UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 17, 2010

World Series of Golf, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-140685

|

87-0719383

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

10161 Park Run Dr., Suite 150, Las Vegas

Nevada

|

89145

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 702-740-1740

Copies to:

Andrea Cataneo, Esq.

Jeff Cahlon, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, New York 10006

Phone: (212) 930-9700

Fax: (212) 930-9725

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

On September 17, 2010, World Series of Golf, Inc. (the “Company”) entered into a Note and Warrant Purchase Agreement pursuant to which the Company issued and sold to Inter-Mountain Capital Corp. (“Inter-Mountain”), seven Secured Convertible Notes in the aggregate principal amount of $1,446,500 (the “Notes”) and a five-year Warrant to purchase up to 19,047,619 shares of common stock of the Company . The Notes are due on March 17, 2014, and bear interest at the rate of 6% per annum, payable upon maturity. The Notes are convertible into the Company’s common stock at a conversion price equal to 70% of the closing bid price of the common stock for the three trading days with the lowest closing bids during the 20 trading days immediately preceding the conversion date. The Warrant has an exercise price equal to the lower of $1.00 or 70% of the closing bid price of the common stock for the three trading days with the lowest closing bids during the 20 trading days immediately preceding the exercise date. The Warrant may be exercised on a cashless basis.

The Notes are secured by certain buyer trust deed notes issued by Inter-Mountian to the Company described below. The Company received net proceeds of $100,000, computed as follows: $1,446,500 less $131,500 in original issue discount, $15,000 in transaction expenses paid to Inter-Mountain, and $1,200,000 for the trust deed notes.

Inter-Mountain issued to the Company 6 trust deed notes each in the principal amount of $200,000 for an aggregate principal amount of $1,200,000. The trust deed notes each bear interest at a rate of 5% per annum and are secured by certain real estate located in Wasatch County, Utah.

Trust Deed Note #1 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #1 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #1 has been repaid, and (B) April 17, 2011.

Trust Deed Note #2 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #2 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #2 has been repaid, and (B) May 17, 2011.

Trust Deed Note #3 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #3 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #3 has been repaid, and (B) June 17, 2011.

Trust Deed Note #4 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #4 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #4 has been repaid, and (B) July 17, 2011.

Trust Deed Note #5 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #5 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #5 has been repaid, and (B) August 17, 2011.

Trust Deed Note #6 is due at the earlier of (i) May 17, 2013, or (ii) so long as the shares of common stock underlying Note #6 are then freely saleable under Rule 144 promulgated under the Securities Act of 1933, as amended, the later of (A) the date on which Note #6 has been repaid, and (B) September 17, 2011

The Company relied on the exemption from registration provided by Section 4(2) under the Securities Act of 1933, as amended, for transactions not involving a public offering.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

See Item 1.01.

Item 3.02. Unregistered Sales of Equity Securities.

See Item 1.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

10.1 Company Note #1

10.2 Company Note #2

10.3 Company Note #3

10.4 Company Note #4

10.5 Company Note #5

10.6 Company Note #6

10.7 Company Note #7

10.8 Note and Warrant Purchase Agreement

10.9 Security Agreement

10.10 Warrant to Purchase Shares of Common Stock

10.11 Buyer Trust Deed Note #1

10.12 Buyer Trust Deed Note #2

10.13 Buyer Trust Deed Note #3

10.14 Buyer Trust Deed Note #4

10.15 Buyer Trust Deed Note #5

10.15 Buyer Trust Deed Note #6

10.16 Trust Deed

10.17 Deed of Reconveyance

10.18 Request for Full Reconveyance

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

WORLD SERIES OF GOLF, INC.

|

|

|

|

By:

|

/s/ James Tilton

|

|

|

|

|

James Tilton

|

|

|

|

|

Chief Financial Officer

|

|

Dated: October 6, 2010

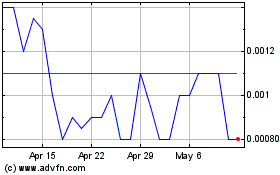

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Sep 2024 to Oct 2024

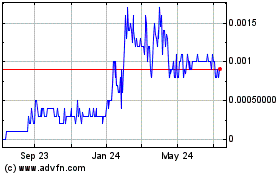

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Oct 2023 to Oct 2024