Additional Proxy Soliciting Materials (definitive) (defa14a)

March 11 2021 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material Pursuant to §240.14a-12

PEOPLES FINANCIAL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

___________________________________________________

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

___________________________________________________

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

___________________________________________________

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

___________________________________________________

___________________________________________________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

_______________________________________________________

|

|

(2)

|

Form, Schedule or Registration Statement No:

|

_______________________________________________________

_______________________________________________________

_______________________________________________________

March 11, 2021

IMPORTANT INFORMATION ABOUT YOUR INVESTMENT

Re: New York Hedge Fund Attacking Your Bank

Dear Peoples Financial Corporation Shareholder:

We are writing to advise you that your Board of Directors unanimously opposes the attempt of a New York hedge fund and related entities managed and controlled by Joseph Stilwell (the “Stilwell Group”) to nominate one or more individuals for election to the Board Directors of Peoples Financial Corporation (the “Company”) at the Company’s 2021 Annual Meeting of Shareholders outside of the normal nomination process of the Company, which is normally led by the Company’s Nominating Committee according to the bylaws. Such a nomination would be the first in the history of the Company.

The Stilwell Group announced its intentions publicly in a press release and amended Schedule 13D (“13D/A”) filed with the Securities and Exchange Commission (“SEC”) on February 9, 2021. This 13D/A listed numerous other community banks the Stilwell Group has attacked in the past as well as the result that was achieved in each situation, which in many cases was a sale of the community bank. The Board of the Company anticipates that the Stilwell Group’s nominee(s) will be named in opposition to one or more of the candidates that will be nominated for election by the Company’s Board of Directors upon recommendation from the Nominating Committee. The Stilwell Group invested in the Company’s stock last fall, and is seeking to place its hand-picked representative on your Board of Directors in order to “profit from the appreciation in the market price of the shares of Common Stock” of the Company.

BECAUSE MAXIMIZING SHAREHOLDER VALUE INVOLVES MORE THAN ANY POSSIBLE SHORT TERM GAIN THE STILWELL GROUP COULD REALIZE, THE COMPANY’S BOARD OF DIRECTORS STRONGLY OPPOSES THE STILWELL GROUP’S PROXY SOLICITATION AND URGES YOU NOT TO SIGN OR RETURN ANY GREEN PROXY CARD SENT TO YOU BY THE STILWELL GROUP.

Within a few weeks, the Company will send you a detailed proxy statement and a WHITE PROXY CARD for the 2021 Annual Meeting of Shareholders to be held on a date, and at a place and time, not yet determined by the Board of Directors. The Company’s Board of Directors recommends that you carefully review the Company’s proxy statement when it becomes available and that you demonstrate your support for the Company’s nominees by signing, dating and mailing the Company’s WHITE PROXY CARD that will be sent with our proxy statement.

DO NOT BE RUSHED INTO MAKING THIS VERY IMPORTANT VOTING DECISION UNTIL YOU RECEIVE THE COMPANY’S PROXY STATEMENT, ANNUAL REPORT AND WHITE PROXY CARD.

The Company’s Board of Directors is firmly committed to creating long-term shareholder value. Four of the Five members of the Company’s Board of Directors are independent directors and none of the Company’s directors are beholden to any individual shareholder. The Board of Directors, a majority of whom have joined the Board within the last two years, just completed a comprehensive, two year strategic planning process that demonstrates the commitment of the Company’s Board of Directors and management team to the maximization of long-term shareholder value in the best interests of all shareholders. As we mentioned in our earlier press release on January 27, 2021, you will be provided more information on this strategic plan in this year’s annual report.

Notwithstanding Hurricane Zeta, COVID-19 and the current challenging economic environment, the Company’s Board of Directors and management team are keenly focused on positioning the Company to build long-term value for the Company’s shareholders through the effective use of the Company’s capital. We believe that the Nominating Committee of the Company is very well qualified to perform the essential role of identifying Board candidates, and this unprecedented, costly and disruptive challenge is unwarranted at this time.

We again urge you not to take any action in connection with the very important decision to elect directors of the Company until you have had the opportunity to review and consider our proxy statement when it becomes available. Until then, the Company is not asking its shareholders to grant any proxies or take any action with respect to the election of directors or any other matter that may be submitted for a shareholder vote at the meeting.

If you have any questions, please call Kathy Crabtree, Vice President and Corporate Trust Officer for The Peoples Bank at (228) 435-8208, extension 8347.

The Board of Directors of the Company greatly appreciates your time and attention in this very important matter.

Sincerely,

|

/s/ Ronald G. Barnes

|

/s/ Padrick D. Dennis

|

|

Ronald G. Barnes, Director

|

Padrick D. Dennis, Director

|

|

|

|

|

/s/ Jeffrey H. O’Keefe

|

/s/ George J. Sliman, III

|

|

Jeffrey H. O’Keefe, Director

|

George J. Sliman, III, Director

|

|

|

|

|

/s/ Chevis C. Swetman

|

|

|

Chevis C. Swetman, Director

|

|

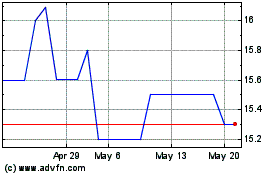

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Jul 2023 to Jul 2024