- Current report filing (8-K)

April 13 2009 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 8, 2009

World Series of Golf, Inc.

(Exact name of registrant as specified in charter)

|

Nevada

|

|

333-140685

|

|

87-0719383

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

10161 Park Run Drive, Suite 150

Las Vegas, Nevada 89145

(Address of principal executive offices; zip code)

(702) 740-1740

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

SECTION 4 – MATTERS RELATED

TO ACCOUNTANTS AND FINANCIAL STATEMENTS

|

Item 4.02.

|

Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim

Review.

|

On April 8, 2009, our authorized officers determined that it is necessary to restate our audited financial statements as of and for the year ended December 31, 2007 which were included in our Annual

Report on Form 10-KSB for the year ended December 31, 2007 (the “2007 Audited Financial Statements”). As a result of errors discovered in the 2007 Audited Financial Statements, our authorized officers have determined it is necessary to

review and, if necessary, restate our unaudited interim financial statements as of and for the three months ended March 31, 2008, the three and six months ended June 30, 2008, and the three and nine months ended September 30, 2008, which were

included in our Quarterly Report on Form 10-QSB for the period ended March 31, 2008 and our Quarterly Reports on Form 10-Q for the periods ended June 30, 2008 and September 30, 2008, respectively (collectively, the “2008 Interim Financial

Statements”). The need to restate the 2007 Audited Financial Statements relates to several errors as follows:

The

2007 Audited Financial Statements reflect an accounts receivable in the amount

of approximately $186,000 that we determined was offset in 2008 against amounts

due a vendor for advertising services rendered to us during 2007. However, we

failed to record the expense and related accounts payable in our 2007 Audited

Financial Statements. As a result, net loss and accounts payable were understated

by approximately $186,000 for the

year ended December 31, 2007. This entry has a material effect on our statement

of operations and statement of stockholders’ equity for the year ended December

31, 2007 but has no net effect on our balance sheet or statement of cash flows.

The 2007 Audited Financial Statements incorrectly reflect a subscription receivable in the amount of $2 million and a corresponding $2 million recorded as common stock and additional paid-in

capital. We have determined that this transaction had no basis and should be reversed. This entry has no net effect on our consolidated balance sheet, statement of operations, statement of cash flows or statement of stockholders’ equity for the

year ended December 31, 2007.

The 2007 Audited Financial Statements reflect fixed assets, representing tournament signage, with a net book value of approximately $183,000. We have determined that these amounts should not have

been capitalized. As a result, depreciation expense was overstated by approximately $48,000 and fixed assets were overstated by approximately $231,000. This entry has a material effect on our balance sheet, statement of operations and

statement of stockholders’ equity for the year ended December 31, 2007. This entry has no net effect on our statement of cash flows for the year ended December 31, 2007.

The 2007 Audited Financial Statements incorrectly reflect $1.4 million in commissions expense that was recorded to common stock and additional paid-in capital. We have determined that this

transaction had no basis and should be reversed. As a result, net loss and common stock

and additional paid-in capital were overstated by $1.4 million for the year ended December 31, 2007. This entry has a material effect on our statement of operations for the year ended December 31, 2007. This entry has no net

effect on our balance sheet, statement of cash flows or statement of stockholders’ equity for the year ended December 31, 2007.

We also are in the process of reviewing the revenue recognition regarding a contract pursuant to which we recorded approximately $930,000 in revenue during the first quarter of 2008 as reflected

in the 2008 Interim Financial Statements.

In light of the errors in our 2007 Audited Financial Statements and the aforementioned review of a transaction in the first quarter of 2008, management plans to fully review the 2008 Interim Financial

Statements to determine the effect of these and other possible errors in the 2007 Audited Financial Statements and to review the accounting of similar transactions during the periods covered in such reports. There can be no assurance that the amount

of any further adjustments will not be material, either individually or in the aggregate. Pending the completion of such review, neither the 2007 Audited Financial Statements nor the 2008 Interim Financial Statements should be relied

upon.

We will include any restated financial information in amendments to our Quarterly Reports on Forms 10-QSB and 10-Q and our Annual Report on Form 10-KSB for these periods, which we intend to file as

soon as practicable.

The determination to restate our financial statements was reached by our authorized financial officers in conjunction with the preparation and review of our financial statements for the year ended

December 31, 2008. These errors have been discussed with Moore & Associates, Charted, our independent public accountants.

As a result of this review, we are also reviewing the effectiveness of our internal controls over financial reporting.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

WORLD SERIES OF GOLF, INC.

|

|

Date: April 13, 2009

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ R. Terry

Leiweke

|

|

|

|

|

Name: R. Terry Leiweke

|

|

|

|

|

Title: Chief Executive Officer

|

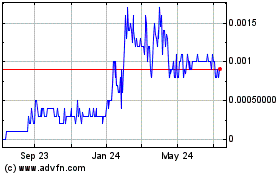

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

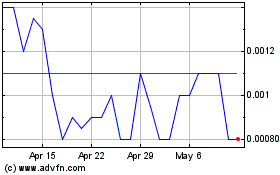

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Nov 2023 to Nov 2024