UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015.

[X] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______.

Commission File Number 000-26108

AMERICAN CANNABIS COMPANY, INC.

(Exact name of registrant as specified in its charter)

| |

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization) |

|

|

94-2901715

(I.R.S. Employer

Identification No.) |

5690 Logan St #A

Denver, Colorado

(Address of principal executive offices) |

|

|

80216

(Zip Code) |

(720) 466-3789

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated

filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] |

Non-accelerated filer [ ]

(Do not check if a smaller reporting company) |

| Accelerated filer [ ] |

Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

On August 11, 2015, 44,643,750 shares of common stock were outstanding.

TABLE OF

CONTENTS

| PART I. FINANCIAL INFORMATION | |

Page |

| | |

| |

| | |

| Item 1. | |

FINANCIAL STATEMENTS (Unaudited): | |

| 1 | |

| | |

| |

| | |

| | |

CONDENSED CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2015 AND DECEMBER 31, 2014 | |

| 1 | |

| | |

| |

| | |

| | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE AND SIX MONTH PERIODS ENDED JUNE

30, 2015 AND JUNE 30, 2014 | |

| 2 | |

| | |

| |

| | |

| | |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2015 AND JUNE

30, 2014 | |

| 3 | |

| | |

| |

| | |

| | |

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |

| 4 | |

| | |

| |

| | |

| Item 2. | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| 16 | |

| | |

| |

| | |

| Item 3. | |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| 23 | |

| | |

| |

| | |

| Item 4. | |

CONTROLS AND PROCEDURES | |

| 23 | |

| | |

| |

| | |

| PART II. OTHER INFORMATION | |

| | |

| | |

| |

| | |

| Item 1. | |

LEGAL PROCEEDINGS | |

| 24 | |

| | |

| |

| | |

| Item 1A. | |

RISK FACTORS | |

| 24 | |

| | |

| |

| | |

| Item 2. | |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

| 24 | |

| | |

| |

| | |

| Item 3. | |

DEFAULTS UPON SENIOR SECURITIES | |

| 24 | |

| | |

| |

| | |

| Item 5. | |

OTHER INFORMATION | |

| 24 | |

| | |

| |

| | |

| Item 6. | |

EXHIBITS | |

| 25 | |

| | |

| |

| | |

| SIGNATURES | |

| |

| 26 | |

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

AMERICAN CANNABIS COMPANY, INC. AND SUBSIDIARY

FORMERLY BRAZIL INTERACTIVE MEDIA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June 30,

2015 | |

December 31, 2014 |

| Assets | |

| (Unaudited) | | |

| (Audited) | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 227,513 | | |

$ | 165,213 | |

| Accounts receivable, net | |

| 102,484 | | |

| 57,642 | |

| Deposits | |

| 79,739 | | |

| 181,941 | |

| Inventory | |

| 30,155 | | |

| 4,555 | |

| Prepaid expenses and other current assets | |

| 105,634 | | |

| 12,325 | |

| Total current assets | |

| 545,525 | | |

| 421,676 | |

| Property and equipment, net | |

| 59,273 | | |

| 48,416 | |

| Total assets | |

$ | 604,798 | | |

$ | 470,092 | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 142,301 | | |

$ | 62,136 | |

| Deferred revenue | |

| 29,414 | | |

| 173,528 | |

| Convertible notes, net of discount | |

| 42,255 | | |

| 24,551 | |

| Accrued and other current liabilities | |

| 51,442 | | |

| 125,518 | |

| Total current liabilities | |

| 265,412 | | |

| 385,733 | |

| Total liabilities | |

| 265,412 | | |

| 385,733 | |

| Commitments and contingencies (Note 12) | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock; $0.01 par value; 5,000,000 shares authorized; no shares

issued or outstanding | |

| — | | |

| — | |

| Common stock, $0.00001 par value; 100,000,000 shares authorized;

44,643,750 and 44,518,750 issued and outstanding at June 30, 2015 and December 31, 2014, respectively | |

| 446 | | |

| 446 | |

| Additional paid-in capital | |

| 4,225,005 | | |

| 3,699,526 | |

| Retained deficit | |

| (3,886,065 | ) | |

| (3,615,613 | ) |

| Total stockholders' equity | |

| 339,386 | | |

| 84,359 | |

| Total liabilities and stockholders' equity | |

$ | 604,798 | | |

$ | 470,092 | |

The accompanying notes are an integral part of these condensed

consolidated unaudited financial statements

AMERICAN CANNABIS COMPANY, INC. AND SUBSIDIARY

FORMERLY BRAZIL INTERACTIVE MEDIA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

Three Months | |

Three Months | |

Six Months | |

Six Months |

| |

Ended | |

Ended | |

Ended | |

Ended |

| |

June 30, 2015 | |

June 30, 2014 | |

June 30, 2015 | |

June 30, 2014 |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Consulting services | |

$ | 268,488 | | |

$ | 103,540 | | |

$ | 464,058 | | |

$ | 127,404 | |

| Products and equipment | |

| 200,257 | | |

| 2,190 | | |

| 448,354 | | |

| 9,638 | |

| Total revenues | |

$ | 468,745 | | |

$ | 105,730 | | |

$ | 912,412 | | |

$ | 137,042 | |

| Costs of revenues | |

| | | |

| | | |

| | | |

| | |

| Cost of consulting services | |

| 115,522 | | |

| 55,464 | | |

| 216,414 | | |

| 74,889 | |

| Cost of products and equipment | |

| 176,347 | | |

| 1,992 | | |

| 401,998 | | |

| 9,017 | |

| Total cost of revenues | |

| 291,869 | | |

| 57,456 | | |

| 618,412 | | |

| 83,906 | |

| Gross Profit | |

| 176,876 | | |

| 48,274 | | |

| 294,000 | | |

| 53,136 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 159,850 | | |

| 77,887 | | |

| 370,349 | | |

| 95,893 | |

| Selling and marketing | |

| 113,224 | | |

| 26,072 | | |

| 207,529 | | |

| 47,517 | |

| Research and development | |

| 11,350 | | |

| — | | |

| 41,722 | | |

| — | |

| Total operating expenses | |

| 284,424 | | |

| 103,959 | | |

| 619,600 | | |

| 143,410 | |

| Income (loss) from operations | |

| (107,548 | ) | |

| (55,685 | ) | |

| (325,600 | ) | |

| (90,274 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Gain on debt extinguishment | |

| 72,771 | | |

| — | | |

| 72,771 | | |

| — | |

| Interest income (expense), net | |

| (8,837 | ) | |

| (218 | ) | |

| (17,623 | ) | |

| (261 | ) |

| Total other income (expense) | |

| 63,934 | | |

| (218 | ) | |

| 55,148 | | |

| (261 | ) |

| Net income (loss) before income taxes | |

| (43,614 | ) | |

| (55,903 | ) | |

| (270,452 | ) | |

| (90,535 | ) |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | |

| Net income (loss) | |

$ | (43,614 | ) | |

$ | (55,903 | ) | |

$ | (270,452 | ) | |

$ | (90,535 | ) |

| Basic and diluted net income (loss) per common share | |

$ | (0.00 | )* | |

$ | (0.00 | )* | |

$ | (0.01 | ) | |

$ | (0.00 | )* |

| Basic and diluted weighted average common shares outstanding | |

| 45,752,033 | | |

| 29,550,179 | | |

| 45,275,183 | | |

| 29,550,179 | |

*denotes net loss per common share

of less than $0.01.

The accompanying

notes are an integral part of these condensed consolidated unaudited financial statements

AMERICAN CANNABIS COMPANY, INC. AND SUBSIDIARY

FORMERLY BRAZIL INTERACTIVE MEDIA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| |

Six Months | |

Six Months |

| |

Ended | |

Ended |

| |

June 30, 2015 | |

June 30, 2014 |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (270,452 | ) | |

$ | (90,535 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating

activities: | |

| | | |

| | |

| Depreciation | |

| 1,474 | | |

| 287 | |

| Amortization of discount on convertible notes payable | |

| 17,704 | | |

| — | |

| Stock-based compensation to employees | |

| 80,394 | | |

| — | |

| Stock-based compensation to service providers | |

| 107,385 | | |

| — | |

| Gain on debt extinguishment | |

| (72,771 | ) | |

| — | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (44,842 | ) | |

| 1,250 | |

| Deposits | |

| 102,202 | | |

| — | |

| Inventory | |

| (25,600 | ) | |

| (29,198 | ) |

| Prepaid expenses and other current assets | |

| (5,606 | ) | |

| (11,479 | ) |

| Deferred revenue | |

| (144,115 | ) | |

| 105,533 | |

| Accrued and other current liabilities | |

| (1,511 | ) | |

| 51,713 | |

| Accounts payable | |

| 80,370 | | |

| 46,427 | |

| Net cash provided by (used in) operating activities | |

| (175,368 | ) | |

| 73,998 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (12,332 | ) | |

| (1,250 | ) |

| Net cash used in investing activities | |

| (12,332 | ) | |

| (1,250 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from sale of common stock | |

| 250,000 | | |

| 200 | |

| Cash assumed from BIMI, net of expenses | |

| — | | |

| 215,642 | |

| Proceeds from short-term notes payable | |

| — | | |

| 35,000 | |

| Settlement of short-term notes payable | |

| — | | |

| (35,000 | ) |

| Distributions to stockholders | |

| — | | |

| (4,000 | ) |

| Net cash provided by financing activities | |

| 250,000 | | |

| 211,842 | |

| Net increase in cash and cash equivalents | |

| 62,300 | | |

| 284,590 | |

| Cash and cash equivalents at beginning of period | |

| 165,213 | | |

| 17,597 | |

| Cash and cash equivalents at end of period | |

| 227,513 | | |

| 302,187 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for (received from) interest | |

$ | (80 | ) | |

$ | 261 | |

| Cash paid for (received from) income taxes, net | |

$ | — | | |

$ | — | |

The accompanying

notes are an integral part of these condensed consolidated unaudited financial statements

AMERICAN

CANNABIS COMPANY, INC. AND SUBSIDIARY

FORMERLY BRAZIL INTERACTIVE MEDIA, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2015 AND 2014

(Unaudited)

Note 1. Description of the Business

American Cannabis Company, Inc. and its subsidiary company, Hollister

& Blacksmith, Inc., doing business as American Cannabis Consulting (“American Cannabis Consulting”), (collectively

“the “Company”) are based in Denver, Colorado and operate a fully-integrated business model that features end-to-end

solutions for businesses operating in the regulated cannabis industry in states and countries where cannabis is regulated and/or

has been de-criminalized for medical use and/or legalized for recreational use. The Company provides advisory and consulting services

specific to this industry, designs industry-specific products and facilities, and manages a strategic group partnership that offers

both exclusive and non-exclusive customer products commonly used in the industry. American Cannabis Company, Inc. is a publicly

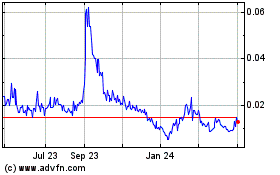

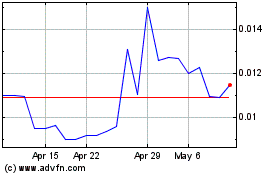

listed company quoted on the OTCQB under the symbol “AMMJ”.

American Cannabis Company, Inc. was incorporated in the State

of Delaware on September 24, 2001 under the name Naturewell, Inc. to develop and market clinical diagnostic products using immunology

and molecular biologic technologies.

On March 13, 2013, Naturewell, Inc. completed a merger transaction

whereby it acquired 100% of the issued and outstanding share capital of Brazil Interactive Media, Inc. (“BIMI”), which

operated as a Brazilian interactive television company and television production company through its wholly owned Brazilian subsidiary

company EsoTV Brasil Promoção Publicidade Licenciamento e Comércio Ltda. (“EsoTV”). Naturewell’s

Articles of Incorporation were amended to reflect a new name: Brazil Interactive Media, Inc.

On May 15, 2014, BIMI entered into a merger agreement (“the

Merger Agreement”) to acquire 100% of the issued and outstanding American Cannabis Consulting while simultaneously disposing

of 100% of the issued share capital EsoTV (“the Separation Agreement”). Both the merger with American Cannabis Consulting

and disposal of EsoTV were completed on September 29, 2014. BIMI subsequently amended its Articles of Incorporation to change

its name to American Cannabis Company, Inc. On October 10, 2014, American Cannabis Company, Inc changed its stock symbol from

BIMI to AMMJ.

The foregoing descriptions of the Merger Agreement and Separation

Agreement do not purport to be complete and are qualified in their entirety by the terms of such agreements, which are filed as

exhibits to the Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”)

on October 3, 2014.

Immediately following the completion of the Merger Agreement,

former shareholders of American Cannabis Consulting owned 31,710,628 shares of American Cannabis Company, Inc.’s common

stock representing 78.44% of American Cannabis Company, Inc.’s issued and outstanding share capital. Accordingly, American

Cannabis Consulting was deemed to have been the accounting acquirer in a Reverse Merger which resulted in a recapitalization of

the Company. Consequently, the Company’s condensed consolidated financial statements reflect the results of American

Cannabis Consulting since Inception (March 5, 2013) and of American Cannabis Company, Inc. (formerly BIMI) since September 29,

2014.

Note 2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements are prepared in accordance with accounting

principles generally accepted in the United States of America ("U.S. GAAP"). The Company has elected a fiscal year ending

on December 31. Certain balance sheet reclassifications have been made to prior period balances to reflect the current period’s

presentation format; such reclassifications had no impact on the Company’s consolidated statements of operations or consolidated

statements of cash flows and had no material impact on the Company’s consolidated balance sheets.

Use of Estimates in Financial Reporting

The preparation of financial statements in conformity with GAAP

requires management to make estimates and assumptions that affect amounts of assets and liabilities and disclosures of contingent

assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the periods

presented. Actual results could differ from these estimates. Estimates and assumptions are reviewed periodically and the effects

of revisions are reflected in the financial statements in the period they are deemed to be necessary. Significant estimates made

in the accompanying financial statements include but are not limited to following: those related to revenue recognition, allowance

for doubtful accounts and unbilled services, lives and recoverability of equipment and other long-lived assets, contingencies

and litigation. The Company is subject to uncertainties, such as the impact of future events, economic, environmental and political

factors, and changes in the business climate; therefore, actual results may differ from those estimates. When no estimate in a

given range is deemed to be better than any other when estimating contingent liabilities, the low end of the range is accrued.

Accordingly, the accounting estimates used in the preparation of the Company's financial statements will change as new events

occur, as more experience is acquired, as additional information is obtained and as the Company's operating environment changes.

Changes in estimates are made when circumstances warrant. Such changes and refinements in estimation methodologies are reflected

in reported results of operations; if material, the effects of changes in estimates are disclosed in the notes to the financial

statements.

Unaudited Interim Financial Statements

The accompanying unaudited financial statements have been prepared

in accordance with U.S. GAAP for interim financial information and with the instructions to Form 10-Q and Regulation S-X. Accordingly,

the financial statements do not include all of the information and footnotes required by generally accepted accounting principles

for complete financial statements. In the opinion of management, all adjustments consisting of normal recurring entries necessary

for a fair statement of the periods presented for: (a) the financial position; (b) the result of operations; and (c) cash flows,

have been made in order to make the financial statements presented not misleading. The results of operations for such interim

periods are not necessarily indicative of operations for a full year.

Cash and Cash Equivalents

The Company considers all highly liquid investments with original

maturities of three months or less to be cash equivalents. Cash and cash equivalents are held in operating accounts at a major

financial institution.

Accounts Receivable

Accounts receivable are recorded at the net value of face amount

less an allowance for doubtful accounts. The Company evaluates its accounts receivable periodically based on specific identification

of any accounts receivable for which the Company deems the net realizable value to be less than the gross amount of accounts receivable

recorded; in these cases, an allowance for doubtful accounts is established for those balances. In determining its need for an

allowance for doubtful accounts, the Company considers historical experience, analysis of past due amounts, client creditworthiness

and any other relevant available information. However, the Company’s actual experience may vary from its estimates. If the

financial condition of its clients were to deteriorate, resulting in their inability or unwillingness to pay the Company’s

fees, it may need to record additional allowances or write-offs in future periods. This risk is mitigated to the extent that the

Company receives retainers from its clients prior to performing significant services.

The allowance for doubtful accounts, if any, is recorded as a

reduction in revenue to the extent the provision relates to fee adjustments and other discretionary pricing adjustments. To the

extent the provision relates to a client's inability to make required payments on accounts receivables, the provision is recorded

in operating expenses. The Company’s allowance for doubtful accounts was $4,497 and $9,338 as of June 30, 2015 and December

31, 2014, respectively. The Company did not record bad debt expense during the three and six months ended June 30, 2015 or during

the three and six months ended June 30, 2014.

Deposits

Deposits is comprised of advance payments made to third parties,

primarily for inventory for which the Company has not yet taken title. When the Company takes title to inventory for which deposits

are made, the related amount is classified as inventory, then recognized as a cost of revenues upon sale (see “Costs of

Revenues” below).

Inventory

Inventory is comprised of products and equipment owned by the

Company to be sold to end-customers. Inventory is valued at cost, based on the specific identification method, unless and until

the market value for the inventory is lower than cost, in which case an allowance is established to reduce the valuation to market

value. As of June 30, 2015 and December 31, 2014, market values of all of the Company’s inventory were greater than cost,

and accordingly, no such valuation allowances were recognized.

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets is primarily comprised

of advance payments made to third parties for independent contractors’ services or other general expenses. Prepaid services

and general expenses are amortized over the applicable periods which approximate the life of the contract or service period.

Significant Clients and Customers

For the three months ended June 30, 2015, two customers individually

accounted for 10% or more of the Company’s revenues; these customers accounted for approximately 63% of the Company’s

total revenues for the period. For the six months ended June 30, 2015, three customers individually accounted for 10% or more

of the Company’s revenues; these customers accounted for approximately 70% of the Company’s total revenues for the

period. For the three months ended June 30, 2014, three customers individually accounted for 10% or more and 65% in aggregate

of the Company’s total revenues. For the six months ended June 30, 2014, three customers individually accounted for 10%

or more and 66% in aggregate of the Company’s total revenues.

As of June 30, 2015, four customers accounted for 10% or more

of the Company’s accounts receivable balance; these customers accounted for approximately 86% of the Company’s accounts

receivable balance at that date. As of December 31, 2014, three customers accounted for 10% or more of the Company’s accounts

receivable balance; these customers accounted for approximately 88% of the Company’s gross accounts receivable balance at

that date.

Property and Equipment, net

Property and Equipment is stated at net book value, cost less

depreciation. Maintenance and repairs are expensed as incurred. Depreciation of owned equipment is provided using the straight-line

method over the estimated useful lives of the assets, ranging from two to seven years. Costs associated with in-progress construction

are capitalized as incurred and depreciation is consummated once the underlying asset is placed into service. Property and equipment

is reviewed for impairment as discussed below under “Accounting for the Impairment of Long-Lived Assets.” The Company

did not capitalize any interest as of June 30, 2015 or December 31, 2014.

Accounting for the Impairment of Long-Lived Assets

The Company evaluates long-lived assets for impairment whenever

events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Upon such an occurrence,

recoverability of assets to be held and used is measured by comparing the carrying amount of an asset to forecasted undiscounted

net cash flows expected to be generated by the asset. If the carrying amount of the asset exceeds its estimated future cash flows,

an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset.

For long-lived assets held for sale, assets are written down to fair value, less cost to sell. Fair value is determined based

on discounted cash flows, appraised values or management's estimates, depending upon the nature of the assets. The Company had

not recorded any impairment charges related to long-lived assets as of June 30, 2015 or December 31, 2014.

Beneficial Conversion Feature

If the conversion features of conventional convertible debt provides

for a rate of conversion that is below market value at issuance, this feature is characterized as a beneficial conversion feature

(“BCF”). A BCF is recorded by the Company as a debt discount pursuant to Financial Accounting Standards Board

(“FASB”) Accounting Standards Codification (“ACF”) Topic 470-20 Debt with Conversion and Other Options.

In those circumstances, the convertible debt is recorded net of the discount related to the BCF, and the Company amortizes the

discount to interest expense, over the life of the debt using the effective interest method.

Revenue Recognition

Revenue is recognized in accordance with FASB ASC Topic 605, Revenue

Recognition. The Company recognizes revenue when persuasive evidence of an arrangement exists, the related services are rendered

or delivery has occurred, the price is fixed or determinable and collectability is reasonably assured.

The Company generates revenues from professional services consulting

agreements. These arrangements are generally entered into on a time basis, for a fixed-fee or on a contingent fee basis. Generally,

a prepayment or retainer is required prior to performing services.

Revenues from time-based engagements are recognized as the hours

are incurred by the Company.

Revenues from fixed-fee engagements are recognized under the completed

or proportional performance methods. Management reviews arrangement to determine whether or not the fixed-fee is for a final deliverable

or act which is significant to the arrangement as a whole. If it is, revenue is recognized under the completed performance method,

in which revenue is recognized once the final act or deliverable is performed or delivered. Revenue recognized under the proportional

performance method is recognized as services are performed. Under this method, the Company estimates the amount of completed work

in comparison to the total services to be provided under the arrangement or deliverable in order to determine the amount of revenue

to be recognized. Revenue recognition is affected by a number of factors that change the estimated amount of work required to

complete the deliverable, such as changes in scope, timing, awaiting notification of license award from local government, and

the level of client involvement. Losses, if any, on fixed-fee engagements are recognized in the period in which the loss first

becomes probable and reasonably estimable. During the three and six month periods ended June 30, 2015 and June 30, 2014, no such

losses have occurred. The Company believes if an engagement terminates prior to completion it can recover the costs incurred related

to the services provided.

The Company has some arrangements for which revenues are contingent

upon achieving a pre-determined deliverable or future outcome. Any contingent revenue for these arrangements is not recognized

until the contingency is resolved and collectability is reasonably assured.

The Company’s arrangements with clients may include terms

to deliver multiple services or deliverables. These contracts specifically identify the services to be provided with the corresponding

deliverable. The value for each deliverable is determined based on the prices charged when each element is sold separately or

by other vendor-specific objective evidence (“VSOE”). Revenues are recognized in accordance with our accounting policies

for the elements as described above. The elements qualify for separation when the deliverables have value on a stand-alone basis

and the value of the separate elements can be established by VSOE or an estimated selling price. While assigning values and identifying

separate elements requires judgment, generally selling prices of the separate elements are readily identifiable as the Company

also sells those elements individually outside of a multiple services engagement. Contracts with multiple elements are typically

fixed-fee or on time basis. Arrangements are typically terminable by either party upon sufficient notice and do not include provisions

for refunds relating to services provided.

Differences between the timing of billings and the recognition

of revenue are recognized as either unbilled services or deferred revenue in the accompanying balance sheet. Revenues recognized

for services performed, but not yet billed to clients are recorded as unbilled services.

Reimbursable expenses, including those relating to travel, other

out-of-pocket expenses and any third-party costs, are included as a component of revenues. Typically, an equivalent amount of

reimbursable expenses are included in total direct client service costs. Reimbursable expenses related to time and materials and

fixed-fee engagements are recognized as revenue in the period in which the expense is incurred and collectability is reasonably

assured. Taxes collected from customers and remitted to governmental authorities are presented in the statement of operations

on a net basis.

Revenue from product and equipment sales, including delivery fees,

is recognized when an order has been obtained, the price is fixed and determinable, the product is shipped, title has transferred

and collectability is reasonably assured. Generally, our suppliers’ drop-ship orders to our clients with origin terms. For

any shipments with destination terms, the Company defers revenue until delivery to the customer. During the three and six months

ended June 30, 2015 and June 30, 2014, sales returns were not significant and as such, no sales return allowance had been recorded

as of June 30, 2015 and December 31, 2014.

Costs of Revenues

The Company’s policy is to recognize costs of revenue in

the same manner in conjunction with revenue recognition. Cost of revenue includes the costs directly attributable to revenue recognition

and includes compensation and fees for services, travel and other expenses for services and costs of products and equipment. Selling,

general and administrative expenses are charged to expense as incurred.

Advertising and Promotion Costs

Advertising and promotion costs are

included as a component of selling and marketing expense and are expensed as incurred. During the three and six month periods

ended June 30, 2015, these costs were $25,727 and $31,218, respectively. During the three and six month periods ended June 30,

2014, these costs were $8,253 and $8,323, respectively.

Shipping and Handling Costs

For product and equipment sales, shipping and handling costs are

included as a component of cost of revenues.

Stock-Based

Compensation

Restricted shares are awarded to employees and entitle the grantee

to receive shares of common stock at the end of the established vesting period. The fair value of the grant is based on the stock

price on the date of grant. The Company recognizes related compensation costs on a straight-line basis over the requisite vesting

period of the award. During the three and six months ended June 30, 2015, stock-based compensation expense for restricted shares

was $37,123 and $80,394, respectively, while no such costs were incurred during the three and six months ended June 30, 2014.

Compensation expense for warrants and options is based on the fair value of the instruments on the grant date, which is determined

using the Black-Scholes valuation model. During the three and six months ended June 30, 2015 and 2014, there was no compensation

expense for warrants or stock options. Compensation expense for common shares of stock is based on an assessment of fair value

as of the grant date and is recognized over the vesting period, or if the common shares immediately vest, is recognized in full

upon the grant.

Income Taxes

The Company’s corporate status changed from an S-Corporation,

which it had been since inception, to a C-Corporation during the year ended December 31, 2014. As provided in Section 1361 of

the Internal Revenue Code, for income tax purposes, S-Corporations are not subject to corporate income taxes; instead, the owners

are taxed on their proportionate share of the S-Corporation’s taxable income. Accordingly, we were not subject to income

taxes for the six months ended June 30, 2014. We recognize deferred tax assets and liabilities for the expected future tax consequences

of events that have been included in the financial statements or tax returns in accordance with applicable accounting guidance

for accounting for income taxes, using currently enacted tax rates in effect for the year in which the differences are expected

to reverse. We record a valuation allowance when necessary to reduce deferred tax assets to the amount expected to be realized.

For the three and six months June 30, 2015, due to cumulative losses since our corporate status changed, we recorded a valuation

allowance against our deferred tax asset that reduced our income tax benefit for the period to zero. As of June 30, 2015 and December

31, 2014, we had no liabilities related to federal or state income taxes and the carrying value of our deferred tax asset was

zero.

Net Income (Loss) Per Common Share

The Company reports net income (loss) per common share in

accordance with FASB ASC 260, “Earnings per Share”. This statement requires dual presentation of basic and

diluted earnings with a reconciliation of the numerator and denominator of the earnings per share computations. Basic net

income (loss) per share is computed by dividing net income attributable to common stockholders by the weighted average number

of shares of common stock outstanding during the period and excludes the effects of any potentially dilutive securities.

Diluted net income (loss) per share gives effect to any dilutive potential common stock outstanding during the period. The

computation does not assume conversion, exercise or contingent exercise of securities that would have an anti-dilutive effect

on earnings.

Related Party Transactions

The Company follows FASB ASC subtopic

850-10, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Pursuant to ASC 850-10-20, related parties include: a) affiliates

of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair

value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method

by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by

or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with

which the Company may deal if one party controls or can significantly influence the management or operating policies of the other

to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other

parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership

interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting

parties might be prevented from fully pursuing its own separate interests.

The financial statements shall include disclosures of material

related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary

course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial

statements is not required in those statements. The disclosures shall include: a) the nature of the relationship(s) involved;

b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of

the periods for which statements of operation are presented, and such other information deemed necessary to an understanding of

the effects of the transactions on the financial statements; c) the dollar amounts of transactions for each of the periods for

which statements of operations are presented and the effects of any change in the method of establishing the terms from that used

in the preceding period; and d) amounts due from or to related parties as of the date of each balance sheet presented and, if

not otherwise apparent, the terms and manner of settlement.

See Note 11. Related Party Transactions for associated disclosures.

Recent Accounting Pronouncements

The Company has reviewed all the recently issued, but not yet

effective, accounting pronouncements and it does not believe any of these pronouncements will have a material impact on the Company.

Note 3. Accounts Receivable, net

Accounts receivable, net, was comprised of the following as of

June 30, 2015 and December 31, 2014:

| | |

June 30, | |

December 31, |

| | |

2015 | |

2014 |

| | |

(Unaudited) | |

(Audited) |

| Gross accounts receivable | |

$ | 106,981 | | |

$ | 66,980 | |

| Less: allowance for doubtful accounts | |

| (4,497 | ) | |

| (9,338 | ) |

| Accounts receivable, net | |

$ | 102,484 | | |

$ | 57,642 | |

The Company had no bad debt expense during the three and six months

ended June 30, 2015 and June 30, 2014.

Note 4. Deposits

Deposits was comprised of the following as of June 30, 2015 and

December 31, 2014:

| | |

June 30, | |

December 31, |

| | |

2015 | |

2014 |

| | |

(Unaudited) | |

(Audited) |

| Inventory deposits | |

$ | 77,739 | | |

$ | 179,941 | |

| Operating lease deposits | |

| 2,000 | | |

| 2,000 | |

| Deposits | |

$ | 79,739 | | |

$ | 181,941 | |

Inventory deposits reflect down payments made to suppliers or

manufacturers under inventory purchase agreements.

Note 5. Inventory

Inventory as of June 30, 2015 and December 31, 2014 of $30,155

and $4,555, respectively, was fully comprised of finished goods.

Note 6. Prepaid expenses and other current assets

Prepaid expenses and other current assets were comprised of the

following as of June 30, 2015 and December 31, 2014:

| | |

June 30, | |

December 31, |

| | |

2015 | |

2014 |

| | |

(Unaudited) | |

(Audited) |

| Prepaid professional services compensated in stock | |

$ | 87,505 | | |

$ | — | |

| Prepaid expenses | |

| 14,119 | | |

| 9,454 | |

| Other current assets | |

| 4,010 | | |

| 2,871 | |

| Prepaid expenses and other current assets | |

$ | 105,634 | | |

$ | 12,325 | |

Note 7. Property and Equipment, net

Property and equipment, net, was comprised of the following as

of June 30, 2015 and December 31, 2014:

| | |

June 30, | |

December 31, |

| | |

2015 | |

2014 |

| | |

(Unaudited) | |

(Audited) |

| Office equipment | |

$ | 6,823 | | |

$ | 5,742 | |

| Furniture and fixtures | |

| 2,935 | | |

| 2,935 | |

| Machinery and equipment | |

| 1,250 | | |

| 1,250 | |

| Construction in progress | |

| 51,301 | | |

| 40,051 | |

| Property and equipment, gross | |

| 62,309 | | |

| 49,978 | |

| Less: accumulated depreciation | |

| (3,036 | ) | |

| (1,562 | ) |

| Property and equipment, net | |

$ | 59,273 | | |

$ | 48,416 | |

The Company recorded depreciation expense of $758 and $141 during

the three months ended June 30, 2015 and 2014, respectively. The Company recorded depreciation expense of $1,474 and $287 during

the six months ended June 30, 2015 and 2014, respectively.

Note 8. Convertible Notes Payable

As of June 30, 2015, the Company had remaining convertible debentures

in the total amount of $71,500. The debentures were originally issued on April 24, 2014, mature on April 24, 2016, pay zero interest,

and are convertible until maturity at the holders’ discretion into shares of the Company’s common stock at $0.08 per

share. The debentures have been discounted in the amount of $71,500 due to the intrinsic value of the beneficial conversion option.

As of June 30, 2015, the aggregate carrying value of the debentures was $42,255, net of debt discounts of $29,245, and is reflected

on the Company’s consolidated balance sheet as Convertible notes payable, net. Amortization of debt discount, which is reflected

on the consolidated statement of operations as interest expense, was $8,901 and zero for the three months ended June 30, 2015

and June 30, 2014, respectively. Amortization of debt discount was $17,704 and zero for the six months ended June 30, 2015 and

June 30, 2014, respectively.

In connection with the Reverse Merger and the issuance of convertible

notes payable as described in the preceding paragraph, a previously held short-term note payable with a principal amount of $35,000

was deemed to be fully satisfied. The Company recorded interest expense related to this note of $261 during the six months ended

June 30, 2014.

Note 9. Accrued and Other Current Liabilities

Accrued and other current liabilities was comprised of the following

at June 30, 2015 and December 31, 2014:

| | |

June 30, | |

December 31, |

| | |

2015 | |

2014 |

| | |

(Unaudited) | |

(Audited) |

| Accrued legal fees | |

$ | 33,938 | | |

$ | 101,509 | |

| Accrued payroll liabilities | |

| 8,066 | | |

| 11,522 | |

| Accrued accounting fees | |

| 5,000 | | |

| 5,000 | |

| Due to directors | |

| 1,769 | | |

| 1,999 | |

| Other | |

| 2,669 | | |

| 5,488 | |

| Accrued and other current liabilities | |

$ | 51,442 | | |

$ | 125,518 | |

Note 10. Net Income (Loss) Per Common Share

The following is a reconciliation of weighted common shares outstanding

used in the calculation of basic and diluted net income (loss) per common share:

| | |

Three Months | |

Three Months | |

Six Months | |

Six Months |

| | |

Ended | |

Ended | |

Ended | |

Ended |

| | |

June 30, 2015 | |

June 30, 2014 | |

June 30, 2015 | |

June 30, 2014 |

| | |

(Unaudited) | |

(Unaudited) | |

(Unaudited) | |

(Unaudited) |

| Net loss | |

$ | (43,614 | ) | |

$ | (55,903 | ) | |

$ | (270,452 | ) | |

$ | (90,535 | ) |

| Weighted average shares used for basic net loss per common share | |

| 45,752,033 | | |

| 29,550,179 | | |

| 45,275,183 | | |

| 29,550,179 | |

| Incremental diluted shares | |

| — | | |

| — | | |

| — | | |

| — | |

| Weighted average shares used for diluted net loss per commo share | |

| 45,752,033 | | |

| 29,550,179 | | |

| 45,275,183 | | |

| 29,550,179 | |

| Net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.00 | )* | |

$ | (0.00 | )* | |

$ | (0.01 | ) | |

$ | (0.00 | )* |

| Diluted | |

$ | (0.00 | )* | |

$ | (0.00 | )* | |

$ | (0.01 | ) | |

$ | (0.00 | )* |

*denotes net loss per common share of less than $0.01.

For the three months ended June 30, 2015 and 2014, as a result

of the net loss for the period, the Company excluded 1,384,293 shares from its calculation of diluted net income (loss) per common

share because their effect would have been antidilutive. These shares were comprised of 90,022 shares of restricted stock, 400,521

of warrants and 893,750 of share equivalents associated with convertible notes payable. For the six months ended June 30, 2015,

as a result of the net loss for the period, the Company excluded 1,381,552 shares from its calculation of diluted net income (loss)

per common share because their effect would have been antidilutive. These shares were comprised of 87,281 shares of restricted

stock, 400,521 of warrants and 893,750 of share equivalents associated with convertible notes payable. No potentially dilutive

shares were issued or outstanding during the three and six months ended June 30, 2014.

Note 11. Related Party Transactions

From time to time, the Company purchases inventory

and equipment from Baroud Development Group, in which Anthony Baroud, formerly the Company’s Chief Technology

Officer, is an owner. During the three months ended June 30, 2015 and 2014, total such purchases were zero and $3,300,

respectively. During the six months ended June 30, 2015 and 2014, total such purchases were zero and $30,300,

respectively.

During the three and six months ended June 30, 2014, prior to

the Reverse Merger, the Company distributed a total of $4,000 to its co-founders and owners, Corey Hollister and Ellis Smith.

During the three and six months ended June 30, 2015, the Company

incurred $4,701 and $18,588 of expense payable to New Era CPAs, an accounting firm in which Antonio Migliarese, the Company’s

Chief Financial Officer, is a partner. These expenses are payable in 12,053 shares of common stock for the three months ended

June 30, 2015 and 47,660 total shares of common stock for the six months ended June 30, 2015. No such expenses were incurred during

the three and six months ended June 30, 2014. As of June 30, 2015, the Company owed Mr. Migliarese $25,227 in cash and 77,660

shares of common stock valued at $36,888. As of December 31, 2014, the Company owed Mr. Migliarese $30,227 in cash and 30,000

shares of common stock valued at $18,300.

Note 12. Commitments and Contingent Liabilities

Under the terms of the Company’s agreement with the manufacturer

of its exit packing product, the SatchelTM, the Company is committed to the purchase of a total of 500,000 units at

a price per unit of $1.00. As of June 30, 2015, a total of 144,600 units had yet to be received, for a remaining purchase commitment

of $144,600. As of the date of this report, the manufacturer has not met the delivery schedule established under the agreement,

which represents a material breach of the agreement under its terms.

During the six months ended June 30, 2015, the Company entered

into an agreement with a third-party service provider for services to be compensated in shares of common stock. Under the terms

of the agreement, the Company issued 50,000 shares of its common stock during the three months ended June 30, 2015, which were

due upon execution, and the Company is obligated to issue an additional 150,000 share of its common stock upon the fulfillment

of certain stated deliverables.

Under the terms of the Company’s various consulting agreements

with clients, the Company is obligated to perform certain future services. The Company is not currently a party to any pending

legal proceedings.

Note 13. Stock-based Compensation

During the three and six months ended June 30, 2015, the Company

recorded a total of $37,123 and $80,394 of stock-based compensation expense to employees, which was the result of the following

activity:

Restricted Shares

From time to time, the Company grants certain employees restricted

shares of its common stock to provide further compensation in-lieu of wages and to align the employee’s interests with the

interests of its stockholders. Because vesting is based on continued employment, these equity-based incentives are also intended

to attract, retain and motivate personnel upon whose judgment, initiative and effort the Company’s success is largely dependent.

There were 202,500 restricted shares granted as of June 30, 2015. The fair value of restricted stock units is determined based

on the quoted closing price of the Company’s common stock on the date of grant.

The following table summarizes the Company’s restricted

share award activity during the six months ended June 30, 2015:

| | |

| |

Weighted Average |

| | |

Restricted Shares | |

Grant Date |

| | |

Common Stock | |

Fair Value |

| | Outstanding

unvested at December 31, 2014 | | |

| 150,000 | | |

$ | 0.94 | |

| | Granted | | |

| 167,481 | | |

| 0.36 | |

| | Vested restricted shares | | |

| (114,981 | ) | |

| 0.21 | |

| | Forfeited | | |

| (50,000 | ) | |

| 0.91 | |

| | Outstanding

unvested at June 30, 2015 | | |

| 152,500 | | |

$ | 0.87 | |

During the three and six months ended June 30, 2015, the Company

granted 114,981 and 167,481 restricted shares. Total stock-based compensation expense for restricted shares was $37,123 and $80,394

for the three and six months ended June 30, 2015. The Company had no stock-based compensation activity during or preceding the

three months ended June 30, 2014.

Unrecognized stock-based compensation expense related to outstanding

unvested restricted shares as of June 30, 2015 is expected to be recognized over a weighted average period of 0.4 years, as follows:

| | |

Future Stock-Based |

| | |

Compensation Expense |

| | |

(Restricted Shares) |

| | 2015 | | |

$ | 34,768 | |

| | 2016 | | |

$ | 632 | |

| | Thereafter | | |

| — | |

| | Total | | |

$ | 35,400 | |

As of June 30, 2015, fully-vested warrants issued to the Company’s

independent board member to purchase up to two hundred and fifty thousand (250,000) shares of common stock at an exercise price

of sixty-three cents ($0.63) per share were outstanding, exercisable within five (5) years of the date of issuance on November

19, 2014. The grant date fair value of the warrants, as calculated based on the Black-Scholes valuation model, was $0.59 per share.

There were no outstanding unvested warrants or new issuances of warrants during the three or six months ended June 30, 2015; consequently,

no stock-based compensation expense associated with warrants was recorded during the three or six months ended June 30, 2015.

As of June 30, 2015 and December 31, 2014, as the exercise price

per share exceeded the price per share of our common shares, there was no aggregate intrinsic value of outstanding warrants. As

of June 30, 2015 and December 31, 2014, the warrants had 4.4 and 4.9 years remaining until expiration, respectively. No warrants

were issued or outstanding during or preceding the three months ended June 30, 2014.

Stock Options

In addition to the warrants as described above, the Company’s

independent board member shall be eligible to receive options for 400,000 shares of common stock under the Company’s incentive

plan, as and when duly approved by the Board of Directors. As these stock options were not granted as of June 30, 2015, no expense

in relation to these options was recognized during the three and six months ended June 30, 2015.

Stock Issuable in Compensation for Professional Services

From time to time, the Company enters into agreements whereby

a professional service provider will be compensated for services rendered to the Company by shares of common stock in lieu of

cash. During the six months ended June 30, 2015, the following related activity occurred:

| • | | The Company

incurred $18,588 of expense payable in 47,660 common shares to New Era CPAs, an accounting

firm in which Antonio Migliarese, the Company’s Chief Financial Officer, is a partner. During

the six months ended June 30, 2014, the Company did not incur any such expenses. |

| • | | The Company

issued 200,000 common shares valued at $156,000 to a professional service provider in

exchange for $200 and services to be rendered from January 2015 to January 2016. The

Company recorded expense of $68,296 on its condensed consolidated statement of operations

during the six months ended June 30, 2015; $87,504 was reflected as prepaid and other

current assets as of June 30, 2015. |

| • | | The Company

agreed to issue 200,000 common shares valued at $82,000 to a professional service provider

in exchange for services. Of these shares, 50,000 were earned and issued as of June 30,

2015, for which $20,500 of expense was recognized on the condensed consolidated statement

of operations for the period. An additional 150,000 common shares, valued at $61,500,

are issuable upon the service provider meeting certain established deliverables. The

agreement is effective through August 30, 2015. |

Note 14. Stockholders’ Equity

Preferred Stock

American Cannabis Company, Inc. is authorized to issue 5,000,000

shares of preferred stock at $0.01 par value. No shares of preferred stock were issued and outstanding during the three and

six month periods ended June 30, 2015 and June 30, 2014.

Common Stock

American Cannabis Company, Inc. is authorized to issue 100,000,000

common shares at $0.00001 par value per share.

During the six months ended June 30, 2015:

| • | | Stock-based

compensation granted to employees resulted in an increase to additional paid-in capital

of $80,394, |

| • | | 50,000 shares

of common stock were issued as compensation for professional services, |

| • | | 200,000 shares

of common stock, valued at $156,000, were issued as prepaid compensation for professional

services settled in stock in lieu of cash. As of June 30, 2015, $68,296 of this expense

was recognized and $87,504 was reflected on the consolidated balance sheet within prepaid

expenses and other current assets, and |

| • | | 125,000 shares

of previously issued common stock were rescinded and canceled. |

Common Stock Shares Issuable

During the six months ended June 30, 2015:

| • | | The Company

sold 833,333 shares of common stock for $250,000 of cash; these shares were fully issuable

as of March 31, 2015, |

| • | | 50,000 shares

of common stock, valued at $20,500, were earned and issued as compensation for professional

services settled in stock in lieu of cash, and |

| • | | 47,660 shares

of common stock, valued at $18,588, were earned by and issuable to an accounting firm

in which the Company’s Chief Financial Officer is a partner as compensation for

professional services to be settled in stock in lieu of cash. |

As a result of the transactions described above, as of June 30,

2015, there were 44,643,750 shares of our common stock issued and outstanding and the balances of common stock and additional

paid-in capital were $446 and $4,225,005, respectively. An additional 1,025,974 shares of common stock were issuable to an investor,

various service providers and employees.

Note 15. Reportable Segments

The Company operates in one segment, in the regulated cannabis

industry, as a provider of professional consulting services, products and equipment.

Note 16. Subsequent Events

No subsequent events requiring

disclosure or adjustment have occurred after the balance sheet date and before issuance of the Company's financial statements.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The statements contained in this report that are not statements

of historical fact, including without limitation, statements containing the words “believes,” “expects,”

“anticipates” and similar words, constitute forward-looking statements that are subject to a number of risks and uncertainties.

From time to time we may make other forward-looking statements. Investors are cautioned that such forward-looking statements are

subject to an inherent risk that actual results may materially differ as a result of many factors, including the risks discussed

from time to time in this report, including the risks described under “Risk Factors” in any filings we have made with

the SEC.

Our discussion and analysis of our financial condition and results

of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally

accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that

affect the reported amounts of assets, liabilities, revenues and expenses. On an on-going basis, we evaluate these estimates,

including those related to useful lives of real estate assets, cost reimbursement income, bad debts, impairment, net lease intangibles,

contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed

to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of

assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not

differ from those estimates.

Background

American Cannabis Company, Inc. and its subsidiary company, Hollister

& Blacksmith, Inc., doing business as American Cannabis Consulting (“American Cannabis Consulting”), (collectively

“the “Company”, “we”, “us”, or “our”) are based in Denver, Colorado and

operate a fully-integrated business model that features end-to-end solutions for businesses operating in the regulated cannabis

industry in states and countries where cannabis is regulated and/or has been de-criminalized for medical use and/or legalized

for recreational use. We provide advisory and consulting services specific to this industry, design industry-specific products

and facilities, and manage a strategic group partnership that offers both exclusive and non-exclusive customer products commonly

used in the industry. We are a publicly listed company quoted on the OTCQB under the symbol “AMMJ”.

We were incorporated in the State of Delaware on September 24,

2001 under the name Naturewell, Inc. to develop and market clinical diagnostic products using immunology and molecular biologic

technologies.

On March 13, 2013, Naturewell, Inc. completed a merger transaction

whereby it acquired 100% of the issued and outstanding share capital of Brazil Interactive Media, Inc. (“BIMI”), which

operated as a Brazilian interactive television company and television production company through its wholly owned Brazilian subsidiary

company, EsoTV Brasil Promoção Publicidade Licenciamento e Comércio Ltda. (“EsoTV”). Naturewell’s

Articles of Incorporation were amended to reflect a new name: Brazil Interactive Media, Inc.

On May 15, 2014, BIMI entered into a merger agreement (“the

Merger Agreement”) to acquire 100% of the issued and outstanding American Cannabis Consulting while simultaneously disposing

of 100% of the issued share capital EsoTV (“the Separation Agreement”). Both the merger with American Cannabis Consulting

and disposal of EsoTV were completed on September 29, 2014. BIMI subsequently amended its Articles of Incorporation to change

its name to American Cannabis Company, Inc. On October 10, 2014, American Cannabis Company, Inc. changed its stock symbol from

BIMI to AMMJ.

The foregoing descriptions of the Merger Agreement and Separation

Agreement do not purport to be complete and are qualified in their entirety by the terms of such agreements, which are filed as

exhibits to the Current Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”)

on October 3, 2014.

Immediately following the completion of the Merger Agreement,

former shareholders of American Cannabis Consulting owned 31,710,628 shares of American Cannabis Company, Inc.’s common

stock representing 78.4% of American Cannabis Company, Inc.’s issued and outstanding share capital. Accordingly, American

Cannabis Consulting was deemed to have been the accounting acquirer in a Reverse Merger which resulted in a recapitalization of

the Company. Consequently, the Company’s consolidated financial statements reflect the results of American Cannabis

Consulting since Inception (March 5, 2013) and of American Cannabis Company, Inc. (formerly BIMI) since September 29, 2014.

Results of Operations

Three months ended June 30, 2015 compared to three months ended

June 30, 2014

The following table presents our consolidated operating results

for the three months ended June 30, 2015 compared to the three months ended June 30, 2014:

| |

Three Months | |

| |

Three Months | |

| |

|

| |

Ended | |

% of | |

Ended | |

% of | |

|

| |

June 30, 2015 | |

Revenues | |

June 30, 2014 | |

Revenues | |

$ Change |

| Revenues | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consulting services | |

$ | 268,488 | | |

| 57.3 | | |

$ | 103,540 | | |

| 97.9 | | |

$ | 164,948 | |

| Products and equipment | |

| 200,257 | | |

| 42.7 | | |

| 2,190 | | |

| 2.1 | | |

| 198,067 | |

| Total revenues | |

$ | 468,745 | | |

| 100.0 | | |

$ | 105,730 | | |

| 100.0 | | |

$ | 363,015 | |

| Costs of revenues | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of consulting services(1) | |

| 115,522 | | |

| 43.0 | | |

| 55,464 | | |

| 53.6 | | |

| 60,058 | |

| Cost of products and equipment(1) | |

| 176,347 | | |

| 88.1 | | |

| 1,992 | | |

| 91.0 | | |

| 174,355 | |

| Total cost of revenues | |

| 291,869 | | |

| 62.3 | | |

| 57,456 | | |

| 54.3 | | |

| 234,413 | |

| Gross Profit | |

| 176,876 | | |

| 37.7 | | |

| 48,274 | | |

| 45.7 | | |

| 128,602 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 159,850 | | |

| 34.1 | | |

| 77,887 | | |

| 73.7 | | |

| 81,963 | |

| Selling and marketing | |

| 113,224 | | |

| 24.2 | | |

| 26,072 | | |

| 24.7 | | |

| 87,152 | |

| Research and development | |

| 11,350 | | |

| 2.4 | | |

| — | | |

| — | | |

| 11,350 | |

| Total operating expenses | |

| 284,424 | | |

| 60.7 | | |

| 103,959 | | |

| 98.3 | | |

| 180,465 | |

| Income (loss) from operations | |

| (107,548 | ) | |

| (22.9 | ) | |

| (55,685 | ) | |

| (52.7 | ) | |

| (51,863 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gain on debt extinguishment | |

| 72,771 | | |

| 15.5 | | |

| — | | |

| — | | |

| 72,771 | |

| Interest income (expense), net | |

| (8,837 | ) | |

| (1.9 | ) | |

| (218 | ) | |

| (0.2 | ) | |

| (8,619 | ) |

| Total other income (expense) | |

| 63,934 | | |

| 13.6 | | |

| (218 | ) | |

| (0.2 | ) | |

| 64,152 | |

| Net income (loss) before income taxes | |

| (43,614 | ) | |

| (9.3 | ) | |

| (55,903 | ) | |

| (52.9 | ) | |

| 12,289 | |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Net income (loss) | |

$ | (43,614 | ) | |

| (9.3 | ) | |

$ | (55,903 | ) | |

| (52.9 | ) | |

$ | 12,289 | |

(1) Percentage of net revenues of line of business.

Revenues

Total revenues were $468,745 for the three months ended June 30,

2015, compared to $105,730 for the three months ended June 30, 2014, an increase of $363,015. This increase was primarily due

to the further establishment of our products and equipment offerings and growth in our client base and volume of operations as

our business has matured following commencement of business operations in April 2013. For the three months ended June 30, 2015,

consulting services revenue was $268,488, or 57.3% of total revenue, compared to $103,540, or 97.9% of total revenues for the

three months ended June 30, 2014. For the three months ended June 30, 2015, products and equipment revenue was $200,257, or 42.7%

of total revenues, compared to $2,190, or 2.1% of total revenues for the three months ended June 30, 2014. This increase was primarily

driven by sales of our child-proof exit packaging solution, The Satchel ™, which we introduced subsequent to the three months

ended June 30, 2014, as well as higher sales of our other product and equipment offerings.

Costs of Revenues

Costs of revenues primarily consist of labor, travel, and other

costs directly attributable to providing services or products. During the three months ended June 30, 2015, our total costs of

revenues were $291,869, or 62.3% of total revenues. This compares to total costs of revenues for the three months ended June 30,

2014 of $57,456, or 54.3% of total revenues. The increase in costs of revenues of $234,413 was primarily due to the increase in

sales volume discussed above and internal infrastructure development.

For the three months ended June 30, 2015, consulting-related costs

were $115,522, or 43.0% of consulting-related revenue, as compared to $55,464, or 53.6% of consulting-related revenue for the

three months ended June 30, 2014. The increase in total dollars of $60,058 is a result of higher consulting sales volume during

the period, while the decrease as a percentage of consulting-related revenue reflects margin improvements achieved during the

period. Costs associated with products and equipment were $176,347, or 88.1% of total products and equipment revenue for the three

months ended June 30, 2015 as compared to $1,992, or 91.0% of total products and equipment revenue for the three months ended

June 30, 2014, as our products and equipment line of business was not fully developed during the three months ended June 30, 2014.

Gross Profit

Total gross profit was $176,876 for

the three months ended June 30, 2015, comprised of consulting services gross profit of $152,966 and products and equipment gross

profit of $23,910. This compares to total gross profit of $48,274 for the three months ended June 30, 2014, comprised of consulting

services gross profit of $48,076 and products and equipment gross profit of $198. These increases of $104,890 for consulting services

gross profit and $23,712 for products and equipment gross profit were primarily due to growth in our client base and volume of

operations and further establishment of our products and equipment offerings. As a percentage of total revenues, gross profit

was 37.7% for the three months ended June 30, 2015 and 45.7% for the three months ended June 30, 2014. This decrease was primarily

due to product and equipment sales making up a higher proportion of sales during the three months ended June 30, 2015 as compared

to the three months ended June 30, 2014, as margins are lower for this line of business than for consulting services.

Operating Expenses

Total operating expenses were $284,424, or 60.7% of total revenues

for the three months ended June 30, 2015, compared to $103,959, or 98.3% of total revenues for the three months ended June 30,

2014. This increase was primarily due to increased headcount to meet the increasing demand and address selling, marketing and

research and development functions, as well as higher operating expenses associated with becoming an SEC registrant. Professional

fees, which include legal, auditing and accounting expenses, were $91,411 for the three months ended June 30, 2015, compared to

$49,833 for the three months ended June 30, 2014.

Note: On May 2, 2014, prior to the Reverse Merger, the Company

granted 2,000 total shares of its then Hollister & Blacksmith, Inc. common shares to three employees for $200. Because this

transaction occurred after the signature of a letter of intent and shortly prior to the announcement of the Reverse Merger on

May 15, 2014, the Company based its determination of the fair value of this grant on the 3,171.0628 to 1 share exchange that the

Reverse Merger would effect. Accordingly, the Company recorded stock-based compensation for the three grants of $3,132,874 in

the fourth quarter of 2014. The Company changed its assessment of fair value associated with this grant during the fourth quarter

of 2014; during the second quarter of 2014, the grant was recorded based on the price charged to the employee, which in turn was

based on an estimate of the fair value of common shares of Hollister & Blacksmith, Inc. without considering the impact of

the Reverse Merger.

Other Income (Expense)

Other income (expense) for the three

months ended June 30, 2015 was income of $63,934, comprised of a gain on debt extinguishment related to the settlement of accumulated

legal fees of $72,771 and net interest expense of $8,837. Net interest expense was primarily comprised of non-cash interest expense

on convertible notes payable discount amortization during the period. Other income (expense) for the three months ended June 30,

2014 was $218 of net interest expense related to the short-term note payable we held during that period.

Income Tax Expense (Benefit)

Although our tax status changed from a non-taxable pass-through

entity (S-Corporation) to a taxable entity (C-Corporation) during the year ended December 31, 2014, due to cumulative losses since

we became a C-Corporation, we recorded a valuation allowance against our related deferred tax asset which netted our deferred

tax asset and benefit for income taxes to zero for the three and six months ended June 30, 2015. We were an S-Corporation throughout

the three and six months ended June 30, 2014, and accordingly, no provision or benefit for income taxes was applicable.

Net Income (Loss)

As a result of the factors discussed

above, net income (expense) for the three months ended June 30, 2015 was net loss of $43,614, or 9.3% of total revenues for the

period, as compared to a net loss of $55,903, or 52.9% of total revenues for the three months ended June 30, 2014.

Six months ended June 30, 2015 compared to six months ended

June 30, 2014

The following table presents our consolidated operating results

for the six months ended June 30, 2015 compared to the six months ended June 30, 2014:

| |

Six Months | |

| |

Six Months | |

| |

|

| |

Ended | |

% of | |

Ended | |

% of | |

|

| |

June 30, 2015 | |

Revenues | |

June 30, 2014 | |

Revenues | |

$ Change |

| Revenues | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consulting services | |

$ | 464,058 | | |

| 50.9 | | |

$ | 127,404 | | |

| 93.0 | | |

$ | 336,654 | |

| Products and equipment | |

| 448,354 | | |

| 49.1 | | |

| 9,638 | | |

| 7.0 | | |

| 438,716 | |

| Total revenues | |

$ | 912,412 | | |

| 100.0 | | |

$ | 137,042 | | |

| 100.0 | | |

$ | 775,370 | |

| Costs of revenues | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of consulting services(1) | |

| 216,414 | | |

| 46.6 | | |

| 74,889 | | |

| 58.8 | | |

| 141,525 | |

| Cost of products and equipment(1) | |

| 401,998 | | |

| 89.7 | | |

| 9,017 | | |

| 93.6 | | |

| 392,981 | |

| Total cost of revenues | |

| 618,412 | | |

| 67.8 | | |

| 83,906 | | |

| 61.2 | | |

| 534,506 | |

| Gross Profit | |

| 294,000 | | |

| 32.2 | | |

| 53,136 | | |

| 38.8 | | |

| 240,864 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 370,349 | | |

| 40.6 | | |

| 95,893 | | |

| 70.0 | | |

| 274,456 | |

| Selling and marketing | |

| 207,529 | | |

| 22.7 | | |

| 47,517 | | |

| 34.7 | | |

| 160,012 | |

| Research and development | |

| 41,722 | | |

| 4.6 | | |

| — | | |

| — | | |

| 41,722 | |

| Total operating expenses | |

| 619,600 | | |

| 67.9 | | |

| 143,410 | | |

| 104.6 | | |

| 476,190 | |

| Income (loss) from operations | |

| (325,600 | ) | |

| (35.7 | ) | |

| (90,274 | ) | |

| (65.9 | ) | |

| (235,326 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gain on debt extinguishment | |

| 72,771 | | |

| 8.0 | | |

| — | | |

| — | | |

| 72,771 | |

| Interest income (expense), net | |

| (17,623 | ) | |

| (1.9 | ) | |

| (261 | ) | |

| (0.2 | ) | |

| (17,362 | ) |

| Total other income (expense) | |

| 55,148 | | |

| 6.0 | | |

| (261 | ) | |

| (0.2 | ) | |

| 55,409 | |

| Net income (loss) before income taxes | |

| (270,452 | ) | |

| (29.6 | ) | |

| (90,535 | ) | |

| (66.1 | ) | |

| (179,917 | ) |

| Income tax expense (benefit) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Net income (loss) | |

$ | (270,452 | ) | |

| (29.6 | ) | |

$ | (90,535 | ) | |