General and administrative

. General and administrative expense consists primarily of salaries and other personnel-related expenses to support our tournament operations, non-cash stock-based compensation for general and administrative personnel, professional fees, such as accounting and legal, corporate insurance and facilities costs. The 25% decrease in general and administrative expenses in the three months ended March 31, 2009 compared to the three months ended March 31, 2008 resulted primarily from an overall decrease in consulting fees and reduced salaries paid to administrative personnel in the first quarter of 2009. We expect general and administrative expenses to increase in future periods, due to additional accounting and management personnel hired in the first and second quarters of 2009.

Interest Expense

.

In January 2008, the original promissory note due to the chairman of our board of directors in the amount of $985,000 was replaced by a second promissory note in the principal amount of $961,000, bearing interest at a rate of 12% per annum. This new note was due on January 1, 2009. During the three months ended March 31, 2008, we recorded interest expense of approximately $29,000 related to this note.

In February 2009, the existing obligations under our promissory note with the chairman of our board of directors were replaced by another promissory note for $1,150,000. In connection with the refinancing of the obligations under the promissory note, we recorded interest expense of $78,000 in February 2009 as a financing fee. The new note, as amended and restated in May 2009, is payable within five days after the demand of the holder, and bears interest at 8% per annum. During the three months ended March 31, 2009, we recorded interest expense of approximately $114,000 related to this note.

Change in Fair Value Liability Related to Price Adjustable Warrants.

Effective January 1, 2009, we adopted EITF 07-5. In connection with warrants issued together with the convertible notes in 2008, the financial reporting (non-cash) effect of initial adoption of this accounting requirement for future financial statements resulted in a cumulative effect of change in accounting principle of approximately $102,000, based on a per share price of our common stock of $0.09 at January 1, 2009, which increased accumulated deficit and recorded a fair value liability for price adjustable warrants. The fair value liability is revalued quarterly utilizing Black-Scholes valuation model computations with the increase or decrease in fair value being reported in the statement of operations as other income (expense). During the three months ended March 31, 2009,

the fair value decreased approximately $91,000, based on a per share price of our common stock of $0.01 at March 31, 2009, which was recorded as other income.

Off-Balance Sheet Arrangements

As of March 31, 2009, we did not have any off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of SEC Regulation S-K.

ITEM 4T. CONTROLS AND PROCEDURES

(a) Disclosure Controls and Procedures. As of the end of the period covered by this Quarterly Report on Form 10-Q, we carried out an evaluation, under the supervision and with the participation of senior management, including Mr. Joseph F. Martinez, our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the design and operation of our disclosure controls and procedures (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Based upon that evaluation, our CEO/CFO concluded that our disclosure controls and procedures were not effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by us in the reports that we file or submit under the Exchange Act. As

previously reported under Item 9A(T) in our Annual Report on Form 10-K for the year ended December 31, 2008 (the “Annual Report”), we had numerous deficiencies in our disclosures controls as of December 31, 2008. In the Annual Report we described the remediation efforts we have begun to undertake in order to correct such deficiencies. As of March 31, 2009, the deficiencies described in the Annual Report still existed since the remediation efforts had not yet been fully implemented as of such date.

(b) Internal Control over Financial Reporting. There have been no changes in our internal controls over financial reporting or in other factors during the first fiscal quarter ended March 31, 2009 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting subsequent to the date we carried out our most recent evaluation. As previously reported in Item 9A(T) of the Annual Report, we had numerous material weaknesses in our internal control over financial reporting as of December 31, 2008. In the Annual Report we described the remediation efforts we have begun to undertake in order to correct such material weaknesses. As of March 31, 2009, the material weaknesses described in the Annual Report still existed since the remediation efforts had not yet been fully implemented as of such date.

20

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

A summons and complaint was filed with the Supreme Court of the State of New York, County of New York by Rooney & Associates, LLC (“Rooney”) in January 2009 with regard to a consulting agreement dated January 23, 2007 we entered into with Rooney wherein we agreed to pay Rooney a six month base retainer of $48,000, payable in $8,000 monthly installments. The complaint was in the amount of $32,000, which Rooney alleges was due pursuant to the consulting agreement, plus interest and costs. In April, 2009, Rooney filed a motion for an order of default judgment in the sum of $32,000 plus interest. In May 2009, the Supreme Court of the State of New York, County of New York granted Rooney’s motion for default judgment in the amount of $32,000 plus interest from April 2008.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

The following sets forth certain information for all securities we sold during the quarter ended March 31, 2009 without registration under the Securities Act of 1933, as amended (the “Securities Act”), other than those sales previously reported in a Current Report on Form 8-K:

In April 2009, we issued to an executive officer and director options to purchase 1,000,000 shares of our common stock at an exercise price of $0.02 per share pursuant to our 2009 Equity Incentive Plan. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

In April 2009, we issued to a consultant options to purchase 350,000 shares of our common stock at an exercise price of $0.02 per share pursuant to our 2009 Equity Incentive Plan. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

In April 2009, we issued to employees options to purchase an aggregate of 915,000 shares of our common stock at an exercise price of $0.08 per share pursuant to our 2009 Equity Incentive Plan. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

In April 2009, we issued to a consultant 112,500 shares of our common stock pursuant to the terms of settlement and release agreement. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

In May 2009, we issued to an executive officer and director (i) a convertible promissory note in the principal amount of $1,150,000, the principal amount of which is convertible into shares of our common stock at $0.50 per share, and (ii) a warrant to purchase 1,150,000 shares of our common stock at an exercise price of $0.50 per share. Such issuances were exempt from registration pursuant to Section 4(2) of the Securities Act.

In June 2009, we issued to an executive officer and director a warrant to purchase 50,000 shares of our common stock at an exercise price of $0.05 per share, pursuant to the terms of a professional services consulting agreement. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

In June 2009, we issued to an executive officer and director a warrant to purchase 540,000 shares of our common stock at an exercise price of $0.50 per share, pursuant to the terms of a consulting agreement. Such issuance was exempt from registration pursuant to Section 4(2) of the Securities Act.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters have been submitted to our security holders for a vote, through the solicitation of proxies or otherwise, during the three-month period ended March 31, 2009.

21

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

The exhibits required by this item are set forth on the Exhibit Index attached hereto.

22

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Dated: June 17, 2009

|

WORLD SERIES OF GOLF, INC.

|

|

|

|

|

|

|

By:

|

/s/ Joseph F. Martinez

|

|

|

|

Chief Executive Officer, Chief Financial

Officer,

|

|

|

|

and Principal Accounting Officer

|

|

|

|

|

23

EXHIBIT INDEX

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

31.1

|

|

Certification

of our Chief Executive Officer and Chief Financial Officer pursuant

to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

32.1

|

|

Certification

of our Chief Executive Officer Chief Financial Officer pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

|

24

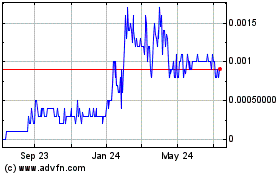

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

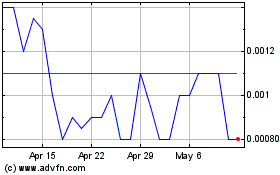

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Nov 2023 to Nov 2024