For the first time in a long time, earnings season has been a bit

of a disappointment.

The typical earnings season will have a surprise

ratio (#beat/#miss) around 3:1 with a median surprise of about

3.0%. So far this season, the surprise ratio is 1.81 and the median

surprise is 1.9%.

According to Zacks' Chief Equity Strategist Dirk

Van Dijk, this is the weakest start to an earnings season since the

depths of the Great Recession.

As for estimate revision activity, the ratio of

S&P 500 companies with rising to falling estimates is 0.61 for

2012 - not a very bullish indicator.

And excluding financials, the year-over-year

increase in net income is 11.8% - down from 16.1% in the third

quarter.

Not All Bad

This earnings season may not be that hot so far,

but there are several companies that have reported exceptionally

strong quarters. You just have to hunt a little harder to find

them. I've highlighted 5 companies below that delivered the coveted

'triple play' this earnings season:

- A positive earnings surprise

- A positive sales surprise, and

- Guidance from management above the Zacks Consensus

Estimate

While some of these stocks have already moved

higher after their earnings announcement, I believe there is still

room for each of them to run higher.

For one, each stock is reasonably valued. Secondly,

the well-documented "post-earnings announcement drift" suggests

that companies with positive earnings surprises can see upward

stock price movements for several weeks, or even months.

5 Triple Plays:

Arctic Cat (ACAT)

EPS Surprise: 59%

Sales Surprise: 14%

Arctic Cat manufactures ATVs and snowmobiles.

Although this winter has been extremely mild, the company delivered

a huge quarter on January 26.

In addition to crushing the Zacks Consensus

Estimates on sales and EPS, management raised its EPS guidance to a

range of $1.60-$1.70 on sales growth of 22%-24%. This is up from

previous guidance of $1.10-$1.15 and well above the consensus of

$1.22 before the announcement.

Analysts raised their estimates for both 2012 and

2013 significantly higher after the beat, sending the stock to a

Zacks #1 Rank (Strong Buy) stock. And although shares jumped 20% on

the day of the announcement, valuation is still reasonable with

shares trading at just 17x forward earnings.

Caterpillar (CAT)

EPS Surprise: 34%

Sales Surprise: 10%

A different kind of "cat" delivered a big quarter

too. The Peoria, Illinois based maker of construction and mining

equipment reported record sales and profit for the fourth quarter

of 2011 on January 26.

Management initiated 2012 EPS guidance of $9.25,

well above the Zacks Consensus Estimate of $9.08 at the time. Now

the consensus is $9.42. The 2013 consensus estimate also increased.

CAT is Zacks #2 Rank (Buy) stock.

And the valuation picture still looks attractive

for CAT. Shares trade at just 12x the 2012 consensus estimate.

Apple (AAPL)

EPS Surprise: 38%

Sales Surprise: 19%

Following and extremely rare miss last quarter,

Apple delivered blowout results this quarter on January 24.

Known for its conservative guidance, the company said that it

expects EPS of about $8.50 next quarter, which was well above the

Zacks Consensus Estimate of $8.01 at the time (its $9.36 now). It

is a Zacks #1 Rank (Strong Buy) stock.

Shares jumped to a new all-time high after the

excellent quarter, but the valuation picture still looks very

attractive. Shares trade at a ridiculously low 10x 12-month forward

earnings, and the company has a whopping $103.66 per share in cash

and securities.

United Rentals, Inc. (URI)

EPS Surprise: 34%

Sales Surprise: 9%

United Rentals is the largest equipment rental

company in the world, with locations throughout the United States

and Canada. It offers approximately 3,000 classes of equipment,

ranging from heavy machinery to hand tools.

Despite a sluggish economy, the company delivered

outstanding Q4 results on January 25, and management gave a bullish

outlook for 2012. Although it did not give specific EPS guidance,

the company expects a 5% increase in rental rates year-over-year.

And CEO Michael Kneeland stated that he expects 2012 to be a

"transformative year" for the company and that URI is in an

excellent position to capitalize on the emerging up-cycle as well

as the broader secular shift toward equipment rental.

Analysts revised their estimates significantly

higher for both 2012 and 2013, sending the stock to a Zacks #1 Rank

(Strong Buy). Shares jumped 9% after the announcement, but

valuation is still very reasonable at 15x forward earnings.

CA Technologies (CA)

EPS Surprise: 18%

Sales Surprise: 5%

CA Technologies provides enterprise IT management

software. The company delivered very solid results for the third

quarter of its fiscal 2012 on January 24. On top of strong sales

and EPS beats, management raised guidance for the remainder of 2012

to a range of $2.21-$2.25 - well above the Zacks Consensus Estimate

of $2.02 at the time.

This prompted analysts to revise their estimates

significantly higher for both 2012 and 2013, sending the stock to a

Zacks #1 Rank (Strong Buy) stock.

Shares popped 10% on the earnings announcement. But

valuation still looks attractive for CA with shares trading at just

11x 12-month forward earnings.

Conclusion

This earnings season may not be off to a great

start. But these five companies each reported outstanding quarters

and have plenty of room to run higher over the coming weeks and

months.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks.com and Co-Editor with Steve Reitmeister of

the Reitmeister Value Investor that snaps up discounted value

stocks and sells them after the market realizes their true worth

for long-term gains.

APPLE INC (AAPL): Free Stock Analysis Report

ARCTIC CAT INC (ACAT): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

UTD RENTALS INC (URI): Free Stock Analysis Report

To read this article on Zacks.com click here.

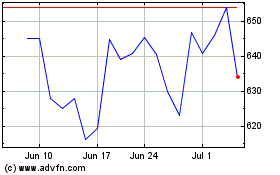

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2024 to Jul 2024

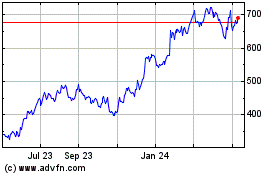

United Rentals (NYSE:URI)

Historical Stock Chart

From Jul 2023 to Jul 2024