TIDMBMS

RNS Number : 5815L

Braemar Shipping Services PLC

10 May 2010

BRAEMAR SHIPPING SERVICES PLC

10 May 2010

Unaudited preliminary results for the year ended 28 February 2010

Braemar Shipping Services plc ("Braemar" or the "Group"), a leading

international provider of broking, consultancy, technical and other services to

the shipping and energy industries, today announces full year unaudited results

for the year ended 28 February 2010.

· Pre-tax profit before amortisation GBP15.0m (2009: GBP17.3m)

· Pre-tax profit GBP13.5m (2009: GBP16.2m)

· Basic EPS from continuing operations 47.93p (2009: 56.70p)

· Cash generated from operating activities GBP15.3m (2009: GBP21.0m)

· Cash at 28 February 2010: GBP27.9m (28 Feb 2009: GBP25.2m)

· Final dividend 16.25p per share (up 5%), full year 25.00p (2009: 24.00p)

up 4%

OPERATIONAL HIGHLIGHTS

· Demand in shipping markets is recovering with values and rates stabilising

· Group services to the energy sector growing

· Positive outlook for the year ahead

· Estimated forward order book deliverable in 2010/11 - GBP28m [US$42m]

(2009/10 - GBP29m [US$42m])

· Non-broking businesses contributed 25% of group operating profits*

*before amortisation and central costs

Commenting on the results and outlook, Sir Graham Hearne, Chairman of Braemar

Shipping Services PLC, said:

"These results are good, and ahead of our expectations at the beginning of the

year. After the exceptional years of boom conditions in shipping through 2007

and most of 2008, the 2009/10 profits are the third highest in the Group's

history."

"Demand in most shipping sectors is recovering steadily in line with the

improving economic outlook. We go into the new financial year with a healthy

forward book and we are positive on the outlook for the year ahead."

"We have invested in our Technical division this year by establishing two new

businesses. The first is a marine cargo loss adjusting business based in the US,

UK and Singapore under the name Braemar Marine. The second is the expansion of

Wavespec's activity by the opening of an operation in Houston under the name

Braemar Wavespec Inc."

"The Logistics and Environmental divisions, which operate predominantly in the

UK, both performed well despite economic recession. They both benefit from a

strong reputation and a diverse client base which sustains activity levels."

ENDS

For further information, contact:

+------------------------------------+------------------------------+

| | |

| Braemar Shipping Services plc | |

+------------------------------------+------------------------------+

| Alan Marsh | Tel +44 (0) 20 7535 2650 |

+------------------------------------+------------------------------+

| James Kidwell | Tel +44 (0) 20 7535 2881 |

| | |

+------------------------------------+------------------------------+

| Pelham Bell Pottinger | |

+------------------------------------+------------------------------+

| Damian Beeley | Tel +44 (0) 20 7337 1508 |

| Zoe Pocock | Tel +44 (0) 20 7337 1532 |

| | |

+------------------------------------+------------------------------+

| Elaborate Communications | |

+------------------------------------+------------------------------+

| Sean Moloney | Tel +44 (0) 1296 682356 |

| | |

+------------------------------------+------------------------------+

| Charles Stanley Securities | |

+------------------------------------+------------------------------+

| Mark Taylor | Tel +44 (0) 20 7149 6457 |

+------------------------------------+------------------------------+

Notes to Editors

Braemar Shipping Services plc is a leading international provider of broking,

consultancy, technical and other services to the shipping, marine and energy

industries. Braemar is listed on the Official List of the London Stock Exchange

in the Industrial Transportation sector. The Group is divided into four

businesses: Shipbroking, Technical, Logistics, and Environmental.

Shipbroking

Braemar Seascope provides specialised shipbroking and consultancy services to

international clients. The services include: chartering tankers (including gas,

chemicals and LNG), dry cargo, containers, offshore vessels, secondhand sale and

purchase, newbuilding, demolition, and research. It has offices in the UK,

China, Australia, India, Singapore and Italy.

www.braemarseascope.com

Technical

Braemar Steege provides specialist loss adjusting and other expert services to

the energy (oil and gas), marine, power and other related industrial sectors. It

operates from offices in London, Houston, Singapore, Calgary, Mexico City,

Miami, Quito, Puerto Rico and Rio de Janeiro. In 2009 Braemar Marine was

established as a cargo loss adjusting business in the US, UK and Singapore.

www.braemarsteege.com

Braemar Falconer provides specialised surveying and engineering services to the

marine and offshore sectors. It has offices at the following locations:

Australia, China, India, Indonesia, Malaysia, Singapore, Vietnam and the UK.

www.braemarfalconer.com

Wavespec provides marine engineering, newbuilding supervision and naval

architecture services on a consultancy basis to the shipping and offshore

markets. It has offices in London and Houston and site offices in most of the

major yards in Korea, Japan and China.

www.wavespec.com

Logistics

Cory Brothers Shipping Agency provides port agency, freight forwarding and

logistics services within the UK and Singapore.

www.cory.co.uk

Environmental

Braemar Howells provides pollution response and advisory services, primarily in

the UK for marine, tank storage and rail operations and is now developing an

international presence, particularly in Africa.

www.braemarhowells.com

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 28 FEBRUARY 2010

CHAIRMAN'S STATEMENT

After the exceptional years of boom conditions in shipping through 2007 and most

of 2008, revenue and profit fell back in 2009/10 as the world economy and

shipping markets went into recession. However, the Group performed well in these

difficult markets and the profits are the third highest in the Group's history.

Group revenue in 2009/10 was GBP119.0m (2008/9: GBP127.1m), profit before tax

from continuing operations was GBP13.5m (2008/9: GBP16.2m) and earnings per

share from continuing operations were 47.93 pence compared with 56.70 pence in

2008/9. The Group remains financially strong, with no debt and cash balances of

GBP27.9m at 28 February 2010 (28 Feb 2009: GBP25.2m). These results are good,

and ahead of our expectations at the beginning of the year.

We have invested in our Technical division this year by establishing two new

businesses. The first is a marine cargo loss adjusting business based in the US,

UK and Singapore under the name Braemar Marine. The second is the expansion of

Wavespec's activity by the opening of an operation in Houston under the name

Braemar Wavespec Inc. Both of these are expected to contribute positively next

year. Our marine engineering and surveying businesses should benefit from the

anticipated growth of the world ship fleet over the coming years.

The Logistics and Environmental divisions, which operate predominantly in the

UK, both performed well despite economic recession. They both benefit from a

strong reputation and a diverse client base which sustains activity levels.

Our Shipbroking division delivered strong results despite the global downturn.

This is a testament to the diversity of our client relationships across the full

range of our activities, departments and offices. Sustained growth in the

demand for oil and raw materials from the Far East has underpinned the tanker

market and stimulated a number of healthy rallies in dry bulk, although the

container market suffered from weak demand and excess tonnage. Over the last

year, shipping has seen the greater involvement of major commodity and trading

companies seeking to manage their transportation costs and the return of long

established ship owners who are attracted by value. We are pleased that our

shipbroking teams have played a part in helping them execute their chosen

strategies.

Demand in most shipping sectors is recovering steadily in line with the

improving economic outlook. The delivery of substantial new tonnage in many

vessel categories is a key factor in determining the equilibrium price for

freight. This offers us more opportunity to do business, albeit at rates which

have adjusted to new market conditions. We go into the new financial year with a

healthy forward book - our estimate of the shipbroking forward order book

deliverable over the course of the financial year 2010/11 stands at GBP28

million (US$42 million) compared with the forward book at 1 March 2009 of GBP29

million (US$42 million). We are positive on the outlook for the year ahead.

The Directors are recommending for approval at the Annual General Meeting a

final dividend of 16.25 pence per ordinary share, to be paid on 28 July 2010 to

shareholders on the register at the close of business on 2 July 2010. Together

with the 8.75p interim dividend, the Company's dividend for the year will be

25.0 pence (2009: 24.0 pence), a rise of 4%. The dividend is covered 1.92 times

by earnings.

On behalf of the Board, I would like to express our thanks to Alan Marsh, his

executive team and the whole of the Braemar staff for their contribution in

delivering these results. They can be justly proud of their efforts which we

recognise with gratitude.

Sir Graham Hearne

7 May 2010

CHIEF EXECUTIVE'S REVIEW OF THE BUSINESS

Strategy

The Group's strategy is to maintain and grow its international marine and energy

services businesses. To do this we are building our shipbroking presence

overseas with a combination of local and UK trained staff. The extent of

services provided overseas depends on the size and scope of local markets, but

increasingly, we see the growing importance of shipping centres such as

Singapore and Shanghai, and these will be a vital ingredient to the Group's

composition in the future. We also have sizeable shipbroking offices in Beijing,

Melbourne, Perth, Delhi and Mumbai. Shipbroking represents 75% of the Group's

operating profits before amortisation and central costs.

At the same time we are investing in and developing businesses which serve the

marine engineering and surveying requirements of the shipping and energy

industries. Our Technical division, which has offices around the world, is

particularly well represented in the Far East. Within Logistics, ship agency and

freight forwarding operate in the UK and Singapore. Pollution response and

environmental consultancies operate in the UK and Africa. The common customer

base in these divisions enables us to extend the range of services we offer to

our clients. In addition, these businesses generally derive their income from

fees or one-off projects. This differs from shipbroking where income is mainly

derived from commission earned on the successful conclusion of business. Our

non-broking interests are complementary to shipbroking and now represent 25% of

the Group's operating profits before amortisation and central costs.

Part of our strategy for the development of the Group over the last few years

has been achieved through acquisitions and we continue to look at attractive

opportunities as they arise. To date acquisitions have been funded from cash

flow with only an occasional use of new equity for a management team joining the

Group.

Performance

The performance of the Group has been better than we had expected at the

beginning of 2009. Our businesses have performed well during a testing period.

There are signs now that confidence is being restored and fragile shipping

markets are regaining their composure. While there are no reliable measures of

global market share for our international businesses, we are confident, based on

our transaction volumes, that our market performance has improved.

A divisional review of business performance and the markets in which we operate

is set out below.

Shipbroking - Braemar Seascope

Dry Bulk

Dry bulk is the largest shipping market and over the past few years we have been

developing our office network which now extends across London, Melbourne, Perth,

Delhi, Mumbai, Beijing and Singapore making it a more significant part of the

Group's business.

On 2 March 2009 the Baltic Dry Index stood at 2,014 and by the end of our

financial year it was 2,738 having reached a high of 4,661 on 19 November 2009

and a low of 1,463 on 8 April 2009. The average for that period was 2,874 and on

7 May 2010 it stood at 3,468. In the wake of the global financial crisis and the

state-initiated stimulus spending, Chinese demand recovered quickly which led

the dry bulk freight market out of the doldrums. This helped stimulate regional

economies with Japanese steel makers enjoying better times driven by China's

demand for finished steel. The cape sector was a particular beneficiary of this

resurgence but freight rates have been suppressed by a steady influx of new

ships. The panamax sector enjoyed strong demand for coal and grain and this has

carried into the new fiscal year, with rates temporarily higher than those in

the cape market. The handymax and handy sectors have also seen rates hold up,

benefitting from a deferral of newbuildings. The demand outlook is solid but

the effect of the overhang of new tonnage threatens rate stability. The

expectations for the freight market for the financial year ahead are less

bearish than 12 months ago owing to renegotiated deliveries and yard slippage

pushing back the increase in vessel supply towards late 2010/early 2011. The

forecast for oversupply is more prominent in the cape market than for the

smaller ships.

Tankers

The deep sea tanker markets remained soft for most of the year with only a small

increase in demand for energy. However, towards the end of the year, significant

volumes of tonnage had been employed for storing the excess production of crude

oil and this had a firming effect on the transportation rates of which we were

able to take advantage. Subsequently, there have been encouraging signs of an

improvement in the global economy, with demand for energy increasing. The Baltic

Dirty Tanker Index started the financial year on 2 March 2009 at 626 and

averaged 642 during our financial year, closing at 897. On 7 May 2010 it stood

at 988 which is a good start to our new financial year. We are pleased that our

transaction volumes are continuing to grow and that our various contracts of

affreightment are performing well. It is also pleasing to see that the busier

markets have ensured that our time charters were all performing with many being

extended into our new financial year.

The wet FFA desk is also performing according to our expectations and

continually growing their client base.

In combination with the harsh winter conditions, the volume of CPP (clean

petroleum product) distribution has increased and more business has been

concluded in this sector. Although the delivery of newbuilding tanker tonnage in

the product sectors is affecting the spot market, the increase in our

transactions has offset the lower rates. We are pleased to have won new

customers in these markets through the year, as well as growing our time charter

portfolio on all product sizes.

The strong presence of our specialised chemical and petrochemical gas divisions

has resulted in the conclusion of new contracts with a large oil company. The

LPG markets were busier in the second half of the year and our expansion into

the VLGC (Very Large Gas Carrier) market is now showing the anticipated results.

Our LPG product broking division has also had a successful end to the year with

several notable cargo deals in which we also brokered the transportation. In

addition we have won several LNG shipping consultancy appointments, some of

which are for new market participants who are looking at this developing market.

Containers

The container shipping market remained depressed for most of the year but in the

first quarter of 2010 showed signs of a modest recovery. The container lines are

now seeing increased cargo volumes but this will only slowly filter through to

the freight market since there remains a significant number of laid up ships and

as well as newbuildings still to deliver. Despite the low market our chartering

and sale and purchase desks had an active year and after a recent restructuring

have started this year in a similar vein.

Offshore

We have offshore offices in London, Aberdeen, Singapore and Perth, Australia

which has helped to generate more international business. Despite a generally

weak offshore chartering market our desk had a strong year due to the increased

volume of international activity and some good sale and purchase/project

business. The rising oil price should stimulate drilling activity which

ordinarily would lead to better vessel utilisation and increasing day rates.

Sale and Purchase

The sale and purchase department achieved a record number of transactions during

the year. There was a sizeable downwards adjustment in vessel prices over the

past year, partly due to the contraction in available ship finance, but despite

difficult market conditions our team concluded a high level of secondhand

business. Buyers have been attracted by investment opportunities at lower

prices and in many cases are not reliant on external sources of finance. We have

also been particularly active in demolition business which has increased over

the past year especially for older container ships and bulk carriers. We expect

this business to remain strong over the next year as the phase out of single

hull tankers gathers pace. Against the market trend, our newbuilding

departments concluded substantial new business, most of which was quite

specialist in nature, demonstrating the diversity of our client base. We have

seen some newbuilding contract renegotiation and a limited cancellation, but we

believe this is lower than the industry average and overall our forward order

book remains in a healthy state.

Technical - Braemar Falconer, Braemar Steege, Braemar Marine and Wavespec

Braemar Falconer's revenue and profits for the past financial year were lower

than the previous year due to reduced rig movement and drilling activity. There

was also a small decrease in engineering consultancy work caused by fewer

long-term projects being commenced in the aftermath of the financial crisis, and

the completion of projects being worked on during the year. However, revenue

from damage surveys, particularly in Vietnam, improved with a steady stream of

work from major insurance companies.

Braemar Steege maintained its position as one of the leading international

players in the energy loss adjusting market. In addition to core oil and gas

energy claims, other business streams continue to be developed covering power,

infrastructure and pollution insurance claims, particularly in Latin America.

With no significant hurricane in the Gulf of Mexico during 2009, the workload of

the Houston office has reduced, but this has been offset by continued growth of

the Singapore office due to high demand for energy loss adjusting services in

Asia, Australia and in London where expert technical assistance to lawyers

dealing with non-insurance disputes has also provided further growth.

Braemar Marine was launched in August 2009 to provide marine surveying and

adjusting services to the hull, cargo and protection & indemnity (P&I) insurance

market. With a head office in Atlanta, a surveying network has already been

established with personnel based in London, Los Angeles, Seattle, Miami,

Houston, Puerto Rico and Rio de Janeiro. The severe earthquake in Haiti provided

Braemar Marine with its first catastrophe response work; they were the first

marine surveyors on scene and carried out a large proportion of the work

generated by the earthquake. In April 2010, a Braemar Marine presence was

established in Singapore and their business in Asia is expected to develop

quickly, utilising the existing network of Braemar Falconer surveyors in place

throughout the region. The net costs before tax incurred during the year in

starting this business were GBP0.7m, and we expect to achieve a profitable

business in the next financial year.

Wavespec's profits were lower in 2009/10 due to GBP0.2m of net set up costs of

establishing a new office in Houston which provides consulting services to LNG

terminal operators; this office is expected to be profitable in the coming

financial year. The core LNG business remains strong with the continuation of

the Qatargas project and the Company is now assisting shipyards to develop gas

management strategies for LNG Carriers.

Logistics - Cory Brothers

Revenues decreased primarily as a result of the impact of one-off projects

within Logistics in 2008 which were not repeated. However, operating profits

before amortisation were up slightly at GBP1.4m (2009: GBP1.1m) as overall

margins improved and a significant project which spanned both years was

concluded. 2009 saw the first full year of the combined operations of Cory

Logistics and Fred. Olsen Freight. Forwarding and one-off projects continue to

be the mainstay of the performance to date although the growth in a number of

liner operations is promising for the coming year. Despite a depressed UK

market, Port Agency maintained its leading position, handling approximately

10,000 port calls annually (including hub managed calls) with some significant

new activity especially within ship-to-ship operations on behalf of oil majors

which is expected to continue into the coming year.

Environmental - Braemar Howells

Braemar Howells enjoyed a successful year due to an improved performance from

the incident response division. In addition, the industrial services division

has handled a large contaminated cargo incident which is ongoing and has

contributed to a good start to the new financial year.

Recently the Company has successfully renewed its main multi-year retainer

contracts with the Maritime Coastguard Agency and Network Rail and won important

new spill response business for new drilling in West Africa. This is in addition

to the international contract the company has with the Ministry of Defence.

Staff

I would like to thank all of our staff across the Group for their hard work and

team spirit which have contributed to making this another successful year for

the company.

Alan Marsh

7 May 2010

Financial Review

Key divisional statistics

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| | 2010 | 2009 | 2008 | | | 2010 | 2009 | 2008 |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Shipbroking | GBP'000 | GBP'000 | GBP'000 | | Technical | GBP'000 | GBP'000 | GBP'000 |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Revenue | 57,362 | 60,409 | 52,794 | | Revenue | 22,697 | 21,193 | 9,467 |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Operating | 13,324 | 14,990 | 13,093 | | Operating | 2,325 | 4,156 | 844 |

| profit before | | | | | profit before | | | |

| amortisation | | | | | amortisation | | | |

| and central | | | | | and central | | | |

| costs | | | | | costs | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Operating | 23.2% | 24.8% | 24.8% | | Operating | 10.2% | 19.6% | 8.9% |

| profit margin | | | | | profit margin | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Employee | 247 | 218 | 211 | | Employee | 202 | 178 | 82 |

| numbers | | | | | numbers | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| | | | | | | | | |

| | | | | | | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Logistics | | | | | Environmental | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Revenue | 31,899 | 40,797 | 27,874 | | Revenue | 7,066 | 4,745 | 10,829 |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Operating | 1,434 | 1,130 | 1,153 | | Operating | 614 | (165) | 1,871 |

| profit before | | | | | profit /(loss) | | | |

| amortisation | | | | | before | | | |

| and central | | | | | amortisation | | | |

| costs | | | | | and central | | | |

| | | | | | costs | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Operating | 4.5% | 2.8% | 4.1% | | Operating | 8.7% | (3.5%) | 17.3% |

| profit margin | | | | | profit margin | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

| Employee | 235 | 232 | 176 | | Employee | 62 | 60 | 65 |

| numbers | | | | | numbers | | | |

+----------------+---------+---------+---------+----------+-----------------+---------+---------+---------+

Operating margins were lower in the Technical division mainly due to GBP0.9m of

net costs incurred in connection with the start-up of new Technical businesses

(Braemar Marine and Wavespec's office in Houston), all of which were fully

expensed. These were offset by an improvement in the Environmental division

which benefited from an increase in incident response activity and project work.

Staff numbers increased across the Group mainly through the addition of new

shipbroking trainees and staff in our Far East offices, and the new business

investments made within the Technical division. Operating costs excluding

amortisation of intangible assets increased by 1.6% compared with last year

mainly due to the investment in new staff. Despite the economic climate, we

consciously maintained our commitment to recruiting and developing staff during

the past year. Stripping out the effect of new businesses, operating costs fell

by 1.2%.

Foreign exchange

The average rate of exchange for the US dollar-denominated shipbroking earnings

was $1.55/GBP (2009: $1.85/GBP) and at 28 February 2010 the balance sheet rate

for conversion was $1.52/GBP (28 February 2009: $1.43/GBP). At 28 February 2010

the Group held a variable forward window agreement to sell US$1.0 million per

month with upper and lower limits of $1.4885 - $1.6510 for the months March 2010

to February 2012. The balance sheet includes an unamortised foreign exchange

gain of GBP0.7m in respect of the hedging of 2010/11 expected cash flows which

will be recognised within profit during the coming year.

Taxation

The effective rate of tax for the Group was 28.2% (2009: 29.0%) - this includes

the effect of disallowable expenditure and the net profit from joint ventures

which is included net of corporation tax. The improvement in the rate relative

to the prior year is due to the mix of overseas profits, lower UK disallowed

expenditure and a tax refund in Australia.

Goodwill & intangible assets

Goodwill totals GBP28.7m at 28 February 2010, 75% of which relates to our

shipbroking business. New goodwill and intangible assets totalling GBP2.4m were

recognised during the year in respect acquisitions for cash of Cagnoil - a

forward order book of time charters, Freight Action within Logistics and

shipbroking interests in India.

Cash flow

The Group generated GBP11.0m (2009: GBP15.0m) of cash from operating activities

during the year, after tax payments. This was primarily expended on acquisitions

totalling GBP2.8m - most of which was for the purchase of Cagnoil and a deferred

consideration payment for Braemar Steege, capital expenditure of GBP1.4m and

dividend payments of GBP4.9m. Cash balances totalled GBP27.9m at the end of the

year (28 Feb 2009: GBP25.2m) and there was no debt.

The balance sheet includes an accrual for deferred consideration totalling

GBP1.9m most of which will be paid in cash during 2010/11.

James Kidwell

7 May 2010

Braemar Shipping Services PLC

Unaudited Consolidated Income statement for the year ended 28 February 2010

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | Year | | Year |

| | | | | | ended | | ended |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | 28 Feb | | 28 Feb |

| | | | | | 2010 | | 2009 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Continuing operations |Notes | | | | GBP'000 | | GBP'000 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Revenue | 3 | | | | 119,024 | | 127,144 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Cost of sales | | | | | (28,094) | | (35,038) |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | 90,930 | | 92,106 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Operating costs | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Operating costs excluding | | | | | (76,550) | | (75,345) |

| amortisation | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Amortisation of intangible | | | | | (1,480) | | (1,074) |

| assets | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | (78,030) | | (76,419) |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Operating profit | 3 | | | | 12,900 | | 15,687 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Finance income | | | | | 193 | | 309 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Finance costs | | | | | (2) | | (18) |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Share of profit from joint | | | | | 400 | | 246 |

| ventures | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Profit before taxation | | | | | 13,491 | | 16,224 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Taxation | | | | | (3,806) | | (4,704) |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Profit for the year | | | | | 9,685 | | 11,520 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Attributable to: | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Ordinary shareholders | | | | | 9,655 | | 11,463 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Minority interest | | | | | 30 | | 57 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Profit for the year | | | | | 9,685 | | 11,520 |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| | | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Earnings per ordinary share | 5 | | | | | | |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Basic - profit for the year | | | | | | | |

| | | | | | 47.93p | | 56.70p |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

| Diluted - profit for the year | | | | | | | |

| | | | | | 47.26p | | 55.72p |

+--------------------------------+-------+---------+----+---------+----------+---------+----------+

Unaudited Consolidated Statement of comprehensive income

+------------------------------+---+--+------+---------+----------+---------+

| | | | | Year | | Year |

| | | | | ended | | ended |

+------------------------------+---+--+------+---------+----------+---------+

| | | | | 28 Feb | | 28 Feb |

| | | | | 2010 | | 2009 |

+------------------------------+---+--+------+---------+----------+---------+

| | | | | GBP'000 | | GBP'000 |

+------------------------------+---+--+------+---------+----------+---------+

| | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| Profit for the period | | | | 9,685 | | 11,520 |

+------------------------------+---+--+------+---------+----------+---------+

| Other comprehensive income / | | | | | | |

| (expense) | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| Foreign exchange differences on | | (164) | | 3,612 |

| retranslation of foreign operations | | | | |

+-------------------------------------+------+---------+----------+---------+

| Cash flow hedges - net of | | | | 703 | | (429) |

| tax | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| Total comprehensive income | | | | 10,224 | | 14,703 |

| for the period | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| Attributable to: | | | | | | |

+------------------------------+---+--+------+---------+----------+---------+

| Equity holders of the parent | | | | 10,194 | | 14,646 |

+------------------------------+---+--+------+---------+----------+---------+

| Minority interest | | | | 30 | | 57 |

+------------------------------+---+--+------+---------+----------+---------+

| Profit for the period | | | | 10,224 | | 14,703 |

+------------------------------+---+--+------+---------+----------+---------+

Braemar Shipping Services PLC

Unaudited Consolidated Balance sheet as at 28 February 2010

+-----------------------------------+------+--+---------+----------+---------+

| | | | As at | | As at |

+-----------------------------------+------+--+---------+----------+---------+

| | | | 28 Feb | | 28 Feb |

| | | | 10 | | 09 |

+-----------------------------------+------+--+---------+----------+---------+

| Assets | | | GBP'000 | | GBP'000 |

+-----------------------------------+------+--+---------+----------+---------+

| Non-current assets | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Goodwill | | | 28,740 | | 28,137 |

+-----------------------------------+------+--+---------+----------+---------+

| Other intangible assets | | | 4,247 | | 3,921 |

+-----------------------------------+------+--+---------+----------+---------+

| Property, plant and equipment | | | 6,510 | | 6,189 |

+-----------------------------------+------+--+---------+----------+---------+

| Investments | | | 1,485 | | 2,344 |

+-----------------------------------+------+--+---------+----------+---------+

| Deferred tax assets | | | 1,208 | | 810 |

+-----------------------------------+------+--+---------+----------+---------+

| Other long-term receivables | | | 169 | | 176 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | 42,359 | | 41,577 |

+-----------------------------------+------+--+---------+----------+---------+

| Current assets | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Trade and other receivables | | | 36,918 | | 38,055 |

+-----------------------------------+------+--+---------+----------+---------+

| Derivative financial instruments | | | - | | 160 |

+-----------------------------------+------+--+---------+----------+---------+

| Restricted cash | | | 5,521 | | - |

+-----------------------------------+------+--+---------+----------+---------+

| Cash and cash equivalents | | | 27,930 | | 25,194 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | 70,369 | | 63,409 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Total assets | | | 112,728 | | 104,986 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Liabilities | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Current liabilities | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Derivative financial instruments | | | 571 | | 649 |

+-----------------------------------+------+--+---------+----------+---------+

| Trade and other payables | | | 41,706 | | 46,221 |

+-----------------------------------+------+--+---------+----------+---------+

| Current tax payable | | | 3,346 | | 2,689 |

+-----------------------------------+------+--+---------+----------+---------+

| Provisions | | | 288 | | 88 |

+-----------------------------------+------+--+---------+----------+---------+

| Client monies held as escrow | | | 5,521 | | - |

| agent | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| | | | 51,432 | | 49,647 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Non-current liabilities | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Deferred tax liabilities | | | 2,001 | | 2,255 |

+-----------------------------------+------+--+---------+----------+---------+

| Provisions | | | 168 | | 137 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | 2,169 | | 2,392 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Total liabilities | | | 53,601 | | 52,039 |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Total assets less total | | | 59,127 | | 52,947 |

| liabilities | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Equity | | | | | |

+-----------------------------------+------+--+---------+----------+---------+

| Share capital | | | 2,108 | | 2,104 |

+-----------------------------------+------+--+---------+----------+---------+

| Share premium | | | 11,014 | | 10,920 |

+-----------------------------------+------+--+---------+----------+---------+

| Shares to be issued | | | (3,198) | | (3,479) |

+-----------------------------------+------+--+---------+----------+---------+

| Other reserves | | | 25,525 | | 25,020 |

+-----------------------------------+------+--+---------+----------+---------+

| Retained earnings | | | 23,534 | | 18,268 |

+-----------------------------------+------+--+---------+----------+---------+

| Group shareholders' equity | | | 58,983 | | 52,833 |

+-----------------------------------+------+--+---------+----------+---------+

| Minority interest | | | 144 | | 114 |

+-----------------------------------+------+--+---------+----------+---------+

| Total equity | | | 59,127 | | 52,947 |

+-----------------------------------+------+--+---------+----------+---------+

Braemar Shipping Services PLC

Unaudited Consolidated Cash flow statement for the year ended 28 February 2010

+-------------------------------------+-------+---------+----------+---------+

| | | Year | | Year |

| | | ended | | ended |

+-------------------------------------+-------+---------+----------+---------+

| | | 28 Feb | | 28 Feb |

| | | 2010 | | 2009 |

+-------------------------------------+-------+---------+----------+---------+

| |Notes | GBP'000 | | GBP'000 |

+-------------------------------------+-------+---------+----------+---------+

| Cash flows from operating | | | | |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Cash generated from operations | 6 | 15,278 | | 20,959 |

+-------------------------------------+-------+---------+----------+---------+

| Interest received | | 193 | | 309 |

+-------------------------------------+-------+---------+----------+---------+

| Interest paid | | (2) | | (18) |

+-------------------------------------+-------+---------+----------+---------+

| Tax paid | | (4,421) | | (6,245) |

+-------------------------------------+-------+---------+----------+---------+

| Net cash generated from operating | | 11,048 | | 15,005 |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Cash flows from investing | | | | |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Dividends from joint ventures | | 406 | | - |

+-------------------------------------+-------+---------+----------+---------+

| Acquisition of subsidiaries, net of | | (2,793) | | (5,137) |

| cash acquired | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Purchase of property, plant and | | (1,394) | | (1,189) |

| equipment | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Proceeds from sale of property, | | 59 | | 6 |

| plant and equipment | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Purchase of investments | | - | | (9) |

+-------------------------------------+-------+---------+----------+---------+

| Other long term assets | | 7 | | (21) |

+-------------------------------------+-------+---------+----------+---------+

| Net cash used in investing | | (3,715) | | (6,350) |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Cash flows from financing | | | | |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Proceeds from issue of ordinary | | 98 | | 324 |

| shares | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Dividends paid | | (4,888) | | (4,868) |

+-------------------------------------+-------+---------+----------+---------+

| Dividends paid to minority interest | | - | | (45) |

+-------------------------------------+-------+---------+----------+---------+

| Purchase of own shares | | (72) | | (1,134) |

+-------------------------------------+-------+---------+----------+---------+

| Net cash used in financing | | (4,862) | | (5,723) |

| activities | | | | |

+-------------------------------------+-------+---------+----------+---------+

| | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Increase/(decrease) in cash and | | 2,471 | | 2,932 |

| cash equivalents | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Cash and cash equivalents at | | 25,194 | | 21,635 |

| beginning of the period | | | | |

+-------------------------------------+-------+---------+----------+---------+

| Foreign exchange differences | | 265 | | 627 |

+-------------------------------------+-------+---------+----------+---------+

| Cash and cash equivalents at end of | | 27,930 | | 25,194 |

| the period | | | | |

+-------------------------------------+-------+---------+----------+---------+

Braemar Shipping Services PLC

Unaudited Consolidated Statement of Changes in Total Equity for the year ended

28 February 2010

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| | Share | Share | Shares | Other | Retained | Total | Minority | Total |

| | capital | premium | to be | reserves | earnings | | interest | equity |

| | | | issued | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Group | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| At 1 March 2008 | 2,061 | 9,261 | (2,527) | 20,687 | 11,717 | 41,199 | 328 | 41,527 |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Cash flow hedges | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| - Transfer to net | - | - | - | 3,034 | - | 3,034 | - | 3,034 |

| profit | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| - Fair value | - | - | - | (3,629) | - | (3,629) | - | (3,629) |

| losses in the | | | | | | | | |

| period | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Exchange | - | - | - | 3,597 | - | 3,597 | 15 | 3,612 |

| differences | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Net income | - | - | - | 3,002 | - | 3,002 | 15 | 3,017 |

| recognised | | | | | | | | |

| directly in equity | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Profit for the | - | - | - | - | 11,463 | 11,463 | 57 | 11,520 |

| year | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Total recognised | - | - | - | 3,002 | 11,463 | 14,465 | 72 | 14,537 |

| income in the year | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Acquisition | - | - | | - | - | - | 19 | 19 |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Dividends paid | - | - | | - | (4,868) | (4,868) | (45) | (4,913) |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Issue of shares | 43 | 1,659 | - | - | - | 1,702 | - | 1,702 |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Purchase of shares | - | - | (1,134) | - | - | (1,134) | - | (1,134) |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Consideration paid | - | - | - | 900 | - | 900 | (260) | 640 |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Consideration to | - | - | - | 265 | - | 265 | - | 265 |

| be paid | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| ESOP shares | - | - | 182 | - | (182) | - | - | - |

| allocated | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Credit in respect | - | - | - | - | 299 | 299 | - | 299 |

| of share option | | | | | | | | |

| schemes | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Deferred tax on | - | - | - | 166 | (161) | 5 | - | 5 |

| items taken to | | | | | | | | |

| equity | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| At 28 February | 2,104 | 10,920 | (3,479) | 25,020 | 18,268 | 52,833 | 114 | 52,947 |

| 2009 | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Cash flow hedges | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| - Transfer to net | - | - | - | 643 | - | 643 | - | 643 |

| profit | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| - Fair value | - | - | - | 333 | - | 333 | - | 333 |

| losses in the | | | | | | | | |

| period | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Exchange | - | - | - | (164) | - | (164) | - | (164) |

| differences | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Net income | - | - | - | 812 | - | 812 | - | 812 |

| recognised | | | | | | | | |

| directly in equity | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Profit for the | - | - | - | - | 9,655 | 9,655 | 30 | 9,685 |

| year | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Total recognised | - | - | - | 812 | 9,655 | 10,467 | 30 | 10,497 |

| income in the year | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Dividends paid | - | - | - | - | (4,888) | (4,888) | - | (4,888) |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Issue of shares | 4 | 94 | - | - | - | 98 | - | 98 |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Purchase of shares | - | - | (72) | - | - | (72) | - | (72) |

| | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Consideration to | - | - | - | (34) | - | (34) | - | (34) |

| be paid | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| ESOP shares | - | - | 353 | - | (353) | - | - | - |

| allocated | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Credit in respect | - | - | - | - | 591 | 591 | - | 591 |

| of share option | | | | | | | | |

| schemes | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| Deferred tax on | - | - | - | (273) | 261 | (12) | - | (12) |

| items taken to | | | | | | | | |

| equity | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

| At 28 February | 2,108 | 11,014 | (3,198) | 25,525 | 23,534 | 58,983 | 144 | 59,127 |

| 2010 | | | | | | | | |

+--------------------+---------+---------+---------+----------+----------+---------+----------+---------+

Braemar Shipping Services PLC

Notes to the financial statements

Note 1 - General Information

The Preliminary Announcement of unaudited results for the year ended 28 February

2010 is an extract from the forthcoming 2010 Annual Report and Accounts and does

not constitute the Group's statutory accounts of 2010 nor 2009. Statutory

accounts for 2009 have been delivered to the Registrar of Companies, and those

for 2010 will be delivered following the company's Annual General Meeting. The

auditors have reported on the 2009 accounts; their report was unqualified and

did not contain statements under Sections 237(2) or (3) of the Companies Act

1985.

Note 2 - Accounting policies

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with International Financial Reporting Standards

(IFRSs) adopted for use in the European Union, this announcement does not itself

contain sufficient information to comply with IFRSs. The company expects to

distribute full accounts that comply with IFRSs as adopted by the EU on 25 May

2010.

+----------------------+----+--------+----------+----------+--------+----------+-----------+----------+---------------+----------+---------+

| | Shipbroking | | Technical | | Logistics | | Environmental | | Total |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| 2010 | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 | | GBP'000 |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Revenue | 57,362 | | 22,697 | | 31,899 | | 7,066 | | 119,024 |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Segment result | 13,324 | | 2,325 | | 1,434 | | 614 | | 17,697 |

| before amortisation | | | | | | | | | |

| of intangible assets | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Amortisation of | (481) | | (644) | | (319) | | (36) | | (1,480) |

| intangible assets | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Segment result | 12,843 | | 1,681 | | 1,115 | | 578 | | 16,217 |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Unallocated other | | | | | | | | | (3,317) |

| costs | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Operating profit | | | | | | | | | 12,900 |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Finance | | | | | | | | | 191 |

| income/(cost)- net | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Share of profit from joint ventures | | | | 400 |

+------------------------------------------------------------------------------------------+----------+---------------+----------+---------+

| Profit before | | | | | | | | | 13,491 |

| taxation | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Taxation | | | | | | | | | (3,806) |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Profit for the | | | | | | | | | 9,685 |

| period attributable | | | | | | | | | |

| to shareholders from | | | | | | | | | |

| continuing | | | | | | | | | |

| operations | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| | | | | | | | | | |

+----------------------+-------------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| 2009 | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Revenue | 60,409 | | 21,193 | | 40,797 | | 4,745 | | 127,144 |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Segment result | 14,990 | | 4,156 | | 1,130 | | (165) | | 20,111 |

| before amortisation | | | | | | | | | |

| of intangible assets | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Amortisation of | (100) | | (644) | | (292) | | (38) | | (1,074) |

| intangible assets | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Segment result | 14,890 | | 3,512 | | 838 | | (203) | | 19,037 |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Unallocated other | | | | | | | | | (3,350) |

| costs | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Operating profit | | | | | | | | | 15,687 |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Finance | | | | | | | | | 291 |

| income/(cost)- net | | | | | | | | | |

+----------------------+-------------+---------------------+--------+----------+-----------+----------+---------------+----------+---------+

| Share of profit from joint ventures | | | | 246 |

+------------------------------------------------------------------------------------------+----------+---------------+----------+---------+

| Profit before taxation | | | | | | | | | 16,224 |

+---------------------------+--------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Taxation | | | | | | | | | (4,704) |

+---------------------------+--------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| Profit for the period | | | | | | | | | 11,520 |

| attributable to | | | | | | | | | |

| shareholders from | | | | | | | | | |

| continuing operations | | | | | | | | | |

+---------------------------+--------+----------+-------------------+----------+-----------+----------+---------------+----------+---------+

| | | | | | | | | | | | |

+----------------------+----+--------+----------+----------+--------+----------+-----------+----------+---------------+----------+---------+

Note 4 - Dividend

The proposed final dividend of 16.25 pence per share (2009: final 15.5 pence)

takes the total dividend for the year to 25.0 pence (2009: 24.0 pence). The cost

of the final dividend will be GBP3.3m (2009: GBP3.1m) based on 20.2m shares

(which excludes shares held in the ESOP for which the dividend has been waived.

Braemar Shipping Services PLC

Notes to the financial statements

Note 5 - Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the year, excluding 871,760 ordinary shares held by the

employee share trust (2009: 962,914) which are treated as cancelled. For diluted

earnings per share, the weighted average number of ordinary shares in issue is

adjusted to assume conversion of all dilutive ordinary shares. The Group has one

class of potential dilutive ordinary shares being those granted to employees

where the exercise price is less than the average market price of the Company's

ordinary shares during the year.

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | 2010 | | 2009 |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | GBP'000 | | GBP'000 |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Profit for the period attributable | | | 9,655 | | 11,463 |

| to shareholders | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | pence | | pence |

| | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Basic earnings per share | | | 47.93 | | 56.70 |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Effect of dilutive share options | | | (0.67) | | (0.98) |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Diluted earnings per share | | | 47.26 | | 55.72 |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| | | | Shares | | Shares |

| | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Weighted average number of | | | 20,143,909 | | 20,215,801 |

| ordinary shares | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Effect of dilutive share options | | | 287,780 | | 356,495 |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

| Diluted weighted average number of | | | 20,431,689 | | 20,572,296 |

| ordinary shares | | | | | |

+------------------------------------+--------+----------+----------------------+----------+----------------------+

Note 6 - Reconciliation of operating profit to net cash flow from operating

activities

+------------------------------------------------+---------+----------+---------+

| | 2010 | | 2009 |

+------------------------------------------------+---------+----------+---------+

| | GBP'000 | | GBP'000 |

+------------------------------------------------+---------+----------+---------+

| Profit before tax for the year from continuing | 13,491 | | 16,224 |

| operations | | | |

+------------------------------------------------+---------+----------+---------+

| Adjustments for: | | | |

+------------------------------------------------+---------+----------+---------+

| - Depreciation | 1,064 | | 956 |

+------------------------------------------------+---------+----------+---------+

| - Amortisation | 1,480 | | 1,074 |

+------------------------------------------------+---------+----------+---------+

| - Goodwill impairment charge | - | | 56 |

+------------------------------------------------+---------+----------+---------+

| - (Profit) / loss on sale of property plant | (5) | | 15 |

| and equipment | | | |

+------------------------------------------------+---------+----------+---------+

| - Profit on increase to investment in | - | | (15) |

| subsidiary | | | |

+------------------------------------------------+---------+----------+---------+

| - Finance income | (193) | | (309) |

+------------------------------------------------+---------+----------+---------+

| - Finance expense | 2 | | 18 |

+------------------------------------------------+---------+----------+---------+

| - Share of profit of joint ventures | (400) | | (246) |

+------------------------------------------------+---------+----------+---------+

| - Share based payments and related insurance | 591 | | 453 |

| charges | | | |

+------------------------------------------------+---------+----------+---------+

| Changes in working capital: | | | |

+------------------------------------------------+---------+----------+---------+

| - Trade and other receivables | 1,745 | | 1,246 |

+------------------------------------------------+---------+----------+---------+

| - Trade and other payables | (3,417) | | 1,437 |

+------------------------------------------------+---------+----------+---------+

| - Provisions | 234 | | 50 |

+------------------------------------------------+---------+----------+---------+

| - Financial instruments | 686 | | - |

+------------------------------------------------+---------+----------+---------+

| Cash generated from operations | 15,278 | | 20,959 |

+------------------------------------------------+---------+----------+---------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKSXEADEEFF

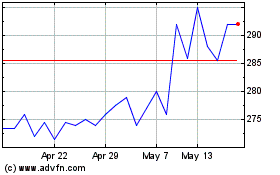

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024