China Construction Bank Becomes First Chinese Bank to Help Set Silver Price

March 07 2016 - 11:39AM

Dow Jones News

By Ese Erheriene

China Construction Bank Corp. has become the first Chinese bank

to participate in the London silver price fix, in a further

demonstration of the country's footprint in global financial

markets.

The addition to the panel of price participants comes amid

unrest among silver market participants following a recent series

of fixings that deviated from the spot price and cost some users

thousands of dollars.

CCB, one of China's big-four state-owned lenders, will

participate in the daily electronic auctions that set the LBMA

Silver Price benchmark, CME Group Inc. said in a news release

Monday. CME Group and Thomson Reuters Corp. co-administrate the

silver fix.

The Chinese bank will join UBS AG, Bank of Nova Scotia, HSBC

Holdings PLC, Toronto Dominion Bank and J.P. Morgan Chase &

Co.

"CCB is delighted to be the first Chinese bank to become a

participant in the Silver Price auction process in London," said

Mr. Gu Yu, general manager of the financial markets department at

CCB. "This further builds on our combined efforts to boost RMB

liquidity and products in Europe."

The move is the latest in a series of steps taken by China to

extend its reach in global financial markets, and will make it

easier for companies and individuals to invest abroad.

The Asian giant had its currency, the yuan, declared an official

reserve currency last November putting it on a par with global

powerhouse currencies such as the dollar, the euro and the yen.

China is also playing a larger role in metals markets, although

its efforts have been tainted by a scandal at a warehouse in the

port city of Qingdao, in which banks allegedly pledged metal

multiple times as collateral on loans. CCB, the nation's

second-largest lender by assets, said in October it would buy a

majority stake in British metal trading company Metdist Trading

Limited.

"Every new participant is good news for a market," said Robin

Bhar, head of metals research at Société Générale SA "Hopefully,

we'll have other members from the region."

The silver fix went electronic in August 2014, after 117 years

as a telephone-based system, after coming under scrutiny from

regulators recently, as part of a wider probe into key financial

benchmarks. The benchmark is used globally by firms, from miners to

retailers, in the pricing of silver stock.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

March 07, 2016 11:24 ET (16:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

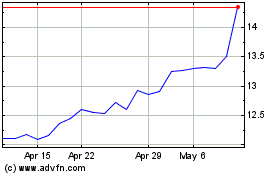

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Apr 2024 to May 2024

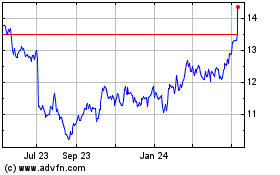

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From May 2023 to May 2024