Weak Prelim Results for TreeHouse - Analyst Blog

January 24 2012 - 5:45AM

Zacks

TreeHouse Foods

Inc. (THS) recently reduced its fiscal 2011 earnings

outlook to $2.70–$2.73 per share from the earlier projection of

$2.90–$3.00 per share based on a 4% reduction in fourth-quarter

retail channel volume. December volumes declined a record low of

8%, which was the worst in the company’s history. Lower consumer

food purchases, sales shift away from traditional grocery customers

toward alternate channel retailers and adverse impact of warm

weather in the Midwest and Northeast on seasonal sales were the

primary deterrents. The recent guidance includes the fourth quarter

earnings projection of 84–87 cents per share.

This is the second time TreeHouse

cut its outlook for fiscal 2011. In June last year, the company

trimmed its outlook to the range of $2.90–$3.00 from $3.00–$3.08

per share after taking into account higher freight, transportation,

packaging and other related commodity costs.

While sales in December are

generally driven by cold weather products like soup, non-dairy

creamers and hot cereal, however, relatively warmer weather during

this December marred the business. Soup fell 8.8%, non-dairy

creamers declined 4.7% and hot cereal was down 4.6% year over year.

Additionally, customers were more inclined to purchase from

alternate channel retailers such as club stores, limited assortment

stores and dollar stores. As a result, sales to traditional

retailers declined in the high single digits, while sales to

alternate retail channels were up double digits.

TreeHouse had expected to counter

the increased expenses through pricing. The pricing initiated in

the second quarter contributed approximately 4% to fourth quarter

sales, while acquisitions added approximately 2%. However,

volume/mix subtracted 1%.

Illinois-based TreeHouse, which

operates as a food manufacturing company serving primarily the

retail grocery and foodservice channels, reported fourth quarter

revenue growth of 5.0% to $535.0 million. However, fourth quarter

gross margin is expected to be approximately 22%, down from 24.8%

in the year-ago fourth quarter. Despite lower operating expenses,

mix shift toward lower margin products hurt the quarterly margin.

After registering steady growth in

the last six years, purchases of shelf stable dry groceries

recorded sharpest decline, which forced TreeHouse to trim its

guidance. However, despite this disappointing outlook, TreeHouse

expects to overcome these temporary difficulties as early as

possible. The company kicked off January on a positive note with

retail grocery private label shipments and orders up by approaching

double digits year over year. The company is also equipped with

strong balance sheet and cash flow to purse further acquisitions in

private label foods.

TreeHouse currently retains a Zacks

#3 Rank (short-term Hold rating). The company will announce its

fourth quarter results on February 10. Major competitors of

TreeHouse include Corn Products International Inc.

(CPO) and Omega Protein Corp. (OME).

CORN PROD INTL (CPO): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

TREEHOUSE FOODS (THS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

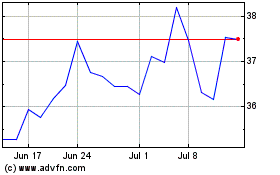

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From May 2024 to Jun 2024

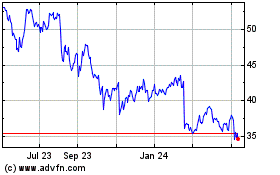

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2023 to Jun 2024