RNS Number:4066C

Braemar Seascope Group PLC

04 May 2006

For immediate release 4 May 2006

Results - Year ended 28 February 2006

Braemar Seascope Group plc (the "Group"), a leading provider of shipping

services, today announced full year unaudited results for the year ended 28

February 2006.

HIGHLIGHTS

*Revenue up to #68.5m (2005: #45.2m)

*Pre-tax profit up 27% to #10.3m (2005: #8.1m)

*Basic EPS up 26% to 37.03p (2005: 29.50p)

*Operating cash flow up 25% to #10.7m (2005: #8.6m)

*Final dividend 11.5p per share (up 15%), full year 18.0p (2005: 16.00p)

up 12.5%

*DV Howells acquired in March 2006, extending our service range

Commenting on the results and outlook, Sir Graham Hearne, Chairman, said:

"Shipbroking has continued to flourish in favourable markets and our business

has benefited from high freight rates and vessel values as well as increased

transaction volumes "

"The demand for seaborne trade continues to grow driven by the demand for the

long-range transportation of raw materials, oil, gas and manufactured products.

The Group is well-placed to benefit from the increased activity in all sectors.

We also expect the contribution from our non-broking businesses to increase in

the coming year.

The new financial year has started well with a good level of business concluded

already, both for this year and future years."

For further information, contact:

Braemar Seascope Group plc

Alan Marsh Tel 020 7535 2650

James Kidwell Tel 020 7535 2881

Aquila Financial

Peter Reilly Tel 020 7202 2601

Charles Stanley Securities

Philip Davies Tel 020 7953 2000

Notes to editors:

Through its subsidiaries Braemar Seascope Group plc's services provided

comprise:

Braemar Seascope Specialised shipbroking and consultancy services to

Limited, Braemar international ship owners and charterers in the sale &

Seascope Pty purchase, tanker, offshore, container and dry bulk

(Australia), markets.

www.braemarseascope.com

DV Howells Limited Pollution response service provider primarily in the

UK

www.dvhowells.co.uk

Cory Brothers Shipping Liner and port ship agency services within the UK.

Agency Limited www.cory.co.uk

Wavespec Limited Marine engineering and naval architecture consultants

to the shipping and offshore markets.

www.wavespec.com

PRELIMINARY ANNOUNCEMENT - YEAR ENDED 28 FEBRUARY 2006

CHAIRMAN'S STATEMENT

I am delighted to report another year of record profits for the Group and on

behalf of the Board I would like to thank the staff throughout the Group for

their hard work and commitment during the year. Their effort and skill has

contributed greatly to these results.

Revenue for the year increased to #68.5m (2005: #45.2m) and profit before tax

was #10.3m compared with #8.1m in the prior year. Earnings per share grew by 26%

to 37.03 pence (2005: 29.50 pence). The good performance was also reflected in

the net cash generated from operating activities which increased to #10.7m

(2005: #8.6m) contributing to the improvement in net funds which ended the year

at #13.6m (2005: #6.5m).

Shipbroking has continued to flourish in favourable markets and our business has

benefited from high freight rates and vessel values as well as increased

transaction volumes. Our new Australian business has integrated well within the

Group and we have used this as a platform to set up a new bunker trading

operation during the year.

We are encouraged by the growth we are seeing in certain of our broking and

shipping service areas which we have worked hard to develop in recent years. We

believe this growth will stand the Group in good stead in the future. The

non-broking segments of the Group have begun to show they are capable of a

meaningful financial contribution to the Group's overall result. Cory Brothers

improved its performance significantly in the UK ship agency, forwarding and

logistics market and has added two bolt-on acquisitions in the year to expand

its operations. Wavespec is now seeing the benefit of its market leading

position in technical design and supervisory work for LNG vessel construction.

In March 2006 we added a new services arm to the Group through the acquisition

of D V Howells, the UK based pollution response business. We expect that its

marine business will be capable of significant growth within the Group. The

acquisition is another step in our overall strategy of building a broadly-based

shipping services Group.

Iain Shaw will be retiring from the Company at the forthcoming AGM having been a

director since the company's inception. He has made an outstanding contribution

to the Group over the years for which the Board wish to record their deep

appreciation.

The Board is recommending a final dividend of 11.5 pence per ordinary share,

which together with the 6.5 pence interim dividend takes the total dividend for

the year to 18.0 pence (2005: 16.0 pence), a rise of 12.5%.

Outlook

The demand for seaborne trade continues to grow driven by the demand for the

long-range transportation of raw materials, oil, gas and manufactured products.

The Group is well-placed to benefit from the increased activity in all sectors.

We also expect the contribution from our non-broking businesses to increase in

the coming year.

The new financial year has started well with a good level of business concluded

already, both for this year and future years.

Sir Graham Hearne

4 May 2006

CHIEF EXECUTIVE'S OPERATIONAL AND FINANCIAL REVIEW

The size and scope of our business has increased significantly over the last few

years. An overview of the operations and composition of the Group by business

segment is shown in the table below:

Segment Trading names Number of Business

employees Locations

Shipbroking Braemar Seascope 189 UK head office

in London and an

office in

Aberdeen;

Shanghai and

Beijing;

Melbourne, Perth

and Sydney;

Singapore; Delhi

and Mumbai

(joint venture

offices).

Ship agency, Cory Brothers,

forwarding Morrisons,

and Planetwide 120 16 offices in

Logistics the UK, mainly

in ports of

which Tilbury,

Felixstowe and

Southampton are

the main

offices.

Technical

shipping

support Wavespec 17 Office in Malden

Essex.

Site offices in

the major

shipyards in

Korea and Japan

Bunker Braemar Seascope 2 Melbourne,

trading Australia

Pollution

response

services D V Howells 27 7 offices in the

(acquired March 2006) UK.

The segments form a complementary grouping of businesses operating separately

within the shipping industry. Together they extend the range of advice and

services we are able to provide for our clients and increasingly we are able to

act in a wide-ranging consulting capacity because of the breadth of our

services. We believe this is an important feature of the future of the business

and we will continue to seek opportunities to add value in related areas where

we can.

The new financial year has begun well with significant business concluded

already. We currently have in excess of US$30 million of shipbroking revenues

deliverable within the current year.

A segmental commentary on the operating activities during the year is set out

below.

Shipbroking

Shipbroking activities are undertaken by Braemar Seascope with revenues in 2005/

6 increasing to #39.7m (2005: #32.4m) and operating profits of #9.0m (2005:

#8.9m).

The tanker freight market began the financial year in a relatively benign state,

however the second half of the year was significantly influenced by the after

effects of the hurricane season in the United States. The initial impact on U.S.

refining capacity resulted in a surge of demand for imported products,

especially gasoline. The damage to offshore crude oil production facilities in

the Gulf of Mexico has still not been fully repaired, and less than half of the

sub-sea pipeline system has so far been restored. The consequent demand for

crude oil, imported from more geographically remote supply sources, supported a

strong tanker market throughout the winter months. In spite of high oil prices,

and a steady increase in the cost of bunker fuel, shipowners enjoyed healthy

earnings. Modern Very Large Crude Carriers averaged around $90,000 per day over

the 4th quarter of 2005 and 1st quarter of 2006, and over the same period a

medium size products carrier averaged around $25,000 per day.

Looking ahead over 2006, oil prices are at record levels and are likely to

remain high, as long as tension exists over Iran's nuclear ambitions. Problems

with supplies from Nigeria, due to local insurrection, and growing antipathy

between the governments of the USA and Venezuela, which accounts for some 15 per

cent of American crude oil imports, suggest that the United States will continue

to rely on long haul crude oil imports. In spite of the 'wake up call' to the US

refining sector, there are no plans for early expansion of capacity there.

Although the tanker market is currently experiencing a predictable seasonal

lull, there is every reason to believe that owners of all types of tanker can

look forward to healthy returns.

Specialised products chartering, comprising chemicals, gas, small tankers and

vegetable oils, enjoyed a year of high activity and good growth. The gas and

chemicals businesses are based on contracts with major charterers. Shipment

volumes and freight rates have increased year-on-year and the signs are that the

upward trend will continue in the coming year. Changes in regulations and

controls within the chemicals and vegetable oils sectors can only further

tighten available tonnage.

The Dry bulk market was volatile over the course of the financial year. The

benchmark Baltic Dry Index (BDI) was 4,663 on 1 March 2005 falling to a low of

1,747 on 3 August 2005 and recovering to 2,680 at 28 February 2006, overall

averaging 3,020 (2004/5: 4,396). It currently stands at 2,378. At the start of

the year demand for iron ore was high though this fell off through the first

half and freight rates reduced as the fleet grew with increases in the supply of

tonnage and port congestion eased. The addition of our Australian offices has

greatly increased our Dry market coverage and during the year we opened a new

Dry Bulk office in Singapore as some operators have relocated to benefit from

the local tax environment for shipping. Over the coming year demand is expected

to increase - Chinese GDP is expected to grow by at least 8 per cent during 2006

- though this may be offset by an increase in the supply of vessels,

particularly in the Capesize fleet where tonnage is expected to grow by some 12

per cent in deadweight terms over 2006. However scrapping of older vessels in

next few years is likely and may serve to restore a balance to the fleet.

Our sale and purchase team is engaged in second hand, demolition and newbuilding

business. Second hand activity prospered in markets which have seen sustained

investment activity for more than two years. The business has grown year-on-year

benefiting from the continuing high volume of transactions and a shift in the

mix towards higher value transactions. Substantial capital was raised in the

public markets for investment in shipping and we were involved in a number of

large vessel purchases for newly quoted clients. Activity levels across most

types and sizes of ship have remained high even though vessel prices have come

down in some sectors since the highs at the beginning of the financial year.

Newbuilding income increased over the year - it is recognised in line with the

contractual phasing of payments by the ship owner to the shipyard, and therefore

mainly reflects the activity of previous years. The addition of new contracted

business during the year maintained the forward order book with the benefit to

earnings accruing over the next four years.

There has been a high level of activity in the offshore market this year both in

the North Sea and worldwide, with exploration activity increasing due to the

outlook for oil prices. Charter rates firmed over the year and are expected to

remain high for the foreseeable future. Transaction volumes improved

year-on-year and the forward book of business has also been built significantly.

Container market rates began the year strongly but weakened sharply in the

latter half of 2005, finding a level of stability in the first quarter of 2006.

Global container volume growth was in the region of 10% in 2005 driven by strong

global economic growth. However, newbuilding tonnage under construction will

represent a high proportion of the existing fleet size and will continue to be

so for the next few years. Our team, held through a joint venture, performed

well in both chartering and sale and purchase in this volatile market.

Ship agency, forwarding and logistics

Ship agency, forwarding and logistics is undertaken by Cory Brothers. Revenues

increased to #15.9m (2005: #8.5m) and operating profits were #0.6m (2005: #(1.2)

m loss).

A much stronger performance from shipping service provider, Cory Brothers, has

been achieved through growth in all sectors. The new income streams identified

in 2005 in Logistics performed very strongly whilst there was continued

significant growth in both General Forwarding, Project Forwarding and Liner

services. Performance in Ship Agency was also higher due to increased port calls

which is a key driver of revenue.

In July 2005 Cory acquired the business of Geo Morrison & Co (Leith) Limited

which trades as Morrison Shipping and Morrison Tours for a cash consideration of

up to #525,000. Morrison is based in Leith, Scotland and acts as Ship's Agent,

Project Forwarder and provides shore excursions for Cruise operators. These

long-term business relationships with the Cruise operators complement those of

Cory Brothers which should enable further development elsewhere in the UK. In

November 2005 Cory acquired Planetwide Group Limited for a cash consideration of

up to #766,000. Planetwide is a Freight Forwarding business with strong

relationships in the Australia, New Zealand and Nigerian markets. Its business

involves warehousing, European trailer transport, air freight, containerisation

to deep-sea destinations and undertakes packing and all export and import

documentation as per its clients' needs. This expertise combines well with the

growing Cory Brothers Forwarding and Logistics business centred in Felixstowe.

Subsequent to the end of the financial year Cory Brothers formed Gorman Cory

Shipping Agency Limited, in which it has a 41% interest, with Gorman Shipping, a

Mersey based company providing ship agency services and handling more than 750

vessel calls per year. The three transactions are natural additions to Cory

Brothers' existing business and build on the client base and range of services

the company can offer.

Technical shipping support

Wavespec's revenues increased to #5.2m (2005: #4.3m) and operating profits were

#0.3m (2005: #0.1m).

Wavespec consolidated its position as the pre-eminent LNG carrier design and

construction specialists having been awarded contracts to act as Charterers'

Representatives in projects for Qatar and Sakhalin. The Qatari contract involves

overseeing the design review and construction of, potentially, up to 100 LNG

Carriers in three yards in Korea. For the most part these vessels represent the

cutting edge of LNG carrier design taking vessels up to 250,000 cubic metres in

size. Previously, LNG carriers had not exceeded 155,000 cubic metres. These

vessels are also the first LNG carriers to be fitted with slow speed diesel

propulsion and LNG gas reliquefaction plants. The Sakhalin vessels are the first

generation of ice-class LNG carriers and are to carry LNG from Sakhalin Island

to Japan. The company is also involved in new business connected with the

development of vessels to carry Compressed Natural Gas (CNG) and in the offshore

sector. As a result of these developments, and ongoing projects, Wavespec has a

strong order book going forward into 2006-7.

Bunker trading

Revenues in this new segment were #7.7m (2005: #Nil) and operating profits were

#30,000 (2005: Nil) after four months of operation.

We opened a bunker trading business which is operating successfully in the

Australian and Far East markets. This activity involves the purchase of bunkers

from oil companies against matched sales to ship owners or operators. We expect

revenues and profits from this segment to be significantly increased in the next

financial year.

Financial

Profit before tax increased to #10.3m compared with the IFRS restated figure of

#8.1m in 2005 on revenues of #68.5m (2005: #45.2m). The operating profit margin

of 14.4% in 2006 compared with 17.2% in 2005. The reduction mainly reflects the

inclusion of the new bunker trading business in Australia which acts as a

principal for the purchase and resale of bunkers and has an inherently lower

margin than the other segments together with the increased relative importance

of the lower margin, but less volatile, forwarding and logistics business and

higher staff and premises costs in shipbroking.

The majority of the Company's shipbroking, technical services and bunker trading

income is US dollar denominated and the average rate of exchange for conversion

of US dollar income in the year was $1.80/# (2005: $1.82/#) and at the year

ended 28 February 2006 the rate was $1.75/#. At present the Group has cover for

the 2006/7 year through forward foreign exchange contracts totalling US$21m at a

blended rate of $1.76/# plus the right to sell $US12m at $1.80/# over the next 6

months.

The tax rate on profits was 30.3% (2005: 33.2%). The tax charge in the year

benefited from the tax deductibility of share option exercises based on the

market value at the point of exercise.

Operating cash flow of #10.7m (2005: #8.6m), calculated after corporation tax

payments, increased in line with profits. The net cash balance increased over

the year by #7.1m to #13.6m (2005: #6.5m).

Cash expenditure for acquisitions (net of cash acquired) totalled #0.5m in

respect of Morrisons and Planetwide and an estimated additional #0.5m is payable

dependent on profits. In March 2006 the Group acquired the pollution response

specialist, D V Howells, for a cash consideration of #550,000.

The directors are proposing for approval at the AGM a final dividend of 11.5

pence per ordinary share, at a cost of #2.2m (not recognised as a liability at

28 February 2006), to be paid on 27 July 2006 to shareholders on the register at

the close of business on 30 June 2006 (the ex-dividend date will be 28 June

2006). Together with the 6.5p interim dividend the Company's dividend for the

year is 18.0 pence (2005: 16.0 pence) at a cost of #3.6m. The dividend is

covered 2.0 times by earnings.

Alan Marsh

4 May 2006

Braemar Seascope Group PLC

Consolidated income statement for the year ended 28 February 2006

Notes Year ended Year ended

28 Feb 2006 28 Feb 2005

#'000 #'000

Revenue 3 68,497 45,203

Operating costs (58,607) (37,412)

------- -------

Amortisation of other intangibles (287) -

Impairment of goodwill - (931)

Operating costs excluding amortisation of

other intangibles and impairment of goodwill (58,320) (36,481)

------- -------

------- -------

Operating profit 3 9,890 7,791

Finance income 162 28

Finance costs (2) (53)

Share of profit from joint ventures' and

associates after tax 243 365

------- -------

Profit before taxation 10,293 8,131

Taxation 4 (3,115) (2,699)

------- -------

Profit for the period attributable to

equity shareholders 7,178 5,432

------- -------

Earnings per ordinary share 6

Basic - pence 37.03 p 29.50 p

Diluted - pence 36.18 p 28.59 p

Braemar Seascope Group PLC

Statement of recognised income and expenses for the year ended 28 February 2006

Year ended Year ended

Notes 28 Feb 2006 28 Feb 2005

Restated

#'000 #'000

Profit attributable to

shareholders 7,178 5,432

Foreign exchange differences on

retranslation of foreign

operations 83 (8)

Tax on items taken directly to

or transferred from equity 576 40

Cash flow hedges:

- Transferred to income

statement in period (1,401) -

- Losses deferred in equity (40) -

-------- -------

Recognised income and expense

for the year 8 6,396 5,464

-------- -------

First time adoption of IAS 32 & 39 1,077 -

-------- -------

Total recognised income and

expense 7,473 5,464

-------- -------

Braemar Seascope Group PLC

Consolidated Balance sheet as at 28 February 2006

As at As at

28 Feb 06 28 Feb 05

ASSETS #'000 #'000

Non current assets

Goodwill 22,480 21,652

Other intangible assets 462 215

Property, plant and equipment 5,034 4,960

Investments 1,611 1,555

Deferred tax assets 510 309

Other receivables 58 95

-------- --------

30,155 28,786

Current assets

Trade and other receivables 17,717 11,688

Financial assets

- Derivative financial instruments 12 -

Restricted cash - 4,434

Cash and cash equivalents 13,567 9,606

-------- --------

31,296 25,728

-------- --------

Total assets 61,451 54,514

-------- --------

LIABILITIES

Current liabilities

Financial liabilities

- Short term borrowings - 3,067

- Derivative financial instruments 99 -

Trade and other payables 25,490 17,113

Current tax payable 2,224 1,556

Finance leases 11 31

Provisions 288 41

Client monies held as escrow agent - 4,434

-------- --------

28,112 26,242

Non-current liabilities

Deferred tax liabilities 139 65

Finance leases - 8

Provisions 343 110

-------- --------

482 183

-------- --------

Total liabilities 28,594 26,425

-------- --------

Total assets less total liabilities 32,857 28,089

-------- --------

EQUITY

Share capital 1,988 1,945

Capital redemption reserve 396 396

Share premium 8,046 7,505

Merger reserve 21,346 21,346

Shares to be issued (997) (637)

Other reserves 639 196

Retained earnings 1,439 (2,662)

-------- --------

Total equity 32,857 28,089

-------- --------

Braemar Seascope Group PLC

Consolidated Cash flow statement for the year ended 28 February 2006

Year ended Year ended

28 Feb 06 28 Feb 05

Notes #'000 #'000

Cash flows from operating

activities

Cash generated from operations 7 13,769 11,044

Interest received 156 26

Interest paid (1) (52)

Tax paid (3,210) (2,448)

-------- --------

Net cash generated from operating

activities 10,714 8,570

-------- --------

Cash flows from investing

activities

Dividends received from joint

ventures 239 -

Acquisition of subsidiaries, net of

cash acquired (521) (1,026)

Purchase of property, plant and

equipment (387) (175)

Proceeds from sale of property,

plant and equipment 29 11

Purchase of investments (36) (21)

Proceeds from sale of investment - 386

Other long term assets 37 8

-------- --------

Net cash used in investing

activities (639) (817)

-------- --------

Cash flows from financing

activities

Proceeds from issue of ordinary

shares 535 1

Dividends paid (3,194) (2,597)

Purchase of own shares (360) (572)

Payment of principal under finance

leases (28) (2)

Other - (2)

-------- --------

Net cash used in financing

activities (3,047) (3,172)

-------- --------

Increase in cash and cash

equivalents 7,028 4,581

Cash and cash equivalents at

beginning of the period 6,539 1,958

-------- --------

Cash and cash equivalents at end of

the period 13,567 6,539

-------- --------

Balance sheet analysis of cash and cash

equivalents

Cash and cash equivalents 13,567 9,606

Short term borrowings - (3,067)

-------- --------

Cash and cash equivalents at end of

the period 13,567 6,539

-------- --------

Braemar Seascope Group PLC

Notes to the financial statements

Note 1 - General Information

The Preliminary Announcement of results for the year ended 28 February 2006 is

an extract from the unaudited 2006 Annual Report and Accounts and does not

constitute the Group's statutory accounts of 2006 nor 2005. Statutory accounts

for 2005 (reported under UK GAAP) have been delivered to the Registrar of

Companies, and those for 2006 will be delivered following the company's Annual

General Meeting. The auditors have reported on the 2005 accounts; their report

was unqualified and did not contain statements under Sections 237(2) or (3) of

the Companies Act 1985.

Note 2 - Accounting policies

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with International Financial Reporting Standards

(IFRSs) adopted for use in the European Union, this announcement does not itself

contain sufficient information to comply with IFRSs. The company expects to

publish full accounts that comply with IFRSs on 26 May 2006. The accounting

policies adopted by the Group are as set out in the Adoption of International

Financial Reporting Standards as published by the Group on 19 October 2005.

Note 3 - Segmental results

-------------- --------------

Revenue Profit for the period

--------------- --------------

2006 2005 2006 2005

#'000 #'000 #'000 #'000

Shipbroking 39,745 32,420 9,003 8,864

Ship agency, forwarding & 15,851 8,461 568 (1,213)

logistics

Technical shipping support 5,202 4,322 289 140

Bunker trading 7,699 - 30 -

-------- -------- -------- --------

Operating profit 68,497 45,203 9,890 7,791

-------- -------- -------- --------

Finance income (cost)- net 160 (25)

Share of profit from joint

ventures' and associates 243 365

-------- --------

Profit before taxation 10,293 8,131

Taxation (3,115) (2,699)

-------- --------

Profit for the period attributable

to shareholders 7,178 5,432

-------- --------

Note 4 - Taxation

The rate of taxation applicable to the Group's profits is 30.3% (2005: 33.2%).

Note 5 - Dividend

The proposed final dividend of 11.5 pence per share (2005: final 10.0 pence)

takes the total dividend for the year to 18.0 pence (2005: 16.0 pence). The cost

of the final dividend will be #2.2m (2005: #1.9m) based on 19,555,273 shares

(being the total in issue less shares held in the ESOP for which the dividend

has been waived) and will be charged to equity in the 2006/7 financial year.

Note 6 - Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the year, excluding 321,495 ordinary shares held by the

employee share trust (2005:222,500) which are treated as cancelled.

For diluted earnings per share, the weighted average number of ordinary shares

in issue is adjusted to assume conversion of all dilutive ordinary shares. The

Group has one class of potential dilutive ordinary shares being those granted to

employees where the exercise price is less than the average market price of the

Company's ordinary shares during the year.

2006 2006 2006 2005 2005 2005

Earnings Weighted Per share Earnings Weighted Per share

#'000s average amount #'000s average amount

number of pence number of pence

shares shares

From

continuing

operations

Profit for

the period

attributable

to 7,178 19,385,615 37.03 5,432 18,412,881 29.50

shareholders

Effect of

dilutive

share - 452,339 - - 585,077 -

options -------- -------- ------ ------ ------- -------

Fully

diluted

earnings per 7,178 19,837,955 36.18 5,432 18,997,958 28.59

share -------- -------- ------ ------ ------- -------

Note 7 - Reconciliation of operating profit to net cash flow from operating

activities

2006 2005

#'000 #'000

Profit for the period attributable to shareholders 7,178 5,432

Adjustments for:

Taxation 3,115 2,699

Depreciation 339 297

Profit on sale of investment - (123)

Profit on sale of property, plant and equipment (17) -

Impairment of goodwill - 931

Amortisation of intangibles 287 -

Share based payments 244 135

Finance income (162) (28)

Finance costs 2 53

Share of profit from joint ventures' and associates (243) (365)

Changes in working capital (excluding effects of

acquisitions of subsidiaries)

(Increase) in trade and other receivables (129) (1,416)

Increase in trade and other payables 2,913 3,658

Increase/(decrease) in provisions 242 (229)

-------- --------

Cash generated from operations 13,769 11,044

-------- --------

Note 8 - Statement of changes in total equity

Capital

Share redemption Share Merger Shares to Other Retained Total

capital reserve premium reserve be issued reserves earnings equity

Group #'000 #'000 #'000 #'000 #'000 #'000 #'000 #'000

-------------------------------------------------------------------------------------------------------------------

At 1March 2004 1,862 396 7,505 18,302 (65) 29 (5,469) 22,560

Recognised

income and

expense for

the year - - - - - 32 5,432 5,464

Dividends paid - - - - - - (2,625) (2,625)

Issue of

shares 83 - - 3,044 - - - 3,127

Purchase of

shares to be

issued - - - - (572) - - (572)

Credit in

respect of

share option

schemes - - - - - 135 - 135

At 28 February

2005 1,945 396 7,505 21,346 (637) 196 (2,662) 28,089

First time ---------------------------------------------------------------------------------------------------

adoption of

IAS 39 (net of

taxation) - - - - - 981 96 1,077

---------------------------------------------------------------------------------------------------

At 1 March

2005 1,945 396 7,505 21,346 (637) 1,177 (2,566) 29,166

Recognised

income and

expense for

the year - - - - - (782) 7,178 6,396

Dividends paid - - - - - - (3,173) (3,173)

Issue of

shares 43 - 541 - - - - 584

Purchase of

shares to be

issued - - - - (360) - - (360)

Cash flow

hedges

Credit in

respect of

share option

schemes - - - - - 244 - 244

---------------------------------------------------------------------------------------------------

At 28 February

2006 1,988 396 8,046 21,346 (997) 639 1,439 32,857

---------------------------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAXSDESPKEFE

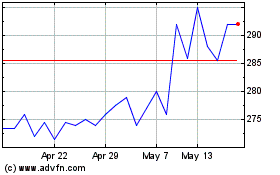

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024