For Immediate Release

Chicago, IL – January 31, 2012 – Today, Zacks Investment Ideas

feature highlights Features: Arctic Cat

(ACAT), Caterpillar

(CAT), Apple

(AAPL), United Rentals, Inc.

(URI) and CA Technologies

(CA).

5 Stocks That Turned a Triple Play

For the first time in a long time, earnings season has been a

bit of a disappointment.

The typical earnings season will have a surprise ratio

(#beat/#miss) around 3:1 with a median surprise of about 3.0%. So

far this season, the surprise ratio is 1.81 and the median surprise

is 1.9%.

According to Zacks' Chief Equity Strategist Dirk Van Dijk, this

is the weakest start to an earnings season since the depths of the

Great Recession.

As for estimate revision activity, the ratio of S&P 500

companies with rising to falling estimates is 0.61 for 2012 - not a

very bullish indicator.

And excluding financials, the year-over-year increase in net

income is 11.8% - down from 16.1% in the third quarter.

Not All Bad

This earnings season may not be that hot so far, but there are

several companies that have reported exceptionally strong quarters.

You just have to hunt a little harder to find them. I've

highlighted 5 companies below that delivered the coveted 'triple

play' this earnings season:

- A positive earnings surprise

- A positive revenue surprise, and

- Guidance from management above the Zacks Consensus

Estimate

While some of these stocks have already moved higher after their

earnings announcement, I believe there is still room for each of

them to run higher.

For one, each stock is reasonably valued. Secondly, the

well-documented "post-earnings announcement drift" suggests that

companies with positive earnings surprises can see upward stock

price movements for several weeks, or even months.

5 Triple Plays:

Arctic Cat (ACAT)

EPS Surprise: 59%

Sales Surprise: 14%

Arctic Cat manufactures ATVs and snowmobiles. Although this

winter has been extremely mild, the company delivered a huge

quarter on January 26.

In addition to crushing the Zacks Consensus Estimates on sales

and EPS, management raised its EPS guidance to a range of

$1.60-$1.70 on sales growth of 22%-24%. This is up from previous

guidance of $1.10-$1.15 and well above the consensus of $1.22

before the announcement.

Analysts raised their estimates for both 2012 and 2013

significantly higher after the beat, sending the stock to a Zacks

#1 Rank (Strong Buy) stock. And although shares jumped 20% on the

day of the announcement, valuation is still reasonable with shares

trading at just 17x forward earnings.

Caterpillar (CAT)

EPS Surprise: 34%

Sales Surprise: 10%

A different kind of "cat" delivered a big quarter too. The

Peoria, Illionis based maker of construction and mining equipment

reported record sales and profit for the fourth quarter of 2011 on

January 26.

Management initiated 2012 EPS guidance of $9.25, well above the

Zacks Consensus Estimate of the time at $9.08. Now the consensus is

$9.42. The 2013 consensus estimate also increased. CAT is Zacks #2

Rank (Buy) stock.

And the valuation picture still looks attractive for CAT. Shares

trade at just 12x the 2012 consensus estimate.

Apple (AAPL)

EPS Surprise: 38%

Sales Surprise: 19%

Following its first EPS miss in more than 7 years last quarter,

Apple delivered blowout results this quarter on January

24. Known for its conservative guidance, the company said that it

expects EPS of about $8.50 next quarter, which was well above the

Zacks Consensus Estimate of $8.01 at the time (its $9.36 now). It

is a Zacks #1 Rank (Strong Buy) stock.

Shares jumped to a new all-time high after the excellent

quarter, but the valuation picture still looks very attractive.

Shares trade at a ridiculously low 10x 12-month forward earnings,

and the company has a whopping $103.66 per share in cash and

securities.

United Rentals, Inc. (URI)

EPS Surprise: 34%

Sales Surprise: 9%

United Rentals is the largest equipment rental company in the

world, with locations throughout the United States and Canada. It

offers approximately 3,000 classes of equipment, ranging from heavy

machinery to hand tools.

Despite a sluggish economy, the company delivered outstanding Q4

results on January 25, and management gave a bullish outlook for

2012. Although it did not give specific EPS guidance, the company

expects a 5% increase in rental rates year-over-year. And CEO

Michael Kneeland stated that he expects 2012 to be a

"transformative year" for the company and that URI is in an

excellent position to capitalize on the emerging up-cycle as well

as the broader secular shift toward equipment rental.

Analysts revised their estimates significantly higher for both

2012 and 2013, sending the stock to a Zacks #1 Rank (Strong Buy).

Shares jumped 9% after the announcement, but valuation is still

very reasonable at 15x forward earnings.

CA Technologies (CA)

EPS Surprise: 18%

Sales Surprise: 5%

CA Technologies provides enterprise IT management software. The

company delivered very solid results for the third quarter of its

fiscal 2012 on January 24. On top of its sales and EPS beats,

management raised guidance for the remainder of 2012 to a range of

$2.21-$2.25.

This prompted analysts to revise their estimates significantly

higher for both 2012 and 2013, sending the stock to a Zacks #1 Rank

(Strong Buy) stock.

Shares popped 10% on the announcement. But valuation still looks

attractive for CA with shares trading at just 11x 12-month forward

earnings.

Conclusion This earnings season may not be off

to a great start. But these five companies each reported

outstanding quarters and have plenty of room to run higher over the

coming weeks and months.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Len Zacks. The company continually

processes stock reports issued by 3,000 analysts from 150 brokerage

firms. It monitors more than 200,000 earnings estimates,

looking for changes.

Then when changes are discovered, they’re applied to help assign

more than 4,400 stocks into five Zacks Rank categories: #1

Strong Buy, #2 Buy, #3 Hold, #4 Sell, and #5 Strong Sell. This

proprietary stock picking system; the Zacks Rank, continues to

outperform the market by nearly a 3 to 1 margin. The best way

to unlock the profitable stock recommendations and market insights

of Zacks Investment Research is through our free daily email

newsletter Profit from the Pros. In short, it’s your steady

flow of profitable ideas GUARANTEED to be worth your time.

Get your free subscription to Profit from the Pros at:

http://at.zacks.com/?id=7298

Follow us on Twitter: http://twitter.com/ZacksResearch

Join us on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Zacks Investment Research is under common control with

affiliated entities (including a broker-dealer and an investment

adviser), which may engage in transactions involving the foregoing

securities for the clients of such affiliates.

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

ARCTIC CAT INC (ACAT): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

UTD RENTALS INC (URI): Free Stock Analysis Report

To read this article on Zacks.com click here.

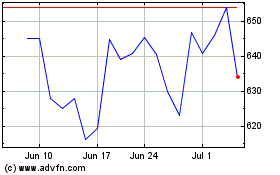

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2024 to Jul 2024

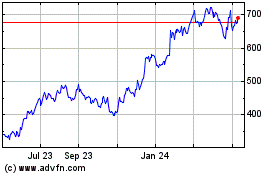

United Rentals (NYSE:URI)

Historical Stock Chart

From Jul 2023 to Jul 2024