UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of report (Date of earliest event reported): January 19, 2015

Boreal Water Collection, Inc.

(Exact name of registrant as specified in its

charter)

| NV |

000-54776 |

98-0453421 |

| (State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

| of Incorporation) |

|

Identification No.) |

| 4496 State Road 42 North, Kiamesha Lake, New York |

12751 |

| (Address of Principal Executive Officers |

(Zip Code) |

Registrant's telephone number, including area

code: (845) 794-0400

________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Section 3 - Securities and Trading

Markets

3.02 Unregistered

Sales of Equity Securities

JSJ Investments Note Conversion:

JSJ Investments, Inc. entered into a convertible promissory note

with the Company dated May 25, 2014 (“JSJ Note”). Currently, according to the JSJ’s Conversion Notice dated January

20, 2015, the principal balance of the JSJ Note is $76,256.21 with $6,016.93 in accrued interest. The JSJ Note provides for a conversion

rate of a 45% discount of the average of the 3 lowest trades in the last 20 trading days prior to the conversion. The Conversion

Notice converts $18,621.49 of the JSJ Note. The conversion share price is $0.001118 (45% discount of $0.00203). The total number

of common shares to be issued as a result of this conversion is 16,651,113. The Conversion Notice and Board Resolution authorizing

the conversion are attached as Exhibits hereto.

Officer Stock Matters:

On January 19, 2015, Mrs. Francine Lavoie, President, CEO and sole

member of the Board of Directors, converted her Debt Conversion Note Agreement (“Note”) to restricted Company common

shares. The Note is dated July 31, 2014 and is attached hereto as an Exhibit. The principal amount of the Note is $250,342.10,

with accrued interest of $5,897.88, totaling $256,239.88. The Note was converted into 180,032,305 restricted common shares at $0.0014233

per share. Mrs. Lavoie’s Notice of Conversion and the Company’s Board of Directors Resolution, both dated January 19,

2015, are included herewith as Exhibits.

Mrs. Lavoie is currently serving a 3 year term as CEO and President

of the Company. The contract expires after September 23, 2015. The contract is expressly not “at will.” She is to receive

3 million shares of restricted common stock per year of the contract. Her salary is $120,000 per year. However, if the Company

does not pay her salary, or all of it, Mrs. Lavoie can take the equivalent value in restricted common stock, calculated at a

30% discount of the average of the 3 lowest trades during the previous 10 trading days prior to the date of conversion.

Pursuant to said employment contract, and because the Company has

not paid any portion of the cash salary to her, Mrs. Lavoie has elected to receive 203,566,444 restricted common shares as compensation

from September 24, 2012 through January 22, 2015.

Mr. Krzysztof Umecki is currently serving a 3 year term as

Vice-President - Operations of the Company. The contract expires after September 23, 2015. The contract is expressly not

“at will.” He is to receive 1 million shares of restricted common stock per year of the contract. His salary is

$60,000 per year. However, if the Company does not pay his salary, or all of it, Mr. Umecki can take the equivalent value

in restricted common stock, calculated at a 30% discount of the average of the 3 lowest trades during the previous 10 trading

days prior to the date of conversion.

Pursuant to said employment contract, on January 19, 2015, Mr. Umecki

(Mrs. Lavoie’s spouse), and further because the Company has not paid any portion of the cash salary to him, has elected to

receive 100,617,468 restricted common shares as compensation from September 24, 2012 through January 22, 2015.

The above stock totals payable to Mrs. Lavoie and Mr. Umecki were

calculated in the manner as presented in the following table:

| |

Days |

Salary CEO |

Salary VP op. |

Stock Bonus |

Stock Bonus |

| |

worked |

F. Lavoie |

K. Umecki |

F. Lavoie |

K. Umecki |

| Sept 24/2012 to Dec 31/2012 |

99 |

$ 32,547.94 |

$ 16,273.97 |

975,699 |

271,233 |

| Jan 1/2013 to Dec 31/2013 |

365 |

$ 120,000.00 |

$ 60,000.00 |

3,000,000 |

1,000,000 |

| Jan 1/2014 to Dec 31/2014 |

365 |

$ 120,000.00 |

$ 60,000.00 |

3,000,000 |

1,000,000 |

| Jan 1/2015 to Jan 22/2015 |

22 |

$ 7,232.88 |

$ 3,616.44 |

18,821 |

60,273 |

| |

|

$ 279,780.82 |

$ 139,890.41 |

6,994,520 |

2,331,506 |

Conversion rate: 70% ( ($.002 + $.002 +$.0021) / 3)

= $0.0014233

For Mrs. Lavoie: $279,780.82 / $0.0014233 = 196,571924 shares

plus stock bonus 6,994,520 = 203,566,444 shares

For Mr. Umecki: $139,890.41 / $0.0014233 =98,285,962 shares plus

stock bonus 2,331,506 = 100,617,468 shares

A Board of Directors Consent/Resolution dated January 22, 2015 approving

these stock issuances is attached hereto as an Exhibit.

Section 5 - Corporate Governance and Management

| 5.02 |

Departure of Directors

or Principal Officers; Election of Directors; Appointment of Principal Officers |

| 5.07 |

Submission of Matters to a Vote of

Security Holders. |

| 5.08 |

Shareholder Director Nominations |

On January 22, 2015, the shareholders of the Company nominated and

re-elected Mrs. Francine Lavoie as the sole member of the Company’s Board of Directors. This was accomplished by Consent

without a meeting as attached hereto as an Exhibit.

On January 22, 2015, subsequent to the above action approved

by the shareholders, the Company’s Board of Directors, consisting of one director, Mrs. Francine Lavoie, re-appointed

Mrs. Lavoie as President, CEO, CFO and Treasurer and conferred other titles for the purpose of Mrs. Lavoie’s signature

on EDGAR reporting documentation. The sole board member, Mrs. Lavoie, also appointed her spouse, Mr. Krzysztof

Umecki, as Vice President – Operations. These appointments were accomplished by Consent without a meeting as attached

hereto as an Exhibit.

5.03 Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year

On January 20, 2015, the shareholders approved an increase in the

authorized common shares of the Company from 600 million to 1.5 billion. This was accomplished through a Consent without a meeting

as attached hereto as an Exhibit. On January 21, 2015, the Nevada Secretary of State accepted and filed the Company’s Certificate

of Amendment to our Articles of Incorporation changing the authorized common shares from 600 million to 1.5 billion. The par value

remains at .001/per share. A copy of the Certificate of Amendment is included herewith as an Exhibit.

Section 9 - Financial Statements

and Exhibits

| 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| Exhibit

Number |

|

Description |

| |

|

|

| 3.1 |

|

Certificate of Amendment to the Company’s Articles of Incorporation as filed with the Nevada Secretary of State on January 21, 2015. |

| |

|

|

| 4.1 |

|

Shareholders’ Consent electing Mrs. Francine Lavoie as the Company’s sole member of the Board of Directors |

| |

|

|

| 4.3 |

|

Shareholders’ Consent authorizing an amendment to the Company’s Articles of Incorporation increasing the number of authorized common shares from 600 million to 1.5 billion shares |

| |

|

|

| 10.1 |

|

JSJ Investments Conversion Notice, dated January 20, 2015 |

| |

|

|

| 10.2 |

|

Debt Conversion Note Agreement; Mrs. Lavoie, dated July 31, 2014 |

| |

|

|

| 10.3 |

|

Notice of Debt Conversion from Mrs. Lavoie, dated January 19, 2015 |

| |

|

|

| 99.1 |

|

Company Board Resolution of January 20, 2015 approving JSJ Investments Note Conversion to Company common stock |

| |

|

|

| 99.2 |

|

Board Resolution approving Note conversion, dated January 19, 2015 |

| |

|

|

| 99.3 |

|

Board Resolution approving the issuance of restricted common stock to Mrs. Lavoie and Mr. Umecki, dated January 22, 2015 |

| |

|

|

| 99.4 |

|

Board of Director’ Consent/Resolution appointing Mrs. Francine Lavoie and Mr. Krzysztof Umecki, husband and wife, as officers of the Company |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 23, 2015

| |

Boreal Water Collection, Inc. |

| |

|

| |

|

| |

By: /s/

Mrs. Francine Lavoie |

| |

Mrs. Francine Lavoie, Principal Executive Officer, Principal Financial Officer, Controller and Sole Member of the Board of Directors |

Exhibit 3.1

Exhibit 4.1

BOREAL WATER COLLECTION, INC.

(a Nevada Corporation)

ACTION OF SHAREHOLDERS WITHOUT A MEETING

BY WRITTEN CONSENT

January 22, 2015

(one page)

The undersigned, constituting a voting majority

of the common stock shareholders of Boreal Water Collection, Inc., a Nevada Corporation (“Company”), take the following

action effective this 22nd day of January, 2015:

Re-elect Francine Lavoie as the sole member of the Board of Directors

WHEREAS: The Shareholders have the responsibility to elect members

of the Board of Directors; and

WHEREAS: The Shareholders desire to re-elect Francine Lavoie as

the Company’s sole member of the Board of Directors; now, therefore, be it

RESOLVED: The Shareholders hereby vote to elect Francine Lavoie

to serve as the sole member of the Company’s Board of Directors until such time as we vote on the matter again in accordance

with Nevada law. We acknowledge and accept the conflict of interest in Mrs. Lavoie voting as a shareholder in electing herself

as our sole Board member, as well as Mr. Umecki voting to elect his spouse, Mrs. Lavoie, as our sole Board member.

DATED: January 22, 2015. The undersigned hereby

waive notice to and agree with the action authorized as aforesaid.

| /s/ Francine Lavoie |

/s/ Krzysztof Umecki |

| Francine Lavoie |

Krzysztof Umecki |

| Number of Common Shares owned: 407,032,305 |

Number of Common Shares owned: 2,000,000 |

| |

|

| % of outstanding common shares owned: 74% |

% of outstanding common shares owned: |

| |

Less than 1% |

/s/ Pete Wilke

Wilke, LLC; Pete Wilke

Manager

Number of Common Shares

owned: 1,538,462

% of outstanding common

shares owned: less than 1%

/s/ Serge Radier

Serge Radier

Number of Common Shares

owned: 2,000,000

% of outstanding common

shares owned: less than 1%

Exhibit 4.3

BOREAL WATER COLLECTION,

INC.

(a Nevada Corporation)

ACTION OF SHAREHOLDERS WITHOUT A MEETING

BY WRITTEN CONSENT

January 20, 2015

(one page)

The undersigned, constituting a voting majority

of the common stock shareholders of Boreal Water Collection, Inc., a Nevada Corporation (“Company”), take the following

action effective this 20th day of January, 2015:

Amend Articles of Incorporation; increase in authorized common

shares to 1.5 billion.

WHEREAS: The Shareholders have been informed of a need to increase

the number of authorized common shares to accommodate the issuance of more such shares for a variety of reasons; and

WHEREAS: The Shareholders, in keeping with the advice of management,

believe an increase from 600 million to 1.5 billion common shares will be adequate to meet the Company’s need for the foreseeable

future; now, therefore, be it

RESOLVED: The Shareholders hereby authorize management to submit

paperwork to the Nevada Secretary of State increasing the authorized Company common shares from 600 million to 1.5 billion.

DATED: January 20, 2015. The undersigned

hereby waive notice to and agree with the action authorized as aforesaid.

/s/ Francine Lavoie

Francine Lavoie

Number of Common Shares

owned: 407,032,305

% of outstanding common shares owned:

74%

Exhibit 10.1

Conversion Notice

Reference is made to the Convertible

Note issued by Boreal Water Collection, Inc. (the "Note"), dated May 25, 2014 in the principal amount of $76,256.21 with

12% interest. This note currently holds a principal balance of $76,256.21 and accrued interest in the amount of $6,016.93. The

features of conversion stipulate a Conversion Price means a 45% discount to the average of the three (3) lowest trading prices

on the previous twenty (20) trading days to the date of Conversion, pursuant to the provisions held forth in Section 2(a)(2) of

the Note.

In accordance with and pursuant

to the Note, the undersigned hereby elects to convert $18,621.49 of the principal and interest balance of the Note, indicated below

into shares of Common Stock (the "Common Stock"), of the Company, by tendering the Note specified as of the date specified

below.

Date of Conversion:

January 20, 2015

Please confirm the

following information:

Conversion Amount:

$18,621.49

Conversion Price:

$0.001118 (45% discount from $0.00203)

Number of Common

Stock to be issued: 16,651,113

Current Issued/Outstanding:

339,818,635

Please issue the

Common Stock into which the Note is being converted in the name of the Holder of the Note and transfer the shares electronically,

where possible, to:

Broker Name: Halcyon Cabot Partners, Ltd. DTC#: 0052

Account Name: JSJ Investments Inc.

Account#: 49154823

If Issuer is not DWAC Eligible, please email

joegurba@gmail.com for mailing instructions.

Holder Authorization:

JSJ Investments Inc.

6060 North Central Expressway, Suite 500 *Do not send

certificates to this address

Dallas, TX 75206

888-503-2599

Tax ID: 20-2122354

/s/ Sameer Hirji

Sameer Hirji, President

January 20, 2015

PLEASE

BE ADVISED, pursuant to Section 2(e)(2) of the Note, “Upon receipt by the Company of a copy of the Conversion Notice, the

Company shall as soon as practicable, but in no event later than one (1) Business Day after receipt of such Conversion Notice,

SEND, VIA EMAIL, FACSIMILE OR OVERNIGHT COURIER, A CONFIRMATION OF RECEIPT OF SUCH CONVERSION NOTICE TO SUCH HOLDER INDICATING

THAT THE COMPANY WILL PROCESS SUCH CONVERSION NOTICE IN ACCORDANCE WITH THE TERMS HEREIN. Within two (2) Business Days

after the date of the Conversion Confirmation, the Company shall have issued and electronically transferred the shares to the

Broker indicated in the Conversion Notice; should the Company be unable to transfer the shares electronically, they shall, within

two (2) Business Days after the date of the Conversion Confirmation, have surrendered to FedEx for delivery the next day to the

address as specified in the Conversion Notice, a certificate, registered in the name of the Holder, for the number of shares of

Common Stock to which the Holder shall be entitled.”

Exhibit 10.2

NEITHER THIS NOTE NOR THE SECURITIES THAT MAY BE ISSUED BY THE

BORROWER UPON CONVERSION HEREOF (COLLECTIVELY, THE "SECURITIES") HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933,

AS AMENDED (THE "1933 ACT"), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. NEITHER THE SECURITIES NOR ANY

INTEREST OR PARTICIPATION THEREIN MAY BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED: (i) IN THE ABSENCE OF AN EFFECTIVE REGISTRATION

STATEMENT FOR THE SECURITIES UNDER THE 1933 ACT, OR APPLICABLE STATE SECURITIES LAWS; OR (ii) IN THE ABSENCE OF AN OPINION OF

COUNSEL, IN A FORM ACCEPTABLE TO THE ISSUER, THAT REGISTRATION IS NOT REQUIRED UNDER THE 1933 ACT OR; (iii) UNLESS SOLD, TRANSFERRED

OR ASSIGNED PURSUANT TO RULE 144 UNDER THE 1933 ACT.

DEBT CONVERTIBLE NOTE AGREEMENT

Maturity date of December 31, 2014

$ 250,342.10 July 31, 2014 (the "Issuance

Date")

FOR VALUE RECEIVED, Boreal Water Collection Inc a Nevada

Corporation (the "Company") doing business in Kiamesha Lake, NY hereby promises to pay to the order of Francine Lavoie,

an affiliated person, or its assigns (the "Holder") the principal amount of Two Hundred and Fifty Thousand and Three

Hundred and Forty Two Dollars and Ten cents ($250,342.10), on demand of the Holder (the "Maturity Date"), and to pay

interest on the unpaid principal balance hereof at the rate of Five Percent (5%) per annum (the “Interest Rate”)

from the date hereof (the “Issue Date”) until the same becomes due and payable, whether at maturity or upon

acceleration or by prepayment or otherwise. Interest shall commence accruing on the Issuance Date, shall be computed on the basis

of a 365-day year and the actual number of days elapsed and shall accrue quarterly

At any time prior to the Maturity Date, this Note shall be convertible

into shares of the Company's common stock, share (the "Common Stock"), on the terms and conditions that will be

negotiated at that time.

At any time or times on or after the Issuance Date, the Holder shall

be entitled to convert the entire outstanding and unpaid principal amount of this Note into fully paid and non-assessable shares

of Common Stock in accordance with the negotiated Conversion Price. The Company shall not issue any fraction of a share of Common

Stock upon any conversion; if such issuance would result in the issuance of a fraction of a share of Common Stock, the Company

shall round such fraction of a share of Common Stock up to the nearest whole share.

IN WITNESS WHEREOF, the Company has caused this Note to be

signed by its CEO, on and as of the Issuance Date.

By: /s/ Francine Lavoie

Francine Lavoie,

Chairman, CEO,

Boreal Water Collection Inc.

Exhibit 10.3

NOTICE OF

CONVERSION

The undersigned hereby elects

to convert $250,342.10 principal amount of the Note (defined below) together with $5,897.88 of accrued and unpaid interest thereto,

totaling $256,239.98 into that number of shares of Common Stock to be issued pursuant to

the conversion of the Note (“Common Stock”) as set forth below, of Boreal Water Collection, Inc., a Nevada corporation

(the “Borrower”), according to the conditions of the convertible note of the Borrower dated as of July 31, 2014 (the

“Note”), as of the date written below. No fee will be charged to the Holder for any conversion, except for transfer

taxes, if any.

Box Checked as to applicable

instructions:

| [ ] |

The Borrower shall electronically transmit the Common Stock issuable pursuant to this Notice of Conversion to the account of the undersigned or its nominee with DTC through its Deposit Withdrawal At Custodian system (“DWAC Transfer”). |

| |

|

| |

Name of DTC Prime Broker: |

| |

Account Number: |

| |

|

| [X] |

The undersigned hereby requests that the Borrower issue a certificate or certificates for the number of shares of Common Stock set forth below (which numbers are based on the Holder’s calculation attached hereto) in the name(s) specified immediately below or, if additional space is necessary, on an attachment hereto: |

| |

|

| |

Name: Francine Lavoie |

| |

Address: 5550 Fullum, Suite 202, Montreal, Quebec H2G 2H4 CANADA |

| Date of Conversion: |

Jan 19, 2015 |

| Applicable Conversion Price: |

$0.0014233 |

| Calculated as 30% discount to the average of the 3 lowest trades on the previous 10 trading days to the conversion (0.70 x ((0.002 + 0.002 + 0.0021)/3)) |

|

| Number of Shares of Common Stock to be Issued |

|

| Pursuant to Conversion of the Notes: |

180,032,305 restricted |

| Amount of Principal Balance Due remaining |

|

| Under the Note after this conversion: |

zero |

| |

|

| Accrued and unpaid interest remaining: |

zero |

Francine Lavoie

By: /s/ Francine Lavoie

Name: Francine Lavoie

Date: January

19, 2015

Exhibit 99.1

BOREAL WATER COLLECTION, INC.

DIRECTORS' RESOLUTION

11.24.2014.JSJ INVESTMENTS

BE IT KNOWN THAT, on the 24th day of November,

2014, at a duly constituted special meeting of the Directors of Boreal Water Collection, Inc. (“Company”), the following

resolution was voted and approved upon motion duly made and seconded.

WHEREAS, the Company is obligated under

the terms of an Debt Securities Purchase Agreement dated May 1, 2014 and

WHEREAS, the Company is agreeable to

such a issuance;

NOW, THEREFORE, BE IT RESOLVED, the Board

of Directors hereby authorizes the issuance of 14,877,058 free trading common stock shares of Boreal Water Collection Inc.

The stock certificate shall be in the

name of JSJ Investments Inc. and shall be free trading shares.

CERTIFICATION BY SECRETARY

I am the Secretary of Boreal Water Collection,

Inc. I hereby certify that the foregoing is a true and correct copy of the Resolution adopted by the Board of Directors of Boreal

Water Collection, Inc. on November 24, 2014, in accordance with the provisions of our Bylaws.

IN WITNESS WHEREOF, I have this 24th day of

November, 2014 subscribed my name as Secretary of Boreal Water Collection, Inc. and have caused the corporate seal to be affixed

hereto (if such a seal exists).

________________________________________

Secretary of Corporation

WAIVER OF NOTICE

The undersigned Directors

of Boreal Water Collection, Inc. hereby waive notice of the special Directors’ meeting held on November 24, 2014. We consent

to all actions taken in the meeting. Faxed and electronic signatures are as valid as original signatures hereupon, and may be signed

in counterparts.

_______________________________

Director

Exhibit 99.2

BOREAL WATER COLLECTION, INC.

DIRECTORS' RESOLUTION

01.19.2015.Francine Lavoie

BE IT KNOWN THAT, on the 19th day of

January, 2015, at a duly constituted special meeting of the Directors of Boreal Water Collection, Inc. (“Company”),

the following resolution was voted and approved upon motion duly made and seconded.

WHEREAS, the Company is obligated under

the terms of a Debt Conversion Note Agreement of $250,342.10 plus 5% yearly interest dated July 31, 2014 and

WHEREAS, the Company is agreeable to

such a issuance;

NOW, THEREFORE, BE IT RESOLVED, the Board

of Directors hereby authorizes the issuance of 180,070,260 restricted common stock shares of Boreal Water Collection Inc for the

total debt of $256,239.98 at a price of $0.0014233 as per the terms of the note.

The stock certificate shall be in the

name of Francine Lavoie and shall be restricted shares.

CERTIFICATION BY SECRETARY

I am the Secretary of Boreal Water Collection,

Inc. I hereby certify that the foregoing is a true and correct copy of the Resolution adopted by the Board of Directors of Boreal

Water Collection, Inc. on January 19, 2015, in accordance with the provisions of our Bylaws.

IN WITNESS WHEREOF, I have this 19th day of

January, 2015 subscribed my name as Secretary of Boreal Water Collection, Inc. and have caused the corporate seal to be affixed

hereto (if such a seal exists).

________________________________________

Secretary of Corporation

WAIVER OF NOTICE

The undersigned Directors

of Boreal Water Collection, Inc. hereby waive notice of the special Directors’ meeting held on January 19, 2015. We consent

to all actions taken in the meeting. Faxed and electronic signatures are as valid as original signatures hereupon, and may be signed

in counterparts.

_______________________________

Director

Exhibit 99.3

BOREAL WATER COLLECTION, INC.

(a Nevada Corporation)

ACTION OF THE SOLE MEMBER OF OUR BOARD OF

DIRECTORS WITHOUT A MEETING

BY WRITTEN CONSENT

January 22, 2015

(two pages + Exhibit “A”)

The undersigned, as the sole member of the

Board of Directors of Boreal Water Collection, Inc., a Nevada Corporation (“Company”), takes the following action effective

this 22nd day of January, 2015:

Authorize Restricted Common Share Issuances to Francine Lavoie

and Krzysztof Umecki (Per Employment Contract Provisions)

WHEREAS: Mrs. Francine Lavoie is currently

serving a 3 year term as CEO and President of the Company. The contract expires after September 23, 2015. The contract is expressly

not “at will.” She is to receive 3 million shares of restricted common stock per year of the contract. Her salary is

$120,000 per year. However, if the Company does not pay her salary, or all of it, Mrs. Lavoie can take the an equivalent value

in restricted common stock, calculated at a 30% discount of the average of the 3 lowest trades during the previous 10 trading days

prior to the date of conversion. And;

WHEREAS: Pursuant to said employment

contract, and because the Company has not paid any portion of the cash salary to her, Mrs. Lavoie has elected to receive 203,566,444

restricted common shares as compensation from September 24, 2012 through January 22, 2015. And;

WHEREAS: Mr. Krzysztof Umecki is currently serving a 3 year term

as Vice-President – Operations of the Company. The contract expires after September 23, 2015. The contract is expressly

not “at will.” He is to receive 1 million shares of restricted common stock per year of the contract. His salary is

$60,000 per year. However, if the Company does not pay his salary, or all of it, Mr. Umecki can take the an equivalent value in

restricted common stock, calculated at a 30% discount of the average of the 3 lowest trades during the previous 10 trading days

prior to the date of conversion. And;

WHEREAS: Pursuant to said employment

contract, on January 22, 2015, Mr. Umecki (Mrs. Lavoie’s spouse), and further because the Company has not paid any portion

of the cash salary to him, has elected to receive 100,617,468 restricted common shares as compensation from September 24, 2012

through January 22, 2015. And;

WHEREAS: The above stock totals payable

to Mrs. Lavoie and Mr. Umecki were calculated in the manner as presented in the attached table, Exhibit “A” hereto:

Now, Therefore Be It

RESOLVED: The sole member of the Board of Directors, Francine Lavoie,

approves of the stock compensation to herself and Mr. Umecki as contained in this Board of Directors Resolution. I, Francine Lavoie,

acknowledge and accept the conflict of interest in me voting as a Director in approving the stock compensation to the officers

of the Company; e.g. common shares to myself as well as to my spouse, Krzysztof Umecki.

DATED: January 22, 2015. The undersigned hereby

waives notice to and agrees with the actions authorized as aforesaid.

/s/ Francine Lavoie

Francine

Lavoie

Sole Member of the Board

of Directors

Exhibit “A”

to Board Resolution

The above stock totals in the Board

Resolution payable to Mrs. Lavoie and Mr. Umecki were calculated in the manner as presented in the following table:

| |

Days |

Salary CEO |

Salary VP op. |

Stock Bonus |

Stock Bonus |

| |

worked |

F. Lavoie |

K. Umecki |

F. Lavoie |

K. Umecki |

| Sept 24/2012 to Dec 31/2012 |

99 |

$ 32,547.94

|

$ 16,273.97

|

975,699 |

271,233 |

| Jan 1/2013 to Dec 31/2013 |

365 |

$ 120,000.00

|

$ 60,000.00

|

3,000,000 |

1,000,000 |

| Jan 1/2014 to Dec 31/2014 |

365 |

$ 120,000.00

|

$ 60,000.00

|

3,000,000 |

1,000,000 |

| Jan 1/2015 to Jan 22/2015 |

22 |

$ 7,232.88

|

$ 3,616.44

|

18,821 |

60,273 |

| |

|

$ 279,780.82

|

$ 139,890.41

|

6,994,520

|

2,331,506

|

Conversion rate: 70% ( ($.002 + $.002 +$.0021) / 3)

= $0.0014233

For Mrs. Lavoie: $279,780.82 / $0.0014233 = 196,571924 shares

plus stock bonus 6,994,520 = 203,566,444 shares

For Mr. Umecki: $139,890.41 / $0.0014233 =98,285,962 shares plus

stock bonus 2,331,506 = 100,617,468 shares

Exhibit 99.4

BOREAL WATER COLLECTION, INC.

(a Nevada Corporation)

ACTION OF THE SOLE MEMBER OF OUR BOARD OF

DIRECTORS WITHOUT A MEETING

BY WRITTEN CONSENT

January 22, 2015

(one page)

The undersigned, as the sole member of the

Board of Directors of Boreal Water Collection, Inc., a Nevada Corporation (“Company”), takes the following action effective

this 22nd day of January, 2015:

Appoint Francine Lavoie and Krzysztof Umecki as Corporate Officers

WHEREAS: The Board of Directors has the responsibility to appoint

officers of the Company; and

WHEREAS: Francine Lavoie, as our sole member of the Board of Directors

desires to appoint herself as well as her spouse, Krzysztof Umecki, as officers of the Company; now, therefore, be it

RESOLVED: The sole member of the Board of Directors hereby appoints

Francine Lavoie to serve as President, Chief Executive Officer, Chief Financial Officer and Treasurer and Krzysztof Umecki to serve

as Vice President – Operations until such time as the Board votes on the matter again in accordance with Nevada law. Mrs.

Lavoie is authorized to include Principal Executive Officer, Principal Financial Officer and Controller as officer positions when

signing EDGAR reporting documents, and for other purposes, on behalf of the Company. I, Francine Lavoie, acknowledge and accept

the conflict of interest in me voting as a Director in appointing myself as officers of the Company, as well as appointing my husband,

Mr. Umecki, as an officer.

DATED: January 22, 2015. The undersigned hereby

waives notice to and agrees with the actions authorized as aforesaid.

/s/ Francine Lavoie

Francine Lavoie

Sole Member of the Board

of Directors

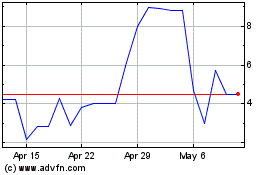

Birdie Win (PK) (USOTC:BRWC)

Historical Stock Chart

From Apr 2024 to May 2024

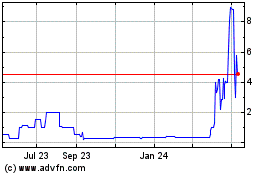

Birdie Win (PK) (USOTC:BRWC)

Historical Stock Chart

From May 2023 to May 2024