Zurich Insurance Falls to Bigger-Than-Expected Loss -- 2nd Update

February 11 2016 - 3:15AM

Dow Jones News

By John Letzing

ZURICH--Zurich Insurance Group AG has set its new chief

executive up for a considerable challenge.

The company reported a worse-than-anticipated net loss of $424

million for the fourth quarter on Thursday, as its largest business

unit continued to suffer. Analysts had been expecting a loss of

$218 million.

"This is a disappointing result," said Chairman Tom de Swaan in

a statement. Following the departure Martin Senn as CEO in

December, Mr. de Swaan has been serving as CEO on an interim

basis.

Zurich Insurance recently announced it had poached Mario Greco

from Italian insurer Assicurazioni Generali SpA to serve as CEO.

Mr. Greco, whose first day on the job is slated for March 7, is a

former Zurich Insurance executive who once oversaw its largest

business, general insurance. Zurich Insurance is now struggling to

revamp that unit.

The company said on Thursday that the general-insurance unit

recorded a 71% fall in operating profit last year compared with

2014, to $864 million. The unit posted a combined ratio--a measure

of how much is paid on claims and costs for every dollar earned--of

103.6%. A ratio of less than 100% means that an underwriting

business is profitable.

The general-insurance business was hit by natural catastrophe

claims stemming from severe flooding in the U.K. and Ireland, and

deadly explosions at the Tianjin port in China, Zurich Insurance

said. The company also said it is scrambling to "re-underwrite or

exit under-performing portfolios."

Total business volumes, which include gross written premiums and

fees, fell 18% in the fourth quarter compared with a year earlier,

to $16.2 billion. The total return on investments was 0.5% in the

quarter, down from 2.2%.

Due to its troubles with general insurance, Zurich Insurance

said it is unlikely to hit its stated target of an operating profit

after tax return on equity of between 12% and 14% this year.

Zurich Insurance also said it now has no plans to return excess

capital shareholders, beyond sticking to an unchanged dividend of

17 Swiss francs ($17.50) a share.

The company had previously flagged plans to make use of billions

of dollars in excess capital by pursuing acquisitions, and

returning the remainder to shareholders.

Last September, Zurich Insurance called off a potential $8.8

billion acquisition of U.K.-based RSA Insurance Group PLC. The deal

would have contributed to a swell of mergers in the insurance

industry, which is faced with weak profit growth and low investment

returns.

Zurich Insurance said at that time that it was ending its

pursuit of the acquisition due to mounting difficulties at its

general-insurance business.

On Thursday, Zurich Insurance said turning around the general

insurance business is a priority for this year. It plans to stop

writing new business for the unit for retail and commercial

customers in the Middle East by the end of the year, "or as soon as

possible."

The company also said it aims to cut more than $1 billion in

costs by the end of 2018, by using new technology and "the

offshoring and near offshoring of some activities."

Write to John Letzing at john.letzing@wsj.com

(END) Dow Jones Newswires

February 11, 2016 03:00 ET (08:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

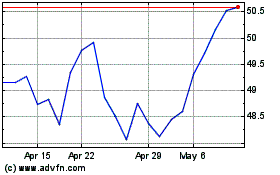

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Sep 2024 to Oct 2024

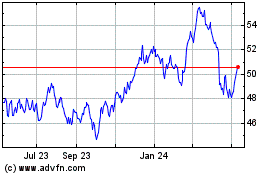

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Oct 2023 to Oct 2024