United Rentals, Inc. (NYSE: URI) today announced financial

results for the fourth quarter and full year 2009. For the fourth

quarter, total revenue was $557 million and rental revenue was $450

million, compared with $791 million and $606 million, respectively,

for the fourth quarter 2008. For the full year, total revenue was

$2.4 billion and rental revenue was $1.8 billion, compared with

$3.3 billion and $2.5 billion, respectively, for the full year

2008.

2009 Highlights

- Free cash flow increased to $367

million for the full year 2009, compared with $335 million for

2008.

- Total debt at year-end 2009

decreased by $270 million compared with year-end 2008, and net

debt, which includes the impact of cash and cash equivalents,

decreased by $362 million. The company has no significant debt

maturities until 2013.

- SG&A expense decreased by

$20 million for the fourth quarter year-over-year, and decreased by

$101 million for the full year 2009 compared with 2008.

- The company sold $653 million of

fleet on an original equipment cost basis in 2009, with an average

age of 78 months.

- Cost of equipment rentals,

excluding depreciation, decreased by $51 million for the fourth

quarter and by $227 million for the full year 2009, compared with

2008.

- Time utilization was 61.8% for

the fourth quarter and 60.7% for the full year 2009, representing

decreases of 2.4 percentage points and 2.9 percentage points,

respectively, from 2008. Rental rates declined 9.6% for the quarter

and 11.8% for the year. Dollar utilization, which reflects the

impact of both rental rates and time utilization, was 46.0% for the

fourth quarter and 45.5% for full year 2009, representing decreases

of 9.3 percentage points and 11.4 percentage points, respectively,

from 2008.

2010 Outlook

The company provided the following financial targets for

2010:

- SG&A expense reduction of

$25 million to $35 million for full year 2010, compared with

2009;

- Cost of equipment rentals,

excluding depreciation, reduction of $70 million to $90 million for

the full year 2010, compared with 2009; and

- Free cash flow of between $175

million and $200 million, including net rental capital expenditures

(defined as purchases of rental equipment less the proceeds from

sales of rental equipment) of between $100 million to $120 million.

The company expects its fleet size at the end of 2010 to be about

$3.6 billion on an original equipment cost basis.

CEO Comments

Michael Kneeland, chief executive officer of United Rentals,

said, "We can point to a number of significant contrasts between

the strategic progress we made as a company in 2009 and our

operating environment . Externally, the economic turmoil took a

toll on our end markets, with the expected constraint on our

revenues and margins. We responded with disciplined cost cutting

and capital management, improving our free cash flow and SG&A

reduction beyond projections.”

Kneeland continued, "At this time we are still seeing an

environment that is very similar to the last half of 2009. Despite

the challenges of a lingering downturn, we believe that the

transformation of our customer service and sales operations, and

our strong capital structure, put us in a unique position to gain

share that will be accretive to earnings over time. We are becoming

increasingly adept at balancing local market development with the

pursuit of national accounts, industrial accounts and government

business – the segments most closely aligned with our strategy for

long-term profitable growth.”

2009 Financial Results

For the fourth quarter 2009, on a GAAP continuing operations

basis, the company reported a loss of $24 million, or a loss of

$0.39 per diluted share, compared with a loss of $853 million, or a

loss of $14.25 per diluted share, for the fourth quarter 2008.

Adjusted EPS, which excludes the impact of restructuring and

impairment charges and other special items, was a loss of $0.21 per

diluted share for the quarter, compared with earnings of $0.74 per

diluted share for the prior year. Adjusted EBITDA margin, which

also excludes the impact of restructuring and impairment charges

and other special items, was 26.8% for the quarter, compared with

31.6% for the prior year.

For the full year 2009, on a GAAP continuing operations basis,

the company reported a loss of $60 million, or a loss of $0.98 per

diluted share, compared with a loss of $704 million, or a loss of

$12.62 per diluted share, for 2008. Adjusted EPS, which excludes

the impact of restructuring and impairment charges and other

special items, was a loss of $0.76 per diluted share for 2009,

compared with earnings of $2.96 per diluted share for the prior

year. Adjusted EBITDA margin, which also excludes the impact of

restructuring and impairment charges and other special items, was

26.6% for 2009, compared with 32.8% for the prior year.

The change in profitability for the fourth quarter and full year

2009, compared with 2008, primarily reflects the continued decline

in non-residential construction activity and its negative impact on

pricing, partially offset by the savings realized from the

company’s ongoing cost-cutting initiatives.

Free Cash Flow and Fleet Size

For full year 2009, free cash flow, a non-GAAP measure, was $367

million after total rental and non-rental capital expenditures of

$311 million, compared with free cash flow of $335 million after

total rental and non-rental capital expenditures of $704 million

for full year 2008. The year-over-year increase in free cash flow

was largely the result of a reduction in capital expenditures,

partially offset by lower cash generated from operating

activities.

The size of the rental fleet, as measured by the original

equipment cost (“OEC”), was $3.8 billion at December 31, 2009,

compared with $4.1 billion at December 31, 2008. The age of the

rental fleet was 42.4 months on a unit-weighted basis at December

31, 2009, compared with 39.2 months at December 31, 2008.

Return on Invested Capital (ROIC)

Return on invested capital was 1.8% for the year ended December

31, 2009, a decrease of 5.8 percentage points compared with 2008.

The company’s ROIC metric uses after-tax operating income for the

trailing 12 months divided by the averages of stockholders’ equity

(deficit), debt and deferred taxes, net of average cash.

Conference Call

United Rentals will hold a conference call tomorrow, Thursday,

February 4, 2010, at 11:00 a.m. Eastern Time. The conference call

will be available live by audio webcast at unitedrentals.com, where it will be

archived, and by calling 866-261-2650.

Non-GAAP Measures

Free cash flow, earnings before interest, taxes, depreciation

and amortization (EBITDA), adjusted EBITDA, and adjusted earnings

per share (adjusted EPS) are non-GAAP financial measures as defined

under the rules of the SEC. Free cash flow represents net cash

provided by operating activities, less purchases of rental and

non-rental equipment plus proceeds from sales of rental and

non-rental equipment and excess tax benefits from share-based

payment arrangements. EBITDA represents the sum of net income

(loss), loss from discontinued operations, net of taxes, benefit

for income taxes, interest expense, net, interest

expense-subordinated convertible debentures, net,

depreciation-rental equipment and non-rental depreciation and

amortization. Adjusted EBITDA represents EBITDA plus the sum of the

restructuring charge, the charge related to the settlement of the

SEC inquiry, the goodwill impairment charge and stock compensation

expense, net. Adjusted EPS represents EPS plus (i) the sum of the

restructuring and asset impairment charges, the losses on the

repurchase/retirement of debt securities and subordinated

convertible debentures, the charge related to the settlement of the

SEC inquiry, the preferred stock redemption charge and the foreign

tax credit valuation allowance and other less (ii) the gains on the

repurchase/retirement of debt securities. The company believes

that: (i) free cash flow provides useful additional information

concerning cash flow available to meet future debt service

obligations and working capital requirements; (ii) EBITDA and

adjusted EBITDA provide useful information about operating

performance and period-over-period growth; and (iii) adjusted EPS

provides useful information concerning future profitability.

However, none of these measures should be considered as

alternatives to net income, cash flows from operating activities or

earnings per share under GAAP as indicators of operating

performance or liquidity. Information reconciling forward-looking

free cash flow to a GAAP financial measure is unavailable to the

company without unreasonable effort.

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world, with an integrated network of 569 rental locations in 48

states, 10 Canadian provinces and Mexico. The company’s

approximately 8,000 employees serve construction and industrial

customers, utilities, municipalities, homeowners and others. The

company offers for rent approximately 3,000 classes of equipment

with a total original cost of $3.8 billion. United Rentals is a

member of the Standard & Poor’s MidCap 400 Index and the

Russell 2000 Index® and is headquartered in Greenwich, Conn.

Additional information about United Rentals is available at

unitedrentals.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such statements can be identified by

the use of forward-looking terminology such as “believe,” “expect,”

“may,” “will,” “should,” “seek,” “on-track,” “plan,” “project,”

“forecast,” “intend” or “anticipate,” or the negative thereof or

comparable terminology, or by discussions of strategy or outlook.

You are cautioned that our business and operations are subject to a

variety of risks and uncertainties, many of which are beyond our

control, and, consequently, our actual results may differ

materially from those projected. Factors that could cause actual

results to differ materially from those projected include, but are

not limited to, the following: (1) on-going decreases in North

American construction and industrial activities, which have

significantly affected revenues and, because many of our costs are

fixed, our profitability, and which may further reduce demand and

prices for our products and services; (2) our highly leveraged

capital structure, which requires us to use a substantial portion

of our cash flow for debt service and can constrain our flexibility

in responding to unanticipated or adverse business conditions; (3)

noncompliance with financial or other covenants in our debt

agreements, which could result in our lenders terminating our

credit facilities and requiring us to repay outstanding borrowings;

(4) inability to access the capital that our businesses or growth

plans may require; (5) increases in our maintenance and replacement

costs as we age our fleet, and decreases in the residual value of

our equipment; (6) inability to sell our new or used fleet in the

amounts, or at the prices, we expect; (7) rates we can charge and

time utilization we can achieve being less than anticipated; and

(8) costs we incur being more than anticipated, and the inability

to realize expected savings in the amounts or time frames planned.

For a fuller description of these and other possible uncertainties,

please refer to our Annual Report on Form 10-K for the year ended

December 31, 2009, as well as to our subsequent filings with the

SEC. Our forward-looking statements contained herein speak only as

of the date hereof, and we make no commitment to update or publicly

release any revisions to forward-looking statements in order to

reflect new information or subsequent events, circumstances or

changes in expectations.

UNITED RENTALS, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In millions, except per share amounts)

Three

Months Ended Twelve Months Ended December 31,

December 31, 2009

2008 % Change

2009 2008 %

Change Revenues: Equipment rentals $ 450 $ 606

(25.7 %) $ 1,830 $ 2,496 (26.7 %) Sales of rental equipment 37 74

(50.0 %) 229 264 (13.3 %) New equipment sales 23 42 (45.2 %) 86 179

(52.0 %) Contractor supplies sales 26 43 (39.5 %) 121 212 (42.9 %)

Service and other revenues 21 26 (19.2

%) 92 116 (20.7 %)

Total

revenues 557 791

(29.6 %)

2,358 3,267

(27.8 %) Cost of revenues:

Cost of equipment rentals,

excluding depreciation

231 282 (18.1 %) 910 1,137 (20.0 %) Depreciation of rental

equipment 101 121 (16.5 %) 417 455 (8.4 %) Cost of rental equipment

sales 33 63 (47.6 %) 222 198 12.1 % Cost of new equipment sales 20

37 (45.9 %) 73 151 (51.7 %) Cost of contractor supplies sales 19 32

(40.6 %) 89 162 (45.1 %) Cost of service and other revenues

8 9 (11.1 %) 37 46

(19.6 %)

Total cost of revenues 412

544 (24.3 %)

1,748

2,149 (18.7 %)

Gross profit 145

247 (41.3 %)

610 1,118 (45.4 %)

Selling, general and administrative expenses 100 120 (16.7 %) 408

509 (19.8 %) Restructuring charge 6 14 (57.1 %) 31 20 55.0 % Charge

related to settlement of SEC inquiry - - - 14 Goodwill impairment

charge - 1,147 - 1,147 Non-rental depreciation and amortization

15 14 7.1 % 57 58

(1.7 %)

Operating income (loss) 24

(1,048 ) 102.3 %

114 (630 )

118.1 % Interest expense, net 72 15 380.0 % 226 174 29.9 %

Interest expense - subordinated

convertible debentures, net

2 2 (4 ) 9 Other (income) expense, net (1 ) -

(1 ) -

Loss from continuing

operations before benefit for income taxes (49

) (1,065 ) (107 ) (813

) Benefit for income taxes (25 ) (212 )

(47 ) (109 )

Loss from continuing operations

(24 ) (853 ) (60 )

(704 )

Loss from discontinued operation,

net of taxes

(2 ) - (2 ) -

Net

loss $ (26 ) $ (853 )

$ (62 ) $ (704 )

Preferred stock redemption charge - - - (239 )

Net loss

available to common stockholders $ (26 )

$ (853 ) $ (62 ) $

(943 ) Basic and diluted loss per

share:

Loss per share from continuing

operations (inclusive of preferred stock redemption charge)

$ (0.39 ) $ (14.25 ) $ (0.98 ) $ (12.62 ) Loss from discontinued

operation (0.04 ) - (0.04 ) -

Net loss $ (0.43 ) $

(14.25 ) $ (1.02 ) $

(12.62 ) UNITED RENTALS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In millions)

December 31, 2009 2008

ASSETS Cash and cash equivalents $ 169 $ 77 Accounts

receivable, net 337 454 Inventory 44 59 Prepaid expenses and other

assets 89 37 Deferred taxes 66 76 Total

current assets 705 703 Rental equipment, net 2,414 2,746

Property and equipment, net 434 447 Goodwill and other intangible

assets, net 231 229 Other long-term assets 75

66

Total assets $ 3,859

$ 4,191 LIABILITIES AND

STOCKHOLDERS' DEFICIT Current maturities of long-term debt $

125 $ 13 Accounts payable 128 157 Accrued expenses and other

liabilities 208 257 Total current

liabilities 461 427 Long-term debt 2,826 3,186 Subordinated

convertible debentures 124 146 Deferred taxes 424 414 Other

long-term liabilities 43 47

Total

liabilities 3,878 4,220

Common stock 1 1 Additional paid-in capital 487 466

Accumulated deficit (574 ) (512 ) Accumulated other comprehensive

income 67 16

Total stockholders'

deficit (19 ) (29 )

Total liabilities and stockholders' deficit $

3,859 $ 4,191 UNITED RENTALS,

INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions) Three

Months Ended Twelve Months Ended December 31,

December 31, 2009

2008 2009

2008 Cash Flows From Operating

Activities: Loss from continuing operations $ (24 ) $ (853 ) $

(60 ) $ (704 ) Adjustments to reconcile loss from continuing

operations to net cash provided by operating activities:

Depreciation and amortization 116 135 474 513 Amortization and

write-off of deferred financing and related costs 4 5 17 16 Gain on

sales of rental equipment (4 ) (11 ) (7 ) (66 ) (Gain) loss on

sales of non-rental equipment - (1 ) 1 (3 ) Goodwill impairment

charge - 1,147 - 1,147 Foreign currency transaction loss - 1 - 1

Non-cash adjustments to equipment (1 ) (1 ) 3 - Stock compensation

expense, net 2 2 8 6 Restructuring charge 6 14 31 20 Loss (gain) on

repurchase of debt securities 9 (45 ) (7 ) (41 ) Gain on retirement

of subordinated convertible debentures - - (13 ) - Increase

(decrease) in deferred taxes 8 (216 ) 4 (129 ) Changes in operating

assets and liabilities: Decrease in accounts receivable 34 43 128

51 Decrease in inventory 9 19 16 31 (Increase) decrease in prepaid

expenses and other assets (48 ) 14 (39 ) 30 Decrease in accounts

payable (15 ) (52 ) (32 ) (34 ) Decrease in accrued expenses and

other liabilities (11 ) (8 ) (86 ) (74

) Net cash provided by operating activities 85 193 438 764

Cash Flows From Investing Activities: Purchases of rental

equipment (62 ) (34 ) (260 ) (624 ) Purchases of non-rental

equipment (17 ) (39 ) (51 ) (80 ) Proceeds from sales of rental

equipment 37 74 229 264 Proceeds from sales of non-rental equipment

2 4 13 11 Purchases of other companies 1 -

(25 ) (17 ) Net cash (used in) provided by

investing activities (39 ) 5 (94 ) (446 )

Cash Flows From

Financing Activities: Proceeds from debt 1,449 426 3,452 2,004

Payments of debt (1,431 ) (606 ) (3,658 ) (1,725 ) Payments of

financing costs (19 ) (1 ) (33 ) (32 ) Proceeds from exercise of

common stock options - 3 - 3 Repurchase of common stock, including

fees - - - (603 ) Shares repurchased and retired (1 ) (2 ) (1 ) (2

) Excess tax benefits from share-based payment arrangements - - (2

) - Cash paid in connection with convertible note hedge

transactions (26 ) - (26 ) -

Cash paid in connection with

preferred stock redemption, including fees

- - - (257 ) Other - (1 ) -

- Net cash used in financing activities (28 )

(181 ) (268 ) (612 ) Effect of foreign exchange rates 2

(6 ) 16 (10 ) Net increase

(decrease) in cash and cash equivalents 20 11 92 (304 ) Cash and

cash equivalents at beginning of period 149 66

77 381 Cash and cash equivalents

at end of period $ 169 $ 77 $ 169 $ 77

UNITED RENTALS, INC. SEGMENT PERFORMANCE ($ in

millions)

Three Months Ended Twelve Months Ended

December 31, December 31, 2009

2008 % Change 2009

2008 % Change General

Rentals Reportable segment revenue $ 520 $ 745 (30.2%) $ 2,202

$ 3,065 (28.2%) Reportable segment operating income (1) 26 103

(74.8%) 123 500 (75.4%) Reportable segment operating margin (1)

5.0% 13.8%

(8.8 pts)

5.6% 16.3% (10.7 pts)

Trench Safety, Pump and Power

Reportable segment revenue $ 37 $ 46 (19.6%) $ 156 $ 202 (22.8%)

Reportable segment operating income 4 10 (60.0%) 22 51 (56.9%)

Reportable segment operating margin 10.8% 21.7% (10.9 pts) 14.1%

25.2% (11.1 pts)

Total United Rentals Total revenue $

557 $ 791 (29.6%) $ 2,358 $ 3,267 (27.8%) Total operating income

(1) 30 113 (73.5%) 145 551 (73.7%) Total operating margin (1) 5.4%

14.3% (8.9 pts) 6.1% 16.9% (10.8 pts)

(1) Excludes the goodwill

impairment charge, restructuring charge and charge related to

settlement of the SEC inquiry

DILUTED LOSS PER SHARE CALCULATION (In millions, except

per share data)

Three Months Ended Twelve Months Ended December

31, December 31, 2009

2008 2009

2008 Loss from continuing operations $

(24 ) $ (853 ) $ (60 ) $ (704 ) Preferred stock redemption charge

(1) - - - (239 )

Loss from continuing operations

available to common stockholders

(24 ) (853 ) (60 ) (943 ) Loss from discontinued operation, net of

taxes (2 ) - (2 ) - Net

loss available to common stockholders $ (26 ) $ (853 ) $ (62 ) $

(943 ) Weighted-average diluted shares 60.2 59.9 60.1 74.7

Diluted loss per share:

Loss from continuing operations

(inclusive of preferred stock redemption charge)

$ (0.39 ) $ (14.25 ) $ (0.98 ) $ (12.62 ) Loss from discontinued

operation (0.04 ) - (0.04 ) -

Net loss $ (0.43 ) $ (14.25 ) $ (1.02 ) $ (12.62 )

(1) Relates to the June 2008 repurchase of all of our

outstanding Series C and Series D preferred stock.

UNITED RENTALS, INC.

ADJUSTED EARNINGS (LOSS) PER

SHARE RECONCILIATION

We define “earnings (loss) per share – adjusted” as the sum of

(i) loss per share from continuing operations – GAAP, as reported,

plus the after-tax impact of (ii) restructuring charge, (iii)

goodwill impairment charge, (iv) loss (gain) on repurchase of debt

securities and retirement of subordinated convertible debentures,

(v) asset impairment charge, (vi) charge related to the settlement

of the SEC inquiry, (vii) preferred stock redemption charge, and

(viii) foreign tax credit valuation allowance and other. Management

believes adjusted earnings (loss) per share provides useful

information concerning future profitability. However, adjusted

earnings (loss) per share is not a measure of financial performance

under GAAP. Accordingly, adjusted earnings (loss) per share should

not be considered an alternative to GAAP loss per share. The table

below provides a reconciliation between loss per share – GAAP, as

reported, and earnings (loss) per share – adjusted.

Three Months Ended Twelve Months

Ended December 31, December 31,

2009 2008

2009 2008

Loss per share from continuing operations- GAAP,

as reported $ (0.39 ) $

(14.25 ) $ (0.98 ) $

(12.62 ) After-tax impact of:

Restructuring charge (1) 0.07 0.14 0.29 0.17 Goodwill impairment

charge (2) - 15.21 - 12.19

Loss (gain) on repurchase of debt

securities and retirement of subordinated convertible

debentures

0.08 (0.44 ) (0.19 ) (0.32 ) Asset impairment charge (3) 0.03 0.08

0.12 0.06 Charge related to settlement of SEC inquiry - - - 0.19

Preferred stock redemption charge (4) - - - 3.19 Foreign tax credit

valuation allowance and other (5) - -

- 0.10

Earnings (loss) per share -

adjusted

$ (0.21 ) $ 0.74 $

(0.76 ) $ 2.96 (1)

Relates to branch closure charges and severance costs (2)

Represents a non-cash goodwill impairment charge related to certain

reporting units within our general rental segment. The charge

reflected the challenges of the construction cycle, as well as the

broader economic and credit environment. Substantially all of the

impairment charge relates to goodwill arising out of acquisitions

made between 1997 and 2000. (3) Primarily relates to the impact of

impairing certain rental equipment and leasehold improvement

write-offs. (4) Relates to the June 2008 repurchase of our Series C

and Series D preferred stock and reduces income available to common

stockholders for earnings per share purposes, but does not affect

net income (loss). (5) Primarily relates to the establishment of a

valuation allowance related to certain foreign tax credits that, as

a result of the preferred stock redemption, were no longer expected

to be realized.

UNITED RENTALS, INC.

EBITDA AND ADJUSTED EBITDA GAAP

RECONCILIATION

(In millions)

“EBITDA” represents the sum of net loss, loss from discontinued

operation, net of taxes, benefit for income taxes, interest

expense, net, interest expense-subordinated convertible debentures,

net, depreciation-rental equipment, and non-rental depreciation and

amortization. Adjusted EBITDA represents EBITDA plus (i) the sum of

the restructuring charge, the charge related to the settlement of

the SEC inquiry, the goodwill impairment charge, and stock

compensation expense, net. These items are excluded from adjusted

EBITDA internally when evaluating our operating performance and

allow investors to make a more meaningful comparison between our

core business operating results over different periods of time, as

well as those of other companies. Management believes that EBITDA

and adjusted EBITDA, when viewed with the Company’s GAAP results

and the accompanying reconciliation, provide useful information

about operating performance and period-over-period growth, and

provide additional information that is useful for evaluating the

operating performance of our core business without regard to

potential distortions. Additionally, management believes that

EBITDA and adjusted EBITDA permit investors to gain an

understanding of the factors and trends affecting our ongoing cash

earnings, from which capital investments are made and debt is

serviced. However, EBITDA and adjusted EBITDA are not measures of

financial performance or liquidity under GAAP and, accordingly,

should not be considered as alternatives to net loss or cash flow

from operating activities as indicators of operating performance or

liquidity. The table below provides a reconciliation between net

loss and EBITDA and adjusted EBITDA.

Three Months Ended Twelve

Months Ended December 31, December 31,

2009 2008

2009 2008 Net loss $

(26 ) $ (853 ) $ (62 ) $ (704 ) Loss from discontinued operation,

net of taxes 2 - 2 - Benefit for income taxes (25 ) (212 ) (47 )

(109 ) Interest expense, net 72 15 226 174 Interest expense -

subordinated convertible debentures, net 2 2 (4 ) 9 Depreciation -

rental equipment 101 121 417 455 Non-rental depreciation and

amortization 15 14 57

58

EBITDA (A) 141 (913 )

589 (117 ) Restructuring charge (1) 6 14 31 20

Charge related to settlement of SEC inquiry - - - 14 Goodwill

impairment charge (2) - 1,147 - 1,147 Stock compensation expense,

net (3) 2 2 8 6

Adjusted EBITDA (B) $ 149

$ 250 $ 628 $

1,070 (A) Our EBITDA margin was 25.3% and

(115.4%) for the three months ended December 31, 2009 and 2008,

respectively, and 25.0% and (3.6%) for the twelve months ended

December 31, 2009 and 2008, respectively. (B) Our adjusted EBITDA

margin was 26.8% and 31.6% for the three months ended December 31,

2009 and 2008, respectively, and 26.6% and 32.8% for the twelve

months ended December 31, 2009 and 2008, respectively. (1)

Relates to branch closure charges and severance costs. (2)

Represents a non-cash goodwill impairment charge related to certain

reporting units within our general rental segment. The charge

reflected the challenges of the construction cycle, as well as the

broader economic and credit environment. Substantially all of the

impairment charge relates to goodwill arising out of acquisitions

made between 1997 and 2000. (3) Represents non-cash, share-based

payments associated with the granting of equity instruments.

UNITED RENTALS, INC.

FREE CASH FLOW GAAP

RECONCILIATION

(In millions)

We define “free cash flow” as (i) net cash provided by operating

activities less (ii) purchases of rental and non-rental equipment

plus (iii) proceeds from sales of rental and non-rental equipment

and excess tax benefits from share-based payment arrangements.

Management believes free cash flow provides useful additional

information concerning cash flow available to meet future debt

service obligations and working capital requirements. However, free

cash flow is not a measure of financial performance or liquidity

under GAAP. Accordingly, free cash flow should not be considered an

alternative to net income (loss) or cash flow from operating

activities as an indicator of operating performance or liquidity.

The table below provides a reconciliation between net cash provided

by operating activities and free cash flow.

Three Months Ended

Twelve Months Ended December 31, December 31,

2009 2008

2009 2008 Net cash

provided by operating activities $ 85 $ 193 $ 438 $ 764 Purchases

of rental equipment (62 ) (34 ) (260 ) (624 ) Purchases of

non-rental equipment (17 ) (39 ) (51 ) (80 ) Proceeds from sales of

rental equipment 37 74 229 264 Proceeds from sales of non-rental

equipment 2 4 13 11

Excess tax benefits from

share-based payment arrangements

- - (2 ) -

Free

cash flow $ 45 $ 198

$ 367 $ 335

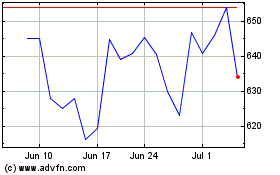

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2024 to Jul 2024

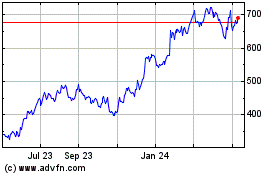

United Rentals (NYSE:URI)

Historical Stock Chart

From Jul 2023 to Jul 2024