|

Capital World Growth

and Income Fund

®

Summary prospectus

February 1, 2014

|

|

Class A

|

B

|

C

|

F-1

|

F-2

|

529-A

|

529-B

|

529-C

|

|

CWGIX

|

CWGBX

|

CWGCX

|

CWGFX

|

WGIFX

|

CWIAX

|

CWIBX

|

CWICX

|

|

|

|

|

|

|

|

|

|

|

529-E

|

529-F-1

|

R-1

|

R-2

|

R-3

|

R-4

|

R-5

|

R-6

|

|

CWIEX

|

CWIFX

|

RWIAX

|

RWIBX

|

RWICX

|

RWIEX

|

RWIFX

|

RWIGX

|

|

Before you invest, you may want to review the fund’s prospectus and statement of additional information, which contain more information about the fund and its risks. You can find the fund’s prospectus, statement of additional information and other information about the fund online at americanfunds.com/prospectus. You can also get this information at no cost by calling (800) 421-4225 or by sending an e-mail request to prospectus@americanfunds.com. The current prospectus and statement of additional information, dated February 1, 2014, are incorporated by reference into this summary prospectus.

|

Investment objective

The fund’s investment objective is to provide you

with long-term growth of capital while providing current income.

Fees and expenses of the fund

This table describes the fees and expenses that you may

pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree

to invest in the future, at least $25,000 in American Funds. More information about these and other discounts is available from

your financial professional and in the “Sales charge reductions and waivers” section on page 27 of the prospectus and

on page 57 of the fund’s statement of additional information.

|

Shareholder fees

(fees paid directly from your investment)

|

|

|

Share classes

|

|

|

A and

529-A

|

B and

529-B

|

C and

529-C

|

529-E

|

F-1, F-2

and

529-F-1

|

All R

share

classes

|

Maximum sales charge (load)

imposed on purchases (as a

percentage of offering price)

|

5.75%

|

none

|

none

|

none

|

none

|

none

|

Maximum deferred sales charge

load) (as a percentage of the

amount redeemed)

|

1.00

1

|

5.00%

|

1.00%

|

none

|

none

|

none

|

Maximum sales charge (load)

imposed on reinvested dividends

|

none

|

none

|

none

|

none

|

none

|

none

|

|

Redemption or exchange fees

|

none

|

none

|

none

|

none

|

none

|

none

|

Maximum annual account fee

(529 share classes only)

|

$10

|

$10

|

$10

|

$10

|

$10

|

N/A

|

|

|

|

|

|

|

|

|

|

|

Annual fund operating expenses

(expenses that you pay each year as a percentage of the

value of your investment)

|

|

|

Share classes

|

|

|

A

|

B

|

C

|

F-1

|

F-2

|

529-A

|

529-B

|

529-C

|

|

Management fees

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

Distribution

and/or service (12b-1) fees

|

0.24

|

1.00

|

1.00

|

0.25

|

none

|

0.22

|

0.99

|

0.99

|

|

Other expenses

|

0.18

|

0.18

|

0.22

|

0.19

|

0.16

|

0.28

|

0.30

|

0.29

|

|

Total annual fund operating expenses

|

0.80

|

1.56

|

1.60

|

0.82

|

0.54

|

0.88

|

1.67

|

1.66

|

|

|

529-E

|

529-F-1

|

R-1

|

R-2

|

R-3

|

R-4

|

R-5

|

R-6

|

|

Management fees

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

0.38%

|

Distribution

and/or service (12b-1) fees

|

0.50

|

0.00

|

1.00

|

0.74

|

0.50

|

0.25

|

none

|

none

|

|

Other expenses

|

0.23

|

0.28

|

0.17

|

0.42

2

|

0.21

|

0.17

|

0.11

|

0.07

|

|

Total annual fund operating expenses

|

1.11

|

0.66

|

1.55

|

1.54

|

1.09

|

0.80

|

0.49

|

0.45

|

|

|

1

|

A contingent deferred sales charge of 1.00% applies on certain redemptions within one year following purchases of $1 million

or more made without an initial sales charge.

|

|

|

2

|

Estimated based on current fees.

|

|

Capital World Growth and Income Fund / Summary prospectus

1

|

Example

This example is intended to help you compare

the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund

for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your

investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may

be higher or lower, based on these assumptions your costs would be:

|

Share classes

|

1 year

|

3 years

|

5 years

|

10 years

|

|

A

|

$652

|

$816

|

$ 994

|

$1,508

|

|

B

|

659

|

893

|

1,050

|

1,652

|

|

C

|

263

|

505

|

871

|

1,900

|

|

F-1

|

84

|

262

|

455

|

1,014

|

|

F-2

|

55

|

173

|

302

|

677

|

|

529-A

|

680

|

879

|

1,093

|

1,701

|

|

529-B

|

690

|

965

|

1,164

|

1,866

|

|

529-C

|

289

|

562

|

959

|

2,064

|

|

529-E

|

133

|

392

|

669

|

1,454

|

|

529-F-1

|

87

|

251

|

426

|

928

|

|

R-1

|

158

|

490

|

845

|

1,845

|

|

R-2

|

157

|

486

|

839

|

1,834

|

|

R-3

|

111

|

347

|

601

|

1,329

|

|

R-4

|

82

|

255

|

444

|

990

|

|

R-5

|

50

|

157

|

274

|

616

|

|

R-6

|

46

|

144

|

252

|

567

|

For the share classes listed below, you would pay the following

if you did not redeem your shares:

|

Share classes

|

1 year

|

3 years

|

5 years

|

10 years

|

|

B

|

$159

|

$493

|

$850

|

$1,652

|

|

C

|

163

|

505

|

871

|

1,900

|

|

529-B

|

190

|

565

|

964

|

1,866

|

|

529-C

|

189

|

562

|

959

|

2,064

|

Portfolio turnover

The fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These

costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results.

During the most recent fiscal year, the fund’s portfolio turnover rate was 24% of the average value of its portfolio.

Principal investment strategies

The fund invests primarily in common stocks of well-established

companies located around the world, many of which have the potential to pay dividends. The fund invests, on a global basis, in

common stocks that are denominated in U.S. dollars or other currencies. Under normal market circumstances the fund will invest

a

|

Capital World Growth and Income Fund / Summary prospectus

2

|

significant portion of its assets in securities of issuers

domiciled outside the United States, including those based in developing countries.

The fund is designed for investors seeking both capital

appreciation and income. In pursuing its objective, the fund tends to invest in stocks that the investment adviser believes to

be relatively resilient to market declines.

The investment adviser uses a system of multiple portfolio

managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by

individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment

adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser

is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities.

The investment adviser believes that an important way to accomplish this is through fundamental analysis, which may include meeting

with company executives and employees, suppliers, customers and competitors. Securities may be sold when the investment adviser

believes that they no longer represent relatively attractive investment opportunities.

Principal risks

This section describes the principal risks associated

with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may

be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to

tolerate potentially sharp declines in value.

Market conditions —

The prices of, and the

income generated by, the common stocks and other securities held by the fund may decline due to market conditions and other factors,

including those directly involving the issuers of securities held by the fund.

Investing outside the United States —

Securities

of issuers domiciled outside the United States, or with significant operations outside the United States, may lose value because

of adverse political, social, economic or market developments in the countries or regions in which the issuers operate. These securities

may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries.

Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside

the United States may also be subject to different settlement and accounting practices and different regulatory, legal and reporting

standards, and may be more difficult to value, than those in the United States. The risks of investing outside the United States

may be heightened in connection with investments in emerging markets.

Investing in emerging markets —

Investing in

emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities

markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those

in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize

a company or industry, place restrictions on

|

Capital World Growth and Income Fund / Summary prospectus

3

|

foreign ownership and on withdrawing sale proceeds of securities

from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies

of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities

markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued

in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries

with more developed economies and/or markets. Additionally, there may be increased settlement risks for transactions in local securities.

Investing in growth-oriented stocks

— Growth-oriented

stocks may involve larger price swings and greater potential for loss than other types of investments.

Investing in income-oriented stocks

— Income

provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies

in which the fund invests.

Management —

The investment adviser to the

fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses

employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value

or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is

not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You

should consider how this fund fits into your overall investment program.

Investment results

The following bar chart shows how the fund’s investment

results have varied from year to year, and the following table shows how the fund’s average annual total returns for various

periods compare with different broad measures of market results. This information provides some indication of the risks of investing

in the fund.The Lipper Global Funds Index includes the fund and other funds that disclose investment objectives and/or strategies

reasonably comparable to the fund’s objective and/or strategies. Past investment results (before and after taxes) are not

predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting

americanfunds.com.

|

Capital World Growth and Income Fund / Summary prospectus

4

|

|

Average annual total returns

For the periods ended December 31, 2013 (with maximum

sales charge):

|

|

Share class

|

Inception date

|

1 year

|

5 years

|

10 years

|

Lifetime

|

|

A

− Before taxes

|

3/26/1993

|

17.66%

|

13.05%

|

8.41%

|

11.09%

|

|

− After taxes on distributions

|

|

17.16

|

12.77

|

7.87

|

N/A

|

|

− After taxes on distributions and sale of fund shares

|

10.63

|

10.74

|

7.18

|

N/A

|

|

Share classes

(before taxes)

|

Inception date

|

1 year

|

5 years

|

10 years

|

Lifetime

|

|

B

|

3/15/2000

|

18.92%

|

13.29%

|

8.38%

|

7.67%

|

|

C

|

3/15/2001

|

22.87

|

13.50

|

8.17

|

8.26

|

|

F-1

|

3/15/2001

|

24.84

|

14.40

|

9.03

|

8.93

|

|

F-2

|

8/1/2008

|

25.18

|

14.70

|

N/A

|

6.44

|

|

529-A

|

2/15/2002

|

17.60

|

12.98

|

8.33

|

9.36

|

|

529-B

|

2/21/2002

|

18.76

|

13.17

|

8.26

|

9.43

|

|

529-C

|

2/22/2002

|

22.81

|

13.42

|

8.09

|

9.15

|

|

529-E

|

3/4/2002

|

24.47

|

14.02

|

8.65

|

9.32

|

|

529-F-1

|

9/17/2002

|

25.03

|

14.57

|

9.16

|

11.57

|

|

R-1

|

6/7/2002

|

23.92

|

13.54

|

8.18

|

8.98

|

|

R-2

|

6/7/2002

|

23.98

|

13.53

|

8.18

|

8.98

|

|

R-3

|

6/6/2002

|

24.51

|

14.06

|

8.68

|

9.40

|

|

R-4

|

6/27/2002

|

24.87

|

14.40

|

9.01

|

10.38

|

|

R-5

|

5/15/2002

|

25.24

|

14.74

|

9.34

|

9.78

|

|

R-6

|

5/1/2009

|

25.28

|

N/A

|

N/A

|

16.23

|

|

Indexes

|

1 year

|

5 years

|

10 years

|

Lifetime

(from Class A inception)

|

MSCI

®

All Country World Index (reflects no deductions for

sales charges, account fees, expenses or U.S. federal income taxes)

|

22.80%

|

14.92%

|

7.17%

|

7.54%

|

|

Lipper Global Funds Index (reflects no deductions for sales charges, account fees or U.S. federal income taxes)

|

25.72

|

14.29

|

7.13

|

7.70

|

Class A annualized 30-day yield at November 30, 2013: 1.81%

(For current yield information, please call American FundsLine® at (800) 325-3590.)

|

After-tax returns are shown only for Class A shares; after-tax

returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates

in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns

depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are

not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account

(IRA) or 529 college savings plan.

|

Capital World Growth and Income Fund / Summary prospectus

5

|

Management

Investment adviser

Capital Research and Management

Company

SM

Portfolio managers

The individuals primarily responsible

for the portfolio management of the fund are:

Portfolio manager/

Fund title (if applicable)

|

Portfolio manager

experience in this fund

|

Primary title

with investment adviser

|

Mark E. Denning

President and Trustee

|

21 years

|

Senior Vice President –

Capital Research Global Investors

|

L. Alfonso Barroso

Vice President

|

7 years

|

Senior Vice President –

Capital Research Global Investors

|

Jeanne K. Carroll

Vice President

|

10 years

|

Senior Vice President –

Capital Research Global Investors

|

Sung Lee

Vice President

|

8 years

|

Senior Vice President –

Capital Research Global Investors

|

David M. Riley

Vice President

|

7 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Joyce E. Gordon

|

6 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Harold H. La

|

7 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Eric S. Richter

|

5 years

|

Senior Vice President –

Capital Research Global Investors

|

|

Capital World Growth and Income Fund / Summary prospectus

6

|

Purchase and sale of fund shares

The minimum amount to establish an account for all share

classes is $250 and the minimum to add to an account is $50. For a payroll deduction retirement plan account, payroll deduction

savings plan account or employer-sponsored 529 account, the minimum is $25 to establish or add to an account.

If you are a retail investor, you may sell (redeem) shares

through your dealer or financial advisor or by writing to American Funds Service Company

®

at P.O. Box 6007,

Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds

Service Company at (888) 421-4351; or accessing our website at americanfunds.com. Please contact your plan administrator

or recordkeeper to sell (redeem) shares from your retirement plan.

Tax information

Dividends and capital gain distributions you receive from

the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your

account is tax-favored.

Payments to broker-dealers and other financial intermediaries

If you purchase shares of the fund through a broker-dealer

or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary

for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer

or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual

financial advisor or visit your financial intermediary’s website for more information.

|

MFGEIPX-033-0214P

Litho in USA CGD/CF/8022

|

Investment

Company File No. 811-07338

|

THE FUND PROVIDES A SPANISH TRANSLATION

OF THE ABOVE SUMMARY PROSPECTUS IN CONNECTION WITH THE PUBLIC OFFERING AND SALE OF ITS SHARES. THE ENGLISH LANGUAGE SUMMARY

PROSPECTUS ABOVE IS A FAIR AND ACCURATE REPRESENTATION OF THE SPANISH EQUIVALENT.

|

/s/

|

MICHAEL W. STOCKTON

|

|

|

MICHAEL W. STOCKTON

|

|

|

SECRETARY

|

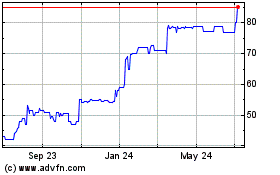

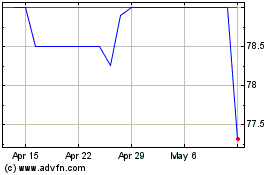

Paul Meuller (PK) (USOTC:MUEL)

Historical Stock Chart

From May 2024 to Jun 2024

Paul Meuller (PK) (USOTC:MUEL)

Historical Stock Chart

From Jun 2023 to Jun 2024