China Speeds Up Bad-Loan Help for Banks

March 13 2016 - 8:50PM

Dow Jones News

BEIJING—Chinese regulators are speeding up ways to help banks

shed bad loans, but some of the measures risk keeping "zombie"

companies afloat while making lenders even more strapped for

capital.

The deepening economic slowdown has heightened the need for

banks to have more funds to lend out. A main feature in a plan

outlined by central-bank and regulatory officials over the weekend

would be to let banks sell dud loans to investors either by

repackaging them as securities or transferring them to special

asset-management companies that handle distressed debt.

Senior executives at China's Big Four state-owned banks say

regulators are also exploring ways for banks to exchange bad loans

for equity in certain too-big-to-fail companies—a potentially

controversial step that they say could saddle banks with

near-worthless stock and squeeze their liquidity.

Bank of China Ltd., one of the top four lenders, recently agreed

to become the largest shareholder in a publicly traded shipbuilder

under the yet-to-be-disclosed plan, people close to the bank say.

Officials at the central bank and banking regulatory agency

declined to comment.

The steps come as Chinese banks are seeing a surge in

nonperforming loans and a sharp decline in profitability, as they

absorb the effects of a yearslong lending binge. To make their

books look healthier, many banks have extended new credit to

corporate borrowers to repay existing debt.

Shang Fulin, chairman of the China Banking Regulatory

Commission, indicated at a news conference on Saturday that policy

makers see such rollover practices as a problem because the funds

aren't used to invest in new projects and create fresh demand.

"Through securitization and transfers of nonperforming assets, the

hope is to increase the turnover rate of bank lending, thereby

improving [banks'] ability to support the real economy," Mr. Shang

said.

Total soured loans in China's banking system reached 1.27

trillion yuan ($195.5 billion) as of December, the highest level

since mid-2006. Even as the official bad-loan ratio remains

relatively low, at 1.67% as of year-end, it has been steadily

climbing in the past three years. That is largely because Chinese

steelmakers, coal miners and other manufacturers find it

increasingly difficult to pay off debts because of weak demand and

excessive industrial capacity.

Nonperforming loans could peak at around 7% of all loans in

China in the current credit cycle, according to a recent analysis

by J.P. Morgan Chase & Co., meaning the entire banking sector

would need about $600 billion to replenish its capital. In a crisis

scenario, China's bad-loan ratio would hit 20% and the banking

system would require five trillion yuan ($770 billion) of capital,

according to the report.

"The key question is, what is the roadmap out of a credit cycle

or crisis?" asked the J.P. Morgan analysts.

Officials at the country's central bank, in particular, are wary

of risks associated with securitization of loans, pointing to how

risky securities tied to home mortgages helped trigger the 2008

global financial crisis. For now, the central bank has picked six

large Chinese banks for a trial run of securitizing tens of

billions of dollars of loans, according to people familiar with the

matter. The banks include the Big Four—Industrial & Commercial

Bank of China Ltd., China Construction Bank Corp., Agricultural

Bank of China Ltd. and Bank of China—along with Bank of

Communications Co. and China Merchants Bank.

Zhou Xiaochuan, China's central-bank governor, said Saturday

that such securities could attract investors who specialize in

buying troubled assets, but he stressed the need to draw lessons

from the global financial crisis in developing the market.

Regulators are also refining a practice pioneered by former

Premier Zhu Rongji, who in the late 1990s set up four state-owned

asset-management companies to take over large amounts of bad loans

from Chinese banks and resell them to other investors. Under the

new plan, the range would be expanded from the four to include

other institutional investors.

Meanwhile, as illustrated by the Bank of China example,

regulators are starting to open the door to more debt-for-equity

restructurings. Under the deal, the bank will hold about 14% of

equity in China Huarong Energy Co., listed in Hong Kong and based

in eastern China's Jiangsu province, in exchange for more than six

billion yuan of loans owed by the struggling shipbuilder.

Current banking rules generally forbid commercial banks from

taking stakes in nonfinancial entities. But regulators, led by the

powerful government commission overseeing state assets—known as the

State-owned Assets Supervision and Administration Commission, or

SASAC—are pushing for changes in the rules to help heavily indebted

state companies cut debts. Corporate debt now amounts to 160% of

China's gross domestic product, according to Standard & Poor's

Ratings Services. That is up from 98% in 2008 and compares with a

current U.S. level of 70%.

Blessed by the leadership's goal to help companies deleverage,

SASAC is compiling a list of big companies that could be slated for

debt-for-equity swaps, according to officials close to the

agency.

But many bankers think such swaps should only be allowed on a

limited scale. By exchanging loans for equity that would be worth

little if the companies already are struggling to pay off debts,

banks would be required to sharply bump up the amount of capital

they set aside against such equity holdings, which are considered

more risky than loans. That would strain their liquidity.

"It doesn't sound like a great idea to save zombie companies

with zombie banks," said Larry Hu, China economist at Macquarie

Securities, a Sydney-based investment bank.

Write to Lingling Wei at lingling.wei@wsj.com

(END) Dow Jones Newswires

March 13, 2016 20:35 ET (00:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

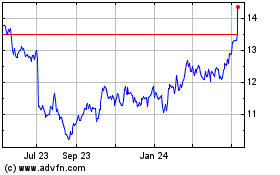

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Jul 2023 to Jul 2024