RNS Number : 7977G

Braemar Shipping Services PLC

28 October 2008

BRAEMAR SHIPPING SERVICES PLC

("Braemar" or "the Group")

Interim results for the six months ended 31 August, 2008

28 October, 2008

Braemar Shipping Services plc (the "Group"), an international provider of shipping and marine services, today announces unaudited

half-year results for the six months ended 31 August, 2008.

FINANCIAL HIGHLIGHTS

* Revenue from continuing operations �69.1m (2007: �46.7m), a rise of 48% (23% excluding acquisitions)

* Pre-tax profit from continuing operations �9.8m (2007: �7.1m), up 38% (18% excluding acquisitions)

* Basic EPS from total operations 33.51p (2007: 23.66p), up 42%

* Increased interim dividend of 8.5p per share (2007: 8.00p)

* Strong balance sheet with cash of �11.1m and no debt

OPERATIONAL HIGHLIGHTS

* Wide mix of shipping operations offsets downturns in particular markets

* Non-broking activities now make up 20% of operating profits before central costs

* Strong performance driven by development in technical services (marine services, marine engineering services, loss adjusting), and

energy-based activities

* Braemar Steege (specialist loss adjuster) acquired in March, 2008 and performing well

MARKET OVERVIEW

* Recent turmoil presents opportunities to build business further

* Probable slowdown in ordering of new ships and possibility of some cancelled orders

* Demand for iron ore in Far East likely to see some recovery after the recent slow down

* Energy related activity businesses seeing continued market strength

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said: "Our strategy remains to position the Group as a leading

player in a selective range of marine and shipping services. We believe this will provide the Group with a resilience to weather adverse

conditions and a platform from which we can take advantage of suitable opportunities. Unprecedented economic events have introduced

uncertainty but we remain cautiously optimistic about the future."

Alan Marsh, Chief Executive, said "Despite the market this is a set of record results for Braemar which gives us confidence that our

expectations for the full year out-turn will be met. Careful operational and financial management has resulted in a strong cash position

with no debt and an increased dividend payment to shareholders."

ENDS

For further information, contact:

Braemar Shipping Services plc

Alan Marsh Tel +44 (0) 20 7535 2650

James Kidwell Tel +44 (0) 20 7535 2881

Pelham Public Relations

Zo?ocock Tel +44 (0) 20 3178 8023

Damian Beeley Tel +44 (0) 20 3178 2253

Elaborate Communications

Sean Moloney Tel +44 (0) 1296 682356

Charles Stanley Securities

Philip Davies/Ben Johnston Tel +44 (0) 20 7149 6457

Notes to Editors

Braemar Shipping Services plc is a leading international provider of broking, consultancy, technical and other services to the shipping,

marine and energy industries.

The business is divided into the following business segments: Shipbroking, Logistics, Technical services and Environmental services.

This growth has been through a mixture of organic and acquisition-led growth.

Shipbroking services include: chartering tankers (including gas, chemicals and LNG), dry cargo, containers, offshore vessels, second

hand sale and purchase, newbuilding, demolition, and sector research.

It is listed on the Official List of the London Stock Exchange in the transport sector.

Recent Acquisitions

2006 - Braemar Howells, a pollution response service primarily in the UK for marine and rail operations.

2007 - Braemar Falconer, provides specialised marine and offshore services.

2008 - Braemar Steege, a specialist loss adjuster to the oil and gas industry.

Principal businesses:

Shipbroking

Braemar Seascope provides specialised shipbroking and consultancy services to international ship owners and charterers in the sale &

purchase, tanker, gas, chemicals, offshore, container and dry bulk markets.

www.braemarseascope.com

Logistics

Cory Brothers Shipping Agency provides port agency, freight forwarding and logistics services within the UK and Singapore.

www.cory.co.uk

Technical

Braemar Steege provides specialist loss adjusting and other expert services to the energy (oil and gas), marine, power and other related

industrial sectors. It has offices in London, Houston, Singapore, Calgary and Mexico City.

www.steegekingston.com

Braemar Falconer provides specialised marine and offshore services. It has offices at the following locations: Australia, China, India,

Indonesia, Malaysia, Singapore, Vietnam, and the UK.

www.falconer-bryan.com

Wavespec provides consultant marine engineering and naval architecture services to the shipping and offshore markets.

www.wavespec.com

Environmental

Braemar Howells provides pollution response and advisory services primarily in the UK for marine and rail operations, and is now

developing an international presence.

www.dvhowells.co.uk

INTERIM ANNOUNCEMENT - SIX MONTHS ENDED 31 AUGUST 2008

CHAIRMAN'S STATEMENT

The trading performance of the Group during the first half of the year was strong with organic growth in shipbroking coupled with

expansion in our technical services division being the principal drivers. Group revenues grew by 48% from �46.7m to �69.1m, pre-tax profits

increased by 38% from �7.1m to �9.8m and basic earnings per share were up 42% to 33.51p from 23.66p. The underlying growth in revenue and

pre-tax profits excluding the contributions from acquired businesses is 23% and 18% respectively.

The unprecedented events occurring in the international financial and commodity markets over the last month have introduced a much

greater degree of uncertainty in shipping. Freight rates for the dry bulk and container markets have experienced significant falls though

tanker rates remain firm. Vessel values have come under pressure because of the contraction of available finance and perceived falls in the

demand for bulk commodities. This has resulted in reduced sale and purchase activity which is likely to remain low until confidence returns.

There is a strong likelihood that some of the newbuilding orders reported in the market will be cancelled. However, we believe that the

majority of our forward order book is secure because the prices at which most orders were placed are below the historic peaks and because of

the relative strength of the yards, the owners of the vessels and the charterers. Some reduction of newbuilding deliveries is likely and

will be welcome by serving to reduce the potential for excess shipping capacity. Similarly, an acceleration in the scrapping of old ships is

beginning to occur which will also moderate the supply of tonnage - demolition shipbroking being an area where we have great expertise.

Our strategy over the past few years has been to invest in related marine services businesses. This has expanded our geographical

presence, activity skill-sets and customer base giving the Group greater resilience in changing markets. We have invested in building the

non-broking aspect of our business and on 3 March 2008 the Company purchased Steege Kingston for a consideration which is expected to total

approximately �8.1m. The business is an international loss-adjuster specialising in the energy market and has now been renamed Braemar

Steege. Together the non-broking businesses contributed �2.7m (representing approximately 20%) of the Group's operating profit before

amortisation in the first half, including �0.8m from Braemar Steege. Activity levels were high during the period and have remained so since,

particularly at Braemar Falconer whose marine engineering and surveying business in the Far East has benefited greatly from the increase in

oil and gas exploration.

The Group is financially strong with net tangible assets of �15.2m including cash of �11.1m and no debt. In the current financial

turmoil, with global recession imminent, it is difficult to predict what impact it will have on our businesses. However, there is a broad

base to our operations and this, coupled with the strength of our forward order book and of the US$ relative to Sterling gives us confidence

that our expectations for the full year out-turn will be met.

The Board has declared an interim dividend of 8.5 pence, an increase of 6% over 2007/8. The interim dividend will be paid on 11 December

2008 to shareholders on the register at the close of business on 14 November 2008, with an ex-dividend date of 12 November 2008.

Sir Graham Hearne

Chairman

27 October 2008

CHIEF EXECUTIVE'S REVIEW OF ACTIVITIES

Our Group has delivered a strong performance in nearly all sectors of activity. We have enjoyed a strong shipping market for much of the

last six months but more importantly we have increased our market share across most shipbroking disciplines which will serve us well in

weaker markets.

I would like to record the Board's thanks to all staff across our divisions for the energy, enthusiasm and commitment they have given to

ensure that more and more companies within the maritime and shipping industries are developing a business relationship with Braemar.

Shipbroking

The average Baltic Dry Index for the six months ended 31 August 2008 was 8,968 (H1 2007: 6,146). The BDI currently stands at 1,102

having fallen sharply during the recent financial crisis. From the start of our financial year the dry cargo market gradually improved until

it peaked in the last half of May and remained high for about one month before gradually sliding back down towards the end of August, a

pattern that was generally followed by all sectors of the dry cargo market. The volume of transactions concluded was higher this half than

last, with a considerable improvement in the value of freights and hence commission earned. China has dominated our activities and we have

increased our presence in Beijing as well as taking on several junior brokers in London, Australia and Singapore. The dry bulk freight

market in the Far East has dropped considerably over the last month with the demand for bulk commodities from China slowing since the

Olympic Games. While we see some potential for an increase in volumes in the near future, this recovery is not expected to reach previous levels. In addition to market turmoil a more direct effect has

been an impasse between Vale of Brazil, the world's largest iron ore supplier, and the Chinese steel mills, over Vale's attempt to increase

the price of iron ore. The Chinese steel mills, who have been suffering from a downturn in the price of steel, have vigorously opposed this

increase and, with a large stockpile of ore in Chinese ports, do not need to import much in the short term.

The deep sea tanker chartering rates have remained relatively firm throughout the first half and our volumes transacted have increased.

The Baltic Dirty Tanker Index averaged 1,731 during the first half (H1 2007: 1,331) and now stands at 1,390. Crude oil prices have dropped

significantly since the highs of the summer, but both China and India are continuing to import crude oil in line with their predictions, and

we expect to benefit from this continuous anticipated requirement. The newbuilding crude tonnage deliveries during the period have so far

been absorbed by market demand but as we move into next year there is a general expectation that the deliveries will exceed market

requirement and rates may start to recede. The wider distribution of products from refineries continues to be the major contribution to the

tonne mile requirement and in the near term we expect the volume of trade in all refined products, simple and sophisticated, to grow in line

with the delivery of new product tonnage.

In August 2008 we entered the FFA (Forward Freight Agreement) broking market through a joint arrangement with Tullett Prebon. This new

desk, which is based in our London office, currently transacts over the counter wet freight trades with a view to expanding into the dry FFA

market in due course.

The LNG sector is now becoming a crucial element to the global power requirement and the projects that have been previously delayed to

date are now nearing completion. The transportation of this clean and available energy will grow over the ensuing year and we are well

placed to service the new demand.

Sale and purchase activity in the first half remained strong with a good level of highly priced transactions in both second hand and

newbuilding. This was maintained into July but has since steadily dried up with the unfolding of the financial market crisis. The present

stagnation in the sale and purchase and newbuilding markets is a combination of lack of liquidity in the financing market and a wholesale

drop in dry freight rates. Despite this current climate we have been able to conclude significant newbuilding business. Demolition volumes

have picked up and we expect this activity to increase in the last quarter of 2008 and early 2009.

Our container desk performed well in the first half against the backdrop of a market which has deteriorated in recent months on the back

of declining consumer confidence. Sale and purchase activity is low at present as potential sellers are holding on to their tonnage rather

than selling. There is however a significant probability that some owners will be forced into selling and we remain well placed for this

business as we do on chartering when vessels seek new employment.

The offshore desk has had a very strong first six months with high charter rates in the North Sea driven by high exploration activity.

Rates have remained at these levels although it would be surprising if they were unaffected by the fall in the oil price in the future.

Technical services - Braemar Falconer, Wavespec and Braemar Steege

Braemar Falconer's revenue and profits for the first half year grew substantially. A significant portion of the growth was attributable

to increased involvement with rig moves, either as a warranty surveyor or as advisor to oil companies. A substantial increase was also

recorded for engineering consultancy work, where we earn higher rates. We opened a third branch office in China, which has secured three

contracts in quick succession. All of the offices in the Far East are busy with day-to-day survey work and the marine engineering department

in Singapore is carrying out significant engineering warranty work.

Wavespec continued to perform steadily with the majority of its business represented by LNG construction supervisory work under the

Qatargas contract which has at least another two years to run. The company is continuing to broaden its work to include offshore, dynamic

positioning and failure mode and effect analysis.

Braemar Steege has performed in line with our expectations and since acquisition in March 2008 it has established a new office in Venezuela

and a regional office in Miami. All offices have received a steady flow of new instructions through the first half of the year and more

recently the Houston and London offices have benefited from over 30 instructions arising from Hurricanes Gustav and Ike, including two of

the four largest energy claims known to have hit the energy insurance market as a result of Hurricane Ike.

Logistics - Cory Brothers

The growth in Cory's revenue was derived from more project forwarding work and the addition of 80% of Fred. Olsen Freight which was

purchased on 24 December 2007. The integration of Fred. Olsen Freight is proceeding well and will culminate in the bringing together of 90

Cory and Fred Olsen staff in new leasehold premises in Felixstowe in early 2009. Ship agency continued to perform steadily with an

increase in volumes following key contract additions. We also established our first overseas ship agency office in Singapore in July 2008.

This office has eight employees providing a full range of port, liner agency and logistics services. The cruise business also saw a

promising increase in port calls and passenger take-up during this summer season.

Environmental services - Braemar Howells

As expected, following the completion of the clean-up activity on the "MSC Napoli", the first half revenues and profits are lower than

last year. However, the effect has been to some extent ameliorated by an increase in retainer contracts with significant new clients and

international business, particularly in West and Central Africa.

Acquisitions

The contributions of acquired businesses to the half year results are as follows:

First half 2008/9 First half 2007/8

Revenue �000 �000

Braemar Falconer 4,143 647

Braemar Steege 3,298 -

Fred Olsen Freight Limited 4,873 -

12,314 647

Operating profit �000 �000

Braemar Falconer 1,133 65

Braemar Steege 777 -

Fred Olsen Freight Limited 86 -

Operating profit before 1,996 65

amortisation

Amortisation (366) (29)

Impact on Group operating profit 1,630 36

The consideration paid for Braemar Steege was �5.8m satisfied by the issue of shares (�1.3m) and cash of �4.5m. Further cash

consideration of �2.3m is expected to be paid based on performance. Net tangible assets acquired were �4.6m, including debtors of �2.5m and

cash of �1.2m resulting in the recognition of goodwill and intangible assets (net of applicable deferred tax) of �3.5m.

During the half the Group also expended cash of �0.9m on the purchase of 59% of Gorman Cory and �0.7m on the final settlement of the

consideration for 80% of Fred Olsen Freight.

Treasury

The majority of the Group's income is US$ denominated and the average rate of exchange for conversion of US$ income in the six months to

31 August 2008 was $1.90/� (Interim 2007/8: $2.02/�, Full Year 2007/8: $1.99/�). In broad terms a 10 cent swing in the US$/� rate

approximates to a �3m change in shipbroking revenues over a full year. The rate of translation as at 31 August 2008 was $1.82/�.

Cash

Cash balances were �11.1m at 31 August 2008 compared with cash of �21.6m as at 29 February 2008. The Group normally generates most of

its annual cash flow in the second half of the year and the reduction in cash principally reflects the payment of the annual broking bonus,

acquisitions (see above) and the full year dividend relating to the prior year.

Alan Marsh

Chief Executive

27 October 2008

Statement of Directors' responsibilities

The Directors confirm, to the best of their knowledge, that this set of financial statements has been prepared in accordance with IAS34

as adopted by the European Union, and that the interim management report herein includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8 of the Disclosure and Transparency rules of the United Kingdom's Financial Securities Authority.

The Directors of Braemar Shipping Services PLC are listed in the Braemar Shipping Services PLC Annual Report for 29 February 2008.

By order of the Board

A R. W. Marsh, Chief Executive J. R. V. Kidwell, Finance Director

Braemar Shipping Services PLC

Consolidated Income Statement

Unaudited Unaudited Audited

Six months to Six months to Year ended

31 Aug 2008 31 Aug 2007 29 Feb 2008

Continuing operations Notes �'000 �'000 �'000

Revenue 4 69,106 46,670 100,964

Cost of sales (19,770) (13,793) (28,267)

Gross profit 49,336 32,877 72,697

Operating costs (39,803) (26,110) (58,729)

Operating profit 4 9,533 6,767 13,968

Finance income 108 234 391

Finance costs - (8) (11)

Share of profit after tax from 144 100 370

joint ventures

Profit before taxation - 9,785 7,093 14,718

continuing operations

Taxation 5 (2,959) (2,323) (4,797)

Profit for the period - 6,826 4,770 9,921

continuing operations

Profit / (loss) for the period from discontinued - 23 (3)

operations

Profit for the period 6,826 4,793 9,918

Attributable to:

Equity holders of the parent 6,795 4,713 9,772

Minority interest 31 80 146

6,826 4,793 9,918

Earnings per ordinary share 7

Basic - pence 33.51 p 23.66 p 48.97 p

Diluted - pence 33.30 p 23.48 p 48.68 p

Braemar Shipping Services PLC

Consolidated Balance Sheet

Unaudited Unaudited Audited

As at As at As at

31 Aug 08 31 Aug 07 29 Feb 08

Assets Notes �'000 �'000 �'000

Non-current assets

Goodwill 8 28,235 24,218 25,826

Other intangible assets 8 4,145 2,254 2,315

Property, plant and equipment 8 6,175 5,771 5,820

Investments 2,087 1,535 1,890

Deferred tax assets 987 644 754

Other receivables 144 60 155

41,773 34,482 36,760

Current assets

Inventories 92 70 91

Trade and other receivables 42,721 28,394 26,784

Derivative financial - 77 107

instruments

Restricted cash - - 3,952

Cash and cash equivalents 11,052 11,122 21,635

53,865 39,663 52,569

Total assets 95,638 74,145 89,329

Liabilities

Current liabilities

Derivative financial 1,168 - 49

instruments

Trade and other payables 41,016 32,264 39,540

Current tax payable 3,438 3,099 3,017

Provisions 57 277 48

Client monies held as escrow - - 3,952

agent

45,679 35,640 46,606

Non-current liabilities

Deferred tax liabilities 2,301 287 681

Trade and other payables - - 434

Provisions 107 40 81

2,408 327 1,196

Total liabilities 48,087 35,967 47,802

Net assets 47,551 38,178 41,527

Equity

Share capital 9 2,102 2,049 2,061

Share premium 9 10,876 9,001 9,261

Shares to be issued (2,798) (1,844) (2,527)

Other reserves 10 21,770 20,806 20,687

Retained earnings 15,434 7,842 11,717

Total shareholders' equity 47,384 37,854 41,199

Minority interest 167 324 328

Total equity 47,551 38,178 41,527

Braemar Shipping Services PLC

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

Six months Six months Year ended

31 Aug 08 31 Aug 07 29 Feb 08

Notes �'000 �'000 �'000

Profit before tax for the 9,785 7,093 14,718

period from continuing

operations

Profit before tax for the - 23 (3)

period from discontinued

operations

Adjustments for:

-Depreciation 423 312 687

-Amortisation 528 189 452

-Goodwill impairment charge - - 114

-Profit on sale of investments - (93) (89)

-Profit / (loss) on sale of - - 57

property, plant and equipment

-Finance income (108) (234) (391)

-Finance expense - 8 11

-Share of pre-tax profit of (144) (100) (370)

joint ventures

-Share based payments 234 190 554

Changes in working capital

-Inventory (1) - (21)

-Trade and other receivables (8,527) (4,166) 143

-Trade and other payables (1,470) (747) 5,630

-Provisions (116) (145) (334)

Cash generated from operations 604 2,330 21,158

Interest received 108 234 391

Interest paid - (8) (11)

Tax paid (3,230) (1,904) (4,587)

Net cash generated from / (2,518) 652 16,951

(used in) operating activities

Cash flows from investing

activities

Acquisition of subsidiaries, 11 (4,887) (931) (4,270)

net of cash acquired

Purchase of property, plant 8 (654) (561) (1,032)

and equipment

Proceeds from sale of - 7 57

property, plant and equipment

Purchase of investments (8) - (38)

Proceeds from sale of - 191 200

investments

Other long-term receivables 11 21 (74)

Net cash used in investing (5,538) (1,273) (5,157)

activities

Cash flows from financing

activities

Proceeds from issue of 133 473 745

ordinary shares

Dividends paid 6 (3,147) (2,451) (4,053)

Dividends paid to minority - (65) (143)

Purchase of own shares (406) (797) (1,480)

Net cash used in financing (3,420) (2,840) (4,931)

activities

(Decrease)/increase in cash (11,476) (3,461) 6,863

and cash equivalents

Cash and cash equivalents at 21,635 14,634 14,634

beginning of the period

Foreign exchange differences 893 (51) 138

Cash and cash equivalents at 11,052 11,122 21,635

end of the period

Braemar Shipping Services PLC

Condensed consolidated half-yearly statement of changes in equity (unaudited)

Share capital Share premium Shares to be issued Other reserves Retained earnings Total Minority

interest Total equity

Notes �'000 �'000 �'000 �'000 �'000 �'000

�'000 �'000

At 28 February 2007 2,023 8,554 (1,047) 21,020 5,390 35,940

309 36,249

Cash flow hedges - - - 43 - 43

- 43

Exchange differences - - - (36) - (36)

- (36)

Net income recognised

directly in equity - - - 7 - 7

- 7

Profit for the period - - - - 4,713 4,713

80 4,793

Total recognised income

for the half year - - - 7 4,713 4,720

80 4,800

Dividends paid 6 - - - - (2,451) (2,451)

(65) (2,516)

Issue of shares 26 447 - - - 473

- 473

Purchase of shares - - (797) - - (797)

- (797)

Consideration to be paid - - - (221) - (221)

- (221)

Credit in respect of

share option schemes - - - - 190 190

- 190

Balance at 31 August 2007 2,049 9,001 (1,844) 20,806 7,842 37,854

324 38,178

At 29 February 2008 2,061 9,261 (2,527) 20,687 11,717 41,199

328 41,527

Cash flow hedges - - - (730) - (730)

- (730)

Exchange differences - - - 913 - 913

6 919

Net income recognised

directly in equity - - - 183 - 183

6 189

Profit for the period - - - - 6,795 6,795

31 6,826

Total recognised income

for the half year - - - 183 6,795 6,978

37 7,015

Acquisition 11 31 1,317 - - - 1,348

18 1,366

Dividends paid 6 - - - - (3,147) (3,147)

- (3,147)

Issue of shares 9 10 298 - - - 308

- 308

Purchase of shares 9 - - (406) - - (406)

- (406)

Consideration paid 11 - - - 900 - 900

(216) 684

ESOP shares allocated 9 - - 135 - (165) (30)

- (30)

Credit in respect of

share option schemes - - - - 234 234

- 234

At 31 August 2008 2,102 10,876 (2,798) 21,770 15,434 47,384

167 47,551

BRAEMAR SHIPPING SERVICES PLC

UNAUDITED NOTES TO THE FINANCIAL INFORMATION

FOR THE SIX MONTHS ENDED 31 AUGUST 2008

1. General Information

The interim consolidated financial statements of the Group for the period ended 31 August 2008 were authorised for issue in accordance

with a resolution of the directors on 28 October 2008. Braemar Shipping Services plc is a Public Limited Company incorporated and domiciled

in England and Wales.

The term 'Company' refers to Braemar Shipping Services plc and 'Group' refers to the Company and all its subsidiary undertakings and the

employee share ownership trust. The address of its registered office is 35 Cosway Street, London NW1 5BT.

These interim consolidated financial statements do not compromise statutory accounts within the meaning of Section 240(5) of the

Companies Act 1985. The audited statutory accounts for the year ended 29 February 2008 have been delivered to the Registrar of Companies in

England and Wales. The report of the auditors on those accounts was unqualified, did not contain an emphasis of matter paragraph and did not

contain any statement under Section 237 of the Companies Act 1985.

2. Accounting policies

Basis of preparation

This condensed consolidated half-yearly financial information for the half-year ended 31 August 2008 has been prepared in accordance

with the Disclosure and Transparency Rules of the Financial Services Authority and with IAS34, 'Interim financial reporting' as adopted by

the European Union. The half-yearly condensed consolidated financial report should be read in conjunction with the annual financial

statements for the year ended 29 February 2008, which have been prepared in accordance with IFRSs as adopted by the European Union.

Forward-looking statements

Certain statements in this half-yearly report are forward-looking. Although the Group believes that the expectations reflected in these

forward-looking statements are reasonable, we can give no assurance that these expectations will prove to have been correct. Because these

statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking

statements. We undertake no obligation to update any forward-looking statements whether as a result of new information, future events or

otherwise.

3. Accounting Policies

The accounting policies adopted in the preparation of these interim consolidated financial statements are consistent with those of the

annual financial statements for the year ended 29 February 2008, as described in those annual financial statements.

4. Segmental information

Revenue Six months to Six months to Year ended

31 Aug 2008 31 Aug 2007 29 Feb 2008

�'000 �'000 �'000

Shipbroking 34,446 23,879 52,794

Logistics 21,583 12,013 27,874

Technical - other 7,085 3,774 9,467

Technical - energy loss 3,298 - -

adjusting

Environmental 2,694 7,004 10,829

69,106 46,670 100,964

Profit for the period

Shipbroking 8,945 6,064 12,993

Logistics 213 432 953

Technical - other 1,349 316 728

Technical - energy loss 542 - -

adjusting

Environmental 159 1,226 1,836

Segment result 11,208 8,038 16,510

Unallocated common costs (1,675) (1,271) (2,542)

Operating profit 9,533 6,767 13,968

Finance income / (cost) - net 108 226 380

Share of profit after tax from 144 100 370

joint ventures

Profit before taxation 9,785 7,093 14,718

Taxation (2,959) (2,323) (4,797)

Profit for the period from 6,826 4,770 9,921

continuing operations

5. Taxation

The taxation charge for the half-year is calculated using the estimated effective tax rate for the full year applied to the pre-tax

profits at the half year.

6. Dividends

The following dividends were paid by the Group:

Six months to Six months to Year ended

31 Aug 2008 31 Aug 2007 29 Feb 2008

�'000 �'000 �'000

Ordinary shares of 10 pence

each

Interim of 8.00 pence per - - 1,602

share paid

Final of 15.0 pence per share 3,147 2,451 2,451

(2007: 12.25 pence per share)

3,147 2,451 4,053

The Directors have declared an interim dividend of 8.5 pence per ordinary share, payable on 11 December 2008 to shareholders on the

register on 14 November 2008.

7. Earnings per share

Six months to Six months to Year ended

31 Aug 2008 31 Aug 2007 29 Feb 2008

�'000 �'000 �'000

Profit for the period from 6,795 4,690 9,775

continuing operations

Profit / (loss) for the period - 23 (3)

from discontinued operations

Profit for the period 6,795 4,713 9,772

attributable to shareholders

Shares Shares Shares

Weighted average number of 20,275,565 19,922,544 19,953,231

ordinary shares

Dilutive effect of share 131,683 153,532 122,061

options

Diluted weighted average 20,407,248 20,076,076 20,075,292

number of ordinary shares

Continuing operations pence pence pence

Basic earnings per share - 33.51 23.54 48.99

pence

Effect of dilutive share (0.21) (0.18) (0.30)

options - pence

Diluted earnings per share - 33.30 23.36 48.69

pence

Total operations pence pence pence

Basic earnings per share - 33.51 23.66 48.97

pence

Effect of dilutive share (0.21) (0.18) (0.29)

options - pence

Diluted earnings per share - 33.30 23.48 48.68

pence

8. Capital expenditure

Goodwill, tangible and

intangible assets

Six months ended 31 August 2007: �000

Opening net book amount at 1 March 2007 29,666

Acquisition of a subsidiary 2,524

Additions 561

Disposals (7)

Depreciation and amortisation (501)

Closing net book amount at 31 August 2007 32,243

Six months ended 31 August 2008:

Opening net book amount at 1 March 2008 33,961

Acquisition of subsidiaries (see note 11) 4,877

Additions 654

Depreciation and amortisation (951)

Exchange movements 14

Closing net book amount at 31 August 2008 38,555

9. Share capital

Number of Ordinary Share

shares Shares Premium Total

(thousands) �000 �000 �000

At 1 March 2007 20,231 2,023 8,554 10,577

Issues - share option schemes 263 26 447 473

At 31 August 2007 20,494 2,049 9,001 11,050

At 1 March 2008 20,607 2,061 9,261 11,322

Acquisitions - see note 11 307 31 1,317 1,348

Shares issued and fully paid 56 5 128 133

Shares issued and unpaid 51 5 170 175

At 31 August 2008 21,021 2,102 10,876 12,978

The Group's ESOP trust acquired 87,600 of the company's shares, including 76,800 through purchases on the London Stock Exchange, at

dates between 17 May 2008 and 28 August 2008 at prices ranging between 467 and 500 pence. The total amount paid to acquire the shares was

�406,000 and has been deducted from shareholders' equity.

During the six months ended 31 August 2008, 414,211 shares were issued at prices ranging between 137.5 pence and 439.75 pence. Of these,

51,471 shares were paid subsequent to the balance sheet date. In addition, of the 414,211 shares issued, 306,513 shares were issued as part

of the consideration to acquire Steege Kingston Partnership Limited (see note 11).

In addition, 48,000 shares at a value of �135,000 that were awarded to employees in May 2005 as part of the Deferred Bonus Plan (the

Plan) were delivered to them in May 2008 following the three year vesting period. Details of the Plan are disclosed in the annual financial

statements for the year ended 29 February 2008.

10. Other reserves

Group Capital redemption Merger reserve Deferred Translation reserve Hedging reserve Total

other reserves

reserve consideration

reserve

�'000 �'000 �'000 �'000 �'000

�'000

Balance at 28 February 2007 396 21,346 (738) 5 11

21,020

Cash flow hedges

-Transfer to net profit - - - - (16)

(16)

-Fair value losses in the - - - - 77

77

period

Foreign exchange differences - - - (36) -

(36)

Consideration to be paid - - (221) - -

(221)

Deferred tax on items taken to - - - - (18)

(18)

equity

As at 31 August 2007 396 21,346 (959) (31) 54

20,806

Balance at 29 February 2008 396 21,346 (1,520) 388 77

20,687

Cash flow hedges

-Transfer to net profit - - - - (107)

(107)

-Fair value losses in the - - - - (907)

(907)

period

Foreign exchange differences - - - 913 -

913

Consideration paid - - 900 - -

900

Deferred tax on items taken to - - - - 284

284

equity

As at 31 August 2008 396 21,346 (620) 1,301 (653)

21,770

11. Acquisitions

On 3 March 2008 the Company acquired 100% of the share capital of Steege Kingston Partnership Limited for an estimated consideration of

�8.1m. The deferred consideration is based on a multiple of the earnings before interest and tax in each of the two years post completion

and these amounts will be settled wholly in cash.

The acquired business contributed revenues of �3,298k and a net profit before amortisation of �777k to the group for the period from

acquisition to 31 August 2008 (see note 4).

Details of provisional net assets acquired and goodwill are set out below. The goodwill is attributable to Steege Kingston's skilled

loss adjusting staff. The group has yet to finalise the amount of the fair value of the identifiable assets acquired.

Purchase consideration �'000

- cash paid 4,203

- shares issued 1,348

- deferred consideration 2,320

- acquisition expenses 187

Total purchase consideration 8,058

- fair value of identifiable assets acquired (see (6,287)

below)

Goodwill 1,771

Acquiree's Provisional

carrying Fair

amount value

�'000 �'000

Cash and cash equivalents 1,161 1,161

Property, plant and equipment 110 110

Intangible assets 0 2,350

Work in progress 4,280 4,280

Receivables 2,503 2,503

Payables (1,745) (1,745)

Current tax liability (407) (407)

Deferred tax liabilities (1,149) (1,807)

Provisions (140) (140)

Net identifiable assets acquired 4,613 6,305

Minority interest (18)

Net assets acquired by the group 6,287

Outflow of cash to acquire the business, net of

cash acquired:

- cash consideration 4,203

- cash and cash equivalents in subsidiary (1,161)

acquired

- acquisition expenses 187

Cash outflow on acquisition 3,229

In addition, on 29 July 2008, the Group paid �28,000 to acquire the assets of Sealion Shipping (S) Pte Limited situated in Singapore

generating goodwill of �23,000.

In respect of previous acquisitions, on 5 March 2008, the Group acquired the 59% minority interest in Gorman Cory Limited for a

consideration of �900,000 which generated additional goodwill of �686,000 and, on 2 July 2008, paid �730,000 as settlement of the 80%

acquisition in Fred. Olsen Freight Limited resulting in a reduction to the provisional goodwill disclosed at 29 February 2008 of �71,000.

Independent review report to Braemar Shipping Services plc

Introduction

We have been engaged by the company to review the condensed set of financial statements in the half-yearly financial report for the six

months ended 31 August 2008, which comprises the consolidated income statement, consolidated balance sheet, condensed consolidated

half-yearly statement of changes in equity, consolidated cash flow statement and related notes. We have read the other information contained

in the half-yearly financial report and considered whether it contains any apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved by, the directors. The directors are responsible for

preparing the half-yearly financial report in accordance with the Disclosure and Transparency Rules of the United Kingdom's Financial

Services Authority.

As disclosed in note 2, the annual financial statements of the group are prepared in accordance with IFRSs as adopted by the European

Union. The condensed set of financial statements included in this half-yearly financial report has been prepared in accordance with

International Accounting Standard 34, "Interim Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the half-yearly financial

report based on our review. This report, including the conclusion, has been prepared for and only for the company for the purpose of the

Disclosure and Transparency Rules of the Financial Services Authority and for no other purpose. We do not, in producing this report, accept

or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save

where expressly agreed by our prior consent in writing.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the Entity' issued by the Auditing Practices Board for use in the United

Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the

half-yearly financial report for the six months ended 31 August 2008 is not prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European Union and the Disclosure and Transparency Rules of the United Kingdom's

Financial Services Authority.

PricewaterhouseCoopers LLP

Chartered Accountants

West London

28 October 2008

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UBVNRWWRRUAA

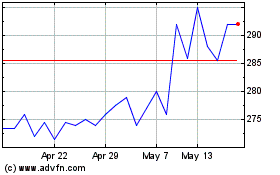

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024