United Rentals, Inc. (NYSE: URI) today announced record earnings

per share from continuing operations for both the fourth quarter

and full year 2007. For the fourth quarter, earnings per share of

$0.84 increased 18.3% compared with $0.71 for the fourth quarter

2006. For the full year, earnings per share of $2.76 increased

21.1% compared with $2.28 for the full year 2006. 2007 fourth

quarter and full year earnings per share are before the benefit the

company realized from its receipt of $100 million following the

recent termination of its merger agreement with affiliates of

Cerberus, net of related costs and expenses. Including this

one-time benefit, the company reported 2007 fourth quarter and full

year GAAP earnings per share of $1.36 and $3.26, respectively, also

a record. Fourth Quarter and Full Year 2007 Financial Highlights

Compared with 2006 (excluding merger termination benefit) EBITDA

increased 9.3% to a record $318 million for the fourth quarter and

increased 8.0% to a record $1.17 billion for the full year. EBITDA

margin improved 3.2 percentage points to 34.2% for the fourth

quarter, and 1.6 percentage points to 31.4% for the full year. As

discussed further below, the fourth quarter and full year EBITDA

include a currency benefit of $17 million ($11 million after-tax).

EBITDA is a non-GAAP measure. Rental revenue increased 4.1% for the

fourth quarter and 4.0% for the full year. Same-store rental

revenue increased 3.7% for the fourth quarter and 3.1% for the full

year. Time utilization, on a larger fleet, increased 2.3 percentage

points for the fourth quarter and 2.5 percentage points for the

full year, more than offsetting rental rate declines of 2.1% and

1.1% for the fourth quarter and full year, respectively. SG&A

expense as a percent of revenue improved 0.8 percentage points to

16.2% for the fourth quarter and 0.9 percentage points to 15.9% for

the full year. Fourth quarter 2007 income from continuing

operations of $94 million, excluding a $59 million after-tax impact

of the merger termination benefit, increased 22.1% from $77 million

for the fourth quarter 2006. Full year 2007 income from continuing

operations of $306 million, excluding a $57 million after-tax

impact of the merger termination benefit, increased 22.9% from $249

million for the full year 2006. Fourth quarter and full year 2007

income from continuing operations includes net foreign currency

transaction gains of $11 million, or $0.10 per diluted share,

primarily related to the company�s Canadian operations.

Additionally, full year 2007 income from continuing operations

includes non-cash reductions in interest expense of $6 million, or

$0.05 per diluted share, related to the mark-to-market impact of

certain interest rate swaps. Of this benefit, $4 million, or $0.04

per diluted share, was recognized in the fourth quarter. Total

revenue from continuing operations was $930 million for the fourth

quarter 2007, a decrease of 1.0% from the fourth quarter 2006, and

$3.73 billion for the full year 2007, an increase of 2.5% from the

full year 2006. The slight decline in fourth quarter total revenue

reflects planned decreases in contractor supplies and used

equipment sales of 20.6% and 12.6%, respectively, partially offset

by a 4.1% increase in equipment rental revenue. Excluding the

merger termination benefit, free cash flow for the full year 2007

was $151 million after total rental and non-rental capital

expenditures of $990 million, compared with free cash flow of $235

million for the full year 2006 after total rental and non-rental

capital expenditures of $951 million. The year-over-year reduction

in free cash flow reflects an increase in cash taxes paid and

working capital usage in 2007 as compared to working capital

generation in the prior year. Free cash flow is a non-GAAP measure.

The size of the rental fleet, measured by the original equipment

cost, was $4.2 billion, and the average age of the fleet was 38

months at December 31, 2007, compared with $3.9 billion and 39

months at year-end 2006. Full Year 2008 Outlook The company

reaffirmed its full year 2008 outlook for earnings per share of

$2.80 to $3.00 based on anticipated rental revenue growth of 3.0%

to $2.71 billion and total revenue of $3.53 billion. Rental revenue

expectations reflect the following assumptions: an improvement in

time utilization, virtually no growth capital and modest growth in

non-residential construction activity. The company also expects to

generate $1.17 to $1.21 billion of EBITDA, representing an expected

full year EBITDA margin improvement to approximately 33.7% of

revenues. Additionally, the company expects to generate $325

million to $375 million of free cash flow after planned total

capital expenditures of approximately $715 million. CEO Comments

Michael Kneeland, chief executive officer for United Rentals, said,

"The record EPS and EBITDA we generated in 2007 were the direct

result of a new strategic plan that is intensely focused on

profitable growth. In mid-year, we put our operations under a

microscope and returned our sales and service focus to our core

equipment rental business, where we have numerous competitive

advantages. This helped drive significant increases in time

utilization and organic rental revenue growth. Additionally, we

took action to improve our cost structure with a 9% headcount

reduction, branch network optimization, and approximately $22

million in cumulative savings through better sourcing.� Mr.

Kneeland continued, "In 2008, we expect to continue to improve our

performance as we move forward with the disciplined execution of

our plan. In the first quarter, we're on pace to double our

equipment transfers compared with 2007. Our agility with fleet

management and our ongoing cost containment initiatives should help

drive a 33.7% EBITDA margin and strong free cash flow in 2008,

given the current construction outlook. Our guidance is consistent

with our goal of realizing $500 million in incremental annual

EBITDA within five years." Return on Invested Capital (ROIC) Return

on invested capital was 14.5% for the twelve months ended December

31, 2007, an improvement of 0.6 percentage points from September

30, 2007, and a decline of 0.2 percentage points from December 31,

2006. The company�s ROIC metric uses operating income for the

trailing twelve months divided by the averages of stockholders�

equity, debt and deferred taxes, net of average cash. The company

reports ROIC to provide information on the company�s efficiency and

effectiveness in deploying its capital and improving stockholder

value. Additional Information on 2007 Results and Status of SEC

Inquiry For additional information concerning the company�s 2007

fourth quarter and full year results, including segment performance

for its general rentals and trench safety, pump and power

businesses, as well as the status of the previously announced SEC

inquiry of the company and related matters, please see the

company�s 2007 Form 10-K filed today with the SEC. CEO Search The

company also reported that its board of directors has retained the

executive recruitment firm of Heidrick & Struggles to conduct a

search for a permanent chief executive officer. In doing so, the

board confirmed that Michael Kneeland, who currently serves as CEO

on an interim basis, is a candidate for the position. The board

also commended Mr. Kneeland on his leadership of the company since

June 2007. Conference Call United Rentals will hold a conference

call tomorrow, Friday, February 29th, at 11:00 a.m. Eastern Time.

The conference will be available live by audio webcast at

www.unitedrentals.com, where it will be archived until the

company�s next call. About United Rentals United Rentals, Inc. is

the largest equipment rental company in the world, with an

integrated network of over 690 rental locations in 48 states, 10

Canadian provinces and Mexico. The company�s approximately 10,900

employees serve construction and industrial customers, utilities,

municipalities, homeowners and others. The company offers for rent

over 2,900 classes of rental equipment with a total original cost

of $4.2 billion. United Rentals is a member of the Standard &

Poor�s MidCap 400 Index and the Russell 2000 Index� and is

headquartered in Greenwich, Conn. Additional information about

United Rentals is available at www.unitedrentals.com. Forward

Looking Statements Certain statements in this press release are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

These statements can generally be identified by words such as

"believes," "expects," "plans," "intends," "projects," "forecasts,"

"may," "will," "should," "on track" or "anticipates," or the

negative thereof or comparable terminology, or by discussions of

vision, strategy or outlook. Our businesses and operations are

subject to a variety of risks and uncertainties, many of which are

beyond our control, and, consequently, actual results may differ

materially from those projected by any forward-looking statements.

Factors that could cause actual results to differ from those

projected include, but are not limited to, the following: (1)

weaker or unfavorable economic or industry conditions can reduce

demand and prices for our products and services, (2)

non-residential construction spending, or governmental funding for

infrastructure and other construction projects, may not reach

expected levels, (3) we may not always have access to capital that

our businesses or growth plans may require, (4) any companies we

acquire could have undiscovered liabilities, may strain our

management capabilities or may be difficult to integrate, (5) rates

we can charge and time utilization we can achieve may be less than

anticipated, (6) costs we incur may be more than anticipated,

including by having expected savings not be realized in the amounts

or time frames we have planned, (7) competition in our industry for

talented employees is intense, which can affect our employee costs

and retention rates, (8) we have (and the ability to incur

additional) significant leverage, which requires us to use a

substantial portion of our cash flow for debt service and can

constrain our flexibility in responding to unanticipated or adverse

business conditions, (9) we are subject to an ongoing inquiry by

the SEC, and there can be no assurance as to its outcome, or any

other potential consequences thereof for us, (10) we are subject to

purported class action lawsuits and derivative actions filed in

light of the SEC inquiry and additional purported class action

lawsuits relating to the terminated merger transaction with

Cerberus affiliates, and there can be no assurance as to their

outcome or any other potential consequences thereof for us, and

(11) we may incur additional significant costs and expenses

(including indemnification obligations) in connection with the SEC

inquiry, the purported class action lawsuits and derivative actions

referenced above, the U.S. Attorney�s office inquiry, or other

litigation, regulatory or investigatory matters, related to the

foregoing or otherwise. For a fuller description of these and other

possible uncertainties, please refer to our Annual Report on Form

10-K for the year ended December 31, 2007, as well as to our

subsequent filings with the SEC. Our forward-looking statements

contained herein speak only as of the date hereof, and we make no

commitment to update or publicly release any revisions to

forward-looking statements in order to reflect new information or

subsequent events, circumstances or changes in expectations. UNITED

RENTALS, INC. CONSOLIDATED STATEMENTS OF INCOME (In millions,

except per share data) � � � � � � Three Months Ended Twelve Months

Ended December 31, December 31, 2007 2006 % Change 2007 2006 %

Change � Revenues: Equipment rentals $ 683 $ 656 4.1 % $ 2,630 $

2,530 4.0 % Sales of rental equipment 76 87 (12.6 %) 319 335 (4.8

%) New equipment sales 53 60 (11.7 %) 230 232 (0.9 %) Contractor

supplies sales 77 97 (20.6 %) 378 385 (1.8 %) Service and other

revenues � 41 � � 39 � 5.1 % � 174 � � 158 � 10.1 % Total revenues

� 930 � � 939 � (1.0 %) � 3,731 � � 3,640 � 2.5 % � Cost of

revenues: Cost of equipment rentals, excluding depreciation 294 287

2.4 % 1,179 1,137 3.7 % Depreciation of rental equipment 113 104

8.7 % 434 408 6.4 % Cost of rental equipment sales 61 65 (6.2 %)

235 237 (0.8 %) Cost of new equipment sales 43 50 (14.0 %) 190 191

(0.5 %) Cost of contractor supplies sales 61 68 (10.3 %) 306 302

1.3 % Cost of service and other revenue � 19 � � 18 � 5.6 % � 79 �

� � 76 � 3.9 % Total cost of revenues � 591 � � 592 � (0.2 %) �

2,423 � � 2,351 � 3.1 % Gross profit 339 347 (2.3 %) 1,308 1,289

1.5 % � Selling, general and administrative expenses 151 160 (5.6

%) 595 613 (2.9 %) Non-rental depreciation and amortization � 16 �

� 13 � 23.1 % � 54 � � 50 � 8.0 % Operating income 172 174 (1.1 %)

659 626 5.3 % Interest expense, net 41 51 187 208 Interest expense

- subordinated convertible debentures 2 2 9 13 Other income � (111

) � - � � (115 ) � - � � Income from continuing operations before

provision for income taxes 240 121 98.3 % 578 405 42.7 % �

Provision for income taxes � 87 � � 44 � � 215 � � 156 � Income

from continuing operations 153 77 98.7 % 363 249 45.8 % � Loss from

discontinued operation, net of taxes � - � � (24 ) � (1 ) � (25 ) �

Net income $ 153 � $ 53 � 188.7 % $ 362 � $ 224 � 61.6 % Diluted

earnings per share: Income from continuing operations $ 1.36 $ 0.71

91.5 % $ 3.26 $ 2.28 43.0 % Loss from discontinued operation �

(0.01 ) � (0.22 ) � (0.01 ) � (0.22 ) Net income $ 1.35 � $ 0.49 �

175.5 % $ 3.25 � $ 2.06 � 57.8 % UNITED RENTALS, INC. CONSOLIDATED

BALANCE SHEETS (In millions) � � December 31, 2007 2006 ASSETS Cash

and cash equivalents $ 381 $ 119 Accounts receivable, net 519 502

Inventory 91 139 Assets of discontinued operation - 107 Prepaid

expenses and other assets 57 56 Deferred taxes � 72 � 82 Total

current assets 1,120 1,005 � Rental equipment, net 2,826 2,561

Property and equipment, net 440 359 Goodwill and other intangible

assets, net 1,404 1,376 Other long-term assets � 52 � 65 Total

assets $ 5,842 $ 5,366 LIABILITIES AND STOCKHOLDERS' EQUITY Current

maturities of long-term debt $ 15 $ 37 Accounts payable 195 218

Accrued expenses and other liabilities 310 322 Liabilities related

to discontinued operation � - � 22 Total current liabilities 520

599 � Long-term debt 2,555 2,519 Subordinated convertible

debentures 146 146 Deferred taxes 539 463 Other long-term

liabilities � 64 � � 101 � Total liabilities � 3,824 � 3,828 Common

stock 1 1 Additional paid-in capital 1,494 1,421 Retained earnings

431 69 Accumulated other comprehensive income � 92 � 47 Total

stockholders' equity � 2,018 � 1,538 � Total liabilities and

stockholders' equity $ 5,842 $ 5,366 UNITED RENTALS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) � � � � Three

Months Ended Twelve Months Ended December 31, December 31, 2007

2006 2007 2006 Cash Flows From Operating Activities: Income from

continuing operations $ 153 $ 77 $ 363 $ 249 Adjustments to

reconcile income from continuing operations to net cash provided by

operating activities: Depreciation and amortization 129 117 488 458

Amortization of deferred financing costs 2 2 9 10 Gain on sales of

rental equipment (15 ) (22 ) (84 ) (98 ) Gain on sales of

non-rental equipment - (2 ) (5 ) (4 ) Foreign currency transaction

gain (17 ) - (17 ) - Non-cash adjustments to equipment 10 (1 ) 9 7

Stock compensation expense 3 5 15 16 Write-off deferred financing

fees and unamortized premiums on interest rate caps - 1 - 9

Increase in deferred taxes 20 38 61 130 Changes in operating assets

and liabilities: Decrease (increase) in accounts receivable 74 39

(5 ) 10 Decrease in inventory 35 12 51 16 (Increase) decrease in

prepaid expenses and other assets (1 ) (1 ) - 5 (Decrease) increase

in accounts payable (60 ) (31 ) (30 ) 9 Increase in accrued

expenses and other liabilities � 42 � � 11 � � 4 � � 17 � Net cash

provided by operating activities - continuing operations 375 245

859 834 Net cash provided by operating activities - discontinued

operation � - � � 7 � � 9 � � 24 � Net cash provided by operating

activities � 375 � � 252 � � 868 � � 858 � � Cash Flows From

Investing Activities: Purchases of rental equipment (85 ) (86 )

(870 ) (873 ) Purchases of non-rental equipment (39 ) (28 ) (120 )

(78 ) Proceeds from sales of rental equipment 76 87 319 335

Proceeds from sales of non-rental equipment 3 4 23 17 Purchases of

other companies � - � � - � � (23 ) � (39 ) Net cash used in

investing activities - continuing operations (45 ) (23 ) (671 )

(638 ) Net cash provided by (used in) investing activities -

discontinued operation � - � � 1 � � 67 � � (10 ) Net cash used in

investing activities � (45 ) � (22 ) � (604 ) � (648 ) � Cash Flows

From Financing Activities: Proceeds from debt 39 - 460 265 Payments

on debt (111 ) (246 ) (531 ) (669 ) Proceeds from the exercise of

common stock options 10 14 32 78 Shares repurchased and retired (1

) (3 ) (5 ) (4 ) Excess tax benefits from share-based payment

arrangements 3 - 31 - Proceeds received in conjunction with partial

termination of interest rate caps - - - 3 Subordinated convertible

debentures repurchased and retired � - � � (13 ) � - � � (77 ) �

Net cash used in financing activities (60 ) (248 ) (13 ) (404 ) �

Effect of foreign exchange rates � (1 ) � (3 ) � 11 � � (3 ) � Net

increase (decrease) in cash and cash equivalents 269 (21 ) 262 (197

) Cash and cash equivalents at beginning of period � 112 � � 140 �

� 119 � � 316 � � Cash and cash equivalents at end of period $ 381

� $ 119 � $ 381 � $ 119 � UNITED RENTALS, INC. SEGMENT PERFORMANCE

($ in millions) � � � � � Three Months Ended Twelve Months Ended

December 31, December 31, 2007 2006 % Change 2007 2006 % Change �

General Rentals Total revenues $ 876 $ 888 (1.4 %) $ 3,508 $ 3,423

2.5 % Operating income 159 159 - 602 568 6.0 % Operating margin

18.2 % 17.9 % 0.3 pts 17.2 % 16.6 % 0.6 pts � Trench Safety, Pump

and Power Total revenues 54 51 5.9 % 223 217 2.8 % Operating income

13 15 (13.3 %) 57 58 (1.7 %) Operating margin 24.1 % 29.4 % (5.3

pts) 25.6 % 26.7 % (1.1 pts) � Total United Rentals Total revenues

$ 930 $ 939 (1.0 %) $ 3,731 $ 3,640 2.5 % Operating income 172 174

(1.1 %) 659 626 5.3 % Operating margin 18.5 % 18.5 % - 17.7 % 17.2

% 0.5 pts � � � DILUTED EARNINGS PER SHARE CALCULATION (In

millions, except per share data) � � � Three Months Ended Twelve

Months Ended December 31, December 31, 2007 2006 % Change 2007 2006

% Change � Income from continuing operations $ 153 $ 77 98.7 % $

363 $ 249 45.8 % Loss from discontinued operation, net of taxes � -

� � (24 ) � (1 ) � (25 ) Net income 153 53 188.7 % 362 224 61.6 %

Convertible subordinated note interest - - 2 2 Subordinated

convertible debentures interest � 2 � � 2 � � 5 � � 8 � Net income

available to common stockholders $ 155 $ 55 181.8 % $ 369 $ 234

57.7 % � � Weighted average common shares 86.1 81.1 6.2 % 83.4 79.6

4.8 % Series C and D preferred shares 17.0 17.0 - 17.0 17.0 -

Convertible subordinated notes 6.5 6.5 - 6.5 6.5 - Stock options,

warrants, restricted stock units and phantom shares 1.8 4.7 (61.7

%) 3.5 6.0 (41.7 %) Subordinated convertible debentures � 3.3 � �

3.5 � (5.7 %) � 3.3 � � 4.7 � (29.8 %) Total weighted average

diluted shares 114.7 112.8 1.7 % 113.7 113.8 (0.1 %) � Diluted

earnings available to common stockholders: Income from continuing

operations $ 1.36 $ 0.71 91.5 % $ 3.26 $ 2.28 43.0 % Loss from

discontinued operation � (0.01 ) � (0.22 ) � (0.01 ) � (0.22 ) Net

income $ 1.35 � $ 0.49 � 175.5 % $ 3.25 � $ 2.06 � 57.8 % UNITED

RENTALS, INC. FREE CASH FLOW GAAP RECONCILIATION (In millions) We

define �free cash flow� as (i) net cash provided by operating

activities � continuing operations less (ii) purchases of rental

and non-rental equipment plus (iii) proceeds from sales of rental

and non-rental equipment and excess tax benefits from share-based

payment arrangements. Management believes free cash flow provides

useful additional information concerning cash flow available to

meet future debt service obligations and working capital

requirements. However, free cash flow is not a measure of financial

performance or liquidity under Generally Accepted Accounting

Principles (�GAAP�). Accordingly, free cash flow should not be

considered an alternative to net income or cash flow from operating

activities as indicators of operating performance or liquidity.

Information reconciling forward-looking free cash flow expectations

to a GAAP financial measure is unavailable to the company without

unreasonable effort. The table below provides a reconciliation

between net cash provided by operating activities � continuing

operations and free cash flow. � Three Months Ended � Twelve Months

Ended December 31, December 31, 2007 � 2006 2007 � 2006 � Net cash

provided by operating activities - continuing operations $ 375 $

245 $ 859 $ 834 Purchases of rental equipment (85 ) (86 ) (870 )

(873 ) Purchases of non-rental equipment (39 ) (28 ) (120 ) (78 )

Proceeds from sales of rental equipment 76 87 319 335 Proceeds from

sales of non-rental equipment 3 4 23 17 Excess tax benefits from

share-based payment arrangements � 3 � � - � � 31 � � - � Free Cash

Flow (1) $ 333 � $ 222 � $ 242 � $ 235 � � � (1) Fourth quarter and

full year 2007 free cash flow includes $94 and $91, respectively,

related to the merger termination benefit. UNITED RENTALS, INC.

EBITDA GAAP RECONCILIATION (In millions) "EBITDA" represents the

sum of income from continuing operations before provision for

income taxes, interest expense, net, interest expense-subordinated

convertible debentures, depreciation-rental equipment and

non-rental depreciation and amortization. Management believes

EBITDA provides useful information about operating performance and

period-over-period growth. However, EBITDA is not a measure of

financial performance or liquidity under GAAP and accordingly

should not be considered an alternative to net income or cash flow

from operating activities as an indicator of operating performance

or liquidity. The table below provides a reconciliation between

income from continuing operations before provision for income taxes

and EBITDA. � Three Months Ended � Twelve Months Ended December 31,

December 31, 2007 � 2006 2007 � 2006 � Income from continuing

operations before provision for income taxes $ 240 $ 121 $ 578 $

405 Interest expense, net 41 51 187 208 Interest expense -

subordinated convertible debentures 2 2 9 13 Depreciation - rental

equipment 113 104 434 408 Non-rental depreciation and amortization

� 16 � 13 � 54 � 50 EBITDA (1) $ 412 $ 291 $ 1,262 $ 1,084 � � (1)

Fourth quarter and full year 2007 EBITDA includes a merger

termination benefit of $94 and $91, respectively.

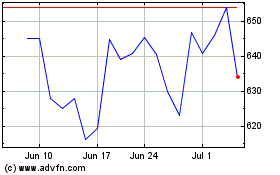

United Rentals (NYSE:URI)

Historical Stock Chart

From May 2024 to Jun 2024

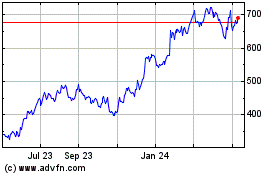

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2023 to Jun 2024