CORRECT: Zurich Has Contingency Plan For Potential Greek Euro Exit

May 10 2012 - 8:59AM

Dow Jones News

Zurich Insurance Group AG (ZURN.VX) has contingency plans in

place should Greece end up leaving the euro zone, Chief Financial

Officer Pierre Wauthier said Thursday, adding that the insurer has

almost no Greek investments left in its portfolio.

Speaking to reporters on a conference call to detail earnings,

Wauthier said the company is looking at different scenarios as part

of its risk-management processes.

Zurich's exposure to Spain and Italy remained relatively stable

during the first quarter and was limited, he said.

Zurich Insurance has a total of $69 billion invested in

government and government related bonds. About $4 billion is held

in Spanish bonds and about $6 billion in Italian bonds. The Greek

exposure amounts to about $1 million, Wauthier said.

-By Anita Greil, Dow Jones Newswires; +41 43 443 8044;

anita.greil@dowjones.com

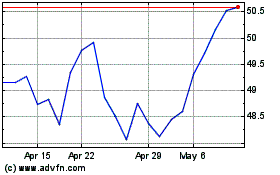

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Sep 2024 to Oct 2024

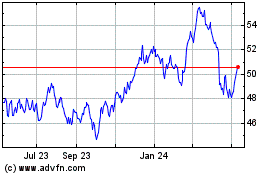

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Oct 2023 to Oct 2024