TreeHouse Cuts Fiscal 2011 Guidance - Analyst Blog

June 28 2011 - 9:15AM

Zacks

TreeHouse Foods

Inc. (THS) recently reduced its fiscal 2011 earnings

outlook to $2.90–$3.00 from $3.00–$3.08 after taking into account

higher freight, transportation, packaging and other related

commodity costs. The guidance includes the second-quarter earnings

projection of 42–44 cents. Following the announcement, Zacks

Consensus estimates for the second quarter and fiscal 2011 declined

28 cents and 15 cents to 43 cents and $2.91, respectively.

TreeHouse had expected to counter

the increased expenses through pricing, which took place after the

company had already incurred the higher costs. The pricing

initiated in the ongoing second quarter will now be realized in the

third and fourth quarters of 2011, resulting in about 6 cents per

share of unrecovered expense in the quarter’s results.

Last month, management noted that

surging export demand for grains and oilseeds as well as a rise in

crude oil prices led to a spike in input costs. While TreeHouse had

hedged the primary ingredients of the cost structure, unhedged

secondary inputs has hit the company badly.

After steady growth in the last six

months in tune with the economic recovery, consumer confidence has

fallen suddenly in the second quarter which forced TreeHouse to

hold up pricing action. Management commented that high gasoline

prices affected consumer spending, even of essentials.

Illinois-based TreeHouse, which

operates as a food manufacturing company serving primarily the

retail grocery and foodservice channels, now estimates strong

organic sales growth of 3.5–4.0% and total net sales of nearly $490

million. However, second-quarter margins are expected to fall short

by 250 basis points year over year to be in the 22–23% range. For

the full year, TreeHouse expects gross margins to be flat to

slightly below last year.

Despite the disappointing

projection for the second quarter, TreeHouse expects to overcome

these temporary difficulties in short order. The company

anticipates rapid margin recovery with the effectiveness of delayed

pricing. Moreover, most of the big win sales will be realized in

the back half of the year from increased distribution of

higher-margin products.

TreeHouse currently retains a Zacks

#4 Rank (short-term Sell recommendation). However, we still have a

long-term Neutral rating on the stock. The company will announce

its second quarter results on August 1. Major competitors of

TreeHouse include Corn Products International Inc.

(CPO) and Omega Protein Corp. (OME).

CORN PROD INTL (CPO): Free Stock Analysis Report

OMEGA PROTEIN (OME): Free Stock Analysis Report

TREEHOUSE FOODS (THS): Free Stock Analysis Report

Zacks Investment Research

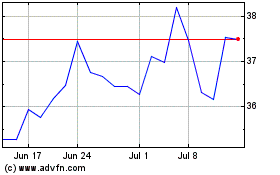

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

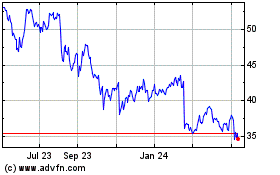

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024