FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of

1934

For the month of November, 2014

Commission File Number: 001-34406

Advantage Oil & Gas Ltd.

(Exact name of registrant as specifiec

in its charter)

300,

440 2 Ave SW,

Calgary, AB, T2P 5E9

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):_______

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s "home country"), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing

the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “ Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________

EXHIBIT INDEX

| EXHIBIT |

|

TITLE |

| |

|

|

| 99.1 |

|

Q3 |

| 99.2 |

|

CEO Certificate |

| 99.3 |

|

CFO Certificate |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ADVANTAGE OIL & GAS LTD. |

| |

(Registrant) |

| |

|

|

| Date: November 14, 2014 |

By: |

/s/ Craig Blackwood |

| |

|

Name: Craig Blackwood |

| |

|

Title: Vice President, Finance and CFO |

Exhibit 99.1

Q3

2014

Third Quarter Report

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30 | | |

September 30 | |

| Financial and Operating Highlights (1) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Financial ($000, except as otherwise indicated) | |

| | | |

| | | |

| | | |

| | |

| Sales including realized hedging | |

$ | 47,190 | | |

$ | 27,857 | | |

$ | 156,694 | | |

$ | 108,639 | |

| Funds from operations | |

$ | 36,818 | | |

$ | 16,516 | | |

$ | 124,828 | | |

$ | 61,488 | |

| per share (2) | |

$ | 0.22 | | |

$ | 0.10 | | |

$ | 0.74 | | |

$ | 0.37 | |

| Total capital expenditures | |

$ | 79,315 | | |

$ | 28,001 | | |

$ | 149,615 | | |

$ | 85,858 | |

| Working capital deficit (3) | |

$ | 48,354 | | |

$ | 19,836 | | |

$ | 48,354 | | |

$ | 19,836 | |

| Bank indebtedness | |

$ | 71,044 | | |

$ | 139,941 | | |

$ | 71,044 | | |

$ | 139,941 | |

| Convertible debentures (face value) | |

$ | 86,250 | | |

$ | 86,250 | | |

$ | 86,250 | | |

$ | 86,250 | |

| Basic weighted average shares (000) | |

| 169,789 | | |

| 168,383 | | |

| 169,285 | | |

| 168,383 | |

| Operating | |

| | | |

| | | |

| | | |

| | |

| Daily Production | |

| | | |

| | | |

| | | |

| | |

| Natural gas (mcf/d) | |

| 131,553 | | |

| 111,518 | | |

| 129,682 | | |

| 115,863 | |

| Crude oil and NGLs (bbls/d) | |

| 161 | | |

| 105 | | |

| 174 | | |

| 651 | |

| Total mcfe/d (4) | |

| 132,519 | | |

| 112,148 | | |

| 130,726 | | |

| 119,769 | |

| Total boe/d (4) | |

| 22,087 | | |

| 18,691 | | |

| 21,788 | | |

| 19,962 | |

| Average prices (including hedging) | |

| | | |

| | | |

| | | |

| | |

| Natural gas ($/mcf) | |

$ | 3.80 | | |

$ | 2.63 | | |

$ | 4.30 | | |

$ | 3.01 | |

| Crude oil and NGLs ($/bbl) | |

$ | 83.14 | | |

$ | 95.13 | | |

$ | 93.87 | | |

$ | 75.97 | |

| Cash netbacks ($/mcfe) (4) | |

| | | |

| | | |

| | | |

| | |

| Petroleum and natural gas sales | |

$ | 4.10 | | |

$ | 2.53 | | |

$ | 4.72 | | |

$ | 3.29 | |

| Realized gains (losses) on derivatives | |

| (0.23 | ) | |

| 0.17 | | |

| (0.33 | ) | |

| 0.03 | |

| Royalties | |

| (0.19 | ) | |

| (0.12 | ) | |

| (0.22 | ) | |

| (0.18 | ) |

| Operating expense | |

| (0.35 | ) | |

| (0.29 | ) | |

| (0.31 | ) | |

| (0.54 | ) |

| Operating netback | |

| 3.33 | | |

| 2.29 | | |

| 3.86 | | |

| 2.60 | |

| General and administrative | |

| (0.12 | ) | |

| (0.46 | ) | |

| (0.17 | ) | |

| (0.47 | ) |

| Finance expense | |

| (0.19 | ) | |

| (0.28 | ) | |

| (0.22 | ) | |

| (0.27 | ) |

| Other income | |

| - | | |

| 0.05 | | |

| 0.03 | | |

| 0.03 | |

| Cash netbacks | |

$ | 3.02 | | |

$ | 1.60 | | |

$ | 3.50 | | |

$ | 1.89 | |

| (1) | Financial and operating highlights for continuing operations of Advantage. |

| (2) | Based on basic weighted average shares outstanding. |

| (3) | Working capital deficit includes trade and other receivables, prepaid expenses and deposits, and trade and other accrued liabilities. |

| (4) | A boe and mcfe conversion ratio has been calculated using a conversion rate of six thousand cubic feet of natural gas equivalent

to one barrel of oil. |

MESSAGE TO SHAREHOLDERS

Advantage’s third quarter 2014 financial

and operating results represents another solid quarter of performance highlighting our industry leading low cost structure, financial

flexibility and operational successes. These results demonstrate the Corporation’s capacity to grow its Glacier Montney resource

play and preserve a strong balance sheet through cycles of high volatility in the commodity and financial markets. Our focus on

execution and optimization of our development plan while maintaining a strong balance sheet is fundamental to delivering per share

growth to our shareholders.

Advantage’s industry leading low

cost structure is demonstrated by a 26% decrease in total cash costs during the third quarter of 2014 to $0.85/mcfe ($5.10/boe)

. This contributed to a 123% increase in funds from operations to $0.22/share with production up 18% to 132.5 mmcfe/d (22,087 boe/d)

despite TransCanada’s northwest Alberta mainline sales gas transportation restrictions during the third quarter of 2014.

Year to date operating and cash G&A costs are tracking on budget at $0.31/mcfe ($1.89/boe) and $0.17/mcfe ($1.02/boe), respectively.

Advantage’s third quarter operating netback of $3.33/mcfe ($19.98/boe) represents 86% of net sales, among the highest margins

in the sector.

Advantage currently has over 100 mmcf/d

of excess well deliverability from recently completed wells including a new Middle Montney well which flowed at a final

production test rate of 11.4 mmcf/d with an estimated liquids yield of 47 bbls/mmcf. The Corporation increased its total Montney

acreage to 129 net sections (82,720 net acres) through the addition of nine contiguous 100% owned sections of Montney acreage in

the new drilling fairway at Progress, located approximately 20 kilometers northeast of Glacier. Our 100% owned Glacier gas plant

and sales pipeline expansions are proceeding on schedule and are targeted for completion by June 2015.

The Corporation’s strong financial

position in support of our development program includes available bank credit facilities of $329 million (18% drawn), a total

debt to third quarter annualized cash flow of 1.4 times and a strong natural gas hedging program. Currently, 51% of forecast production

is hedged for 2014 and 2015 at an average AECO Canadian price of $3.85/mcf and 31% of forecast production hedged in 2016 at an

average AECO Canadian price of $3.93/mcf.

Advantage’s development program

is designed to grow production 36% to 183 mmcfe/d (30,500 boe/d) by June 2015 and 85% to 245 mmcfe/d (40,833 boe/d) by 2017 while

maintaining an average total debt to forward cash flow ratio of 1.5 or less. The ongoing success of our operational activities,

our industry leading low cost structure and commodity price hedging program have positioned Advantage to continue Montney growth

even during lower natural gas price cycles.

| Advantage Oil & Gas Ltd. - 2 |

Funds from Operations Up 123%, Production up 18% and Cash

Costs down 26%

| § | Funds from operations increased 123% to

$36.8 million or $0.22 per share for the third quarter of 2014. For the nine months ended September 30, 2014 fund from operations

increased 103% to $124.8 million or $0.74 per share as compared to the same period of 2013. |

| § | Production from Glacier increased 18%

to 132.5 mmcfe/d (22,087 boe/d) for the third quarter of 2014 as compared to the same period of 2013. Glacier production for the

first nine months of 2014 averaged 130.7 mmcfe/d (21,788 boe/d), 25% higher than 2013. Production for the current quarter was impacted

due to TransCanada’s northwest Alberta mainline sales gas restrictions resulting from their maintenance activities. TransCanada

has advised that they will continue to conduct periodic maintenance work during the fourth quarter of 2014. |

| § | Our operating netback during the third

quarter of 2014 was $3.33/mcfe representing 86% of our net sales price of $3.87/mcfe, including realized hedging. |

| § | Total cash costs including operating expense,

royalties, general and administrative expense, and finance expense during the third quarter of 2014 was $0.85/mcfe, a decrease

of 26% from $1.15/mcfe during the same period of 2013. For the first nine months of 2014 total cash costs was $0.92/mcfe, a decrease

of 37% from $1.46/mcfe during the same period of 2013. |

| § | Operating expense averaged $0.31/mcfe

during the first nine months of 2014, a reduction of 43% as compared to the same period of 2013. Operating expense increased during

the third quarter of 2014 to $0.35/mcfe due to a temporary increase in water handling volumes resulting from the concurrent completion

and flow back of several multi-well pads. An additional water disposal well at Glacier was recently commissioned to reduce the

costs for third party trucking and water disposal costs during these periods of high well completion activity. |

| § | Royalty rates averaged 4.7% in the third

quarter and 4.7% for the nine months of 2014. |

| § | G&A cash expenses decreased 74% to

$0.12/mcfe in the third quarter of 2014 compared to the same period in 2013. G&A cash expense has averaged $0.17/mcfe during

the first nine months of 2014, a reduction of 64% as compared to 2013. Advantage’s concentrated asset base at Glacier contributes

to a highly focused and efficient operation. |

| § | Total capital expenditures for the three

and nine months ended September 30, 2014 were $79.3 million and $149.6 million, respectively. |

| § | Bank indebtedness outstanding at September

30, 2014 was $71.0 million representing an 18% draw on our $400 million credit facility. Total debt including working capital and

debentures was $205.6 million as of September 30, 2014 resulting in a total debt to annualized third quarter 2014 cash flow of

1.4 times. |

Glacier Phase VII Development On Track

Including a New Middle Montney Well Test at 11.4 mmcf/d with 47 bbls/mmcf of Liquids

| § | Advantage’s Phase VII Glacier development

program is designed to grow production 36% to 183 mmcfe/d by June 2015 including the extraction of natural gas liquids at our 100%

owned Glacier gas plant. A total of 33 Phase VII wells are being drilled to support the future ramp up and sustainment of production

at 183 mmcfe/d. |

| § | We have drilled and rig released 21 of

our planned 33 Phase VII Montney wells and drilling operations are continuing ahead of schedule with three drilling rigs. Phase

VII completion activities began during the third quarter with operations conducted on two new multi-well pads. |

| § | Current excess well deliverability of

over 100 mmcfe/d (IP30) is available from three new multi-well pads comprised of a total of 13 new Montney wells (two Phase VI

and one Phase VII well pads) which will be utilized to maintain current production through to June 2015 and to support increasing

production to 183 mmcfe/d. |

| Advantage Oil & Gas Ltd. - 3 |

| § | Included in our completion and production

testing activity in the third quarter, a new Middle Montney well was production tested for 55 hours and demonstrated a final production

test rate of 11.4 mmcf/d based on a normalized average wellhead pressure of 3,000 kpa. This well demonstrated a final free condensate

rate of 31 bbls/mmcf and a propane plus liquids yield of 47 bbls/mmcf based on a shallow cut liquids extraction process. This new

well is a follow-up to our record Middle Montney well which tested at 13 mmcf/d and still producing at a restricted rate of 5 mmcf/d

at a flow pressure of 7,600 kpa after being on-stream for 8 months. |

| § | The Glacier gas plant expansion and sales

line lateral installation is on schedule for June 2015. The gas plant expansion includes installation of a shallow cut liquids

extraction process, condensate stabilization and additional gas compression. |

| § | Advantage has secured firm service sales

gas transportation commitments to support our June 2015 production target of 183 mmcfe/d and additional sales gas transportation

commitments of up to 205 mmcfe/d in 2016. |

Increased Hedging Program Reduces Cash

Flow Volatility

| § | We have increased our natural gas price

hedging positions to provide further downside cash flow protection in support of our multi-year development program. |

| § | For the balance of 2014, we have 56% of

our net forecast production hedged at an average price of $3.90/mcf. For 2015 and 2016, we have 51% and 31% of our net forecast

production hedged at an average price of $3.90/mcf and $3.93/mcf, respectively. For the first quarter of 2017, we have hedged 25%

of our net forecast production at an average price $3.95/mcf. |

Outlook

Although we remain cautious on the current

commodity price volatility we are experiencing, our current Phase VII development plan is on-track to increase production 36% to

183 mmcfe/d by June 2015 with additional production growth to 205 mmcfe/d in 2016 and 245 mmcfe/d in 2017. We anticipate production

to remain at approximately 135 mmcfe/d until June of 2015 when the completion of our Glacier plant expansion will facilitate increasing

production to 183 mmcfe/d including approximately 900 to 1,000 bbls/d of initial natural gas liquids sales. Cash flow per share

is anticipated to increase by 190% over the three year development plan timeframe (2014 to 2017) based on an average natural gas

price of AECO Cdn $3.75/mcf.

Operations have been initiated on our new

Valhalla land block. We anticipate reporting results from this area in 2015.

Advantage’s world class Glacier Montney asset, industry

leading cost structure, strong balance sheet and focused business plan are all key factors in the execution of our development

program designed to deliver significant production and cash flow per share growth. Our third quarter 2014 results demonstrate another

solid reporting period that helps to reinforce the significant long term value opportunity that we believe is available in our

Glacier Montney area. We remain focused on execution and maintaining a strong balance sheet.

| Advantage Oil & Gas Ltd. - 4 |

CONSOLIDATED MANAGEMENT’S DISCUSSION

& ANALYSIS

The following Management’s Discussion

and Analysis (“MD&A”), dated as of November 13, 2014, provides a detailed explanation of the consolidated financial

and operating results of Advantage Oil & Gas Ltd. (“Advantage”, the “Corporation”, “us”,

“we” or “our”) for the three and nine months ended September 30, 2014 and should be read in conjunction

with the unaudited consolidated financial statements for the three and nine months ended September 30, 2014 and the audited consolidated

financial statements and MD&A for the year ended December 31, 2013. The consolidated financial statements have been prepared

in accordance with International Financial Reporting Standards (“IFRS”), representing generally accepted accounting

principles (“GAAP”) for publicly accountable enterprises in Canada. All references in the MD&A and consolidated

financial statements are to Canadian dollars unless otherwise indicated. The term “boe” or barrels of oil equivalent

and “mcfe” or thousand cubic feet equivalent may be misleading, particularly if used in isolation. A boe or mcfe conversion

ratio of six thousand cubic feet of natural gas equivalent to one barrel of oil (6 mcf: 1 bbl) is based on an energy equivalency

conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. As the value

ratio between natural gas and crude oil based on the current prices of natural gas and crude oil is significantly different from

the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

Forward-Looking Information

This MD&A contains certain forward-looking

statements, which are based on our current internal expectations, estimates, projections, assumptions and beliefs. These statements

relate to future events or our future performance. All statements other than statements of historical fact may be forward-looking

statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate",

"plan", "continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might", "should",

"believe", "would" and similar or related expressions. These statements are not guarantees of future performance.

In particular, forward-looking statements

included in this MD&A include, but are not limited to, anticipated timing of completion of Advantage's Phase VII program and

the targeted level of production from such program; effect of commodity prices on the Corporation's financial results, condition

and performance; industry conditions, including effect of changes in commodity prices, weather and general economic conditions

on the crude oil and natural gas industry and demand for crude oil and natural gas; the Corporation's hedging activities, including

its anticipated effect on the volatility of Advantage's future cash flows and the funding of its capital expenditure program; effect

of commodity price risk management activities on the Corporation, including cash flows and sales; terms of the Corporation's derivative

contracts, including the timing of settlement of such contracts; effect of fluctuations in commodity prices as compared to valuation

assumptions on actual gains or losses realized on cash settlement of derivatives; average royalty rates and the impact of well

depths, well production rates, commodity prices and gas cost allowance on average corporate royalty rates; projected royalty rates,

including the estimated royalty rate for the life of a Glacier Montney horizontal well; anticipated effect of Advantage's water

disposal well on operating costs; Advantage's estimated level of operating costs at Glacier and the anticipated effect of processing

natural gas through Advantage's 100% owned Glacier gas plant on operating costs; terms of the Corporation's equity compensation

plans; the Corporation's intentions to monitor debt levels to ensure an optimal mix of financing and cost of capital to provide

a return to the Corporation's shareholders; terms of the Corporation's convertible debentures; terms of the Corporation's credit

facilities, including timing of next review of the credit facilities; the Corporation's expectations regarding extension of Advantage's

credit facilities at each annual review, effect of revisions or changes in reserve estimates and commodity prices on the borrowing

base, and limitations on the utilization of hedging contracts; future commitments and contractual obligations; the ability of the

Corporation to manage its capital structure; the Corporation's strategy for managing its capital structure, including the use of

financial and operational forecasting processes, and the timing of reviews of capital structure and forecast information by management

and the Board; effect of the Corporation's continual financial assessment processes on the Corporation's ability to mitigate risks;

the Corporation's ability to satisfy all liabilities and commitments, including a working capital deficit, and meet future obligations

as they become due; Advantage's focus on development of the natural gas resource play at Glacier, including the anticipated timing

of completion of the various phases of Advantage's development program at Glacier and expected timing of well completions; the

Corporation's expectations as to its ability to maintain and increase production, as applicable, from Glacier at the levels and

for the periods disclosed herein; and the focus of the Corporation's capital drilling program. In addition, statements relating

to "reserves" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates

and assumptions that the reserves described can be profitably produced in the future.

| Advantage Oil & Gas Ltd. - 5 |

These forward-looking statements involve

substantial known and unknown risks and uncertainties, many of which are beyond our control, including, but not limited to, changes

in general economic, market and business conditions; stock market volatility; changes to legislation and regulations and how they

are interpreted and enforced; changes to investment eligibility or investment criteria; our ability to comply with current and

future environmental or other laws; actions by governmental or regulatory authorities including increasing taxes, changes in investment

or other regulations; changes in tax laws, royalty regimes and incentive programs relating to the oil and gas industry; the effect

of acquisitions; our success at acquisition, exploitation and development of reserves; unexpected drilling results; changes in

commodity prices, currency exchange rates, capital expenditures, reserves or reserves estimates and debt service requirements;

the occurrence of unexpected events involved in the exploration for, and the operation and development of, oil and gas properties;

hazards such as fire, explosion, blowouts, cratering, and spills, each of which could result in substantial damage to wells, production

facilities, other property and the environment or in personal injury; changes or fluctuations in production levels; individual

well productivity; delays in anticipated timing of drilling and completion of wells; failure to extend the credit facilities at

each annual review; competition from other producers; the lack of availability of qualified personnel or management; ability to

access sufficient capital from internal and external sources; credit risk; and the risks and uncertainties described in the Corporation’s

Annual Information Form which is available at www.sedar.com and www.advantageog.com. Readers are also referred to risk factors

described in other documents Advantage files with Canadian securities authorities.

With respect to forward-looking statements

contained in this MD&A, in addition to other assumptions identified herein, Advantage has made assumptions regarding, but not

limited to: conditions in general economic and financial markets; effects of regulation by governmental agencies; current commodity

prices and royalty regimes; future exchange rates; royalty rates; future operating costs; availability of skilled labour; availability

of drilling and related equipment; timing and amount of capital expenditures; the impact of increasing competition; the price of

crude oil and natural gas; that the Corporation will have sufficient cash flow, debt or equity sources or other financial resources

required to fund its capital and operating expenditures and requirements as needed; that the Corporation’s conduct and results

of operations will be consistent with its expectations; that the Corporation will have the ability to develop the Corporation’s

crude oil and natural gas properties in the manner currently contemplated; that current or, where applicable, proposed assumed

industry conditions, laws and regulations will continue in effect or as anticipated as described herein; and that the estimates

of the Corporation’s production, reserves and resources volumes and the assumptions related thereto (including commodity

prices and development costs) are accurate in all material respects.

Management has included the above summary

of assumptions and risks related to forward-looking information provided in this MD&A in order to provide shareholders with

a more complete perspective on Advantage's future operations and such information may not be appropriate for other purposes. Advantage’s

actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that Advantage will derive there from. Readers are cautioned that the

foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this MD&A and Advantage

disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future

events or results or otherwise, other than as required by applicable securities laws.

Disposition of Longview and Discontinued

Operations

Advantage owned 21,150,010 common shares

of Longview Oil Corp. (“Longview”) prior to February 28, 2014, representing an interest of approximately 45.1% of Longview.

Since Advantage held the single largest ownership interest of Longview and other ownership interests were comparatively dispersed,

Advantage was considered to control Longview. Accordingly, prior to February 28, 2014, the financial and operating results of Longview

were consolidated 100% within Advantage and non-controlling interest was recognized which represented Longview’s independent

shareholders 54.9% ownership interest in the net assets and income of Longview. On February 28, 2014, Advantage sold the 21,150,010

common shares of Longview at a price of $4.45 per share and received net proceeds of $90.2 million, all of which were used to reduce

existing bank indebtedness. Concurrently, Advantage derecognized all assets and liabilities of Longview from the consolidated statement

of financial position and ceased to consolidate Longview subsequent to February 28, 2014.

Given that the Longview legal entity was

an operating segment, the financial results for the Advantage legal entity are presented as “continuing operations”

and for the Longview legal entity are presented as “discontinued operations” for all periods in the interim consolidated

financial statements, as required by IFRS. This presentation has been consistently applied throughout this MD&A on a similar

basis with the term “continuing operations” referring to the Advantage legal entity and “discontinued operations”

referring to the Longview legal entity.

| Advantage Oil & Gas Ltd. - 6 |

Non-core Asset Sales

The Advantage legal entity has systematically

disposed of substantially all non-core assets to focus on continued development of Advantage's core Glacier Montney natural gas

asset. Net cash proceeds received from all disposition transactions were used to reduce outstanding bank indebtedness. The disposition

transactions have had a pervasive impact on the financial and operating results and financial position of the Advantage legal entity

such that historical financial and operating performance may not be indicative of actual future performance. Advantage is a pure

play company focused on our signature Glacier Montney property.

Non-GAAP Measures

The Corporation discloses several financial

measures in the MD&A that do not have any standardized meaning prescribed under GAAP. These financial measures include funds

from operations and cash netbacks. Management believes that these financial measures are useful supplemental information to analyze

operating performance and provide an indication of the results generated by the Corporation’s principal business activities.

Investors should be cautioned that these measures should not be construed as an alternative to net income, comprehensive income,

and cash provided by operating activities or other measures of financial performance as determined in accordance with GAAP. Advantage’s

method of calculating these measures may differ from other companies, and accordingly, they may not be comparable to similar measures

used by other companies.

Funds from operations, as presented, is

based on cash provided by operating activities, before expenditures on decommissioning liability and changes in non-cash working

capital, reduced for finance expense excluding accretion. Management believes these adjustments to cash provided by operating activities

increase comparability between reporting periods. Cash netbacks are dependent on the determination of funds from operations and

include the primary cash sales and expenses on a per mcfe basis that comprise funds from operations. Funds from operations reconciled

to cash provided by operating activities is as follows:

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| ($000) | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Cash provided by operating activities - continuing operations | |

$ | 55,431 | | |

$ | 21,863 | | |

| 154 | % | |

$ | 121,689 | | |

$ | 56,878 | | |

| 114 | % |

| Expenditures on decommissioning liability | |

| 32 | | |

| 766 | | |

| (96 | )% | |

| 79 | | |

| 3,512 | | |

| (98 | )% |

| Changes in non-cash working capital | |

| (16,333 | ) | |

| (3,269 | ) | |

| 400 | % | |

| 10,825 | | |

| 10,021 | | |

| 8 | % |

| Finance expense (1) | |

| (2,312 | ) | |

| (2,844 | ) | |

| (19 | )% | |

| (7,765 | ) | |

| (8,923 | ) | |

| (13 | )% |

| Funds from operations - continuing operations | |

$ | 36,818 | | |

$ | 16,516 | | |

| 123 | % | |

| 124,828 | | |

| 61,488 | | |

| 103 | % |

| Funds from operations - discontinued operations | |

| - | | |

| 17,959 | | |

| (100 | )% | |

| 10,019 | | |

| 49,455 | | |

| (80 | )% |

| Funds from operations | |

$ | 36,818 | | |

$ | 34,475 | | |

| 7 | % | |

$ | 134,847 | | |

$ | 110,943 | | |

| 22 | % |

(1) Finance expense excludes non-cash accretion expense.

| Advantage Oil & Gas Ltd. - 7 |

FINANCIAL AND OPERATING REVIEW –

CONTINUING OPERATIONS

Overview

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Funds from operations ($000) | |

$ | 36,818 | | |

$ | 16,516 | | |

| 123 | % | |

$ | 124,828 | | |

$ | 61,488 | | |

| 103 | % |

| per share (1) | |

$ | 0.22 | | |

$ | 0.10 | | |

| 120 | % | |

$ | 0.74 | | |

$ | 0.37 | | |

| 100 | % |

| per mcfe | |

$ | 3.02 | | |

$ | 1.60 | | |

| 89 | % | |

$ | 3.50 | | |

$ | 1.89 | | |

| 85 | % |

(1) Based on basic weighted average shares outstanding.

For the three months ended September 30,

2014, Advantage realized an increase of 123% in funds from operations to $36.8 million and an increase of 89% in cash netbacks

to $3.02 per mcfe, as compared to the third quarter of 2013. Funds from operations for the nine months ended September 30, 2014,

increased 103% to $124.8 million and cash netbacks increased 85% to $3.50 per mcfe, as compared to the same period of 2013. The

increased funds from operations and cash netbacks were driven by growth in Glacier production, higher natural gas prices and a

lower total cash cost structure. Glacier production during the three and nine months ended September 30, 2014 was 18% and 25% higher

than the same periods of 2013, as we continue to execute the significant growth targeted in our development plan. AECO daily prices

during the three and nine months ended September 30, 2014 was 64% and 56% higher than the same periods of 2013 due to the prior

cold winter that reduced natural gas storage levels below the five-year average. We have also achieved an industry leading cost

structure whereby total cash costs per mcfe, including royalties, operating expense, general and administrative expense, and finance

expense have been reduced by 37% to $0.92 per mcfe as compared to the first nine months of 2013. The lower total cash cost structure

has been due to the sale of higher cost non-core assets, reduced debt and the continued focus on improving efficiencies at Glacier.

Petroleum and Natural Gas Sales and

Hedging

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| ($000) | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Natural gas sales | |

$ | 48,794 | | |

$ | 25,234 | | |

| 93 | % | |

$ | 163,998 | | |

$ | 94,054 | | |

| 74 | % |

| Realized hedging gains (losses) | |

| (2,832 | ) | |

| 1,709 | | |

| (266 | )% | |

| (11,773 | ) | |

| 1,079 | | |

| (1,191 | )% |

| Natural gas sales including hedging | |

| 45,962 | | |

| 26,943 | | |

| 71 | % | |

| 152,225 | | |

| 95,133 | | |

| 60 | % |

| Crude oil and NGLs sales | |

| 1,228 | | |

| 914 | | |

| 34 | % | |

| 4,469 | | |

| 13,490 | | |

| (67 | )% |

| Realized hedging gains | |

| - | | |

| - | | |

| - | % | |

| - | | |

| 16 | | |

| (100 | )% |

| Crude oil and NGLs sales including hedging | |

| 1,228 | | |

| 914 | | |

| 34 | % | |

| 4,469 | | |

| 13,506 | | |

| (67 | )% |

| Total (1) | |

$ | 47,190 | | |

$ | 27,857 | | |

| 69 | % | |

$ | 156,694 | | |

$ | 108,639 | | |

| 44 | % |

(1) Total excludes unrealized derivative gains and losses.

Total sales excluding hedging for the three

months ended September 30, 2014 was $50.0 million, an increase of $23.9 million or 91%, and for the nine months ended September

30, 2014 was $168.5 million, an increase of $60.9 million or 57%, when compared to the same periods of 2013. The increase in sales

has been attributable to significantly improved natural gas prices and higher natural gas production.

| Advantage Oil & Gas Ltd. - 8 |

Production

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Natural gas (mcf/d) | |

| 131,553 | | |

| 111,518 | | |

| 18 | % | |

| 129,682 | | |

| 115,863 | | |

| 12 | % |

| Crude oil and NGLs (bbls/d) | |

| 161 | | |

| 105 | | |

| 53 | % | |

| 174 | | |

| 651 | | |

| (73 | )% |

| Total - mcfe/d | |

| 132,519 | | |

| 112,148 | | |

| 18 | % | |

| 130,726 | | |

| 119,769 | | |

| 9 | % |

| - boe/d | |

| 22,087 | | |

| 18,691 | | |

| 18 | % | |

| 21,788 | | |

| 19,962 | | |

| 9 | % |

| Natural gas (%) | |

| 99 | % | |

| 99 | % | |

| | | |

| 99 | % | |

| 97 | % | |

| | |

| Crude oil and NGLs (%) | |

| 1 | % | |

| 1 | % | |

| | | |

| 1 | % | |

| 3 | % | |

| | |

Production for the third quarter of 2014

increased 18% as compared to the third quarter of 2013. Glacier production increased 25% during the nine months ended September

30, 2014 as compared to the same period of 2013 but was partially offset by non-core conventional asset sales which closed in April

2013 of approximately 15 mmcfe/d. Production for the third quarter was down slightly as compared to 136.1 mmcfe/d for the second

quarter of 2014 due primarily to TransCanada Corporation pipeline maintenance. We expect production to average approximately 135

mmcfe/d until June 2015 when production is targeted to increase to 183 mmcfe/d with the completion of our Phase VII development

program.

Commodity Prices and Marketing

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Average Realized Pricing | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Natural gas, excluding hedging ($/mcf) | |

$ | 4.03 | | |

$ | 2.46 | | |

| 64 | % | |

$ | 4.63 | | |

$ | 2.97 | | |

| 56 | % |

| Natural gas, including hedging ($/mcf) | |

$ | 3.80 | | |

$ | 2.63 | | |

| 44 | % | |

$ | 4.30 | | |

$ | 3.01 | | |

| 43 | % |

| Crude oil and NGLs, including hedging ($/bbl) | |

$ | 83.14 | | |

$ | 95.13 | | |

| (13 | )% | |

$ | 93.87 | | |

$ | 75.97 | | |

| 24 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Benchmark Prices | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| AECO daily ($/mcf) | |

$ | 4.02 | | |

$ | 2.45 | | |

| 64 | % | |

$ | 4.77 | | |

$ | 3.06 | | |

| 56 | % |

| NYMEX ($US/mmbtu) | |

$ | 4.07 | | |

$ | 3.60 | | |

| 13 | % | |

$ | 4.53 | | |

$ | 3.68 | | |

| 23 | % |

| Edmonton Light ($/bbl) | |

$ | 97.07 | | |

$ | 104.96 | | |

| (8 | )% | |

$ | 100.89 | | |

$ | 95.64 | | |

| 5 | % |

Advantage’s current production from

Glacier is approximately 99% natural gas. Realized natural gas prices, excluding hedging, have increased significantly as compared

to 2013, corresponding to the substantial increase in AECO prices. Natural gas prices remained low throughout much of 2013 due

to a stronger supply to demand situation. Prices improved dramatically during early 2014 as a result of an extremely cold winter

that increased demand and reduced North American storage levels well below the five-year average. During the second and third quarters

of 2014, natural gas prices have pulled back due to the continued strength of U.S. storage injections caused by record supply levels

and reduced demand from mild summer weather. Advantage has hedged approximately 52% of forecast production, net of royalties, for

the fourth quarter of 2014 and calendar 2015 at an average natural gas price of $3.90/mcf to support our Glacier development plan.

| Advantage Oil & Gas Ltd. - 9 |

Commodity Price Risk

The Corporation’s financial results

and condition will be dependent on the prices received for natural gas production. Natural gas prices have fluctuated widely and

are determined by supply and demand factors, including weather, and general economic conditions in natural gas consuming and producing

regions throughout North America. Management has been proactive in mitigating commodity price risk and has entered natural gas

hedging contracts to March 31, 2017 to support our Glacier three year development plan. Our Credit Facilities allow Advantage to

hedge up to 65% of total estimated natural gas and liquids production over the first three years and 50% over the fourth year.

Our current hedging positions are summarized

as follows:

| | |

| |

Forecast Production | |

|

| | |

Average | |

Hedged | |

Average Price |

| Period | |

Production Hedged | |

(net of royalties) | |

AECO ($Cdn.) |

| Q4 2014 | |

71.1 mmcf/d | |

55% | |

$3.89/mcf |

| Q1 2015 to Q4 2015 | |

78.2 mmcf/d | |

51% | |

$3.90/mcf |

| Q1 2016 to Q4 2016 | |

56.9 mmcf/d | |

31% | |

$3.93/mcf |

| Q1 2017 | |

47.4 mmcf/d | |

25% | |

$3.95/mcf |

A summary of realized and unrealized hedging

gains and losses for the three and nine months ended September 30, 2014 and 2013 are as follows:

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| ($000) | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Total realized gains (losses) on derivatives | |

$ | (2,832 | ) | |

$ | 1,709 | | |

| (266 | )% | |

$ | (11,773 | ) | |

$ | 1,095 | | |

| (1,175 | )% |

| Total unrealized gains (losses) on derivatives | |

| 5,987 | | |

| 2,122 | | |

| 182 | % | |

| (7,457 | ) | |

| 5,429 | | |

| (237 | )% |

| Total gains (losses) on derivatives | |

$ | 3,155 | | |

$ | 3,831 | | |

| (18 | )% | |

$ | (19,230 | ) | |

$ | 6,524 | | |

| (395 | )% |

For the three and nine months ended September

30, 2014, we realized derivative losses as a result of higher natural gas prices as compared to our average hedge prices. For the

nine months ended September 30, 2014, $7.5 million was recognized in income as an unrealized derivative loss (September 30, 2013

– $5.4 million unrealized derivative gain), being the change in the fair value of the net derivative liability since December

31, 2013. The fair value of the net derivative liability is the estimated value to settle the contracts as at a point in time.

As such, unrealized derivative gains and losses are not cash and the actual gains or losses realized on eventual cash settlement

can vary materially due to subsequent fluctuations in commodity prices as compared to the valuation assumptions. These derivative

contracts will settle from October 1, 2014 to March 31, 2017 corresponding to when the Corporation will recognize sales from production.

| Advantage Oil & Gas Ltd. - 10 |

Royalties

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Royalties ($000) | |

$ | 2,329 | | |

$ | 1,283 | | |

| 82 | % | |

$ | 7,867 | | |

$ | 6,011 | | |

| 31 | % |

| per mcfe | |

$ | 0.19 | | |

$ | 0.12 | | |

| 58 | % | |

$ | 0.22 | | |

$ | 0.18 | | |

| 22 | % |

| Royalty Rate (percentage of petroleum and natural gas sales) | |

| 4.7 | % | |

| 4.9 | % | |

| (0.2 | )% | |

| 4.7 | % | |

| 5.6 | % | |

| (0.9 | )% |

Advantage pays royalties to the owners

of mineral rights from which we have leases. The Corporation currently has mineral leases with provincial governments, individuals

and other companies. Our average corporate royalty rates are impacted by well depths, well production rates, commodity prices,

and gas cost allowance. The expected royalty rate for the life of a Glacier Upper and Lower Montney horizontal well is approximately

5% before gas cost allowance due to industry provincial incentive programs. Total royalties paid during the three and nine months

ended September 30, 2014 are higher than 2013 due to stronger natural gas prices while the overall royalty rate was comparable.

Operating Expense

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Operating expense ($000) | |

$ | 4,280 | | |

$ | 2,978 | | |

| 44 | % | |

$ | 11,228 | | |

$ | 17,743 | | |

| (37 | )% |

| per mcfe | |

$ | 0.35 | | |

$ | 0.29 | | |

| 21 | % | |

$ | 0.31 | | |

$ | 0.54 | | |

| (43 | )% |

For the nine months ended September 30,

2014, operating expense was $0.31/mcfe, a decrease of 43% as compared to the same period of 2013. Operating costs have decreased

with the disposition of higher cost non-core assets and due to the increased production from our 100% owned Glacier gas plant.

Operating expense per mcfe for the third quarter of 2014 was $0.35/mcfe, due to an increase in third party water disposal and trucking

costs resulting from the flowback of additional water from well completions. To mitigate future water handling costs during periods

of higher well completion activity and associated high water flow back volumes, Advantage recompleted an additional water disposal

well in the fourth quarter of 2014. This will increase the water handling capacity at Glacier and is anticipated to reduce third

party costs.

General and Administrative Expense

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| General and administrative expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash expense ($000) | |

$ | 1,452 | | |

$ | 4,729 | | |

| (69 | )% | |

$ | 6,055 | | |

$ | 15,314 | | |

| (60 | )% |

| per mcfe | |

$ | 0.12 | | |

$ | 0.46 | | |

| (74 | )% | |

$ | 0.17 | | |

$ | 0.47 | | |

| (64 | )% |

| Share based compensation ($000) | |

$ | 539 | | |

$ | 1,055 | | |

| (49 | )% | |

$ | 1,576 | | |

$ | 4,524 | | |

| (65 | )% |

| per mcfe | |

$ | 0.04 | | |

$ | 0.10 | | |

| (60 | )% | |

$ | 0.04 | | |

$ | 0.14 | | |

| (71 | )% |

| Total general and administrative expense ($000) | |

$ | 1,991 | | |

$ | 5,784 | | |

| (66 | )% | |

$ | 7,631 | | |

$ | 19,838 | | |

| (62 | )% |

| per mcfe | |

$ | 0.16 | | |

$ | 0.56 | | |

| (71 | )% | |

$ | 0.21 | | |

$ | 0.61 | | |

| (66 | )% |

| Employees at September 30 | |

| | | |

| | | |

| | | |

| 27 | | |

| 81 | | |

| (67 | )% |

Cash general and administrative (“G&A”)

expense has decreased as significant cost efficiencies were realized with the non-core asset dispositions and termination of the

Technical Services Agreement with Longview on February 1, 2014 whereby Advantage had previously provided the necessary personnel

and technical services to manage Longview's business. Cash G&A in 2013 included one-time costs including retention and staff

rationalization associated with the asset dispositions and costs incurred during Advantage’s strategic alternatives review

process that commenced in early 2013 and was concluded on February 4, 2014.

| Advantage Oil & Gas Ltd. - 11 |

Share based compensation represents non-cash

G&A expense associated with Advantage’s stock option plan and restricted and performance award plan that are designed

to provide for long term compensation to service providers. Share based compensation for the three and nine months ended September

30, 2014 has decreased as a result of staff rationalization. As at September 30, 2014, a total of 5.9 million stock options and

0.4 million performance awards are unexercised which represents only 3.9% of the 10% of Advantage’s total outstanding common

shares which are eligible to be granted to service providers.

Depreciation Expense

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Depreciation expense ($000) | |

$ | 21,930 | | |

$ | 19,720 | | |

| 11 | % | |

$ | 64,131 | | |

$ | 54,182 | | |

| 18 | % |

| per mcfe | |

$ | 1.80 | | |

$ | 1.91 | | |

| (6 | )% | |

$ | 1.80 | | |

$ | 1.66 | | |

| 8 | % |

Depreciation of oil and gas properties

is provided on the unit-of–production method based on total proved and probable reserves, including future development costs,

on a component basis. Depreciation expense was higher during 2014 due to the continued increase in production at Glacier. The rate

of depreciation expense recognized at Glacier has decreased in 2014 as total costs, including future development costs, as a proportion

of total proved and probable reserves has declined due to the continued efficiency of production additions. Depreciation expense

per mcfe was modestly lower during the nine months ended September 30, 2013 as Advantage ceased depreciation of assets held for

sale for the period of January 2013 to April 30, 2013.

Finance Expense

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Finance expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash expense ($000) | |

$ | 2,312 | | |

$ | 2,844 | | |

| (19 | )% | |

$ | 7,765 | | |

$ | 8,923 | | |

| (13 | )% |

| per mcfe | |

$ | 0.19 | | |

$ | 0.28 | | |

| (32 | )% | |

$ | 0.22 | | |

$ | 0.27 | | |

| (19 | )% |

| Accretion expense ($000) | |

$ | 1,147 | | |

$ | 1,119 | | |

| 3 | % | |

$ | 3,401 | | |

$ | 5,005 | | |

| (32 | )% |

| per mcfe | |

$ | 0.09 | | |

$ | 0.11 | | |

| (18 | )% | |

$ | 0.09 | | |

$ | 0.16 | | |

| (44 | )% |

| Total finance expense ($000) | |

$ | 3,459 | | |

$ | 3,963 | | |

| (13 | )% | |

$ | 11,166 | | |

$ | 13,928 | | |

| (20 | )% |

| per mcfe | |

$ | 0.28 | | |

$ | 0.39 | | |

| (28 | )% | |

$ | 0.31 | | |

$ | 0.43 | | |

| (28 | )% |

Cash finance expense represents interest

on bank indebtedness and convertible debentures which have decreased compared to 2013, due to the lower average bank indebtedness.

Our bank indebtedness outstanding at the end of September 30, 2014 was $71.0 million, a decrease of $82.7 million from December

31, 2013. The Corporation’s interest rates on bank indebtedness have decreased due to the lower debt to cash flow ratios

as calculated pursuant to our Credit Facilities and are primarily based on short term bankers’ acceptance rates plus a stamping

fee.

Accretion expense represents non-cash charges

that increase the carrying value of the convertible debenture and decommissioning liability as a result of the passage of time.

The $86.2 million of 5% convertible debentures currently outstanding will mature on January 30, 2015. Accretion expense for the

nine months ended September 30, 2014 is lower than 2013 as the decommissioning liability decreased in April 2013 with the closing

of non-core asset sales.

| Advantage Oil & Gas Ltd. - 12 |

Other Income (Expense)

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| ($000) | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Interest income - Questfire Debenture | |

$ | - | | |

$ | 493 | | |

| (100 | )% | |

$ | 455 | | |

$ | 820 | | |

| (45 | )% |

| Accretion income - Questfire Debenture | |

| - | | |

| 570 | | |

| (100 | )% | |

| 557 | | |

| 947 | | |

| (41 | )% |

| Loss on disposition - Questfire Debenture | |

| - | | |

| - | | |

| - | % | |

| (13,833 | ) | |

| - | | |

| 100 | % |

| Unrealized gain (loss) - Questfire Class B Shares | |

| - | | |

| (450 | ) | |

| (100 | )% | |

| 3,150 | | |

| (150 | ) | |

| (2,200 | )% |

| Unrealized loss on other liability | |

| - | | |

| - | | |

| - | % | |

| (3,000 | ) | |

| - | | |

| 100 | % |

| Gain (loss) on sale of assets | |

| 11 | | |

| (787 | ) | |

| (101 | )% | |

| (1,489 | ) | |

| (6,859 | ) | |

| (78 | )% |

| Miscellaneous income | |

| 1 | | |

| - | | |

| 100 | % | |

| 594 | | |

| 20 | | |

| 2,870 | % |

| | |

$ | 12 | | |

$ | (174 | ) | |

| (107 | )% | |

$ | (13,566 | ) | |

$ | (5,222 | ) | |

| 160 | % |

Advantage recognized interest and accretion

income earned on the Questfire Debenture from April 2013 up to the first quarter of 2014, the time during which we owned the Debenture.

During the first quarter of 2014, Advantage accepted a proposal from Questfire to redeem the Questfire Debenture for an aggregate

purchase price of $13.6 million and Advantage recognized a loss of $13.8 million representing the difference from the carrying

value. Advantage also accepted a Questfire offer to purchase by way of issuer bid, all of the Class B Shares at a price of $2.60

per share. Advantage received $3.9 million in the second quarter of 2014 for the Class B Shares and recognized a net gain of $0.2

million. Advantage recognized a loss of $1.5 million in the second quarter related to the finalization of the gain and loss calculations

attributable to non-core asset dispositions that closed in 2013.

Taxes

Deferred income taxes arise from differences

between the accounting and tax bases of our assets and liabilities. For the nine months ended September 30, 2014, the Corporation

recognized a deferred income tax expense of $12.7 million as a result of the $33.6 million net income before taxes from continuing

operations. As at September 30, 2014, the Corporation had a deferred income tax liability balance of $15.7 million.

Net Income (Loss) and Comprehensive

Income (Loss) from Continuing Operations

| | |

Three months ended | | |

| | |

Nine months ended | | |

| |

| | |

September 30 | | |

| | |

September 30 | | |

| |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| Net income (loss) and comprehensive income (loss) from continuing operations ($000) | |

$ | 14,201 | | |

$ | (3,187 | ) | |

| (546 | )% | |

$ | 20,915 | | |

$ | (2,024 | ) | |

| (1,133 | )% |

| per share - basic and diluted | |

$ | 0.08 | | |

$ | (0.02 | ) | |

| (500 | )% | |

$ | 0.12 | | |

$ | (0.01 | ) | |

| (1,300 | )% |

Advantage’s net income from continuing

operations for 2014 has increased significantly as compared to 2013 primarily due to higher funds from operations attributable

to increased Glacier production, stronger natural gas prices and a lower cost structure. All reporting periods were affected by

derivative gains and losses from our ongoing commodity price risk activities. For the nine months ended September 30, 2014, Advantage

has recognized total losses on derivatives of $19.2 million as compared to a $6.5 million total gain on derivatives for the same

period of 2013. One-time non-cash losses of approximately $15.2 million were recognized on disposition of Questfire investments

and non-core properties in the first half of 2014.

| Advantage Oil & Gas Ltd. - 13 |

Cash Netbacks

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30 | | |

September 30 | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

$000 | | |

per

mcfe | | |

$000 | | |

per

mcfe | | |

$000 | | |

per

mcfe | | |

$000 | | |

per

mcfe | |

| Petroleum and natural gas sales | |

$ | 50,022 | | |

$ | 4.10 | | |

$ | 26,148 | | |

$ | 2.53 | | |

$ | 168,467 | | |

$ | 4.72 | | |

$ | 107,544 | | |

$ | 3.29 | |

| Realized gains (losses) on derivatives | |

| (2,832 | ) | |

| (0.23 | ) | |

| 1,709 | | |

| 0.17 | | |

| (11,773 | ) | |

| (0.33 | ) | |

| 1,095 | | |

| 0.03 | |

| Royalties | |

| (2,329 | ) | |

| (0.19 | ) | |

| (1,283 | ) | |

| (0.12 | ) | |

| (7,867 | ) | |

| (0.22 | ) | |

| (6,011 | ) | |

| (0.18 | ) |

| Operating expense | |

| (4,280 | ) | |

| (0.35 | ) | |

| (2,978 | ) | |

| (0.29 | ) | |

| (11,228 | ) | |

| (0.31 | ) | |

| (17,743 | ) | |

| (0.54 | ) |

| Operating income

and operating netbacks | |

| 40,581 | | |

| 3.33 | | |

| 23,596 | | |

| 2.29 | | |

| 137,599 | | |

| 3.86 | | |

| 84,885 | | |

| 2.60 | |

| General and administrative (1) | |

| (1,452 | ) | |

| (0.12 | ) | |

| (4,729 | ) | |

| (0.46 | ) | |

| (6,055 | ) | |

| (0.17 | ) | |

| (15,314 | ) | |

| (0.47 | ) |

| Finance expense (2) | |

| (2,312 | ) | |

| (0.19 | ) | |

| (2,844 | ) | |

| (0.28 | ) | |

| (7,765 | ) | |

| (0.22 | ) | |

| (8,923 | ) | |

| (0.27 | ) |

| Other income

(3) | |

| 1 | | |

| - | | |

| 493 | | |

| 0.05 | | |

| 1,049 | | |

| 0.03 | | |

| 840 | | |

| 0.03 | |

| Funds

from operations and cash netbacks | |

$ | 36,818 | | |

$ | 3.02 | | |

$ | 16,516 | | |

$ | 1.60 | | |

$ | 124,828 | | |

$ | 3.50 | | |

$ | 61,488 | | |

$ | 1.89 | |

(1) General and administrative expense excludes share based

compensation.

(2) Finance expense excludes non-cash accretion expense.

(3) Other income excludes non-cash other income.

For the three months ended September 30,

2014, Advantage realized an increase of 123% in funds from operations to $36.8 million and an increase of 89% in cash netbacks

to $3.02 per mcfe, as compared to the third quarter of 2013. Funds from operations for the nine months ended September 30, 2014,

increased 103% to $124.8 million and cash netbacks increased 85% to $3.50 per mcfe, as compared to the same period of 2013. The

increased funds from operations and cash netbacks were attributable to growth in Glacier production, higher natural gas prices

and a lower total cash cost structure. As a result of our pure play Montney focus in the Glacier area, Advantage has achieved an

industry leading cost structure.

| Advantage Oil & Gas Ltd. - 14 |

Contractual Obligations and Commitments

The Corporation has contractual obligations

in the normal course of operations including purchases of assets and services, operating agreements, transportation commitments,

sales contracts, bank indebtedness and convertible debentures. These obligations are of a recurring and consistent nature and impact

cash flow in an ongoing manner. The following table is a summary of the Corporation’s remaining contractual obligations and

commitments. Advantage has no guarantees or off-balance sheet arrangements other than as disclosed.

| | |

Payments

due by period | |

| ($

millions) | |

Total | | |

2014 | | |

2015

& 2016 | | |

2017

& 2018 | | |

2019 | | |

After

2019 | |

| Building leases | |

$ | 5.2 | | |

$ | 0.3 | | |

$ | 2.1 | | |

$ | 2.2 | | |

$ | 0.6 | | |

$ | - | |

| Pipeline/transportation | |

| 102.5 | | |

| 3.3 | | |

| 31.7 | | |

| 29.0 | | |

| 13.4 | | |

| 25.1 | |

| Bank indebtedness (1) |

- principal | |

| 71.6 | | |

| - | | |

| 71.6 | | |

| - | | |

| - | | |

| - | |

|

- interest | |

| 8.1 | | |

| 1.2 | | |

| 6.9 | | |

| - | | |

| - | | |

| - | |

| Convertible debenture (2) |

- principal | |

| 86.2 | | |

| - | | |

| 86.2 | | |

| - | | |

| - | | |

| - | |

|

- interest | |

| 2.2 | | |

| - | | |

| 2.2 | | |

| - | | |

| - | | |

| - | |

| Total

contractual obligations | |

$ | 275.8 | | |

$ | 4.8 | | |

$ | 200.7 | | |

$ | 31.2 | | |

$ | 14.0 | | |

$ | 25.1 | |

| (1) | As at September 30, 2014, the Corporation’s bank indebtedness was governed by a credit facility

agreement with a syndicate of financial institutions. Under the terms of the agreement, the facility is reviewed annually, with

the next review scheduled in June 2015. The facility is revolving and extendible at each annual review for a further 364 day period

at the option of the syndicate. If not extended, the credit facility is converted at that time into a one-year term facility, with

the principal payable at the end of such one-year term. Management fully expects that the facility will be extended at each annual

review. |

| | |

| (2) | As at September 30, 2014, Advantage had an $86.2 million convertible debenture outstanding. The

convertible debenture is convertible to common shares based on an established conversion price. All remaining obligations related

to the convertible debenture can be settled through the payment of cash or issuance of common shares at Advantage’s option. |

Liquidity and Capital Resources

The following table is a summary of the

Corporation’s capitalization structure:

| ($000, except as otherwise indicated) | |

September 30, 2014 | |

| Bank indebtedness (non-current) | |

$ | 71,044 | |

| Working capital deficit (1) | |

| 48,354 | |

| Net debt | |

| 119,398 | |

| Convertible debentures maturity value (current) | |

| 86,250 | |

| Total debt | |

$ | 205,648 | |

| | |

| | |

| Shares outstanding | |

| 169,789,466 | |

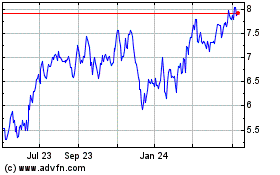

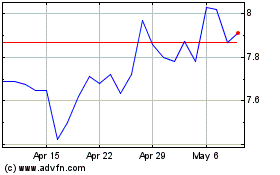

| Shares closing market price ($/share) | |

$ | 5.69 | |

| Market capitalization (2) | |

$ | 966,102 | |

| | |

| | |

| Total capitalization | |

$ | 1,171,750 | |

| (1) | Working capital deficit is a non-GAAP measure that includes trade and other receivables, prepaid expenses and deposits, and

trade and other accrued liabilities. |

| | |

| (2) | Market capitalization is a non-GAAP measure calculated by multiplying shares outstanding by the closing market share price

on the applicable date. |

Advantage monitors its capital structure

and makes adjustments according to market conditions in an effort to meet its objectives given the current outlook of the business

and industry in general. The capital structure of the Corporation is composed of working capital deficit, bank indebtedness, convertible

debentures and share capital. Advantage may manage its capital structure by issuing new common shares, repurchasing outstanding

common shares, obtaining additional financing either through bank indebtedness or convertible debenture issuances, refinancing

current debt, issuing other financial or equity-based instruments, declaring a dividend, adjusting capital spending, or disposing

of assets. The capital structure is reviewed by Management and the Board of Directors on an ongoing basis.

| Advantage Oil & Gas Ltd. - 15 |

Management of the Corporation’s capital

structure is facilitated through its financial and operational forecasting processes. Selected forecast information is frequently

provided to the Board of Directors. This continual financial assessment process further enables the Corporation to mitigate risks.

The Corporation continues to satisfy all liabilities and commitments as they come due and has $329 million available on our $400

million credit facility at September 30, 2014. We will continue to be very cognizant of maintaining financial flexibility in the

current environment.

Shareholders’ Equity and Convertible

Debentures

Advantage utilizes a combination of equity,

convertible debentures, bank indebtedness and funds from operations to finance capital development activities.

As at September 30, 2014, Advantage had

169.8 million common shares outstanding. During 2014, Advantage issued 1.4 million common shares to service providers in exchange

for the exercise of 6.7 million stock options including 5.0 million stock options that vested during 2013 but could not be exercised

due to trading blackout restrictions imposed by the previous strategic review process that was terminated on February 4, 2014.

Additionally, 4.3 million stock options were forfeited/cancelled in 2014 due to staff rationalization associated with the asset

dispositions. For the nine months ended September 30, 2014, 3.8 million stock options and 0.4 million performance awards were granted

to service providers with a vesting term of three years. As at September 30, 2014, a total of 5.9 million stock options and 0.4

million performance awards are unexercised which represents only 3.9% of the 10% of Advantage’s total outstanding common

shares which are eligible to be granted to service providers. As at November 13, 2014, Advantage had 170.1 million common shares

outstanding.

The Corporation has $86.2 million of 5.00%

convertible debentures outstanding at September 30, 2014 that are convertible to 10.0 million common shares based on the applicable

conversion price and will mature in January 2015 (December 31, 2013 - $86.2 million outstanding and convertible to 10.0 million

common shares). Our convertible debenture obligation can be settled through the payment of cash or issuance of common shares at

Advantage’s option. Given our strong financial position, Advantage is well positioned to satisfy the convertible debenture

obligation with our current available credit facilities.

Bank Indebtedness, Credit Facilities

and Other Obligations

At September 30, 2014, Advantage had bank

indebtedness outstanding of $71.0 million. Bank indebtedness has decreased $82.7 million since December 31, 2013 due to net proceeds

received from the disposition of investments in Longview and Questfire, and strong funds from operations. Advantage’s credit

facilities borrowing base is $400 million and is collateralized by a $1 billion floating charge demand debenture covering all assets

of the Corporation (the “Credit Facilities”). The borrowing base for the Credit Facilities is determined by the banking

syndicate through a thorough evaluation of our reserve estimates based upon their own commodity price expectations. Revisions or

changes in the reserve estimates and commodity prices can have either a positive or a negative impact on the borrowing base. The

next annual review is scheduled to occur in June 2015. There can be no assurance that the Credit Facilities will be renewed at

the current borrowing base level at that time.

Advantage had a working capital deficiency

of $48.4 million as at September 30, 2014, a significant increase from the prior quarter due to the relatively high level of capital

expenditure activity underway at September 30, 2014. Our working capital includes items expected for normal operations such as

trade receivables, prepaids, deposits, and trade payables and accruals. Working capital varies primarily due to the timing of such

items, the current level of business activity including our capital expenditure program, commodity price volatility, and seasonal

fluctuations. Our working capital is normally in a deficit position due to our continuing capital development activities. We do

not anticipate any problems in satisfying the working capital deficit and meeting future obligations as they become due as they

can be satisfied with funds from operations and our available Credit Facilities.

| Advantage Oil & Gas Ltd. - 16 |

Capital Expenditures

| | |

Three months ended | | |

Nine months ended | |

| | |

September 30 | | |

September 30 | |

| ($000) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Drilling, completions and workovers | |

$ | 70,752 | | |

$ | 19,953 | | |

$ | 129,658 | | |

$ | 70,325 | |

| Well equipping and facilities | |

| 7,789 | | |

| 1,289 | | |

| 17,370 | | |

| 8,720 | |

| Land and seismic | |

| - | | |

| - | | |

| - | | |

| 24 | |

| Expenditures on property, plant and equipment | |

| 78,541 | | |

| 21,242 | | |

| 147,028 | | |

| 79,069 | |

| Expenditures on exploration and evaluation assets | |

| 774 | | |

| 6,759 | | |

| 2,587 | | |

| 6,789 | |

| Proceeds from property dispositions (1) | |

| - | | |

| 710 | | |

| - | | |

| (52,398 | ) |

| Net capital expenditures (2) | |

$ | 79,315 | | |

$ | 28,711 | | |

$ | 149,615 | | |

$ | 33,460 | |

(1) Proceeds from property dispositons represents the net cash

proceeds and excludes all other forms of consideration.

(2) Net capital expenditures excludes changes in non-cash working

capital and change in decommissioning liability.

Advantage invested $147.0 million on property,

plant and equipment at Glacier for the nine months ended September 30, 2014. We completed our Phase VI development program during

the first quarter of 2014 and our inventory of Phase VI wells are expected to maintain production at approximately the 135 mmcfe/d

level through June 2015 when our plant expansion is expected to be complete. The Glacier Phase VII drilling program was accelerated

during the first quarter of 2014 due to lower than anticipated capital expenditures in our Phase VI program. The lower capital

spending resulted from improved drilling and well completion efficiencies which reduced well costs below our original budget estimates.

One rig continued to drill through spring breakup and currently there are three rigs drilling at Glacier. We have now drilled and

rig released 21 Phase VII wells and have completed our first 6 well pad. A total of 33 wells are included in our Phase VII drilling

program. Advantage’s Phase VII program is proceeding as expected with production anticipated to increase to 183 mmcfe/d in

June 2015 including approximately 900 bbls/d of natural gas liquids. Firm service transportation commitments have been secured

to coincide with Advantage’s Phase VIII production target of 205 mmcfe/d.

| Advantage Oil & Gas Ltd. - 17 |

Sources and Uses of Funds

The following table summarizes the various

funding requirements during the nine months ended September 30, 2014 and 2013 and the sources of funding to meet those requirements:

| | |

Nine months ended | |

| | |

September 30 | |

| ($000) | |

2014 | | |

2013 | |

| Sources of funds | |

| | | |

| | |

| Funds from operations | |

$ | 124,828 | | |

$ | 61,488 | |

| Disposition of Longview investment | |

| 90,153 | | |

| - | |

| Disposition of Questfire investments | |

| 17,500 | | |

| - | |

| Dividends received from Longview | |

| 1,692 | | |

| 9,518 | |

| Property dispositions | |

| - | | |

| 52,398 | |

| | |

$ | 234,173 | | |

$ | 123,404 | |

| Uses of funds | |

| | | |

| | |

| Expenditures on property, plant and equipment | |

$ | 147,028 | | |

$ | 79,069 | |

| Decrease in bank indebtedness | |

| 82,791 | | |

| 21,060 | |

| Expenditures on exploration and evaluation assets | |

| 2,587 | | |

| 6,789 | |

| Change in non-cash working capital and other | |

| 1,477 | | |

| 12,974 | |

| Property dispositions | |

| 211 | | |

| - | |

| Expenditures on decommissioning liability | |

| 79 | | |

| 3,512 | |

| | |

$ | 234,173 | | |

$ | 123,404 | |

The increased funds from operations combined

with proceeds from the disposition of investments in Longview and Questfire were used to fund capital expenditures and repay a

significant portion of bank indebtedness. Bank indebtedness has been significantly reduced and we monitor the debt level to ensure

an optimal mix of financing and cost of capital that will provide a maximum return to our shareholders.

FINANCIAL AND OPERATING REVIEW –

DISCONTINUED OPERATIONS

The following financial and operating highlights

for Longview to February 28, 2014 have been presented to provide additional information with respect to the Longview segment prior

to disposition.

| | |

Nine months ended | |

| | |

September 30 | |

| | |

2014 (1) | | |

2013 | |

| Production (boe/d) | |

| 5,622 | | |

| 6,000 | |

| Funds from operations ($000) | |