Proxy Statement - Other Information (preliminary) (pre 14c)

December 16 2019 - 3:58PM

Edgar (US Regulatory)

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Check

the appropriate box:

[X]

Preliminary

Information Statement

[

]

Confidential, for

Use of the Commission Only (as permitted by Rule

14c-5(d)2))

[

]

Definitive

Information Statement

NORTHERN MINERALS & EXPLORATION LTD.

(Name

of Registrant as Specified in Charter)

Payment

of Filing Fee (Check the appropriate box):

[

]

Fee computed on

table below per Exchange Act Rules 14c-5(g) and 0-11

1.

Title of each class

of securities to which transaction applies:

2.

Aggregate number of

securities to which transaction applies:

3.

Per unit price or

other underlying value of transaction, computed pursuant to

Exchange Act Rule O-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined):

4.

Proposed maximum

aggregate value of transaction:

[

]

Fee paid previously

with preliminary materials.

[

]

Check box if any

part of the fee is offset as provided by Exchange Act Rule

O-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

6.

Amount Previously

Paid:

7.

Form Schedule or

Registration Statement No.:

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Regulation 14C of the Securities Exchange Act of 1934

as amended

NORTHERN MINERALS & EXPLORATION LTD.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This

Information Statement is furnished by the board of directors of

Northern Minerals & Exploration Ltd., a Nevada corporation, to

the holders of record at the close of business on the record date,

December 2, 2019 of our corporation's outstanding common stock,

$0.001 par value per share, pursuant to Rule 14c-2 promulgated

under the Securities Exchange Act of 1934, as amended. This

Information Statement is being furnished to such stockholders for

the purpose of informing the stockholders in regards

to:

(a)

an amendment

to our Articles of Incorporation to

increase the authorized number of shares of our common stock from

75,000,000 shares to 250,000,000 shares, par value of $0.001 per share;

and

(b)

an amendment to our

Articles of Incorporation for the alteration of our authorized

share capital to authorize the issuance of up to 50,000,000 shares

of preferred stock, par value of $0.001 per share (the "Preferred

Shares"), for which the board of directors may fix and determine

the designations, rights, preferences or other variations of each

class or series within each class of the Preferred

Shares;

(collectively, the

“Amendments”)

Our

board of directors approved the Amendments to our authorized share

capital for the increase in our authorized share capital and the

creation of the Preferred Shares in order to enhance our

corporation's ability to attract future financing to develop and

operate our business.

Our

board of directors unanimously approved the Amendments to our

Articles of Incorporation on September 12, 2019.

Subsequent

to our board of directors' approval of the Amendments, the holders

of the majority of the outstanding shares of our corporation gave

us their written consent to the Amendments to our Articles of

Incorporation on September 17, 2019. Therefore, following the

expiration of the twenty-day (20) period mandated by Rule 14c and

the provisions of Chapter 78 of the Nevada Revised Statutes, our

corporation will file Articles of Amendment to amend our Articles

of Incorporation to give effect to the Amendments. We will not file

the Articles of Amendment to our Articles of Incorporation until at

least twenty (20) days after the filing and mailing of this

Information Statement.

The

proposed Articles of Amendment to our Articles of Incorporation are

attached hereto as Schedule A. The Articles of Amendment will

become effective when they are filed with the Nevada Secretary of

State. We anticipate that such filing will occur twenty (20) days

after this Information Statement is first mailed to our

shareholders.

The

entire cost of furnishing this Information Statement will be borne

by our corporation. We will request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this

Information Statement to the beneficial owners of our common stock

held of record by them.

Our

board of directors has fixed the close of business on December 2,

2019 as the record date for the determination of shareholders who

are entitled to receive this Information Statement. There were

56,577,819 shares of our common stock issued and outstanding on

December 2, 2019. We anticipate that this Information Statement

will be mailed on or about December 27, 2019 to all shareholders of

record as of the record date.

PLEASE

NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT,

BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE

AMENDMENTS TO OUR ARTICLES OF INCORPORATION.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY.

PLEASE

NOTE THAT THIS IS NOT AN OFFER TO PURCHASE YOUR

SHARES.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED

UPON

Except

as disclosed elsewhere in this Information Statement, since July

31, 2019, being the commencement of our last financial year, none

of the following persons has any substantial interest, direct or

indirect, by security holdings or otherwise in any matter to be

acted upon:

1.

any director or

officer of our corporation;

2.

any proposed

nominee for election as a director of our corporation;

and

3.

any associate or

affiliate of any of the foregoing persons.

The shareholdings of our directors and officers are listed below in

the section entitled "Principal Shareholders and Security Ownership

of Management". To our knowledge, no director has advised that he

intends to oppose the Amendments to our authorized capital or to

the Sale, as more particularly described herein.

PRINCIPAL SHAREHOLDERS AND SECURITY OWNERSHIP OF

MANAGEMENT

As of

December 2, 2019, we had a total of 56,577,819 shares of common

stock ($0.001 par value per share) issued and

outstanding.

The

following table sets forth, as of December 2, 2019, certain

information with respect to the beneficial ownership of our common

stock by each stockholder known by us to be the beneficial owner of

more than 5% of our common stock and by each of our current

directors and executive officers. Each person has sole voting and

investment power with respect to the shares of common stock, except

as otherwise indicated. Beneficial ownership consists of a direct

interest in the shares of common stock, except as otherwise

indicated.

|

Name

and Address of Beneficial Owner

|

Amount and Nature ofBeneficial Ownership

|

Percentageof Class(1)

|

|

Grasshoppers

Unlimited Inc. 1889 FM 2088, Quitman, Texas 75783

|

3,778,000

|

6.678%

|

|

Golden

Sands Exploration Inc. 11595 Bailey Crescent, Surrey, BC V3V 2V4

Canada

|

3,000,000

|

5.302%

|

|

Labrador Capital

SAPI DE CV San Isidro, Apt 1703, Colonia Reforma Social Miguel

Hidalgo, Ciudad De Mexico 11650

|

5,000,000

|

8.837%

|

|

Starcom

SA De CV Capital Center Local 25 AV, Erick Paolo Martinez Esquina 4

De Marzo Chetumal, Quintana Roo, Mexico 77039

|

5,000,000

|

8.837%

|

|

Ivan

Webb 2020 El Paso Avenue, Cisco, Texas 76437

|

2,900,000

|

5.126%

|

(1) Based on 56,577,819 shares of common stock issued

and outstanding as of December 2, 2019. Beneficial ownership is

determined in accordance with the rules of the SEC and generally

includes voting and investment power with respect to securities.

Except as otherwise indicated, we believe that the beneficial

owners of the common stock listed above, based on information

furnished by such owners, have sole investment and voting power

with respect to such shares, subject to community property laws

where applicable.

AMENDMENT TO OUR CORPORATION'S ARTICLES

Our

Amended Articles of Incorporation (the "Articles") currently

authorize the issuance of 75,000,000 shares of common stock, $0.001

par value, and no shares of preferred stock. On September 12, 2019

our board of directors approved, subject to receiving the approval

of a majority of the shareholders of our common stock, an amendment

to our Articles to increase our authorized shares of common stock

to 250,000,000 shares, and authorize the issuance of up to

50,000,000 shares of preferred stock in the capital of our

corporation, for which the board of directors may fix and determine

the designations, rights, preferences or other variations of each

class or series within each class of the shares of preferred

stock.

The

general purpose and effect of the amendment to our corporation's

Articles is to increase our authorized share capital and authorize

the Preferred Shares, which will enhance our Corporation's ability

to finance the development and operation of our

business.

Our

board of directors approved the amendment to our corporation's

Articles is to increase our authorized share capital and authorize

the Preferred Shares so

that such shares will be available for issuance for general

corporate purposes, including financing activities, without the

requirement of further action by our shareholders. Potential uses

of the additional authorized shares and Preferred Shares may

include public or private offerings, conversions of convertible

securities, issuance of options pursuant to employee benefit plans,

acquisition transactions and other general corporate purposes.

Increasing the authorized number of shares of our common stock and

allowing for the ability to issue the Preferred Shares will give us

greater flexibility and will allow us to issue such shares in most

cases without the expense of delay of seeking shareholder approval.

Our company is at all times investigating additional sources of

financing which our board of directors believes will be in our best

interests and in the best interests of our shareholders. We do not

currently have any agreements, plans, arrangements, understandings

or commitments for any transaction that would require the issuance

of additional shares of common stock or Preferred Shares. Our

common shares carry no pre-emptive rights to purchase additional

shares. The adoption of the amendment to our Articles of

Incorporation will not of itself cause any changes in our capital

accounts.

The

amendment to our corporation's Articles to increase our authorized

share capital and authorize the Preferred Shares will not have any

immediate effect on the rights of existing shareholders. However,

our board of directors will have the authority to issue authorized

common stock and the Preferred Shares without requiring future

shareholders approval of such issuances, except as may be required

by applicable law or exchange regulations. To the extent that

additional authorized common shares are issued in the future, they

will decrease the existing shareholders' percentage equity

ownership and would be dilutive to the existing

shareholders.

The increase in the authorized number of shares of our common

stock, the authorization of the Preferred Shares and the subsequent

issuance of such shares of common stock and/or Preferred Shares

could have the effect of delaying or preventing a change in control

of our company without further action by the shareholders. Shares

of authorized and unissued common or preferred stock could be

issued (within limits imposed by applicable law) in one or more

transactions. Any such issuance of additional common or preferred

stock could have the effect of diluting the earnings per share and

book value per share of outstanding shares of common stock, and

such additional shares could be used to dilute the stock ownership

or voting rights of a person seeking to obtain control of our

company. Further, to the extent that additional Preferred Shares

are issued in the future, they would be dilutive to the existing

shareholders. As the specific terms of any series of

Preferred Shares have not yet been finalized, we have not yet

determined the minimum or maximum number of Preferred Shares that

may be issued, or the price at which these shares may be issued. As

a result, we cannot provide any assurances regarding the extent of

the dilution upon our shareholders.

Our

board of directors may authorize and issue classes of Preferred

Shares that have rights that are preferential to our common stock.

Such rights may include:

●

the payment of

dividends in preference and priority to any dividends on our common

stock;

●

preference to any

distributions upon any liquidation, dissolution or winding up of

our company;

●

voting rights that

may rank equally to, or in priority over, our common

stock;

●

mandatory

redemption by the company in certain circumstances, for amounts

that may exceed the purchase price of the Preferred

Shares;

●

conversion

provisions for the conversion of the Preferred Shares into common

stock;

●

pre-emptive or

first refusal rights in regards to future issuances of common stock

or Preferred Shares by the company; or

●

rights that

restrict our company from undertaking certain corporate actions

without the approval of the holders of the Preferred

Shares.

We do

not have any provisions in our Articles, bylaws, or employment or

credit agreements to which we are party that have anti-takeover

consequences. We do not currently have any plans to adopt

anti-takeover provisions or enter into any arrangements or

understandings that would have anti-takeover consequences. In

certain circumstances, our management may issue additional shares

to resist a third party takeover transaction, even if done at an

above market premium and favoured by a majority of independent

shareholders.

Shareholder

approval for the Amendments to our Articles was obtained by written

consent of 8 shareholders owning 29,116,667 shares of our common

stock, which represented 51.5% on September 17, 2019. The increase

in our authorized capital and the creation of the Preferred Shares

will not become effective until not less than twenty (20) days

after this Information Statement is first mailed to shareholders of

our common stock and until the appropriate filings have been made

with the Nevada Secretary of State.

DISSENTERS RIGHTS

Under

Nevada law, shareholders of our common stock are not entitled to

dissenter's rights of appraisal with respect to our proposed

Amendments to our Articles of Incorporation.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934,

Northern Minerals & Exploration Ltd. has duly caused this

report to be signed by the undersigned hereunto

authorized.

December

12, 2019

NORTHERN MINERALS & EXPLORATION LTD.

By:

/s/ Ivan Webb

Ivan

Webb

President

and Director

Northern Minerals and Ex... (PK) (USOTC:NMEX)

Historical Stock Chart

From May 2024 to Jun 2024

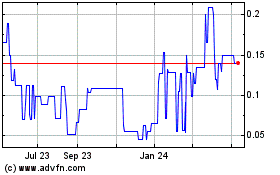

Northern Minerals and Ex... (PK) (USOTC:NMEX)

Historical Stock Chart

From Jun 2023 to Jun 2024