with sales candidates limited and prices very firm, due to the

number of competing buyers. As a result we have seen increasing

newbuilding activity and it seems likely this will remain a focus

for the main players in the coming months.

Over the past year second-hand vessel values and newbuilding

prices have been generally stable in most ship categories and our

team has conducted a good level of business both in the wet and dry

sectors.

The worldwide volume of demolition business has been lower than

expected, partly due to the closure of yards in Bangladesh for some

of the year, but our share remains high and demolition is an

important aspect of the full service we provide.

Our newbuilding activity has been surprisingly resilient

particularly with Chinese and South Korean yards which for the most

part have order books covering the next three years. During the

year we established new sale and purchase desks in Singapore and

Monaco which allows us to serve an extended client base.

2. Technical

We are reorganising the companies in our Technical division to

operate as a single unit, which will give a greater ability to

market all of the technical services we offer to our clients across

the world. This will be rolled out over the coming quarter and as

part of the process we are re-establishing the business along

geographical lines with two regional sub-divisions in the Far East

and the West.

The financial results for the Technical division did not meet

our full expectations due to lower than anticipated activity in the

new ventures of cargo loss adjusting and Wavespec's consulting

business in Houston, both of which have yet to achieve

profitability. However, the division has begun the new financial

year well and we expect a better overall performance for the

year.

Our marine engineering and marine surveying business (Braemar

Falconer) posted higher revenue compared to the previous year with

the offices in Singapore, Malaysia, Vietnam and Indonesia all

performing well. Regional rig move and drilling activity in the Far

East picked up during the year and this trend is expected to

continue in 2011. Marine warranty surveys, the main revenue stream

of the group, also grew by 20%. Revenue from China operations

lagged behind during the year although the second half showed an

improvement. The outlook for 2011 for the group is good and so far

the year has begun well with opportunities for growth in

geotechnical services and work from deep water drilling

activity.

Our energy loss adjusting business (Braemar Steege) performed in

line with expectations. Claims activity in the energy sector was

below average throughout the year as most oil and gas exploration

and production areas were not affected by natural disasters.

Activity levels in the Gulf of Mexico dropped significantly

following the BP Macondo incident and it will be some time before

projects start moving again. Despite the magnitude of this

incident, the impact on the insurance industry has been less than

expected because of lower insurance cover. Activity in other deep

water areas such as West Africa and Brazil has increased as

investment has been transferred from the Gulf of Mexico. Braemar

Steege has responded by establishing a new office in Rio do Janeiro

and making greater use of the group's connections in Nigeria. The

Singapore office continues to grow from strong regional activity in

Asia and Australia, where access to group resources throughout the

region is also supporting development. Instructions on expert

witness cases remain steady and provide a good source of income

while new energy claims are low.

The financial year was challenging for the marine engineering

and naval architecture consulting business (Wavespec). They are

pre-eminent in LNG supervisory and consulting work, but over the

last two years very few LNG carriers have been ordered. In Houston

this was compounded by the discontinuance of several projects that

the office was advising on and by the reaction to the BP Macondo

incident in April 2010 which stopped all work in the Gulf of

Mexico. Looking forward to 2011-12 we are starting to see a

recovery in LNG carrier construction both in terms of orders placed

and expressions of interest. In addition, the burgeoning activity

for Floating Storage and Re-gasification Units (FSRUs) and

improvements in the offshore sector point to increased demand for

the skill-sets in both the UK and US offices.

The economic environment in the US slowed the growth of our new

cargo claims arm (Braemar Marine) which also has a presence in the

UK and the Far East. As a consequence the division was absorbed

into Braemar Falconer and has been restructured subsequent to this

re-branding. In recent months a better base has been established

from which to build.

3. Logistics - Cory Brothers

Cory Brothers returned to Cardiff this year by opening a new

office for its Agency and Logistics businesses just a short

distance from where the company was founded in 1842 and

subsequently earned the right to use the Welsh Dragon as its

logo.

Revenues in the Logistics division grew by 10% with forwarding,

one-off projects and liner all contributing. Prospects are

promising for the new financial year with an expected increase in

activity from several major clients and projects on the back of

business won in this year.

Port Agency continues to maintain its leading position within a

depressed UK market, handling approximately 8,500 port calls

annually (including hub managed calls). As anticipated,

ship-to-ship operations activity continued throughout the year and

are expected at least to maintain their volume in the current year.

During 2010, Agency entered into agreements with a number of

customers for the use of its highly-respected operational system

"ShipTrak".

Overseas activity increased with the Singapore office performing

well with increased volume. The establishment of new partnerships

in Brazil and Gibraltar will serve to develop the global Cory

brand.

4. Environmental - Braemar Howells

The weak UK economy and Government spending cuts constrained

activity in the domestic market. However, in the latter part of the

year the industrial services arm successfully undertook two large

tank cleaning contracts and was also involved in a clean-up

response for an oil spill. Looking ahead, the International

division is gaining more enquiries and three new international

projects are due to commence in the first quarter of the new

financial year. These will be serviced by the company's versatile

and multi-skilled workforce.

Colleagues

Everyone across the Group has worked very hard throughout the

year, with skill and commitment second to none, and I wish to thank

them all sincerely for their contribution.

Alan Marsh

6 May 2011

Financial Review

Key divisional statistics

2011 2010 2009 2011 2010 2009

-------------- -------- -------- -------- -------------- -------- -------- --------

Shipbroking GBP'000 GBP'000 GBP'000 Technical GBP'000 GBP'000 GBP'000

Revenue 61,646 57,362 60,409 Revenue 22,621 22,697 21,193

Operating

profit Operating

before profit before

amortisation amortisation

and central and central

costs 14,309 13,324 14,990 costs 1,319 2,325 4,156

Operating Operating

profit profit

margin 23.2% 23.2% 24.8% margin 5.8% 10.2% 19.6%

Employee Employee

numbers 288 272 218 numbers 222 202 178

-------------- -------- -------- -------- -------------- -------- -------- --------

Logistics Environmental

Revenue 35,119 31,899 40,797 Revenue 6,749 7,066 4,745

Operating

Operating profit

profit /(loss)

before before

amortisation amortisation

and central and central

costs 1,230 1,434 1,130 costs 271 614 (165)

Operating Operating

profit profit

margin 3.5% 4.5% 2.8% margin 4.0% 8.7% (3.5%)

Employee Employee

numbers 232 235 232 numbers 60 62 60

-------------- -------- -------- -------- -------------- -------- -------- --------

Group revenue increased by 6% with a similar gross margin of

76.3% and an operating margin before amortisation of 11.5% (2010:

12.1%). Operating profits in Technical were lower, principally due

to the new cargo loss adjusting activities and Wavespec's

consulting arm in Houston which have not yet reached

profitability.

Operating costs (excluding amortisation) increased by 6.8%

mainly due to an increase in staff numbers, a full year of activity

from new and acquired businesses along with the effect of foreign

exchange on the translation of overseas costs and office relocation

costs in Singapore. We have continued to invest in our staff, and

have continued to recruit and headcount has increased to 802 of

which 305 are based overseas.

Foreign exchange

Over the year the US dollar weakened against most G20 currencies

and the average rate of exchange for US dollar-denominated

shipbroking earnings was $1.57/GBP (2010: $1.55/GBP). At 28

February 2011 the balance sheet rate for conversion was $1.63/GBP

(28 February 2010: $1.52/GBP) and the Group held forward currency

contracts to sell $13.0 million at an average rate of $1.57/GBP and

a variable forward window agreement to sell US$1.0 million per

month with upper and lower limits of $1.4885 - $1.6510 between the

months March 2011 and February 2012. During the year ended 28

February 2011, the Group recognised in the income statement a

foreign exchange gain of GBP0.7 million that had been deferred at

28 February 2010.

Taxation

The effective rate of tax for the Group was 25.6% (2010: 28.2%).

The improvement in the rate relative to the prior year is due to

the mix of overseas profits, prior year over provisions and lower

non-deductible expenditure. The provision for deferred tax is

calculated using the reduced UK corporation tax rate of 27%. The

further reductions from 27% to 26% together with the three further

annual 1% cuts to 23% by April 2014 that were announced on 23(rd)

March 2011are expected to reduce the rate in future years.

Balance sheet

Net assets at 28 February 2011 amounted to GBP64.8 million

(2010: GBP59.1 million). Goodwill of GBP30.0 million mostly relates

to our shipbroking business. Net current assets were GBP23.0

million within which the staff bonus represents the most

significant liability and the majority of this was paid subsequent

to the end of the company's financial year. There were no

acquisitions during the year and there is a deferred consideration

of GBP0.4 million (2010: GBP1.9 million) relating to acquisitions

in previous years, most of which will be paid in cash during

2011/12.

Cash flow

The Group generated GBP7.3 million (2010: GBP11.0 million) of

cash from operating activities during the year, after tax payments.

This was used to make deferred consideration payments relating to

previous acquisitions amounting to GBP1.3 million, capital

expenditure of GBP1.5 million and dividend payments of GBP5.1

million. Capital expenditure includes costs associated with fitting

out the new office in Singapore. Cash balances were GBP25.6 million

at the end of the year (28 February 2010: GBP27.9 million) and

there was no debt.

James Kidwell

6 May 2011

Braemar Shipping Services PLC

Audited Consolidated Income statement for the year ended 28

February 2011

28 Feb

28 Feb 2011 2010

Continuing operations Notes GBP'000 GBP'000

---------------------------------------- ------ ------------ ---------

Revenue 3 126,135 119,024

Cost of sales (29,897) (28,094)

---------------------------------------- ------ ------------ ---------

96,238 90,930

Operating costs

------------ ---------

Operating costs excluding amortisation (81,744) (76,550)

Amortisation of intangible assets (1,565) (1,480)

---------------------------------------- ------ ------------ ---------

(83,309) (78,030)

Operating profit 3 12,929 12,900

Finance income 177 193

Finance costs (14) (2)

Share of profit from joint ventures 103 400

Profit before taxation 13,195 13,491

Taxation (3,378) (3,806)

Profit for the year 9,817 9,685

---------------------------------------- ------ ------------ ---------

Attributable to:

Ordinary shareholders 9,802 9,655

Non-controlling interest 15 30

Profit for the year 9,817 9,685

---------------------------------------- ------ ------------ ---------

Earnings per ordinary share 5

Basic - profit for the year 48.41p 47.93p

Diluted - profit for the year 47.43p 47.26p

Audited Consolidated Statement of comprehensive income

28 Feb 2011 28 Feb 2010

GBP'000 GBP'000

----------------------------------------------- ------------ ------------

Profit for the year 9,817 9,685

Other comprehensive income / (expense)

Foreign exchange differences on retranslation

of foreign operations 977 (164)

Cash flow hedges - net of tax (179) 703

Total comprehensive income for the

year 10,615 10,224

----------------------------------------------- ------------ ------------

Attributable to:

Equity holders of the parent 10,600 10,194

Non-controlling interest 15 30

Total comprehensive income for the

year 10,615 10,224

----------------------------------------------- ------------ ------------

Braemar Shipping Services PLC

Audited Consolidated Balance sheet as at 28 February 2011

As at As at

28 Feb 11 28 Feb 10

Assets GBP'000 GBP'000

------------------------------------- ---------- ----------

Non-current assets

Goodwill 30,006 28,740

Other intangible assets 2,777 4,247

Property, plant and equipment 6,813 6,510

Investments 1,694 1,485

Deferred tax assets 1,797 1,208

Other long-term receivables 238 169

------------------------------------- ---------- ----------

43,325 42,359

Current assets

Trade and other receivables 40,741 36,918

Derivative financial instruments 314 -

Restricted cash - 5,521

Cash and cash equivalents 25,634 27,930

------------------------------------- ---------- ----------

66,689 70,369

Total assets 110,014 112,728

------------------------------------- ---------- ----------

Liabilities

Current liabilities

Derivative financial instruments - 571

Trade and other payables 41,062 41,706

Current tax payable 2,379 3,346

Provisions 267 288

Client monies held as escrow agent - 5,521

------------------------------------- ---------- ----------

43,708 51,432

Non-current liabilities

Deferred tax liabilities 1,271 2,001

Provisions 217 168

------------------------------------- ---------- ----------

1,488 2,169

Total liabilities 45,196 53,601

Total assets less total liabilities 64,818 59,127

------------------------------------- ---------- ----------

Equity

Share capital 2,110 2,108

Share premium 11,077 11,014

Shares to be issued (3,275) (3,198)

Other reserves 26,323 25,525

Retained earnings 28,424 23,534

------------------------------------- ---------- ----------

Group shareholders' equity 64,659 58,983

Non-controlling interest 159 144

Total equity 64,818 59,127

------------------------------------- ---------- ----------

Braemar Shipping Services PLC

Audited Consolidated Cash flow statement for the year ended 28

February 2011

28 Feb 2011 28 Feb 2010

Notes GBP'000 GBP'000

----------------------------------------- ------- ------------ ------------

Cash flows from operating activities

Cash generated from operations 6 12,280 15,278

Interest received 177 193

Interest paid (14) (2)

Tax paid (5,164) (4,421)

Net cash generated from operating

activities 7,279 11,048

----------------------------------------- ------- ------------ ------------

Cash flows from investing activities

Dividends from joint ventures - 406

Acquisition of subsidiaries, net

of cash acquired (1,293) (2,793)

Purchase of property, plant and

equipment (1,549) (1,394)

Proceeds from sale of property, plant and

equipment 43 59

Purchase of investments (94) -

Other long term assets (69) 7

Net cash used in investing activities (2,962) (3,715)

----------------------------------------- ------- ------------ ------------

Cash flows from financing activities

Proceeds from issue of ordinary

shares 65 98

Dividends paid (5,110) (4,888)

Purchase of own shares (916) (72)

Net cash used in financing activities (5,961) (4,862)

----------------------------------------- ------- ------------ ------------

(Decrease) / increase in cash and cash

equivalents (1,644) 2,471

Cash and cash equivalents at beginning of the

period 27,930 25,194

Foreign exchange differences (652) 265

------------ ------------

Cash and cash equivalents at end

of the period 25,634 27,930

----------------------------------------- ------- ------------ ------------

Braemar Shipping Services PLC

Audited Consolidated Statement of Changes in Total Equity for

the year ended 28 February 2011

Shares Non

Share Share to be Other Retained controlling Total

capital premium issued reserves earnings Total interest equity

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

At 1 March

2009 2,104 10,920 (3,479) 25,020 18,268 52,833 114 52,947

Cash flow

hedges

- Transfer to

net profit - - - 643 - 643 - 643

- Fair value

gains in the

period - - - 333 - 333 - 333

Exchange

differences - - - (164) - (164) - (164)

Net income

recognised

directly in

equity - - - 812 - 812 - 812

Profit for the

year - - - - 9,655 9,655 30 9,685

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

Total

recognised

income in the

year - - - 812 9,655 10,467 30 10,497

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

Dividends paid - - - (4,888) (4,888) - (4,888)

Issue of

shares 4 94 - - - 98 - 98

Purchase of

shares - - (72) - - (72) - (72)

Consideration

to be paid - - - (34) - (34) - (34)

ESOP shares

allocated - - 353 - (353) - - -

Credit in

respect of

share option

schemes - - - - 591 591 - 591

Deferred tax

on items

taken to

equity - - - (273) 261 (12) - (12)

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

At 28 February

2010 2,108 11,014 (3,198) 25,525 23,534 58,983 144 59,127

Cash flow

hedges

- Transfer to

net profit - - - (488) - (488) - (488)

- Fair value

gains in the

period - - - 236 - 236 - 236

Exchange

differences - - - 977 - 977 - 977

------------

Net income

recognised

directly in

equity - - - 725 - 725 - 725

Profit for the

year - - - - 9,802 9,802 15 9,817

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

Total

recognised

income in the

year - - - 725 9,802 10,527 15 10,542

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

Dividends paid - - - - (5,110) (5,110) - (5,110)

Issue of

shares 2 63 - - - 65 - 65

Purchase of

shares - - (916) - - (916) - (916)

ESOP shares

allocated - - 839 - (839) - - -

Credit in

respect of

share option

schemes - - - - 829 829 - 829

Deferred tax

on items

taken to

equity - - - 73 208 281 - 281

At 28 February

2011 2,110 11,077 (3,275) 26,323 28,424 64,659 159 64,818

--------------- -------- -------- -------- --------- --------- -------- ------------ --------

Braemar Shipping Services PLC

Notes to the financial statements

Note 1 - General Information

The financial information set out above does not constitute the

company's statutory accounts for the years ended 28 February 2011

or 2010 but is derived from those accounts. Statutory accounts for

2010 have been delivered to the registrar of companies, and those

for 2011 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

Note 2 - Accounting policies

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (IFRSs) adopted for use in the

European Union, this announcement does not itself contain

sufficient information to comply with IFRSs. The company expects to

distribute full accounts that comply with IFRSs as adopted by the

EU on 25 May 2011.

Note 3 - Segmental results

Shipbroking Technical Logistics Environmental Total

2011 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ------------ ---------- ---------- -------------- --------

Revenue 61,646 22,621 35,119 6,749 126,135

--------------- ------------ ---------- ---------- -------------- --------

Segment result

before

amortisation

of intangible

assets 14,309 1,319 1,230 271 17,129

Amortisation

of intangible

assets (586) (644) (299) (36) (1,565)

Segment result 13,723 675 931 235 15,564

--------------- ------------ ---------- ---------- -------------- --------

Unallocated

other costs (2,635)

--------------- ------------ ---------- ---------- -------------- --------

Operating

profit 12,929

Finance

income/(cost)-

net 163

Share of

profit from

joint

ventures 103

--------------- ---------------------------------------------------- --------

Profit before

taxation 13,195

Taxation (3,378)

Profit for the

year

attributable

to

shareholders

from

continuing

operations 9,817

--------------- ------------ ---------- ---------- -------------- --------

2010

--------------- ------------ ---------- ---------- -------------- --------

Revenue 57,362 22,697 31,899 7,066 119,024

--------------- ------------ ---------- ---------- -------------- --------

Segment result

before

amortisation

of intangible

assets 13,324 2,325 1,434 614 17,697

Amortisation

of intangible

assets (481) (644) (319) (36) (1,480)

Segment result 12,843 1,681 1,115 578 16,217

--------------- ------------ ---------- ---------- -------------- --------

Unallocated

other costs (3,317)

--------------- ------------ ---------- ---------- -------------- --------

Operating

profit 12,900

Finance

income/(cost)-

net 191

Share of profit from joint ventures 400

----------------------------------------------------- -------------- --------

Profit before

taxation 13,491

Taxation (3,806)

Profit for the

year

attributable

to

shareholders

from

continuing

operations 9,685

--------------- ------------ ---------- ---------- -------------- --------

Braemar Shipping Services PLC

Notes to the financial statements

Note 4 - Dividend

The proposed final dividend of 17.0 pence per share (2010: final

16.25 pence) takes the total dividend for the year to 26.0 pence

(2010: 25.0 pence). The cost of the final dividend will be GBP3.4m

(2010: GBP3.3m) based on 20.3m shares (which excludes shares held

in the ESOP for which the dividend has been waived).

Note 5 - Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year, excluding

817,242 ordinary shares held by the employee share trust (2010:

871,760) which are treated as cancelled. For diluted earnings per

share, the weighted average number of ordinary shares in issue is

adjusted to assume conversion of all dilutive ordinary shares. The

Group has one class of potential dilutive ordinary shares being

those granted to employees where the exercise price is less than

the average market price of the Company's ordinary shares during

the year.

2011 2010

GBP'000 GBP'000

-------------------------------------------------- ----------- -----------

Profit for the year attributable to shareholders 9,802 9,655

-------------------------------------------------- ----------- -----------

pence pence

-------------------------------------------------- ----------- -----------

Basic earnings per share 48.41 47.93

Effect of dilutive share options (0.98) (0.67)

Diluted earnings per share 47.43 47.26

-------------------------------------------------- ----------- -----------

Profit for the year attributable to shareholders

before amortisation 10,901 10,721

-------------------------------------------------- ----------- -----------

pence pence

-------------------------------------------------- ----------- -----------

Basic earnings per share 53.84 53.22

Effect of dilutive share options (1.10) (0.75)

Diluted earnings per share 52.74 52.47

-------------------------------------------------- ----------- -----------

Shares Shares

-------------------------------------------------- ----------- -----------

Weighted average number of ordinary shares 20,248,456 20,143,909

Effect of dilutive share options 419,543 287,780

Diluted weighted average number of ordinary

shares 20,667,999 20,431,689

-------------------------------------------------- ----------- -----------

Note 6 - Reconciliation of operating profit to net cash flow

from operating activities

2011 2010

GBP'000 GBP'000

-------------------------------------------------------- -------- --------

Profit before tax for the year from continuing

operations 13,195 13,491

Adjustments for:

- Depreciation 1,202 1,064

- Amortisation 1,565 1,480

- (Profit) / loss on sale of property plant

and equipment (20) (5)

- Finance income (177) (193)

- Finance expense 14 2

- Share of profit of joint ventures (103) (400)

- Share based payments 829 591

- Net foreign exchange gains and financial instruments (714) 686

Changes in working capital:

- Trade and other receivables (4,395) 1,745

- Trade and other payables 854 (3,417)

- Provisions 30 234

Cash generated from operations 12,280 15,278

-------------------------------------------------------- -------- --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAFSPEEKFEAF

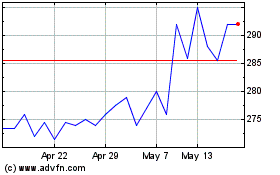

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024