UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March 2016

Commission File Number 001—32945

WNS

(HOLDINGS) LIMITED

(Exact name of registrant as specified in the charter)

Not Applicable

(Translation of Registrant’s name into English)

Gate 4,

Godrej & Boyce Complex

Pirojshanagar, Vikhroli (W)

Mumbai 400 079, India

+91-22-4095-2100

(Address

of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

TABLE OF CONTENTS

Other Events

On March 11, 2016, WNS (Holdings) Limited issued a press release announcing that it has entered into a definitive agreement to acquire Value Edge Research

Services Pvt. Ltd., a leading provider of commercial research and analytics services to clients in the Pharma / Biopharma industry. This acquisition is subject to Reserve Bank of India (RBI) approval and other customary closing conditions.

A copy of the press release dated March 11, 2016 is attached hereto as Exhibit 99.1.

|

|

|

| Exhibit |

|

|

|

|

| 99.1 |

|

Press release of WNS (Holdings) Limited dated March 11, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

WNS (Holdings) Limited |

|

|

|

|

| Date: March 11, 2016 |

|

|

|

By: |

|

/s/ Sanjay Puria |

|

|

|

|

|

|

|

|

Name: |

|

Sanjay Puria |

|

|

|

|

Title: |

|

Group Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| 99.1 |

|

Press release of WNS (Holdings) Limited dated March 11, 2016. |

Exhibit 99.1

WNS to Acquire Value Edge Research Services

Adds Domain Expertise, Analytics and Technology Platform in Pharma

NEW YORK, NY and MUMBAI, INDIA, March 11, 2016 — WNS (Holdings) Limited (WNS) (NYSE: WNS), a leading provider of global Business Process

Management (BPM) services, today announced that on March 11, 2016 the company entered into a definitive agreement to acquire Value Edge Research Services Pvt. Ltd., a leading provider of commercial research and analytics services to clients in

the Pharma / Biopharma industry. Value Edge provides consulting grade marketing and data analytics to a blue-chip roster of globally leading bio-pharma companies. Value Edge has created a cloud-based advanced technology platform designed to provide

clients with competitive intelligence (CI) to drive strategic decision-making. Core company offerings include CI, opportunity assessment, forecasting, reporting & dash-boarding, modeling, business intelligence (BI) tool building, and data

analysis. The company also provides services in the areas of pricing analytics, patient data analysis, key account management (KAM), sales force effectiveness (SFE), and social media monitoring.

“The acquisition of Value Edge deepens our domain and specialized analytical capabilities in the growing pharma market, and provides WNS with a

technology asset which is leverageable across clients and industries,” said Keshav Murugesh, WNS’ Chief Executive Officer. “We are thrilled to welcome Value Edge’s talented industry experts to the WNS family, and look forward to

jointly creating new opportunities and true business value for our clients.”

“Value Edge is excited to partner with WNS, and the combination of

our firm’s respective capabilities will enable us to help clients in the Pharma / Bio-Pharma industry improve their competitive positioning,” said Rohit Anand, Value Edge’s Founder and Managing Director. “We believe WNS’

global size and strength will allow us to tap new areas of demand, drive deeper relationships and expand our offerings.”

The acquisition of Value

Edge is subject to Reserve Bank of India (RBI) approval and other customary closing conditions, and is expected to close in the first quarter of fiscal 2017. Cash consideration for the transaction is $17.5 million plus adjustments for cash and

working capital. WNS intends to fund the consideration with cash on hand. Based on Value Edge’s existing book of business, the acquisition is expected to contribute approximately $5 million in revenue for WNS in fiscal 2017. The acquisition is

also expected to be accretive to earnings in fiscal 2017. Value Edge currently employs over 100 people in India, the United States and Europe.

About WNS

WNS (Holdings) Limited (NYSE: WNS), is

a leading global business process management company. WNS offers business value to 200+ global clients by combining operational excellence with deep domain expertise in key industry verticals including Travel, Insurance, Banking and Financial

Services, Manufacturing, Retail and Consumer Packaged Goods, Shipping and Logistics, Healthcare and Utilities. WNS delivers an entire spectrum of business process management services such as finance and accounting, customer care, technology

solutions, research and analytics and industry specific back office and front office processes. As of December 31, 2015, WNS had 31,340 professionals across 39 delivery centers worldwide including China, Costa Rica, India, Philippines, Poland,

Romania, South Africa, Sri Lanka, United Kingdom and the United States. For more information, visit www.wns.com.

Page 1 of 2

Safe Harbor Statement

This release contains

forward-looking statements, as defined in the safe harbor provisions of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations and assumptions about Value Edge, our Company and

our industry. Generally, these forward-looking statements may be identified by the use of terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “will,”

“seek,” “should” and similar expressions. These statements include, among other things, the discussions of the completion of our acquisition of Value Edge, the timing of the completion of our acquisition of Value Edge, and the

expected benefits of our acquisition of Value Edge, including Value Edge’s expected revenue contribution to WNS and accretive benefit to our earnings, our growth opportunities, industry environment, expectations concerning our future financial

performance and growth potential. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include but

are not limited to worldwide economic and business conditions; political or economic instability in the jurisdictions where we have operations; regulatory, legislative and judicial developments; our ability to attract and retain clients;

technological innovation; telecommunications or technology disruptions; future regulatory actions and conditions in our operating areas; our dependence on a limited number of clients in a limited number of industries; our ability to expand our

business or effectively manage growth; our ability to hire and retain enough sufficiently trained employees to support our operations; negative public reaction in the US or the UK to offshore outsourcing; the effects of our different pricing

strategies or those of our competitors; and increasing competition in the BPM industry. These and other factors are more fully discussed in our most recent annual report on Form 20-F and subsequent reports on Form 6-K filed with or furnished to the

US Securities and Exchange Commission (SEC) which are available at www.sec.gov. We caution you not to place undue reliance on any forward-looking statements. Except as required by law, we do not undertake to update any forward-looking statements to

reflect future events or circumstances.

References to “$” and “USD” refer to the United States dollars, the legal currency of the

United States

CONTACT:

|

|

|

|

Investors: |

|

Media: |

| David Mackey

Corporate SVP–Finance & Head of Investor Relations WNS

(Holdings) Limited +1 (201) 942-6261

david.mackey@wns.com |

|

Archana Raghuram

Head – Corporate Communications WNS (Holdings) Limited

+91 (22) 4095 2397 archana.raghuram@wns.com ;

pr@wns.com |

Page 2 of 2

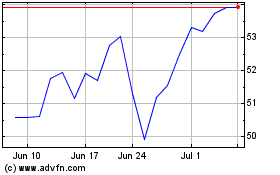

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024