0001423774false00014237742024-05-222024-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2024

_________________________________________

Zuora, Inc.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | |

| Delaware | 001-38451 | 20-5530976 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

101 Redwood Shores Parkway, Redwood City, California | | 94065 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (888) 976-9056

Not Applicable

(Former name or former address, if changed since last report.)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | ZUO | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On May 22, 2024, Zuora, Inc. (“Zuora” or “we”) issued a press release announcing the financial results of its fiscal quarter ended April 30, 2024. The press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The information in this current report, including Exhibit 99.1, are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in Exhibit 99.1 shall not be deemed incorporated by reference in any registration statement or other document filed with the Securities and Exchange Commission by Zuora, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished as part of this report:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | |

| | ZUORA, INC. |

| | (Registrant) | |

| | | |

Dated: May 22, 2024 | By: | /s/ Todd McElhatton | |

| | Todd McElhatton | |

| | Chief Financial Officer | |

Exhibit 99.1

Zuora Reports First Quarter Fiscal 2025 Results

Operating cash flow grew to $32.9 million compared to $14.6 million last year

Adjusted free cash flow grew to $31.4 million compared to $13.0 million last year

GAAP operating margin increased 16 percentage points year-over-year

Non-GAAP operating margin increased 11 percentage points year-over-year

Subscription revenue grew 10% year-over-year

Redwood City, Calif. – May 22, 2024 – Zuora, Inc. (NYSE: ZUO), a leading monetization suite for modern business, today announced financial results for its fiscal first quarter ended April 30, 2024.

“Our first quarter speaks to the quality of our install base and ability to drive strong expansion with innovations including the recent acquisition of Togai,” said Tien Tzuo, Founder and CEO at Zuora. “As more companies look to monetize with subscription, usage and other business models, they continue to look to our offerings to accelerate their Total Monetization strategies.”

First Quarter Fiscal 2025 Financial Results:

•Revenue: Subscription revenue was $99.0 million, an increase of 10% year-over-year. Total revenue was $109.8 million, an increase of 6% year-over-year.

•GAAP Loss from Operations: GAAP loss from operations was $4.0 million, compared to a loss from operations of $20.2 million in the first quarter of fiscal 2024.

•Non-GAAP Income from Operations: Non-GAAP income from operations was $18.6 million, compared to non-GAAP income from operations of $6.1 million in the first quarter of fiscal 2024.

•GAAP Net Loss: GAAP net loss was $13.7 million, or 12% of revenue, compared to a net loss of $19.3 million, or 19% of revenue, in the first quarter of fiscal 2024. GAAP net loss per share was $0.09 based on 146.7 million weighted-average shares outstanding, compared to a net loss per share of $0.14 based on 136.2 million weighted-average shares outstanding in the first quarter of fiscal 2024.

•Non-GAAP Net Income: Non-GAAP net income was $16.8 million, compared to non-GAAP net income of $6.9 million in the first quarter of fiscal 2024. Non-GAAP net income per share was $0.11 based on 146.7 million weighted-average shares outstanding, compared to non-GAAP net income per share of $0.05 based on 136.2 million weighted-average shares outstanding in the first quarter of fiscal 2024.

•Cash Flow: Net cash provided by operating activities was $32.9 million, compared to net cash provided by operating activities of $14.6 million in the first quarter of fiscal 2024.

•Adjusted Free Cash Flow: Adjusted free cash flow was $31.4 million compared to $13.0 million in the first quarter of fiscal 2024.

•Cash and Investments: Cash and cash equivalents and short-term investments were $547.2 million as of April 30, 2024.

Descriptions of our non-GAAP financial measures are contained in the section titled "Explanation of Non-GAAP Financial Measures" below and reconciliations of GAAP and non-GAAP financial measures are contained in the tables below.

Key Metrics and Business Highlights:

•Customers with annual contract value (ACV) equal to or greater than $250,000 were 451, up from 436 as of April 30, 2023.

•Dollar-based retention rate (DBRR) was 104%, compared to 108% as of April 30, 2023.

•Annual Recurring Revenue (ARR) was $404.4 million compared to $373.9 million as of April 30, 2023, representing ARR growth of 8%.

•Announced the planned acquisition of Togai, a leading metering and rating solution, to enhance Zuora's usage-based offerings. The acquisition closed in early May.

•Announced that Ubisoft has adopted Zuora to power its Ubisoft+ and Rocksmith+ subscription services.

•Released Zuora's latest Subscription Economy Index (SEI) report, which found that companies in the SEI have experienced 3.4x faster growth rates than the S&P 500 over the past 12 years.

•New customers and go-lives included Mitsubishi Electric, The Asahi Shimbun Company, AVEVA and The Atlantic.

Financial Outlook:

As of May 22, 2024, we are providing guidance for the second quarter and full fiscal year 2025 based on current market conditions and expectations. For the full fiscal year 2025, we are maintaining our topline outlook and raising our non-GAAP operating income range while absorbing the operating expense impact of Togai. We emphasize that the guidance is subject to various important cautionary factors referenced in the section entitled “Forward-Looking Statements” below.

For the second quarter and full fiscal year 2025, Zuora currently expects the following results:

| | | | | | | | | | | |

| | Second Quarter | | Fiscal 2025 |

| Subscription revenue | $101.0M - $102.0M | | $410.0M - $414.0M |

| Professional services revenue | $10.5M - $11.5M | | $41.0M - $45.0M |

| Total revenue | $111.5M - $113.5M | | $451.0M - $459.0M |

Non-GAAP income from operations1 | $17.5M - $19.5M | | $80.0M - $82.0M |

Non-GAAP net income per share1,2 | $0.09 - $0.10 | | $0.41 - $0.43 |

ARR growth3 |

| | 8% - 10% |

Dollar-based Retention Rate3 | | | 104% - 106% |

Adjusted Free Cash Flow1 | | | $80.0M+ |

(1) For information on how we derive our non-GAAP financial measures, see the section titled "Explanation of Non-GAAP Financial Measures" below. Zuora has not reconciled its guidance for non-GAAP income from operations to GAAP loss from operations or non-GAAP net income per share to GAAP net loss per share because stock-based compensation expense cannot be reasonably calculated or predicted at this time. Additionally, adjusted free cash flow has not been reconciled to operating cash flows as it cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation of these non-GAAP measures is not available without unreasonable effort.

(2) Non-GAAP net income per share was computed assuming 149.4 million and 151.0 million weighted-average shares outstanding for the second quarter and full fiscal year 2025, respectively.

(3) Refer to the "Explanation of Key Operational and Financial Metrics" section below for how these metrics are calculated.

These statements are forward-looking and actual results may differ materially. Refer to the “Forward-Looking Statements” safe harbor section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Explanation of Key Operational and Financial Metrics:

Annual Contract Value (ACV). We define ACV as the subscription revenue we would contractually expect to recognize from a customer over the next twelve months, assuming no increases or reductions in their subscriptions. We define the number of customers at the end of any particular period as the number of parties or organizations that have entered into a distinct subscription contract with us and for which the term has not ended. Each party with whom we have entered into a distinct subscription contract is considered a unique customer, and in some cases, there may be more than one customer within a single organization.

Dollar-based Retention Rate (DBRR). We calculate DBRR as of a period end by starting with the sum of the ACV from all customers as of twelve months prior to such period end, or prior period ACV. We then calculate the sum of the ACV from these same customers as of the current period end, or current period ACV. Current period ACV includes any upsells and also reflects contraction or attrition over the trailing twelve months but excludes revenue from new customers added in the current period. We then divide the current period ACV by the prior period ACV to arrive at our dollar-based retention rate.

Annual Recurring Revenue (ARR). ARR represents the annualized recurring value at the time of initial booking or contract modification for all active subscription contracts at the end of a reporting period. ARR excludes the value of non-recurring revenue such as professional services revenue as well as contracts with new customers with a term of less than one year. ARR should be viewed independently of revenue and deferred revenue, and is not intended to be a substitute for, or combined with, any of these items. ARR growth is calculated by dividing the ARR as of a period end by the ARR for the corresponding period end of the prior fiscal year.

Webcast and Conference Call Information:

Zuora will host a conference call for investors on May 22, 2024 at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss the company’s financial results and business highlights. Investors are invited to listen to a live webcast of the conference call by visiting https://investor.zuora.com. A replay of the webcast will be available through May 22, 2025. The call can also be accessed live via phone by the toll-free dial-in number: 1-888-596-4144 or toll dial-in number: 1-646-968-2525 with conference ID 8022374. An audio replay will be available shortly after the call and can be accessed by dialing 1-800-770-2030 or 1-609-800-9909 with conference ID 8022374 available from May 22, 2024 at 4:00 p.m. PT to May 29, 2024 at 11:59 p.m. PT.

Explanation of Non-GAAP Financial Measures:

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release and the accompanying tables contain non-GAAP financial measures including: non-GAAP cost of subscription revenue; non-GAAP subscription gross margin; non-GAAP cost of professional services revenue; non-GAAP professional services gross margin; non-GAAP gross profit; non-GAAP gross margin; non-GAAP income from operations; non-GAAP operating margin; non-GAAP net income; non-GAAP net income per share; and adjusted free cash flow. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

We use non-GAAP financial measures in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our Board of Directors concerning our financial performance. We believe these non-GAAP measures provide investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of our operating results. We also believe these non-GAAP measures are useful in evaluating our operating performance compared to that of other companies in our industry, as they generally eliminate the effects of certain items that may vary for different companies for reasons unrelated to overall operating performance.

We exclude the following items from one or more of our non-GAAP financial measures:

•Stock-based compensation expense. We exclude stock-based compensation expense, which is a non-cash expense, because we believe that excluding this item provides meaningful supplemental information regarding operational performance. In particular, stock-based compensation expense is not comparable across companies given it is calculated using a variety of valuation methodologies and subjective assumptions.

•Amortization of acquired intangible assets. We exclude amortization of acquired intangible assets, which is a non-cash expense, because we do not believe it has a direct correlation to the operation of our business.

•Charitable contributions. We exclude expenses associated with charitable donations of our common stock. We believe that excluding these non-cash expenses allows investors to make more meaningful comparisons between our operating results and those of other companies.

•Shareholder matters. We exclude non-recurring charges and benefits, net of insurance recoveries, including litigation expenses, settlements and other legal, consulting and advisory fees, related to shareholder matters that are outside of the ordinary course of our business, including expenses related to a cooperation agreement. We believe these charges and benefits do not have a direct correlation to the operations of our business and may vary in size depending on the timing, results and resolution of such litigation, settlements, agreements or other shareholder matters.

•Asset impairment. We exclude non-cash charges for impairment of assets, including impairments related to internal-use software, office leases, and acquired intangible assets. Impairment charges can vary significantly in terms of amount and timing and we do not consider these charges indicative of our current or past operating performance. Moreover, we believe that excluding the effects of these charges allows investors to make more meaningful comparisons between our operating results and those of other companies.

•Change in fair value of debt conversion and warrant liabilities. We exclude fair value adjustments related to the debt conversion and warrant liabilities, which are non-cash gains or losses, as they can fluctuate significantly with changes in Zuora's stock price and market volatility, and do not reflect the underlying cash flows or operational results of the business.

•Acquisition-related expenses. We exclude acquisition-related expenses (including integration-related charges) that are not related to our ongoing operations, including expenses we incurred and gains or losses recognized on contingent consideration, related to our acquisitions. We do not consider these transaction expenses as reflective of our core business or ongoing operating performance.

•Workforce reductions. We exclude charges related to workforce reduction plans, including severance, health care and related expenses. We believe these charges are not indicative of our continuing operations.

Additionally, we disclose "adjusted free cash flow", which is a non-GAAP measure that includes adjustments to operating cash flows for cash impacts related to Shareholder matters and Acquisition-related expenses described above, and net purchases of property and equipment. We include the impact of net purchases of property and equipment in our adjusted free cash flow calculation because we consider these capital expenditures to be a necessary component of our ongoing operations. We believe this measure is meaningful to investors because management reviews cash flows generated from operations excluding such expenditures that are not related to our ongoing operations.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures.

Forward-Looking Statements:

Zuora’s Financial Outlook and other statements in this release that refer to future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as “believes,” “may,” “will,” “determine,” “estimates,” “potential,” “continues,” “anticipates,” “intends,” “expects,” “could,” “would,” “projects,” “plans,” “targets,” “strategy,” “likely,” and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this release include our financial outlook for the second quarter and full year fiscal 2025. Forward-looking statements are based on management's expectations as of the date of this filing and are subject to a number of risks, uncertainties and assumptions, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in our Form 10-K filed with the Securities and Exchange Commission on March 26, 2024 as well as other documents that may be filed by us from time to time with the Securities and Exchange Commission. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: our ability to attract new customers and retain and expand sales to existing customers; our ability to manage our future revenue and profitability plans effectively; adoption of monetization platform software and related solutions, as well as consumer adoption of products and services that are provided through such solutions; our ability to develop and release new products and services, or successful enhancements, new features and modifications; challenges related to growing our relationships with strategic partners; loss of key employees; our ability to compete in our markets; adverse impacts on our business and financial condition due to macroeconomic or market conditions; the impact of actions to improve operational efficiencies and operating costs; our history of net losses and ability to achieve or sustain profitability; market acceptance of our products; the success of our product development efforts; risks associated with currency exchange rate fluctuations; risks associated with our debt obligations; successful deployment of our solutions by customers after entering into a subscription agreement with us; the success of our sales and product initiatives; our security measures; our ability to adequately protect our intellectual property; interruptions or performance problems; litigation and other shareholder related costs; the anticipated benefits of acquisitions and ability to integrate operations and technology of any acquired company; geopolitical conflicts or destabilizing events; other business effects, including those related to industry, market, economic, political, regulatory and global health conditions and other risks and uncertainties. The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

About Zuora, Inc.

Zuora provides a leading monetization suite to build, run and grow a modern business through a dynamic mix of usage-based models, subscription bundles and everything in between. From pricing and packaging, to billing, payments and revenue accounting, Zuora’s flexible, modular software platform is designed to help companies evolve monetization strategies with customer demand. More than 1,000 customers around the world, including BMC Software, Box, Caterpillar, General Motors, Penske Media Corporation, Schneider Electric and Zoom use Zuora’s leading combination of technology and expertise to turn recurring relationships and recurring revenue into recurring growth. Zuora is headquartered in Silicon Valley with offices in the Americas, EMEA and APAC. To learn more, please visit zuora.com.

Investor Relations Contact:

Luana Wolk

investorrelations@zuora.com

650-419-1377

Media Relations Contact:

Margaret Juhnke

press@zuora.com

619-609-3919

© 2024 Zuora, Inc. All Rights Reserved. Zuora, Subscribed, Subscription Economy, Powering the Subscription Economy, Subscription Economy Index, Zephr, and Subscription Experience Platform are trademarks or registered trademarks of Zuora, Inc. Third party trademarks mentioned above are owned by their respective companies. Nothing in this press release should be construed to the contrary, or as an approval, endorsement or sponsorship by any third parties of Zuora, Inc. or any aspect of this press release.

SOURCE: Zuora, Inc.

ZUORA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands, except per share data)

(unaudited) | | | | | | | | | | | |

| | Three Months Ended

April 30, |

| | 2024 | | 2023 |

| Revenue: | | | |

| Subscription | $ | 98,959 | | | $ | 89,711 | |

| Professional services | 10,810 | | | 13,384 | |

| Total revenue | 109,769 | | | 103,095 | |

| Cost of revenue: | | | |

Subscription1 | 20,689 | | | 20,588 | |

Professional services1 | 14,372 | | | 16,758 | |

| Total cost of revenue | 35,061 | | | 37,346 | |

| Gross profit | 74,708 | | | 65,749 | |

| Operating expenses: | | | |

Research and development1 | 23,566 | | | 25,668 | |

Sales and marketing1 | 35,845 | | | 41,444 | |

General and administrative1 | 19,269 | | | 18,816 | |

| Total operating expenses | 78,680 | | | 85,928 | |

| Loss from operations | (3,972) | | | (20,179) | |

| Change in fair value of debt conversion and warrant liabilities | (7,928) | | | 30 | |

| Interest expense | (6,771) | | | (4,387) | |

| Interest and other income (expense), net | 5,315 | | | 5,710 | |

| Loss before income taxes | (13,356) | | | (18,826) | |

| Income tax provision | 352 | | | 469 | |

| Net loss | (13,708) | | | (19,295) | |

| Comprehensive loss: | | | |

| Foreign currency translation adjustment | (247) | | | (283) | |

| Unrealized (loss) gain on available-for-sale securities | (487) | | | 340 | |

| Comprehensive loss | $ | (14,442) | | | $ | (19,238) | |

| Net loss per share, basic and diluted | $ | (0.09) | | | $ | (0.14) | |

| Weighted-average shares outstanding used in calculating net loss per share, basic and diluted | 146,670 | | | 136,190 | |

_____________________

(1) Stock-based compensation expense was recorded in the following cost and expense categories:

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| | 2024 | | 2023 |

| Cost of subscription revenue | $ | 1,583 | | | $ | 2,359 | |

| Cost of professional services revenue | 2,038 | | | 3,021 | |

| Research and development | 5,903 | | | 6,744 | |

| Sales and marketing | 5,475 | | | 7,977 | |

| General and administrative | 3,462 | | | 5,123 | |

| Total stock-based compensation expense | $ | 18,461 | | | $ | 25,224 | |

ZUORA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited) | | | | | | | | | | | |

| | April 30, 2024 | | January 31, 2024 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 265,712 | | | $ | 256,065 | |

| Short-term investments | 281,442 | | | 258,120 | |

| Accounts receivable, net | 77,399 | | | 124,602 | |

| Deferred commissions, current portion | 15,934 | | | 15,870 | |

| Prepaid expenses and other current assets | 25,624 | | | 23,261 | |

| Total current assets | 666,111 | | | 677,918 | |

| Property and equipment, net | 26,218 | | | 25,961 | |

| Operating lease right-of-use assets | 21,270 | | | 22,462 | |

| Purchased intangibles, net | 9,474 | | | 10,082 | |

| Deferred commissions, net of current portion | 25,952 | | | 27,250 | |

| Goodwill | 56,147 | | | 56,657 | |

| Other assets | 4,574 | | | 3,506 | |

| Total assets | $ | 809,746 | | | $ | 823,836 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 153 | | | $ | 3,161 | |

| Accrued expenses and other current liabilities | 41,308 | | | 32,157 | |

| Accrued employee liabilities | 28,465 | | | 37,722 | |

| | | |

| Deferred revenue, current portion | 184,278 | | | 199,615 | |

| Operating lease liabilities, current portion | 5,929 | | | 6,760 | |

| Total current liabilities | 260,133 | | | 279,415 | |

| Long-term debt | 362,310 | | | 359,525 | |

| Deferred revenue, net of current portion | 1,411 | | | 2,802 | |

| Operating lease liabilities, net of current portion | 35,276 | | | 37,100 | |

| Deferred tax liabilities | 3,726 | | | 3,725 | |

| Other long-term liabilities | 7,592 | | | 7,582 | |

| Total liabilities | 670,448 | | | 690,149 | |

| | | |

| Stockholders’ equity: | | | |

| Class A common stock | 14 | | | 14 | |

| Class B common stock | 1 | | | 1 | |

| Additional paid-in capital | 984,194 | | | 964,141 | |

| Accumulated other comprehensive loss | (1,593) | | | (859) | |

| Accumulated deficit | (843,318) | | | (829,610) | |

| Total stockholders’ equity | 139,298 | | | 133,687 | |

| Total liabilities and stockholders’ equity | $ | 809,746 | | | $ | 823,836 | |

ZUORA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited) | | | | | | | | | | | |

| | Three Months Ended

April 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (13,708) | | | $ | (19,295) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation, amortization and accretion | 4,235 | | | 4,290 | |

| Stock-based compensation | 18,461 | | | 25,224 | |

| Provision for credit losses | 501 | | | 1,117 | |

| | | |

| Amortization of deferred commissions | 4,554 | | | 4,970 | |

| Reduction in carrying amount of right-of-use assets | 1,192 | | | 1,584 | |

| Change in fair value of debt conversion and warrant liabilities | 7,928 | | | (30) | |

| | | |

| Other | 78 | | | 140 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 46,702 | | | 7,531 | |

| Prepaid expenses and other assets | (2,745) | | | (112) | |

| Deferred commissions | (3,375) | | | (3,607) | |

| Accounts payable | (3,002) | | | 4,703 | |

| Accrued expenses and other liabilities | 1,234 | | | (2,000) | |

| Accrued employee liabilities | (9,257) | | | (3,823) | |

| Deferred revenue | (16,728) | | | (2,527) | |

| Operating lease liabilities | (3,200) | | | (3,572) | |

| Net cash provided by operating activities | 32,870 | | | 14,593 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (2,655) | | | (1,657) | |

| Purchases of short-term investments | (90,399) | | | (61,745) | |

| Maturities of short-term investments | 68,486 | | | 88,228 | |

| Cash paid for acquisition | — | | | (4,524) | |

| Net cash (used in) provided by investing activities | (24,568) | | | 20,302 | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from issuance of common stock upon exercise of stock options | 1,592 | | | 537 | |

| | | |

| | | |

| Net cash provided by financing activities | 1,592 | | | 537 | |

| Effect of exchange rates on cash and cash equivalents | (247) | | | (283) | |

| Net increase in cash and cash equivalents | 9,647 | | | 35,149 | |

| Cash and cash equivalents, beginning of period | 256,065 | | | 203,239 | |

| Cash and cash equivalents, end of period | $ | 265,712 | | | $ | 238,388 | |

ZUORA, INC.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except percentages)

(unaudited)

Subscription Gross Margin

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

| Reconciliation of cost of subscription revenue: | | | |

| GAAP cost of subscription revenue | $ | 20,689 | | | $ | 20,588 | |

| Less: | | | |

| Stock-based compensation | (1,583) | | | (2,359) | |

| Amortization of acquired intangibles | (608) | | | (738) | |

| | | |

| Workforce reductions | (166) | | | (38) | |

| Non-GAAP cost of subscription revenue | $ | 18,332 | | | $ | 17,453 | |

| GAAP subscription gross margin | 79 | % | | 77 | % |

| Non-GAAP subscription gross margin | 81 | % | | 81 | % |

Professional Services Gross Margin

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

| Reconciliation of cost of professional services revenue: | | | |

| GAAP cost of professional services revenue | $ | 14,372 | | | $ | 16,758 | |

(Less) Add: | | | |

| Stock-based compensation | (2,038) | | | (3,021) | |

| Workforce reductions | 6 | | | — | |

| Non-GAAP cost of professional services revenue | $ | 12,340 | | | $ | 13,737 | |

| GAAP professional services gross margin | (33) | % | | (25) | % |

| Non-GAAP professional services gross margin | (14) | % | | (3) | % |

ZUORA, INC.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED)

(in thousands, except percentages)

(unaudited)

Total Gross Margin

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

| Reconciliation of gross profit: | | | |

| GAAP gross profit | $ | 74,708 | | | $ | 65,749 | |

| Add: | | | |

| Stock-based compensation | 3,621 | | | 5,380 | |

| Amortization of acquired intangibles | 608 | | | 738 | |

| | | |

| Workforce reductions | 160 | | | 38 | |

| Non-GAAP gross profit | $ | 79,097 | | | $ | 71,905 | |

| GAAP gross margin | 68 | % | | 64 | % |

| Non-GAAP gross margin | 72 | % | | 70 | % |

Operating (Loss) Income and Operating Margin

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

| Reconciliation of (loss) income from operations: | | | |

| GAAP loss from operations | $ | (3,972) | | | $ | (20,179) | |

| Add: | | | |

| Stock-based compensation | 18,461 | | | 25,224 | |

| Shareholder matters | 2,765 | | | 35 | |

Workforce reductions | 700 | | | 219 | |

| | | |

| | | |

| | | |

| Amortization of acquired intangibles | 608 | | | 738 | |

| Acquisition-related expenses | — | | | 34 | |

| Non-GAAP income from operations | $ | 18,562 | | | $ | 6,071 | |

| GAAP operating margin | (4) | % | | (20) | % |

| Non-GAAP operating margin | 17 | % | | 6 | % |

ZUORA, INC.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED)

(in thousands, except per share data)

(unaudited)

Net (Loss) Income and Net (Loss) Income Per Share

| | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

| Reconciliation of net (loss) income: | | | |

| GAAP net loss | $ | (13,708) | | | $ | (19,295) | |

| Add: | | | |

| Stock-based compensation | 18,461 | | | 25,224 | |

| Change in fair value of debt conversion and warrant liabilities | 7,928 | | | (30) | |

| Shareholder matters | 2,765 | | | 35 | |

| Workforce reductions | 700 | | | 219 | |

| Amortization of acquired intangibles | 608 | | | 738 | |

| | | |

| | | |

| | | |

| Acquisition-related expenses | — | | | 34 | |

| Non-GAAP net income | $ | 16,754 | | | $ | 6,925 | |

GAAP net loss per share, basic and diluted1 | $ | (0.09) | | | $ | (0.14) | |

Non-GAAP net income per share, basic and diluted1 | $ | 0.11 | | | $ | 0.05 | |

_________________________________

(1) For the three months ended April 30, 2024 and 2023, GAAP and Non-GAAP net (loss) income per share are calculated based upon 146.7 million and 136.2 million basic and diluted weighted-average shares of common stock, respectively.

Adjusted Free Cash Flow | | | | | | | | | | | |

| Three Months Ended

April 30, |

| 2024 | | 2023 |

Net cash provided by operating activities (GAAP) | $ | 32,870 | | | $ | 14,593 | |

| Add: | | | |

Shareholder matters | 1,188 | | | 27 | |

Acquisition-related expenses | — | | | 16 | |

| Less: | | | |

| Purchases of property and equipment | (2,655) | | | (1,657) | |

| Adjusted free cash flow (non-GAAP) | $ | 31,403 | | | $ | 12,979 | |

Net cash (used in) provided by investing activities (GAAP) | $ | (24,568) | | | $ | 20,302 | |

| Net cash provided by financing activities (GAAP) | $ | 1,592 | | | $ | 537 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

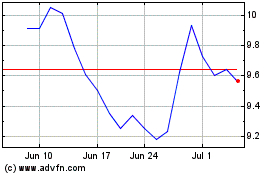

Zuora (NYSE:ZUO)

Historical Stock Chart

From May 2024 to Jun 2024

Zuora (NYSE:ZUO)

Historical Stock Chart

From Jun 2023 to Jun 2024