When Starwood's big suitor from Beijing came unexpectedly

calling again last month, aiming to consummate China's biggest-ever

purchase of a U.S. company, its proposal eventually included an

extraordinary clause to allay the Americans' wariness.

Anbang Insurance Group Co. had failed last fall to woo Starwood

Hotels & Resorts Worldwide Inc., and Starwood was close to a

$12.2 billion sale to Marriott International Inc. The Chinese firm

was back with an offer eventually reaching $14 billion that

included, said people familiar with the bid, a stunning sweetener:

Anbang and its partners would pay up even if Chinese regulators

blocked the tie-up.

Starwood Chief Executive Thomas Mangas had given his Marriott

counterpart, Arne Sorenson, an early warning. "Our friends in China

have resurfaced," Mr. Mangas told him on a March 11 phone call.

After a flurry of negotiations and counterbids came two days of

radio silence from Beijing. Then Anbang walked away on Thursday,

citing only "various market considerations."

Now Marriott is again the winning suitor in what would make it

the world's largest lodging company.

Anbang's role in one of America's biggest takeover stories of

the past 12 months is part of China's recent shopping binge for

foreign companies. The episode also raises questions about China's

ability to play on the global M&A stage.

Chinese companies, which have long flirted with buying big

Western companies, have turned into voracious suitors this year,

agreeing to $92.3 billion of foreign takeovers in industries from

semiconductors to agriculture, compared with $106.7 billion in all

2015, according to data provider Dealogic. While Chinese companies

have honed their deal-making skills, said bankers and lawyers who

work on the transactions, they still often don't play by

long-established M&A rules.

Other ambitious bidders like Tsinghua Unigroup Ltd., China's

largest chip-design company, for example, have eschewed big Wall

Street banks for deal advice, leading to some mishaps. Tsinghua

Unigroup prepared a $23 billion bid for Micron Technology Inc. last

year, but the U.S. chip maker said it never received an offer. The

Chinese government also plays a bigger role than Western regulators

in many cases even before an offer is made.

In ways small and large, Anbang's approach to Starwood was

unorthodox, from surprise meetings to its shifting offers and a

level of scrutiny of the hotel company's books that to some

involved seemed less intense than expected. Most striking was how

it suddenly dropped away after indicating it was committed to

winning.

In the end, said Fred Hu, Chairman of Primavera Capital Group, a

partner in Anbang's bid, the consortium walked away because the

price got too rich. "It was a simple and prudent commercial

decision."

This account of the Starwood saga is based on interviews with

officials at the companies involved, others close to them and

federal filings.

Anbang's unusual approach began with its first courtship of

Starwood last year. The Beijing company had exploded onto the

international scene by acquiring insurers and hotels globally,

including its $1.95 billion purchase of Manhattan's Waldorf

Astoria. The conglomerate is also a big player at home, with stakes

in Chinese companies ranging from developers and banks to a

traditional Chinese medicine maker and a wind-turbine

manufacturer.

Starwood, which controls the St. Regis, Westin, Sheraton and W

Hotels brands, nearly a year ago said it would "explore a full

range of strategic and financial alternatives to increase

shareholder value," effectively hanging out a for-sale sign. Months

earlier, Starwood CEO Frits van Paasschen resigned amid concerns

over the Stamford, Conn., company's slow growth.

Anbang expressed interest in May, but Starwood officials

couldn't get comfortable that the Chinese company could secure

funding. Anbang and its ownership structure remain murky to many

inside and outside China, unlike Marriott or any other publicly

traded U.S. company.

And Starwood officials saw Anbang Chairman Wu Xiaohui as hard to

read. He called a last-minute meeting at the St. Regis hotel in

Manhattan to discuss Anbang's interest in Starwood the last weekend

of August, even though some at the company and its advisers had

vacation plans they ended up having to change.

Anbang's reasons for pursuing Starwood were never made entirely

clear. In three meetings through autumn, in New York and Chicago,

Mr. Wu expressed interest in a variety of deal options. Among them,

he floated the idea of Anbang's taking a minority stake in

Starwood. But Starwood didn't need cash and preferred a deal for

the whole company.

On Nov. 3, Anbang withdrew its interest during a meeting when

Starwood said it couldn't proceed "without a written offer with

specific financing plans," federal filings show.

Marriott's victory

Marriott emerged victorious that month, a surprise given that

Hyatt Hotels Corp. had been widely expected to prevail.

Starwood executives wondered whether a counter bidder would

emerge, expecting any competing bids would follow a December

regulatory filing that disclosed information a spoiler would find

useful. Such bids would typically have come around January.

Now in March, Anbang was back with its partners, including U.S.

private-equity firm J.C. Flowers & Co., Primavera Capital and

state-owned China Construction Bank Corp., and their record

all-cash offer. China's previous record U.S. purchase was Shuanghui

International Holdings Ltd.'s takeover of Smithfield Foods Inc.

announced in 2013 for about $7 billion including debt, according to

Dealogic.

The timing of the surprise bid was odd, coming barely two weeks

before a scheduled shareholder vote on the Marriott deal with

little time to win over Starwood's board.

Starwood officials were pleased but cautious of Anbang and its

chairman. Still, Anbang's new approach, made March 10, was too rich

to ignore. Starwood's advisers at Lazard and Citigroup Inc. told

Anbang its bid of $76 a share was a good start but not high enough

to displace Marriott. They also wanted proof Anbang had

financing.

Anbang in short order raised the offer to $78 and provided a

letter of credit from China Construction Bank for the full

amount.

Anbang's negotiating approach sometimes confounded Starwood. Mr.

Wu would arrive at meetings, many at The St. Regis, with a team of

about a half-dozen Chinese educated at U.S. business schools. Mr.

Wu served as Anbang's lead negotiator. At times his bankers didn't

speak during entire meetings, they said, and Mr. Wu didn't turn to

them for advice.

Anbang's chairman said he loved Starwood's brands and the cash

flow from hotel management. Anbang had few of the obvious synergies

Marriott offered, but Mr. Wu sketched out a vision that involved

bringing Starwood brands to China's emerging middle class, which is

increasingly traveling. Starwood found the idea of China's booming

travel class appealing, but details on what Starwood's role would

be were scant.

Unknown quantity

Much else about Anbang's plans wasn't clear to the Starwood

team. They didn't know what sort of return Anbang expected on its

investment, or whether it viewed an acquisition as a long-term

proposition. The lack of insight into Anbang's intentions, along

with its opaque ownership, made the buyer's actions harder to

predict.

The bidding war subjected unlisted Anbang, founded in 2004 as a

provincial car insurer, to fresh scrutiny over its political

connections in China, as well as its complex ownership, a web of 39

corporate shareholders ranging from car dealerships to mining

companies. Local media have said some of those firms may have ties

to the family of former Chinese leader Deng Xiaoping, whose

granddaughter married Mr. Wu.

In contrast, Marriott was a known quantity, and a combination

with it would create a hotel company with more than a million rooms

and 30 brands, including Marriott's Ritz Carlton, Courtyard by

Marriott and Residence Inn.

Starwood wanted assurance Chinese regulators wouldn't scuttle

any Anbang agreement, a disaster if it happened after the company

broke off its proposed Marriott marriage.

Starwood and Marriott had obtained the green light for their

deal from antitrust regulators in the U.S., Canada and other

countries. Starwood had little insight into how Chinese regulators

would react to the proposed Anbang deal.

So Starwood and its advisers insisted Anbang agree that a deal

would still close, and the cash would change hands, with or without

Chinese regulatory approval. The Chinese company agreed. That sort

of guarantee is rare and demonstrates the wariness with which some

Western companies approach Chinese bidders and how intensely Anbang

wanted its prize.

On March 18, Anbang put in an binding offer, and three days

later Starwood announced it would spurn Marriott for Anbang's $13

billion bid.

Many investors expected Marriott would walk away and collect its

$400 million breakup fee. It had five business days to respond, and

analysts predicted Marriott would be unwilling to get into a

bidding war with a deep-pocketed Chinese company. They warned the

stock portion of a higher offer could too heavily dilute existing

shareholders' stakes, and borrowing to raise the cash component

could put Marriott's credit rating at risk.

Marriott surprised them with a proposal then valued at $13.6

billion containing more cash than its previous stock-and-cash bid.

Starwood agreed to Marriott's new offer, turning its back on Anbang

in a move announced March 21.

Marriott executives were hopeful but knew Anbang was likely to

counter.

The morning the new deal was made public, Mr. Sorenson was in

Havana as part of President Obama's visit. The Marriott CEO was on

an early-morning call from his hotel room with lodging analysts to

discuss the offer when the phone went dead. For a nerve-racking

minute, he wondered if he had lost the call for good, but it

proceeded.

(MORE TO FOLLOW) Dow Jones Newswires

April 04, 2016 08:35 ET (12:35 GMT)

Anbang came back later that week with an all-cash offer of $81 a

share. Mr. Wu scheduled a meeting in Florida on Easter Sunday,

again irking those at Starwood who had changed their August

vacations.

As before, Starwood leaned on Anbang to make a higher offer, and

Mr. Wu said he would go to $82.75, or $14 billion.

Starwood said it wanted proof of financing and regulatory

approval at the higher offer. This time, that wasn't immediately

forthcoming. Still, Starwood announced the higher bid on March 28,

saying it was "reasonably likely to lead to a superior

proposal."

Marriott considered another bid but knew whatever it could

cobble together wouldn't equal $82.75 in cash. Instead, it began a

lobbying campaign to stress the strategic value of its combination

while raising questions about Anbang.

Marriott issued a press statement saying Starwood investors

should think hard about whether Anbang could close the deal "with a

particular focus on the certainty of the consortium's financing and

the timing of any required regulatory approvals."

Starwood waited for Anbang to agree to its demands and make the

bid binding. Mr. Wu indicated to Starwood officials he might raise

his bid further to knock Marriott out once and for all but needed

to speak to his owner group.

Then, for two days, no one at Starwood heard anything from

Anbang.

Thursday afternoon, Anbang's lawyers at Skadden, Arps, Slate,

Meagher & Flom informed Starwood that the company was walking

away.

"It's great to have clarity," Marriott's Mr. Sorenson said in an

interview on Thursday. "We've been struggling with a lack of

clarity for the last three weeks."

It was especially difficult, he said, because "we had very

little insight into what the competing bidder was prepared to

pay."

Anbang's incursion cost Marriott over $1 billion more than it

had originally agreed to pay for Starwood.

Mr. Hu of Primavera Capital, the Anbang partner, chalked the

episode up as a learning experience. "Some missteps by some players

are just unavoidable," he said. "Nevertheless, it is far too early

to declare Chinese forays overseas will all end in tears. People

who hold such views are either arrogant or ignorant."

Write to Craig Karmin at craig.karmin@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Rick Carew at rick.carew@wsj.com

(END) Dow Jones Newswires

April 04, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

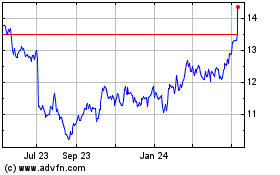

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Apr 2024 to May 2024

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From May 2023 to May 2024