BELLEVILLE, ON, Sept. 14 /CNW/ -- - Animal Health product sales

revenues stable - - overall revenues decrease due to fewer Human

Health milestone revenues compared to Fiscal 2010 - (all figures

are in Canadian dollars unless otherwise noted) BELLEVILLE, ON,

Sept. 14 /CNW/ - Bioniche Life Sciences Inc. (TSX: BNC) (ASX: BNC),

a research-based, technology-driven Canadian biopharmaceutical

company, today announced financial results for its fiscal year

ended June 30, 2011. "The Company has worked diligently over the

past few years to de-risk its business and, thus, create a more

attractive investment opportunity," said Graeme McRae, Chairman,

President & CEO. "This has been achieved through the signing of

partnership deals, the presence of a solid base business generating

revenue and positive earnings before research and development, the

investment in intellectual property protection of core

technologies, and the successful raising of capital resources." The

Company expects to be launching a series of new research and

technology-driven products from its pipeline over the next 18

months. Announcements will be made as these products are launched

in various global jurisdictions. Fiscal 2011 Financial Results

Highlights Consolidated revenues related to Bioniche Animal Health

product sales for the fiscal year were $27.4 million, as compared

to $27 million in Fiscal 2010. This represents a stabilization of

product revenues which had previously been reduced with the

economic recession in some markets. In addition to revenues from

animal health product sales, the Company recorded licensing revenue

of $5.5 million in Fiscal 2011, as compared to $16.2 million in

Fiscal 2010, reflecting non-recurring milestone revenue earned

under the Urocidin(TM) license, development and supply agreement

with Endo Pharmaceuticals Inc. (Endo) and the amortization of the

up-front payment by Endo upon the signing of this agreement. The

total up-front payment received, C$22.3 million, will be recognized

over 15 years, which is the term over which the Company maintains

substantive contractual obligations (per Canadian Generally

Accepted Accounting Principles - GAAP). The Company generated

Earnings Before Interest, Taxes, Depreciation and Amortization

(EBITDA) - before research and development expenses - of $6.0

million, as compared to $20.5 million in Fiscal 2010. The decrease

can be attributed primarily to the lower milestone revenues in

Fiscal 2011. Fiscal year-end cash, cash equivalents and short-term

investments amounted to $16.8 million, as compared to $11.1 million

at June 30, 2010. At June 30, 2011, the Company's net working

capital totaled $23.0 million, excluding the current portion of

non-refundable deferred licensing revenue, as compared to net

working capital of $16.5 million at June 30, 2010. The value of the

Company's Property, Plant and Equipment has increased to $27.8

million at June 30, 2011, compared to $16.6 million at June 30,

2010. This reflects the significant investment in the Animal Health

and Food Safety Vaccine Manufacturing Centre at the Company's

corporate headquarters in Belleville, Ontario. This facility was

officially opened in April, 2011 and is undergoing commissioning

and validation, a process which is expected to be completed in

early calendar 2012, to be followed by production scale-up.

Administrative expenses grew in Fiscal 2011 to $10.5 million from

$6.8 million at June 30, 2010. Administrative expenses reflect the

accrual of approximately $2.0 million for a pension plan for the

Company's President & CEO in recognition of his many years of

service and longstanding leadership in the Company. The plan

provides two months of salary continuance for every year of

service, but has not required any cash outlay as the obligation is

unfunded. Administrative expenses also include an increase in

salaries and related benefits of $0.9 million, comprised of average

salary increases of 3% and the creation of four new positions.

Research and development expenditures increased by $1.5 million in

Fiscal 2011 to $19.8 million, as compared to $18.3 million in

Fiscal 2010. R&D resources are focused on the advancement of

certain development programs in Animal Health and Food Safety.

There is continued investment in the staffing and infrastructure

associated with the GMP production of the Company's Urocidin(TM)

bladder cancer treatment that is in Phase III clinical testing.

Endo has assumed financial responsibility for the external costs of

clinical activities as they relate to Urocidin(TM), and the Company

is refocusing its human clinical development activities for the

underlying technology - Mycobacterial Cell Wall-DNA Complex (MCC) -

on other indications. The basic and fully-diluted net loss per

share for Fiscal 2011 is ($0.17), as compared to a net loss per

share of ($0.02) in Fiscal 2010. The decrease in revenues

associated with reduced milestone payments from Endo contributed to

the greater loss in Fiscal 2011. Total common shares outstanding at

June 30, 2011 were 102,108,692, as compared to 72,890,247 at June

30, 2010. More information on the Company's year-end financial

results is provided in the Company's Fiscal 2011 Management's

Discussion and Analysis dated September 14, 2011. Fiscal 2011

Year-End Results Conference Call The Company will discuss its

year-end results during a: Conference Call & Audio Web Cast

Wednesday, September 21, 2011 6:00 p.m. (Eastern) To participate in

the conference call from North America, call (888) 231-8191. To

participate in the conference call from Australia, call

1-800-287-011. A listen-only audio web cast will be available at:

http://event.on24.com/r.htm?e=357400&s=1&k=196F8E1949C7EF06BF11AE4846538BA0

A replay of the conference call will be available until September

28, 2011 at midnight by calling 1-855-859-2056 (passcode: 10564534

followed by the number sign). The web cast will be available for

replay using the above link until September 20, 2012. Timing of Q1,

Fiscal 2012 Financial Reporting Beginning in Q1, Fiscal 2012, the

Company will be reporting its financial results according to

International Financial Reporting Standards (IFRS). The conversion

to IFRS accounting is a major project and the financial report will

occur on or about December 8, 2011 as per Ontario Securities

Commission regulations. About Bioniche Life Sciences Inc. Bioniche

Life Sciences Inc. is a research-based, technology-driven Canadian

biopharmaceutical company focused on the discovery, development,

manufacturing, and marketing of proprietary products for human and

animal health markets worldwide. The fully-integrated company

employs more than 200 skilled personnel and has three operating

divisions: Human Health, Animal Health, and Food Safety. The

Company's primary goal is to develop proprietary cancer therapies

supported by revenues from marketed products in human and animal

health. The Company was named one of the Top 50 Small and

Medium-Sized Employers in Canada for 2010, based on employee

opinion. For more information, please visit www.Bioniche.com.

Except for historical information, this news release may contain

forward-looking statements that reflect the Company's current

expectation regarding future events. These forward-looking

statements involve risk and uncertainties, which may cause, but are

not limited to, changing market conditions, the successful and

timely completion of clinical studies, the establishment of

corporate alliances, the impact of competitive products and

pricing, new product development, uncertainties related to the

regulatory approval process, and other risks detailed from time to

time in the Company's ongoing quarterly and annual reporting.

Bioniche Life Sciences Inc. Amalgamated under the laws of Ontario

CONSOLIDATED BALANCE SHEETS As at June 30 (thousands of Canadian

dollars) 2011 2010 $ $

-------------------------------------------------------------------------

ASSETS Current Cash and cash equivalents 15,353 11,070 Short-term

investment 1,493 - Accounts receivable 6,460 8,601 Income taxes

receivable 254 63 Future income tax assets 85 197 Inventories 8,604

6,668 Prepaid expenses and deposits 1,068 793

-------------------------------------------------------------------------

33,317 27,392

-------------------------------------------------------------------------

Long-term Property, plant and equipment 27,759 16,584 Intangible

assets 6,306 6,500 Goodwill 456 456 Long-term accounts receivable

1,756 1,156 Future income tax assets 43 51

-------------------------------------------------------------------------

69,637 52,139

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY Current Accounts payable and

accrued liabilities 8,520 9,716 Current portion of long-term debt

and obligations under capital leases 700 256 Current portion of

repayable government assistance 1,049 960 Current portion of

non-refundable deferred licensing revenue 1,486 1,486

-------------------------------------------------------------------------

11,755 12,418

-------------------------------------------------------------------------

Long-term Long-term debt 2,171 1,341 Obligations under capital

leases 546 1,184 Repayable government assistance 13,395 6,965

Employee future benefit 2,012 - Deferred government incentives -

2,382 Non-refundable deferred licensing revenue 17,867 19,353

-------------------------------------------------------------------------

47,746 43,643

-------------------------------------------------------------------------

Shareholders' equity Share capital 125,630 96,677 Other paid-in

capital 8,515 8,700 Deficit (112,254) (96,881)

-------------------------------------------------------------------------

21,891 8,496

-------------------------------------------------------------------------

69,637 52,139

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Commitments and contingencies Bioniche Life Sciences Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (thousands of

Canadian dollars, except share amounts) Preferred shares - Common

shares Series 1 No. $ No. $

------------------------------------------------------------

Balance, June 30, 2009 71,681,147 86,895 167 161 Net loss for the

year - - - - Issued under employee share ownership plan 639,176 464

- - Fair value of stock options vested - - - - Directors' remun-

eration 278,495 103 - - Warrants exercised 211,429 165 - - Options

exercised 80,000 90 - -

------------------------------------------------------------

Balance, June 30, 2010 72,890,247 87,717 167 161

------------------------------------------------------------ Net

loss for the year - - - - Issued under employee share ownership

plan 663,021 829 - - Fair value of stock options vested - - - -

Shares issued 20,121,380 28,928 - - Share issuance costs - (2,969)

- - Share redemption (130,000) (156) - - Conversion of Series II

preferred shares 6,521,677 8,799 - - Warrants exercised 710,992 836

- - Options exercised 1,331,375 1,485 - - Related party transaction

- - - -

------------------------------------------------------------

Balance, June 30, 2011 102,108,692 125,469 167 161

------------------------------------------------------------

------------------------------------------------------------ Other

Preferred shares - paid-in Series ll capital Deficit Total No. $ $

$ $

-------------------------------------------------------------------------

Balance, June 30, 2009 9,000,000 8,799 8,539 (95,291) 9,103 Net

loss for the year - - - (1,590) (1,590) Issued under employee share

ownership plan - - - - 464 Fair value of stock options vested - -

240 - 240 Directors' remun- eration - - - - 103 Warrants exercised

- - (61) - 104 Options exercised - - (18) - 72

-------------------------------------------------------------------------

Balance, June 30, 2010 9,000,000 8,799 8,700 (96,881) 8,496

-------------------------------------------------------------------------

Net loss for the year - - - (15,336) (15,336) Issued under employee

share ownership plan - - - - 829 Fair value of stock options vested

- - 477 - 477 Shares issued - - - - 28,928 Share issuance costs - -

- - (2,969) Share redemption - - - (17) (173) Conversion of Series

II preferred shares (9,000,000) (8,799) - - - Warrants exercised -

- (313) - 523 Options exercised - - (349) - 1,136 Related party

transaction - - - (20) (20)

-------------------------------------------------------------------------

Balance, June 30, 2011 - - 8,515 (112,254) 21,891

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Bioniche Life Sciences Inc. CONSOLIDATED STATEMENTS OF LOSS AND

COMPREHENSIVE LOSS Years ended June 30 (thousands of Canadian

dollars, except share and per share amounts) 2011 2010 $ $

-------------------------------------------------------------------------

REVENUES Sales 27,366 26,993 Licensing 5,532 16,203 Research

collaborations 3,146 1,820 Gain on disposal of intangible assets -

883

-------------------------------------------------------------------------

36,044 45,899

-------------------------------------------------------------------------

EXPENSES Cost of sales (excluding amortization) 13,029 12,387

Administration 10,525 6,841 Marketing and selling 6,643 6,264

Financial expenses 1,015 726 Amortization of property, plant and

equipment 1,058 1,080 Amortization and write-down of intangible

assets 881 813 Foreign exchange loss 516 505

-------------------------------------------------------------------------

33,667 28,616

-------------------------------------------------------------------------

Income before research and development expenses and other items

2,377 17,283 Research and development expenses, gross 19,782 18,264

Repayable government assistance - 3,884 Less: government

assistance, net (1,954) (3,181)

-------------------------------------------------------------------------

Loss before income taxes (15,451) (1,684) Provision for income tax

recovery (115) (94)

-------------------------------------------------------------------------

Net loss and comprehensive loss for the year (15,336) (1,590)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and fully diluted net loss per share (0.17) (0.02)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Weighted-average number of common shares outstanding 88,896,923

72,239,959

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Bioniche Life Sciences Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended June 30 (thousands of Canadian dollars) 2011 2010 $ $

-------------------------------------------------------------------------

OPERATING ACTIVITIES Net loss for the year (15,336) (1,590) Add

(deduct) non cash items: Amortization 1,939 1,841 Accreted interest

on discounted receivables and interest-free loans and amortization

of financial expenses 775 471 Write-down of intangible assets - 52

Unrealized foreign exchange loss (gain) 65 (47) Deemed government

assistance (61) (81) Stock-based compensation expense 477 240

Accrued pension expense 2,012 - Repayable government assistance -

3,884 Licensing revenue (1,486) (1,447) Amortization of deferred

government incentives (1,005) (1,689) Future income taxes 97 (248)

Employee share ownership plan 836 528 Gain on sale of intangible

assets - (883)

-------------------------------------------------------------------------

(11,687) 1,031 Decrease in restricted cash - 1,227 Net change in

non-cash working capital balances (1,361) (7,960) Net change in

non-refundable deferred licensing revenue - 22,286

-------------------------------------------------------------------------

Cash (used in) provided by operating activities (13,048) 16,584

-------------------------------------------------------------------------

INVESTING ACTIVITIES Government incentives received on account of

property, plant and equipment 1,496 1,098 Proceeds on settlement of

long-term accounts receivable 100 - Proceeds on sale of intangible

assets - 606 Purchase of short-term investments (1,493) - Proceeds

on disposal of property, plant and equipment 70 21 Purchases of

intangible assets (687) (521) Purchases of property, plant and

equipment (18,718) (7,789)

-------------------------------------------------------------------------

Cash used in investing activities (19,232) (6,585)

-------------------------------------------------------------------------

FINANCING ACTIVITIES Proceeds from government assistance 9,342

1,706 Proceeds from long-term debt 500 - Payment of financing fees

- debt - (2,117) Proceeds from shares issued 30,587 176 Payment of

share issuance costs (2,969) - Redemption of common shares (173) -

Proceeds from deferred government incentives 691 407 Repayment of

government assistance (960) - Repayment of revolving credit

facility - (4,416) Repayment of capital lease obligations (431)

(292) Repayment of long-term debt (24) (343)

-------------------------------------------------------------------------

Cash provided by (used in) financing activities 36,563 (4,879)

-------------------------------------------------------------------------

Net increase in cash and cash equivalents during the year 4,283

5,120 Cash and cash equivalents, beginning of year 11,070 5,950

-------------------------------------------------------------------------

Cash and cash equivalents, end of year 15,353 11,070

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Jennifer Shea, Vice-President, Communications, Investor &

Government Relations, Bioniche Life Sciences Inc., Telephone: (613)

966-8058; from Australia: 0011 1 613-966-8058, Cell: (613)

391-2097; from Australia: 0011 1 613-391-2097,

Jennifer.Shea@Bioniche.com

Copyright

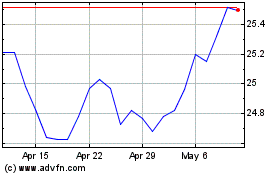

Purpose Canadian Financi... (TSX:BNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Purpose Canadian Financi... (TSX:BNC)

Historical Stock Chart

From Jul 2023 to Jul 2024