00016705922024Q1false--12-28xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00016705922023-12-312024-03-3000016705922024-05-0300016705922024-03-3000016705922023-12-3000016705922023-01-012023-04-010001670592us-gaap:CommonStockMember2023-12-300001670592us-gaap:AdditionalPaidInCapitalMember2023-12-300001670592us-gaap:TreasuryStockCommonMember2023-12-300001670592us-gaap:RetainedEarningsMember2023-12-300001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-300001670592us-gaap:AdditionalPaidInCapitalMember2023-12-312024-03-300001670592us-gaap:CommonStockMember2023-12-312024-03-300001670592us-gaap:TreasuryStockCommonMember2023-12-312024-03-300001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-312024-03-300001670592us-gaap:RetainedEarningsMember2023-12-312024-03-300001670592us-gaap:CommonStockMember2024-03-300001670592us-gaap:AdditionalPaidInCapitalMember2024-03-300001670592us-gaap:TreasuryStockCommonMember2024-03-300001670592us-gaap:RetainedEarningsMember2024-03-300001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-300001670592us-gaap:CommonStockMember2022-12-310001670592us-gaap:AdditionalPaidInCapitalMember2022-12-310001670592us-gaap:TreasuryStockCommonMember2022-12-310001670592us-gaap:RetainedEarningsMember2022-12-310001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100016705922022-12-310001670592us-gaap:AdditionalPaidInCapitalMember2023-01-012023-04-010001670592us-gaap:CommonStockMember2023-01-012023-04-010001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-04-010001670592us-gaap:RetainedEarningsMember2023-01-012023-04-010001670592us-gaap:CommonStockMember2023-04-010001670592us-gaap:AdditionalPaidInCapitalMember2023-04-010001670592us-gaap:TreasuryStockCommonMember2023-04-010001670592us-gaap:RetainedEarningsMember2023-04-010001670592us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-0100016705922023-04-010001670592yeti:MysteryRanchLLCMember2024-02-022024-02-020001670592yeti:MysteryRanchLLCMember2024-02-020001670592srt:MinimumMemberyeti:TradeNameAndCustomerRelationshipsMember2024-03-300001670592yeti:TradeNameAndCustomerRelationshipsMembersrt:MaximumMember2024-03-300001670592yeti:UnredeemedGiftCardsMember2024-03-300001670592us-gaap:SalesChannelThroughIntermediaryMember2023-12-312024-03-300001670592us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-04-010001670592us-gaap:SalesChannelDirectlyToConsumerMember2023-12-312024-03-300001670592us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-04-010001670592yeti:CoolersAndEquipmentMember2023-12-312024-03-300001670592yeti:CoolersAndEquipmentMember2023-01-012023-04-010001670592yeti:DrinkwareMember2023-12-312024-03-300001670592yeti:DrinkwareMember2023-01-012023-04-010001670592us-gaap:ProductAndServiceOtherMember2023-12-312024-03-300001670592us-gaap:ProductAndServiceOtherMember2023-01-012023-04-010001670592country:US2023-12-312024-03-300001670592country:US2023-01-012023-04-010001670592yeti:OtherThanUnitedStatesMember2023-12-312024-03-300001670592yeti:OtherThanUnitedStatesMember2023-01-012023-04-010001670592us-gaap:EmployeeStockOptionMember2023-12-300001670592yeti:PerformanceBasedRestrictedStockAwardsPBRSsAndPerformanceBasedRestrictedStockUnitsPRSUsMember2023-12-300001670592yeti:RestrictedStockUnitsRSUsRestrictedStockAwardsRSAsAndDeferredStockUnitsDSAsMember2023-12-300001670592us-gaap:EmployeeStockOptionMember2023-12-312024-03-300001670592yeti:PerformanceBasedRestrictedStockAwardsPBRSsAndPerformanceBasedRestrictedStockUnitsPRSUsMember2023-12-312024-03-300001670592yeti:RestrictedStockUnitsRSUsRestrictedStockAwardsRSAsAndDeferredStockUnitsDSAsMember2023-12-312024-03-300001670592us-gaap:EmployeeStockOptionMember2024-03-300001670592yeti:PerformanceBasedRestrictedStockAwardsPBRSsAndPerformanceBasedRestrictedStockUnitsPRSUsMember2024-03-300001670592yeti:RestrictedStockUnitsRSUsRestrictedStockAwardsRSAsAndDeferredStockUnitsDSAsMember2024-03-300001670592us-gaap:EmployeeStockOptionMember2023-12-312024-03-300001670592us-gaap:EmployeeStockOptionMember2023-01-012023-04-0100016705922024-02-0100016705922024-02-2700016705922024-02-272024-02-270001670592us-gaap:SubsequentEventMember2024-04-250001670592us-gaap:SubsequentEventMember2024-04-252024-04-250001670592yeti:RedeemedGiftCardsMember2023-12-312024-03-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________

FORM 10-Q

____________________________________________________________________________________________ | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 30, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38713

_____________________________________________________

YETI Holdings, Inc.

(Exact name of registrant as specified in its charter)

______________________________________________________ | | | | | | | | |

| Delaware | | 45-5297111 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

7601 Southwest Parkway

Austin, Texas 78735

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code) (512) 394-9384

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | YETI | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

Large accelerated filer | ☒ | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 85,238,498 shares of Common Stock ($0.01 par value) outstanding as of May 3, 2024.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current fact included in this Quarterly Report on Form 10-Q are forward-looking statements. Forward-looking statements include statements containing words such as “anticipate,” “assume,” “believe,” “can,” “have,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “potential,” “seek,” “should,” “target,” “will,” “would,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operational performance or other events. For example, all statements made relating to our future expectations relating to our recent acquisitions, expected market or macroeconomic environment, estimated and projected costs, expenditures, and growth rates, plans and objectives for future operations, growth, or initiatives, or strategies are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that are expected and, therefore, you should not unduly rely on such statements. The risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include but are not limited to economic conditions or consumer confidence in future economic conditions; our ability to maintain and strengthen our brand and generate and maintain ongoing demand and prices for our products; our ability to successfully design, develop and market new products; our ability to accurately forecast demand for our products and our results of operations; our ability to effectively manage our growth and supply chain; our ability to expand into additional consumer markets, and our success in doing so; the success of our international expansion plans; our ability to compete effectively in the outdoor and recreation market and protect our brand; the level of customer spending for our products, which is sensitive to general economic conditions and other factors; our ability to attract and retain skilled personnel and senior management, and to maintain the continued efforts of our management and key employees; our ability to protect our intellectual property; claims by third parties that we have infringed on their intellectual property rights; our involvement in legal or regulatory proceedings or audits; product recalls, warranty liability, product liability, or other claims against us; problems with, or loss of, our third-party contract manufacturers and suppliers, or an inability to obtain raw materials; our ability to timely obtain shipments and deliver products; risks related to manufacturer concentrations; fluctuations in the cost and availability of raw materials, equipment, labor, and transportation and subsequent manufacturing delays or increased costs; legal, regulatory, economic, political and public health risks associated with international trade; risks associated with tariffs; the impact of currency exchange rate fluctuations; our ability to appropriately address emerging environmental, social and governance matters and meet our environmental, social and governance goals; our and our suppliers’ and partners’ ability to comply with applicable laws and regulations; our relationships with our national, regional, and independent retail partners, who account for a significant portion of our sales; seasonal and quarterly variations in our business; financial difficulties facing our retail partners; the impact of catastrophic events or failures of our information systems, including due to cybersecurity incidents, on our operations and the operations of our manufacturing partners; our ability to raise additional capital on acceptable terms; the impact of our indebtedness on our ability to invest in the ongoing needs of our business; impairment to our goodwill or other intangible assets; changes in tax laws or unanticipated tax liabilities; changes to our estimates or judgments; our ability to successfully execute our share repurchase program and its impact on stockholder value and the volatility of the price of our common stock; strategic transactions targeting us; the impact of stockholder activism, takeover proposals, proxy contests or short sellers; disruptions or diversions of our management’s attention due to acquisitions or investments in other companies; and the risks and uncertainties described in detail in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 30, 2023, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the United States Securities and Exchange Commission.

These forward-looking statements are made based upon detailed assumptions and reflect management’s current expectations and beliefs. While we believe that these assumptions underlying the forward-looking statements are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect actual results.

The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

WEBSITE REFERENCES

In this Quarterly Report on Form 10-Q, we make references to our website at YETI.com. References to our website through this Form 10-Q are provided for convenience only and the content on our website does not constitute a part of, and shall not be deemed incorporated by reference into, this Quarterly Report on Form 10-Q.

TRADEMARKS AND SERVICE MARKS

Solely for convenience, certain trademark and service marks referred to in this Quarterly Report on Form 10-Q appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and service marks. This Quarterly Report on Form 10-Q may also contain additional trademarks or service marks of other companies, which are the property of their respective owners.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except shares and par value) | | | | | | | | | | | |

| March 30,

2024 | | December 30,

2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash | $ | 173,911 | | | $ | 438,960 | |

| Accounts receivable, net | 108,350 | | | 95,774 | |

| Inventory | 363,919 | | | 337,208 | |

| Prepaid expenses and other current assets | 57,005 | | | 42,463 | |

| Total current assets | 703,185 | | | 914,405 | |

| Property and equipment, net | 129,941 | | | 130,714 | |

| Operating lease right-of-use assets | 77,171 | | | 77,556 | |

| Goodwill | 72,894 | | | 54,293 | |

| Intangible assets, net | 133,927 | | | 117,629 | |

| | | |

| Other assets | 2,686 | | | 2,595 | |

| Total assets | $ | 1,119,804 | | | $ | 1,297,192 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 139,133 | | | $ | 190,392 | |

| Accrued expenses and other current liabilities | 97,359 | | | 130,026 | |

| Taxes payable | 29,151 | | | 33,489 | |

| Accrued payroll and related costs | 11,057 | | | 23,141 | |

| Current operating lease liabilities | 15,703 | | | 14,726 | |

| Current maturities of long-term debt | 6,367 | | | 6,579 | |

| Total current liabilities | 298,770 | | | 398,353 | |

| Long-term debt, net of current portion | 77,379 | | | 78,645 | |

| Operating lease liabilities, non-current | 75,398 | | | 76,163 | |

| Other liabilities | 21,358 | | | 20,421 | |

| Total liabilities | 472,905 | | | 573,582 | |

| | | |

| Commitments and contingencies (Note 10) | | | |

| | | |

| Stockholders’ Equity | | | |

Common stock, par value $0.01; 600,000,000 shares authorized; 88,906,143 and 85,231,091 shares issued and outstanding at March 30, 2024, respectively, and 88,592,761 and 86,916,210 shares issued and outstanding at December 30, 2023, respectively | 889 | | | 886 | |

Treasury stock, at cost; 3,675,052 shares at March 30, 2024 and 1,676,551 at December 30, 2023 | (180,702) | | | (100,025) | |

Preferred stock, par value $0.01; 30,000,000 shares authorized; no shares issued or outstanding | — | | | — | |

| Additional paid-in capital | 373,697 | | | 386,377 | |

| Retained earnings | 454,291 | | | 438,436 | |

Accumulated other comprehensive loss | (1,276) | | | (2,064) | |

| Total stockholders’ equity | 646,899 | | | 723,610 | |

| Total liabilities and stockholders’ equity | $ | 1,119,804 | | | $ | 1,297,192 | |

See Notes to Unaudited Condensed Consolidated Financial Statements

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30,

2024 | | April 1,

2023 | | | | |

| Net sales | $ | 341,394 | | | $ | 302,796 | | | | | |

| Cost of goods sold | 146,581 | | | 140,926 | | | | | |

| Gross profit | 194,813 | | | 161,870 | | | | | |

| Selling, general, and administrative expenses | 168,996 | | | 146,772 | | | | | |

| Operating income | 25,817 | | | 15,098 | | | | | |

Interest income (expense), net | 659 | | | (594) | | | | | |

| Other (expense) income, net | (4,101) | | | 6 | | | | | |

| Income before income taxes | 22,375 | | | 14,510 | | | | | |

| Income tax expense | (6,520) | | | (3,946) | | | | | |

| Net income | $ | 15,855 | | | $ | 10,564 | | | | | |

| | | | | | | |

| Net income per share | | | | | | | |

| Basic | $ | 0.18 | | | $ | 0.12 | | | | | |

| Diluted | $ | 0.18 | | | $ | 0.12 | | | | | |

| | | | | | | |

| Weighted-average common shares outstanding | | | | | | | |

| Basic | 86,355 | | | 86,529 | | | | | |

| Diluted | 87,157 | | | 87,086 | | | | | |

See Notes to Unaudited Condensed Consolidated Financial Statements

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30,

2024 | | April 1,

2023 | | | | |

| Net income | $ | 15,855 | | | $ | 10,564 | | | | | |

| Other comprehensive income (loss) | | | | | | | |

| Foreign currency translation adjustments | 788 | | | (197) | | | | | |

| Total comprehensive income | $ | 16,643 | | | $ | 10,367 | | | | | |

See Notes to Unaudited Condensed Consolidated Financial Statements

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands, including shares) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 30, 2024 |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Retained Earnings | | Accumulated

Other

Comprehensive

Loss | | Total

Stockholders’

Equity |

| Shares | | Amount | | | Shares | | Amount | | | |

| Balance, December 30, 2023 | 88,593 | | | $ | 886 | | | $ | 386,377 | | | (1,677) | | | (100,025) | | | $ | 438,436 | | | $ | (2,064) | | | $ | 723,610 | |

| Stock-based compensation | — | | | — | | | 8,497 | | | — | | | — | | | — | | | — | | | 8,497 | |

Common stock issued under employee benefit plans | 343 | | | 3 | | | (3) | | | — | | | — | | | — | | | — | | | — | |

| Common stock withheld related to net share settlement of stock-based compensation | (30) | | | — | | | (1,174) | | | — | | | — | | | — | | | — | | | (1,174) | |

Repurchase of common stock, including excise tax | — | | | — | | | (20,000) | | | (1,998) | | | (80,677) | | | — | | | — | | | (100,677) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 788 | | | 788 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 15,855 | | | — | | | 15,855 | |

| Balance, March 30, 2024 | 88,906 | | | $ | 889 | | | $ | 373,697 | | | (3,675) | | | $ | (180,702) | | | $ | 454,291 | | | $ | (1,276) | | | $ | 646,899 | |

| | | | | | | | | | | | | | | |

| Three Months Ended April 1, 2023 |

| Common Stock | | Additional

Paid-In

Capital | | Treasury Stock | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income | | Total

Stockholders’

Equity |

| Shares | | Amount | | | Shares | | Amount | | | |

Balance, December 31, 2022 | 88,108 | | | $ | 881 | | | $ | 357,490 | | | (1,677) | | | (100,025) | | | $ | 268,551 | | | $ | (420) | | | $ | 526,477 | |

| Stock-based compensation | — | | | — | | | 6,775 | | | — | | | — | | | — | | | — | | | 6,775 | |

Common stock issued under employee benefit plans | 252 | | | 2 | | | 677 | | | — | | | — | | | — | | | — | | | 679 | |

| Common stock withheld related to net share settlement of stock-based compensation | (44) | | | — | | | (1,737) | | | — | | | — | | | — | | | — | | | (1,737) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (197) | | | (197) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 10,564 | | | — | | | 10,564 | |

| Balance, April 1, 2023 | 88,316 | | | $ | 883 | | | $ | 363,205 | | | (1,677) | | | $ | (100,025) | | | $ | 279,115 | | | $ | (617) | | | $ | 542,561 | |

See Notes to Unaudited Condensed Consolidated Financial Statements

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands) | | | | | | | | | | | |

| Three Months Ended |

| March 30,

2024 | | April 1,

2023 |

| Cash Flows from Operating Activities: | | | |

| Net income | $ | 15,855 | | | $ | 10,564 | |

| Adjustments to reconcile net income to cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 11,474 | | | 11,402 | |

| Amortization of deferred financing fees | 163 | | | 138 | |

| Stock-based compensation | 8,497 | | | 6,775 | |

| Deferred income taxes | (7) | | | 6,832 | |

| Impairment of long-lived assets | 2,025 | | | — | |

| | | |

| | | |

| Other | 3,117 | | | (303) | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (9,480) | | | (16,114) | |

| Inventory | (11,090) | | | 23,988 | |

| Other current assets | (10,425) | | | (10,930) | |

| Accounts payable and accrued expenses | (106,536) | | | (69,655) | |

| Taxes payable | (8,032) | | | (8,512) | |

| Other | 765 | | | (873) | |

| Net cash used in operating activities | (103,674) | | | (46,688) | |

| Cash Flows from Investing Activities: | | | |

| Purchases of property and equipment | (10,644) | | | (10,082) | |

Business acquisition, net of cash acquired | (36,164) | | | — | |

| Additions of intangibles, net | (11,197) | | | (3,165) | |

| | | |

| Net cash used in investing activities | (58,005) | | | (13,247) | |

| Cash Flows from Financing Activities: | | | |

| Repayments of long-term debt | (1,055) | | | (5,625) | |

| | | |

| Taxes paid in connection with employee stock transactions | (1,174) | | | (1,737) | |

| Proceeds from employee stock transactions | — | | | 679 | |

| Finance lease principal payment | (586) | | | (710) | |

| | | |

| | | |

| | | |

| Repurchase of common stock | (100,000) | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in financing activities | (102,815) | | | (7,393) | |

| Effect of exchange rate changes on cash | (555) | | | 428 | |

| Net decrease in cash | (265,049) | | | (66,900) | |

| Cash, beginning of period | 438,960 | | | 234,741 | |

| Cash, end of period | $ | 173,911 | | | $ | 167,841 | |

| | | |

| | | |

| | | |

| | | |

See Notes to Unaudited Condensed Consolidated Financial Statements

YETI HOLDINGS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization and Business

Headquartered in Austin, Texas, YETI Holdings, Inc. is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to bags and apparel, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes you. We sell our products through our wholesale channel, including independent retailers, national, and regional accounts across a wide variety of end user markets, as well as through our direct-to-consumer (“DTC”) channel, which includes our websites, YETI Authorized on the Amazon Marketplace, our corporate sales program, and our retail stores. We operate in the U.S., Canada, Australia, New Zealand, Europe, Hong Kong, China, Singapore, and Japan. In the first quarter of 2024, we acquired Mystery Ranch, LLC, which is a designer and manufacturer of durable load-bearing backpacks, bags, and pack accessories.

The terms “we,” “us,” “our,” “YETI” and “the Company” as used herein and unless otherwise stated or indicated by context, refer to YETI Holdings, Inc. and its subsidiaries.

Basis of Presentation and Principles of Consolidation

The unaudited condensed consolidated financial statements and the accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and the rules of the U.S. Securities and Exchange Commission (“SEC”). Accordingly, our financial statements reflect all normal and recurring adjustments that are, in the opinion of management, necessary for a fair statement of our results of operations for the interim periods. Intercompany balances and transactions are eliminated in consolidation. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to applicable rules and regulations of the SEC. The consolidated balance sheet as of December 30, 2023 is derived from the audited financial statements included in our Annual Report on Form 10-K filed with the SEC for the year ended December 30, 2023, which should be read in conjunction with these unaudited consolidated financial statements and notes thereto.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses during the reporting period and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements. Estimates and assumptions about future events and their effects cannot be made with certainty. Estimates may change as new events occur, when additional information becomes available and if our operating environment changes. Actual results could differ from our estimates.

Fiscal Year End

We have a 52- or 53-week fiscal year that ends on the Saturday closest in proximity to December 31, such that each quarterly period will be 13 weeks in length, except during a 53-week year when the fourth quarter will be 14 weeks. Our fiscal year ending December 28, 2024 (“2024”) is a 52-week period. The first quarter of our fiscal year 2024 ended on March 30, 2024, the second quarter ends on June 29, 2024, and the third quarter ends September 28, 2024. Our fiscal year ended December 30, 2023 (“2023”) was also a 52-week period. Unless otherwise stated, references to particular years, quarters, months and periods refer to our fiscal years and the associated quarters, months, and periods of those fiscal years. The unaudited condensed consolidated financial results presented herein represent the three months ended March 30, 2024 and April 1, 2023.

Accounts Receivable

Accounts receivable are recorded net of estimated credit losses. Our allowance for credit losses was $0.6 million as of March 30, 2024 and $0.5 million as of December 30, 2023, respectively.

Business Combinations

We account for business combinations using the acquisition method of accounting. We allocate the purchase consideration to the identifiable assets acquired and liabilities assumed in a business combination based on their acquisition-date fair values. We use our best estimates and assumptions to determine the fair value of tangible and intangible assets acquired and liabilities assumed, as well as the uncertain tax positions and tax-related valuation allowances that are initially recorded in connection with a business combination. These estimates are reevaluated and adjusted, if needed, during the measurement period of up to one year from the acquisition date, and are recorded as adjustments to goodwill. Any adjustments to the acquired assets and liabilities assumed that are identified subsequent to the measurement period are recorded in earnings.

Inventory

Inventories are comprised primarily of finished goods and are carried at the lower of cost (primarily using weighted-average cost method) or market (net realizable value). At March 30, 2024 and December 30, 2023, inventory reserves were $2.7 million and $2.2 million, respectively.

Fair Value of Financial Instruments

For financial assets and liabilities recorded at fair value on a recurring or non-recurring basis, fair value is the price we would receive to sell an asset, or pay to transfer a liability, in an orderly transaction with a market participant at the measurement date. In the absence of such data, fair value is estimated using internal information consistent with what market participants would use in a hypothetical transaction. In determining fair value, observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions; preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1: Quoted prices for identical instruments in active markets.

Level 2: Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3: Significant inputs to the valuation model are unobservable.

Our financial instruments consist principally of cash, accounts receivable, accounts payable, and bank indebtedness. The carrying amount of cash, accounts receivable, and accounts payable, approximates fair value due to the short-term maturity of these instruments. The carrying amount of our long-term bank indebtedness approximates fair value based on Level 2 inputs since our senior secured credit facility (the “Credit Facility”) carries a variable interest rate that is based on the Secured Overnight Financing Rate (“SOFR”).

Supplier Finance Program Obligations

We have a supplier finance program (“SFP”) with a financial institution which provides certain suppliers the option, at their sole discretion, to participate in the program and sell their receivables due from us for early payment. Participating eligible suppliers negotiate the terms directly with the financial institution and we have no involvement in establishing those terms nor are we a party to these agreements. Our payments associated with the invoices from the suppliers participating in the SFP are made to the financial institution according to the original invoice. The outstanding payment obligations under the SFP program recorded within accounts payable in our condensed consolidated balance sheets at March 30, 2024 and December 30, 2023 were $63.5 million and $77.3 million, respectively.

Recently Adopted Accounting Pronouncements

In September 2022, the Financial Accounting Standards Board (“FASB”) issued ASU 2022-04, Liabilities-Supplier Finance Programs (Topic 405-50) - Disclosure of Supplier Finance Program Obligations, which requires disclosures intended to enhance the transparency of supplier finance programs. The ASU requires buyers in a supplier finance program to disclose sufficient information about the program to allow a user of financial statements to understand the program’s nature, activity during the period, changes from period to period, and potential magnitude. The ASU is effective for fiscal years beginning after December 15, 2022, including interim

periods within those fiscal years, except for the amendment on rollforward information, which is effective for our Annual Report on Form 10-K for fiscal years beginning after December 15, 2023. We adopted provisions of this ASU in the first quarter of 2023, with the exception of the amendment on rollforward information, which we adopted in the first quarter of 2024. Adoption of the new standard did not have a material impact on our consolidated financial statements.

Recent Accounting Guidance Not Yet Adopted

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The new standard requires enhanced disclosures about significant segment expenses and other segment items and requires companies to provide all annual disclosures about segments in interim periods. All disclosure requirements under ASU 2023-07 are also required for public entities with a single reportable segment. The ASU is effective for the Company’s Annual Report on Form 10-K for the fiscal year ending December 28, 2024, and subsequent interim periods, with early adoption permitted. We are currently evaluating the impact of adopting this ASU on our consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The amendments in this update are intended to enhance the transparency and decision usefulness of income tax disclosures primarily through changes to the rate reconciliation and income taxes paid information. This update is effective for annual periods beginning after December 15, 2024, with early adoption permitted. We are currently evaluating the ASU to determine its impact on our consolidated financial statements and related disclosures.

2. ACQUISITIONS

Mystery Ranch Acquisition

On February 2, 2024, we completed the acquisition of all of the equity interests of Mystery Ranch, LLC (“Mystery Ranch”), a designer and manufacturer of durable load-bearing backpacks, bags, and pack accessories. The total purchase price consideration was $36.2 million, net of a preliminary working capital adjustment and cash acquired of $2.1 million. We plan to integrate the Mystery Ranch operations and products into our business to further expand our capabilities in our bags category. The acquisition was funded with cash on hand.

We accounted for the acquisition as a business combination using the acquisition method of accounting which requires, among other things, assets acquired and liabilities assumed be recognized at fair value as of the acquisition date. The purchase price allocation is preliminary and based upon valuation information available to determine the fair value of certain assets and liabilities, including goodwill, and is subject to change, primarily for final adjustments to net working capital as additional information is obtained about the facts and circumstances that existed at the valuation date.

The following table summarizes the preliminary amounts recorded for acquired assets and assumed liabilities at the acquisition date (in thousands):

| | | | | |

| |

| |

| Cash | $ | 2,051 | |

| Accounts receivable, net | 3,940 | |

Inventory (1) | 17,164 | |

| Prepaid expenses and other current assets | 3,858 | |

| Property and equipment | 512 | |

| Operating lease right-of-use assets | 1,087 | |

| Goodwill | 18,600 | |

Intangible assets | 5,500 | |

| |

| Total assets acquired | 52,712 | |

| |

| Current liabilities | (13,744) | |

| Non-current liabilities | (753) | |

| |

| |

| |

| |

Total liabilities assumed | (14,497) | |

| Net assets acquired | $ | 38,215 | |

_________________________

(1)Includes a $4.8 million step up of inventory to fair value, which will be expensed as the related inventory is sold.

The goodwill recognized is attributable to the expansion of our backpack and bag offerings and expected synergies from integrating Mystery Ranch’s products into our product portfolio. The goodwill will be deductible for income tax purposes. The intangible assets recognized consist of a trade name and customer relationships and have useful lives which range from 8 to 15 years.

Pro forma results are not presented as the impact of this acquisition is not material to our consolidated financial results. The net sales and earnings impact of this acquisition was not significant to our consolidated financial results for the three months ended March 30, 2024.

Butter Pat Acquisition

During the three months ended March 30, 2024, we acquired substantially all of the assets of Butter Pat Industries, LLC (“Butter Pat”), a designer and manufacturer of cast iron cookware. We plan to integrate Butter Pat products into our product portfolio to further expand our capabilities in the cookware category. This transaction was accounted for as an asset acquisition and is not material to our consolidated financial statements.

3. REVENUE

Contract Balances

Accounts receivable represent an unconditional right to receive consideration from a customer and are recorded at net invoiced amounts, less an estimated allowance for credit losses.

Contract liabilities are recorded when the customer pays consideration before the transfer of a good to the customer and thus represent our obligation to transfer the good to the customer at a future date. Our contract liabilities include advance cash deposits received from customers for certain customized product orders and unredeemed gift card liabilities. As products are shipped and control transfers, we recognize contract liabilities as revenue.

During the second quarter of 2023, we began issuing gift cards as remedies in connection with our voluntary recalls. We recognize sales from gift cards as they are redeemed for products. As of March 30, 2024, $4.0 million of our contract liabilities represented unredeemed gift card liabilities.

The following table provides information about accounts receivable and contract liabilities at the periods indicated (in thousands):

| | | | | | | | | | | |

| March 30,

2024 | | December 30,

2023 |

| Accounts receivable, net | $ | 108,350 | | | $ | 95,774 | |

| Contract liabilities | $ | (11,084) | | | $ | (22,437) | |

For the three months ended March 30, 2024, we recognized $19.7 million of revenue that was previously included in the contract liability balance at the beginning of the period.

Disaggregation of Revenue

The following table disaggregates our net sales by channel, product category, and geography (based on end-consumer location) for the periods indicated (in thousands): | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30,

2024 | | April 1,

2023 | | | | |

| Net Sales by Channel | | | | | | | |

| Wholesale | $ | 153,568 | | | $ | 135,829 | | | | | |

| Direct-to-consumer | 187,826 | | | 166,967 | | | | | |

| Total net sales | $ | 341,394 | | | $ | 302,796 | | | | | |

| | | | | | | |

| Net Sales by Category | | | | | | | |

| Coolers & Equipment | $ | 119,906 | | | $ | 104,354 | | | | | |

| Drinkware | 214,580 | | | 190,287 | | | | | |

| Other | 6,908 | | | 8,155 | | | | | |

| Total net sales | $ | 341,394 | | | $ | 302,796 | | | | | |

| | | | | | | |

| Net Sales by Geographic Region | | | | | | | |

| United States | $ | 275,796 | | | $ | 252,986 | | | | | |

| International | 65,598 | | | 49,810 | | | | | |

| Total net sales | $ | 341,394 | | | $ | 302,796 | | | | | |

For the three months ended March 30, 2024 and April 1, 2023, no single customer represented over 10% of gross sales.

4. PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets include the following (in thousands):

| | | | | | | | | | | |

| March 30,

2024 | | December 30,

2023 |

| Prepaid expenses | $ | 34,191 | | | $ | 21,165 | |

| Prepaid taxes | 14,939 | | | 15,089 | |

| Other | 7,875 | | | 6,209 | |

| Total prepaid expenses and other current assets | $ | 57,005 | | | $ | 42,463 | |

5. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consist of the following (in thousands):

| | | | | | | | | | | |

| March 30,

2024 | | December 30, 2023 |

Product recall reserves(1) | $ | 9,176 | | | $ | 13,090 | |

| Accrued freight and other operating expenses | 27,017 | | | 45,228 | |

| Contract liabilities | 11,084 | | | 22,437 | |

| Customer discounts, allowances, and returns | 11,130 | | | 11,515 | |

| Advertising and marketing | 8,446 | | | 9,945 | |

| Warranty reserve | 8,891 | | | 9,808 | |

| Interest payable | 157 | | | 159 | |

| Accrued capital expenditures | 1,140 | | | 590 | |

| Other | 20,317 | | | 17,254 | |

| Total accrued expenses and other current liabilities | $ | 97,359 | | | $ | 130,026 | |

(1) See Note 10 for further discussion of our product recall reserves.

6. INCOME TAXES

Income tax expense was $6.5 million and $3.9 million for the three months ended March 30, 2024 and April 1, 2023, respectively. The increase in income tax expense is due to a higher income before income taxes. The effective tax rate for the three months ended March 30, 2024 was 29% compared to 27% for the three months ended April 1, 2023. The higher effective tax rate was primarily due to higher discrete tax expenses, including an unfavorable tax impact related to stock compensation in the three months ended March 30, 2024.

Deferred tax liabilities were $4.2 million as of March 30, 2024 and $4.0 million as of December 30, 2023, which is presented in other liabilities on our unaudited condensed consolidated balance sheet.

The Organization for Economic Co-operation and Development enacted model rules for a new global minimum tax framework, also known as Pillar Two, and certain governments globally have enacted, or are in the process of enacting, legislation to address Pillar Two. For the three months ended March 30, 2024, the impact of Pillar Two on our consolidated financial statements was not material.

For interim periods, our income tax expense and resulting effective tax rate are based upon an estimated annual effective tax rate adjusted for the effects of items required to be treated as discrete to the period, including changes in tax laws, changes in estimated exposures for uncertain tax positions, and other items.

7. STOCK-BASED COMPENSATION

We award stock-based compensation to employees and directors under the 2018 Equity and Incentive Compensation Plan (“2018 Plan”), which was adopted by our Board of Directors and became effective upon the completion of our initial public offering in October 2018. The 2018 Plan replaced the 2012 Equity and Performance Incentive Plan, as amended and restated on June 20, 2018 (the “2012 Plan”). Any remaining shares available for issuance under the 2012 Plan as of the date of our initial public offering in October 2018 are not available for future issuance. However, shares subject to stock awards granted under the 2012 Plan (a) that expire or terminate without being exercised or (b) that are forfeited under an award, return to the 2018 Plan.

For the three months ended March 30, 2024 and April 1, 2023, we recognized stock-based compensation expense of $8.5 million and $6.8 million, respectively. At March 30, 2024, total unrecognized stock-based compensation expense of $75.4 million for all stock-based compensation plans is expected to be recognized over a weighted-average period of 2.3 years.

Stock-based activity for the three months ended March 30, 2024 is summarized below (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options | | Performance-Based

Restricted Stock Awards and Units | | Restricted Stock Units, Restricted Stock Awards, and Deferred Stock Units | | |

| Number of Options | | Weighted

Average Exercise

Price | | Number of PBRSs and PRSUs | | Weighted

Average Grant

Date Fair Value | | Number of RSUs, RSAs, and DSUs | | Weighted

Average Grant Date

Fair Value | | | | |

| Balance, December 30, 2023 | 578 | | | $ | 19.62 | | | 398 | | | $ | 48.14 | | | 1,312 | | | $ | 41.99 | | | | | |

| Granted | — | | | — | | | 202 | | | 41.21 | | | 715 | | | 39.19 | | | | | |

| Exercised/released | — | | | — | | | (48) | | | 79.66 | | | (295) | | | 43.65 | | | | | |

Performance adjustment(1) | — | | | — | | | 6 | | | 79.66 | | | — | | | — | | | | | |

| Forfeited/expired | — | | | — | | | (6) | | | 50.93 | | | (62) | | | 42.55 | | | | | |

| Balance, March 30, 2024 | 578 | | | $ | 19.62 | | | 552 | | | $ | 43.13 | | | 1,670 | | | $ | 40.48 | | | | | |

_________________________

(1)Represents adjustment due to the actual achievement of performance-based awards.

8. EARNINGS PER SHARE

Basic income per share is computed by dividing net income by the weighted-average number of common shares outstanding during the period. Diluted income per share includes the effect of all potentially dilutive securities, which include dilutive stock options and other stock-based awards.

The following table sets forth the calculation of earnings per share and weighted-average common shares outstanding at the dates indicated (in thousands, except per share data):

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30,

2024 | | April 1,

2023 | | | | |

| Net income | $ | 15,855 | | | $ | 10,564 | | | | | |

| | | | | | | |

| Weighted-average common shares outstanding—basic | 86,355 | | | 86,529 | | | | | |

| Effect of dilutive securities | 802 | | | 557 | | | | | |

| Weighted-average common shares outstanding—diluted | 87,157 | | | 87,086 | | | | | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.18 | | | $ | 0.12 | | | | | |

| Diluted | $ | 0.18 | | | $ | 0.12 | | | | | |

Effects of potentially dilutive securities are presented only in periods in which they are dilutive. For the three months ended March 30, 2024 and April 1, 2023, outstanding stock-based awards representing less than 0.1 million and 0.3 million shares of common stock, respectively, were excluded from the calculation of diluted earnings per share, because their effect would be anti-dilutive.

9. STOCKHOLDERS’ EQUITY

On February 1, 2024, our Board of Directors authorized the repurchase of up to $300 million of the Company’s common stock (the “Share Repurchase Program”). As of March 30, 2024, $200 million remained under the Share Repurchase Program.

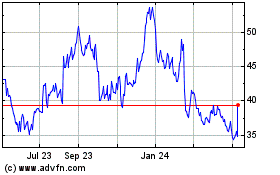

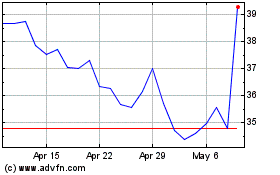

As part of the Share Repurchase Program, on February 27, 2024, we entered into an accelerated share repurchase agreement (the “ASR Agreement”) with Goldman Sachs & Co. LLC (“Goldman Sachs”) to repurchase $100 million of YETI’s common stock. Pursuant to the ASR Agreement, we made a payment of $100 million to Goldman Sachs and received an initial delivery of 1,998,501 shares of YETI’s common stock (the “Initial Shares”), representing 80% of the total shares that we expected to receive under the ASR Agreement based on the market price of $40.03 per share at the time of delivery of the Initial Shares. The ASR Agreement was accounted for as an equity transaction. The fair value of the Initial Shares were recorded as a treasury stock transaction. The remaining $20.0 million was recorded as a reduction to additional paid-in capital. Upon delivery of the Initial Shares, there was an immediate reduction in the weighted average common shares calculation for basic and diluted earnings per share.

On April 25, 2024, we settled the transactions contemplated by the ASR Agreement, resulting in a final delivery of 642,674 shares, with a fair value of $23.6 million. The total number of shares repurchased under the ASR Agreement was 2,641,175 at an average cost per share of $37.86, based on the volume-weighted average share price of YETI’s common stock during the calculation period of the ASR Agreement.

10. COMMITMENTS AND CONTINGENCIES

Claims and Legal Proceedings

We are involved in various claims and legal proceedings, some of which are covered by insurance. We believe that our existing claims and proceedings, and the potential losses relating to such contingencies, will not have a material adverse effect on our consolidated financial position, results of operations, or cash flows.

Product Recall Reserves

In January 2023, we notified the U.S. Consumer Product Safety Commission (“CPSC”) of a potential safety concern regarding the magnet-lined closures of our Hopper M30 Soft Cooler, Hopper M20 Soft Backpack Cooler, and SideKick Dry gear case (the “affected products”) and initiated a global stop sale of the affected products. In February 2023, we proposed a voluntary recall of the affected products to the CPSC, and other relevant global regulatory authorities, which we refer to as the “voluntary recalls” herein unless otherwise indicated. In March 2023, we announced separate, voluntary recalls of the affected products in collaboration with the CPSC and subsequently began processing recall claims and returns.

The reserve for the estimated product recall costs is included within accrued expenses and other current liabilities on our consolidated balance sheets. The reserve for the estimated product recall costs is based on i) expected consumer participation rates; and ii) the estimated costs of the consumer’s elected remedy in the recalls, including the estimated cost of either product replacements or gift card elections, logistics costs, and other recall-related costs. The following table summarizes the activity of the reserve for the estimated product recall expenses (in thousands):

| | | | | |

| March 30, 2024 |

Balance, December 30, 2023 | $ | 13,090 | |

| Actual product refunds, replacements and recall-related costs | (2,488) | |

Gift card issuances(1) | (1,437) | |

| |

Balance, March 30, 2024 | $ | 9,165 | |

_________________________

(1)As of March 30, 2024, we had $4.0 million in unredeemed recall-related gift card liabilities, which are included in contract liabilities within accrued expenses and other current liabilities on our consolidated balance sheet. For the three months ended March 30, 2024, we recognized net sales of $2.0 million from redeemed recall-related gift cards.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis contains forward-looking statements within the meaning of the federal securities laws, and should be read in conjunction with the disclosures we make concerning risks and other factors that may affect our business and operating results, including those described in more detail in Part I “Item 1A. Risk Factors” included in our Annual Report on Form 10-K for the year ended December 30, 2023. The information contained in this section should also be read in conjunction with our consolidated financial statements and related notes and the information contained elsewhere in this Report. See also “Cautionary Note Regarding Forward-Looking Statements” immediately prior to Part I, Item I in this Quarterly Report on Form 10-Q.

The terms “we,” “us,” “our,” “YETI,” and “the Company” as used herein, and unless otherwise stated or indicated by context, refer to YETI Holdings, Inc. and its subsidiaries.

Business Overview

Headquartered in Austin, Texas, YETI is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to bags and apparel, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes you. By consistently delivering high-performing, exceptional products, we have built a strong following of brand loyalists throughout the world, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. We have an unwavering commitment to outdoor and recreation communities, and we are relentless in our pursuit of building superior products for people to confidently enjoy life outdoors and beyond.

We distribute our products through a balanced omni-channel platform, consisting of our wholesale and direct-to-consumer (“DTC”) channels. In our wholesale channel, we sell our products through select national and regional accounts and an assemblage of independent retail partners throughout the United States, Canada, Australia, New Zealand, Europe, and Japan, among others. We carefully evaluate and select retail partners that have an image and approach that are consistent with our premium brand and pricing. Our domestic national and regional specialty retailers include Dick’s Sporting Goods, REI, Academy Sports + Outdoors, Bass Pro Shops, Ace Hardware, Scheels, and Tractor Supply Company. We sell our products in our DTC channel to customers through our websites and YETI Authorized on the Amazon Marketplace, as well as in our retail stores. Additionally, we offer customized products with licensed trademarks and original artwork through our websites and our corporate sales program. Our corporate sales program offers customized products to corporate customers for a wide-range of events and activities, and in certain instances may also offer products to re-sell. In the first quarter of 2024, we acquired Mystery Ranch, LLC, which is a designer and manufacturer of durable load-bearing backpacks, bags, and pack accessories.

Product Introductions and Updates

During the first quarter of 2024, we expanded our drinkware offerings with the launch of a new stackable 16 oz. Rambler cup, and introduced new seasonal colorways.

Acquisitions

During the first quarter of 2024, we completed the acquisitions of Mystery Ranch, LLC (“Mystery Ranch”), a designer and manufacturer of durable load-bearing backpacks, bags, and pack accessories, and Butter Pat Industries, LLC (“Butter Pat”), a designer and manufacturer of cast iron cookware. We plan to integrate Mystery Ranch and Butter Pat operations and products into our business to further expand our capabilities in the bags and cookware categories. See Note 2— Acquisitions of the Notes to Consolidated Financial Statements included herein for additional information about these acquisitions.

Macroeconomic Conditions

There is significant uncertainty regarding how macroeconomic trends, including sustained high levels of inflation and higher interest rates, will impact consumer demand. While some of these conditions have negatively impacted consumer discretionary spending behavior, we continue to see strong overall demand for our products. We have, however, seen instances of consumer sensitivity to higher price points, which has negatively impacted our financial results.

In addition, recent disruptions of container shipping traffic through the Red Sea and surrounding waterways are negatively affecting transit times and freight costs for goods manufactured in Asia and destined to Europe and to a smaller extent the Americas. As a result, we have experienced shipping delays and moderately higher freight costs. Although such effects have not materially impacted our business to date, such conditions could worsen.

A worsening of any of the macroeconomic trends or uncertainties discussed herein may adversely impact our business, operations, and financial results in the future. We will continue to monitor and, if necessary, strive to mitigate the effects of the macroeconomic environment on our business.

General

Components of Our Results of Operations

Net Sales. Net sales are comprised of wholesale channel sales to our retail partners and sales through our DTC channel. Net sales in both channels reflect the impact of product returns as well as discounts for certain sales programs or promotions.

We discuss the net sales of our products in our two primary categories: Coolers & Equipment and Drinkware. Our Coolers & Equipment category includes hard coolers, soft coolers, bags, outdoor equipment, and cargo, as well as accessories and replacement parts for these products. Our Drinkware category is primarily composed of our stainless-steel drinkware products and related accessories. In addition, our Other category is primarily comprised of ice substitutes and YETI-branded gear, such as shirts, hats, and other miscellaneous products.

Gross profit. Gross profit reflects net sales less cost of goods sold, which primarily includes the purchase cost of our products from our third-party contract manufacturers, inbound freight and duties, product quality testing and inspection costs, depreciation expense of our molds, tooling, and equipment, and the cost of customizing products. We calculate gross margin as gross profit divided by net sales. Our DTC channel generally generates higher gross margin than our wholesale channel due to differentiated pricing between these channels.

Selling, general, and administrative expenses. Selling, general, and administrative (“SG&A”) expenses consist primarily of marketing costs, employee compensation and benefits costs, costs of our outsourced warehousing and logistics operations, costs of operating on third-party DTC marketplaces, professional fees and services, non-cash stock-based compensation, cost of product shipment to our customers, depreciation and amortization expense, and general corporate infrastructure expenses. Our variable expenses, including outbound freight, online marketplace fees, third-party logistics fees, and credit card processing fees, will vary as they are dependent on our sales volume and our channel mix. Our DTC channel variable SG&A costs are generally higher as a percentage of net sales than our wholesale channel distribution costs.

Fiscal Year. We have a 52- or 53-week fiscal year that ends on the Saturday closest in proximity to December 31, such that each quarterly period will be 13 weeks in length, except during a 53-week year when the fourth quarter will be 14 weeks. Our fiscal year ending December 28, 2024 (“2024”) is a 52-week period. The first quarter of our fiscal year 2024 ended on March 30, 2024, the second quarter ends on June 29, 2024, and the third quarter ends on September 28, 2024. Our fiscal year ended December 30, 2023 (“2023”) was also a 52-week period. Unless otherwise stated, references to particular years, quarters, months and periods refer to our fiscal years and the associated quarters, months, and periods of those fiscal years. The unaudited condensed consolidated financial results presented herein represent the three months ended March 30, 2024 and April 1, 2023.

Results of Operations

The discussion below should be read in conjunction with the following table and our unaudited condensed consolidated financial statements, and related notes contained elsewhere in this Report. The following table sets forth selected statement of operations data, and their corresponding percentage of net sales, for the periods indicated (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 30, 2024 | | April 1, 2023 | | | | |

| Statement of Operations | | | | | | | | | | | |

| Net sales | $ | 341,394 | | 100 | % | | $ | 302,796 | | 100 | % | | | | | | |

| Cost of goods sold | 146,581 | | 43 | % | | 140,926 | | 47 | % | | | | | | |

| Gross profit | 194,813 | | 57 | % | | 161,870 | | 53 | % | | | | | | |

| Selling, general, and administrative expenses | 168,996 | | 50 | % | | 146,772 | | 48 | % | | | | | | |

| Operating income | 25,817 | | 8 | % | | 15,098 | | 5 | % | | | | | | |

Interest income (expense) | 659 | | — | % | | (594) | | — | % | | | | | | |

| Other (expense) income, net | (4,101) | | 1 | % | | 6 | | — | % | | | | | | |

| Income before income taxes | 22,375 | | 7 | % | | 14,510 | | 5 | % | | | | | | |

| Income tax expense | (6,520) | | 2 | % | | (3,946) | | 1 | % | | | | | | |

| Net income | $ | 15,855 | | 5 | % | | $ | 10,564 | | 3 | % | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Comparison of the Three Months Ended March 30, 2024 and April 1, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| | March 30,

2024 | | April 1,

2023 | | Change |

| (dollars in thousands) | | | | $ | | % |

| Net sales | | $ | 341,394 | | | $ | 302,796 | | | $ | 38,598 | | | 13 | % |

| Gross profit | | $ | 194,813 | | | $ | 161,870 | | | $ | 32,943 | | | 20 | % |

Gross margin (gross profit as a % of net sales) | | 57.1 | % | | 53.5 | % | | 360 basis points |

| Selling, general, and administrative expenses | | $ | 168,996 | | | $ | 146,772 | | | $ | 22,224 | | | 15 | % |

| SG&A as a % of net sales | | 49.5 | % | | 48.5 | % | | 100 basis points |

Net Sales

Net sales increased $38.6 million to $341.4 million for the three months ended March 30, 2024, compared to the three months ended April 1, 2023. Sales and adjusted net sales for the first quarter of 2024 include $2.0 million of sales related to gift card redemptions in connection with recall remedies.

Net sales in our channels were as follows:

•DTC channel net sales increased $20.9 million, or 12%, to $187.8 million, compared to $167.0 million in the prior year quarter, due to growth in both Drinkware and Coolers & Equipment. DTC channel mix remained at 55% for both the first quarter of 2024 and 2023.

•Wholesale channel net sales increased $17.7 million, or 13%, to $153.6 million, compared to $135.8 million in the same period last year, due to growth in both Drinkware and Coolers & Equipment.

Net sales in our two primary product categories were as follows:

•Drinkware net sales increased by $24.3 million, or 13%, to $214.6 million, compared to $190.3 million in the prior year quarter, driven by the continued expansion and innovation of our Drinkware product offerings and new seasonal colorways.

•Coolers & Equipment net sales increased by $15.6 million, or 15%, to $119.9 million, compared to $104.4 million in the same period last year, driven by strong performance in bags, soft coolers, and hard coolers.

Gross Profit

Gross profit increased $32.9 million, or 20%, to $194.8 million, compared to $161.9 million in the prior year quarter. Gross margin rate increased 360 basis points to 57.1% from 53.5% in the prior year quarter. The increase in gross margin was primarily driven by:

•lower inbound freight rates, which favorably impacted gross margin by 370 basis points;

•lower product costs, which favorably impacted gross margin by 190 basis points;

These were partially offset by:

•the unfavorable impact of the amortization of inventory fair value step-up in connection with the Mystery Ranch acquisition, which unfavorably impacted gross margin by 50 basis points;

•the unfavorable impact of a favorable inventory reserve adjustment in the prior year quarter associated with our voluntary product recalls, which unfavorably impacted gross margin in the current year quarter by 40 basis points;

•the unfavorable impact of strategic price decreases on certain hard cooler products implemented during the first quarter of 2024, which unfavorably impacted gross margin by 20 basis points;

•the unfavorable impact of customization costs, on higher customization sales mix, which unfavorably impacted gross margin by 60 basis points; and

•other impacts, which unfavorably impacted gross margin by 30 basis points.

Selling, General, and Administrative Expenses

SG&A expenses increased $22.2 million, or 15%, to $169.0 million for the three months ended March 30, 2024, compared to $146.8 million for the three months ended April 1, 2023. As a percentage of net sales, SG&A expenses increased 100 basis points to 49.5% for the three months ended March 30, 2024 from 48.5% for the three months ended April 1, 2023. The increase in SG&A expenses was primarily driven by:

•an increase in variable expenses of $5.4 million (decreasing SG&A as a percent of net sales by 10 basis points) primarily associated with higher net sales, and comprised of higher distribution costs including higher outbound freight rates, online marketplace fees, and third-party logistics fees; and

•an increase in non-variable expenses of $16.8 million (increasing SG&A as a percent of net sales by 110 basis points) comprised of higher employee costs, mainly due to investments in headcount to support future growth and non-cash stock-based compensation expense, investments in marketing expenses, asset impairments, acquisition-related transition costs, and organizational realignment costs, partially offset by lower warehousing costs.

Non-Operating Expenses

Interest income, net was $0.7 million for the three months ended March 30, 2024, compared to interest expense of $0.6 million for the three months ended April 1, 2023, primarily due to an increase in interest income more than offsetting higher interest expense.

Other expense was $4.1 million for the three months ended March 30, 2024, primarily due to foreign currency losses on intercompany balances. Other income was nominal for the three months ended April 1, 2023.

Income tax expense was $6.5 million for the three months ended March 30, 2024, compared to $3.9 million for the three months ended April 1, 2023. The increase in income tax expense was due to higher income before income taxes. The effective tax rate for the three months ended March 30, 2024 was 29%, compared to 27% for the three months ended April 1, 2023. The higher effective tax rate was primarily due to higher discrete tax expenses, including an unfavorable tax impact related to stock compensation in the three months ended March 30, 2024.

Liquidity and Capital Resources

General

Our cash requirements have principally been for working capital purposes, long-term debt repayments, and capital expenditures. We fund our working capital, which primarily consists of inventory and accounts receivable, and our capital investments from cash flows from operating activities, cash on hand, and borrowings available under our revolving credit facility (the “Revolving Credit Facility”). Pursuant to our new share repurchase plan described below, we also plan to use cash to repurchase shares of our common stock. We believe that our current operating performance, operating plan, our strong cash position, and borrowings available under our Revolving Credit Facility, will be sufficient to satisfy our foreseeable liquidity needs and capital expenditure requirements, including for at least the next twelve months.

Current Liquidity

As of March 30, 2024, we had a cash balance of $173.9 million, working capital (excluding cash) of $230.5 million, and $300.0 million of borrowings available under the Revolving Credit Facility.

Credit Facility

Our Credit Facility provides for a $300.0 million Revolving Credit Facility and an $84.4 million term loan (“Term Loan A”).

On February 26, 2024, we amended the Credit Facility, leaving the material terms of the Credit Facility substantially unchanged, with the exception of a definitional update and a change to make a Hedging Agreement (as defined in the Credit Facility) entered into in connection with an accelerated share purchase program a permitted Hedging Agreement under the Credit Facility.

At March 30, 2024, we had $81.2 million principal amount of indebtedness outstanding under the Term Loan A under the Credit Facility and no outstanding borrowings under the Revolving Credit Facility. Borrowings under the Term Loan A and the Revolving Credit Facility bear interest at Term Secured Overnight Financing Rate (“SOFR”) or the Alternate Base Rate (each as defined in the Credit Agreement) plus an applicable rate ranging from 1.75% to 2.50% for Term SOFR-based loans and from 0.75% to 1.50% for Alternate Base Rate-based loans, depending upon our total Net Leverage Ratio (as defined in the Credit Agreement). Additionally, a commitment fee ranging from 0.200% to 0.300%, determined by reference to a pricing grid based on our net leverage ratio, is payable on the average daily unused amounts under the Revolving Credit Facility. The weighted-average interest rate for borrowings under Term Loan A was 7.09% during the three months ended March 30, 2024.

The Credit Facility requires us to comply with certain covenants, including financial covenants regarding our total net leverage ratio and interest coverage ratio. Fluctuations in these ratios may increase our interest expense. Failure to comply with these covenants and certain other provisions of the Credit Facility, or the occurrence of a change of control, could result in an event of default and an acceleration of our obligations under the Credit Facility or other indebtedness that we may incur in the future. At March 30, 2024, we were in compliance with all covenants and expect to remain in compliance with all covenants under the Credit Facility.

Share Repurchase Program

On February 1, 2024, our Board of Directors authorized the repurchase of up to $300 million (exclusive of fees and commissions) of YETI’s common stock (the “Share Repurchase Program”). The common stock may be repurchased from time to time at prevailing prices in the open market, through various methods, including, but not limited to, open market, privately negotiated, or accelerated share repurchase transactions. Repurchases under the share repurchase program may also be made pursuant to a plan adopted under Rule 10b5-1 promulgated under the Exchange Act. The timing, manner, price, and actual amount of share repurchases will be determined by management based on various factors, including, but not limited to, stock price, economic and market conditions, other capital allocation needs and opportunities, and corporate and regulatory considerations. YETI has no obligation to repurchase any amount of our common stock, and such repurchases may be suspended or discontinued at any time. As of March 30, 2024, $200 million remained available under the Share Repurchase Program

As part of the Share Repurchase Program, on February 27, 2024, we entered into an accelerated share repurchase agreement (the “ASR Agreement”) with Goldman Sachs & Co. LLC (“Goldman Sachs”) to repurchase $100 million of YETI’s common stock. Pursuant to the ASR Agreement, we made a payment of $100 million to Goldman Sachs and received an initial share delivery of 1,998,501 shares of our common stock. We received a final delivery of an additional 642,674 shares on April 25, 2024. The ASR resulted in the total repurchase of 2,641,175 shares. See Note 7-Stockholders’ Equity of the Unaudited Condensed Consolidated Financial Statements for additional information about the Share Repurchase Program.

Material Cash Requirements

Other than as disclosed above, there have been no material changes in our material cash requirements for contractual and other obligations, including capital expenditures, as disclosed under “Material Cash Requirements” included in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 30, 2023 filed with the SEC.

Cash Flows from Operating, Investing, and Financing Activities

The following table summarizes our cash flows from operating, investing and financing activities for the periods indicated (in thousands): | | | | | | | | | | | |

| Three Months Ended |

| March 30,

2024 | | April 1,

2023 |

| Cash flows provided by (used in): | | | |

| Operating activities | $ | (103,674) | | | $ | (46,688) | |

| Investing activities | $ | (58,005) | | | $ | (13,247) | |

| Financing activities | $ | (102,815) | | | $ | (7,393) | |

Operating Activities

Cash flows related to operating activities are dependent on net income, non-cash adjustments to net income, and changes in working capital. The increase in cash used by operating activities during the three months ended March 30, 2024 compared to cash used by operating activities during the three months ended April 1, 2023 is primarily due to an increase in cash used for working capital, partially offset by an increase in net income, adjusted for non-cash items for the periods compared. The increase in cash used for working capital was primarily due to a decrease in accounts payable and other accrued expenses, and an increase in inventory, partially offset by an increase in accounts receivable.

Investing Activities

The increase in cash used in investing activities during the three months ended March 30, 2024 was primarily related to the acquisition of Mystery Ranch and increased purchases of intangible assets.

Financing Activities

The increase in cash used by financing activities during the three months ended March 30, 2024 was primarily driven by repurchases of common stock in connection with our $100 million ASR Agreement.

Critical Accounting Policies and Estimates

Our unaudited condensed consolidated financial statements are prepared in accordance with GAAP. The preparation of these unaudited condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses and related disclosures. We evaluate our estimates and assumptions on an ongoing basis. Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Actual results could differ materially from those estimates. A discussion of the accounting policies that management considers critical in that they involve significant management judgments and assumptions, require estimates about matters that are inherently uncertain and because they are important for understanding and evaluating our reported financial results is included in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 30, 2023 filed with the SEC. Other than as described below, there have been no significant changes to our critical accounting policies.

Business Combinations

We account for business combinations using the acquisition method of accounting. We allocate the purchase consideration to the identifiable assets acquired and liabilities assumed in a business combination based on their acquisition-date fair values. We use our best estimates and assumptions to determine the fair value of tangible and intangible assets acquired and liabilities assumed, as well as the uncertain tax positions and tax-related valuation allowances that are initially recorded in connection with a business combination. These estimates are reevaluated and adjusted, if needed, during the measurement period of up to one year from the acquisition date, and are recorded as adjustments to goodwill. Any adjustments to the acquired assets and liabilities assumed that are identified subsequent to the measurement period are recorded in earnings.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There have been no material changes to our market risk exposures or management of market risk from those disclosed in Quantitative and Qualitative Disclosures About Market Risk included under Item 7A in our Annual Report on Form 10-K for the year ended December 30, 2023.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (“Exchange Act”)) are designed to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms and to ensure that information required to be disclosed is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow for timely decisions regarding disclosures. Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Quarterly Report on Form 10-Q. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures were effective as of March 30, 2024.

Changes in Internal Control over Financial Reporting

During the quarter ended March 30, 2024, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Inherent Limitations in Effectiveness of Controls