HIGHLIGHTS WESTCHESTER, Ill., Feb. 12 /PRNewswire-FirstCall/ --

TreeHouse Foods, Inc. (NYSE:THS) today reported a substantial

increase in adjusted quarterly and full year earnings compared to

last year, after one-time items. On an adjusted basis, as described

below, fully-diluted earnings per share from continuing operations

in the fourth quarter improved 22.2% to $0.55 compared to $0.45

last year. For the full year, adjusted earnings per share from

continuing operations increased 22.7% to $1.62 compared to $1.32

last year. The 22.7% improvement in results was due primarily to

having a full year of E.D. Smith sales and profits in 2008 compared

to only 75 days in 2007. On a reported basis, income from

continuing operations was $0.22 per diluted share for the quarter

ended December 31, 2008, compared to $0.46 per diluted share last

year, reflecting unusual one-time items. For the full year,

reported earnings per share from continuing operations were $0.91

compared to $1.33 last year including unusual one-time items. The

reported results for the fourth quarter and full year included two

large mark to market items, both of which were non-cash and

non-operating. The first was the adjustment of an intercompany loan

with the Company's E.D. Smith subsidiary to reflect current

currency rates and the second was the mark to market adjustment of

an interest rate swap agreement to current LIBOR rates. The

interest rate adjustment will reverse over the remaining life of

the 32 month agreement as a non-cash, non-operating gain. In

addition, the Company reported non-recurring costs of $0.01 per

share associated with the Company's closed Portland, Oregon pickle

plant and $0.05 per share in costs associated with unfavorable

factory variances resulting from the Company's third quarter

inventory reduction programs. The reported results for last year

include the net effect of adjustments from the acquisition of the

E.D. Smith Income Trust ("E.D. Smith") totaling approximately $0.01

per share. ITEMS AFFECTING DILUTED EPS COMPARABILITY: Three Months

Ended Twelve Months Ended December 31 December 31 2008 2007 2008

2007 (unaudited) (unaudited) EPS from continuing operations as

reported $0.22 $0.46 $0.91 $1.33 Plant closing costs 0.01 0.29 Loss

on intercompany note translation 0.13 0.21 Mark to market

adjustment on interest rate swap 0.14 0.14 One time factory costs

from inventory reduction program 0.05 0.05 E.D. Smith acquisition-

related costs (0.01) 0.01 (0.01) Non-cash adjustment to value of

license and other - - 0.01 - Adjusted EPS $0.55 $0.45 $1.62 $1.32

Commenting on the results, Sam K. Reed, Chairman and CEO, said,

"The past year was the most challenging the packaged foods industry

has faced in decades, yet we overcame the extreme inflation and

volatility of input costs through targeted pricing actions and

internal cost controls. We generated top-line growth in key product

categories including soup, salsa, salad dressing and non-dairy

creamer and also expanded distribution of our E.D. Smith and San

Antonio Farms acquisitions. Despite the challenges, we exceeded our

original expectations and outperformed the food industry." Adjusted

operating earnings before interest, taxes, depreciation,

amortization and unusual items (Adjusted EBITDA, reconciled to net

income, the most directly comparable GAAP measure, appears on the

attached schedule) decreased slightly to $44.8 million in the

fourth quarter compared to $46.2 million in the same period last

year. The small decrease in the quarter reflected the negative

effect of Canadian currency rates on E.D. Smith cross border

transactions. Full year Adjusted EBITDA was $157.0 million compared

to $137.6 million last year, an increase of 14.1%. Net sales for

the fourth quarter totaled $398.1 million, an increase of 7.3% over

the fourth quarter of 2007, with 3.6% coming from legacy sales and

the balance from having a full quarter of E.D. Smith sales in 2008.

Reported gross margins for the fourth quarter decreased 40 basis

points to 20.1%, but this includes the negative effect of

under-absorbed factory costs of $2.5 million associated with our

now completed inventory reduction programs. Excluding those

one-time fourth quarter costs, gross margins would have been

slightly above last year's 20.5% gross margins. After experiencing

significant margin erosion early in the year due to very high input

costs, we have now seen two quarters of margin improvement, and

have returned to last year's fourth quarter gross profit margins.

Selling, distribution, general and administrative expenses were

$43.8 million for the quarter, a decrease of 2.2% from $44.8

million in the fourth quarter of 2007. The decrease was due to

lower distribution expenses as energy costs dropped significantly

in the quarter, partially offset by higher administrative costs

associated with the growth of the Company from last year. Selling,

distribution, general and administrative expenses as a percent of

sales improved to 11.0% of sales in the fourth quarter of 2008

compared to 12.1% last year due principally to higher average

selling prices and synergies from the E.D. Smith acquisition. Other

operating expense for the fourth quarter of 2008 was $1.3 million

and primarily reflects the ongoing maintenance costs associated

with the Company's closed Portland, Oregon pickle plant. The

previously announced plant closure took place in June, 2008 in

order to better balance production capacity. Interest expense in

the quarter was $5.8 million compared to $9.2 million last year as

lower debt from strong cash flow and lower interest rates

contributed to the decline. The Company ended the quarter with

$475.2 million of long term debt compared to $620.5 million last

year, with the significant reduction coming from operating cash

flows and the Company's actions to reduce working capital during

2008. In addition, the Company received an insurance reimbursement

of $20.0 million in the quarter associated with the previously

announced fire at the Company's New Hampton, Iowa plant in the

first quarter. The Company's fourth quarter effective income tax

rate of 20.5% was significantly lower than last year's tax rate of

35.8% due to the financing structure established for the E.D. Smith

Canadian and U.S. businesses. The fourth quarter effective tax rate

was lower than the full year run rate of 27.6% due to the low level

of pre-tax earnings in the quarter resulting from the mark to

market adjustments. Net income from continuing operations for the

fourth quarter totaled $7.1 million compared to $14.3 million last

year. Fully-diluted earnings per share from continuing operations

for the quarter were $0.22 per share compared to $0.46 per share

last year. Excluding unusual items, adjusted earnings per share

from continuing operations for the fourth quarter of 2008 would

have been $0.55, compared to last year's fourth quarter adjusted

earnings per share of $0.45. SEGMENT RESULTS The Company has three

reportable segments: 1. North American Retail Grocery -- This

segment sells branded and private label products to customers

within the United States and Canada. These products include

pickles, peppers, relishes, condensed and ready to serve soup,

broths, gravies, jams, spreads, salad dressings, sauces, non-dairy

powdered creamer, salsa, aseptic products and baby food. 2. Food

Away From Home -- This segment sells to foodservice customers,

including restaurant chains and food distribution companies, within

the United States and Canada. 3. Industrial and Export -- This

segment includes the Company's co-pack business and non-dairy

powdered creamer sales to industrial customers for use in

industrial applications, including for repackaging in portion

control packages and for use as an ingredient by other food

manufacturers. Export sales are primarily to industrial customers.

The direct operating income for our segments is determined by

deducting manufacturing costs from net sales and deducting direct

operating costs such as freight to customers, commissions,

brokerage fees as well as direct selling and marketing expenses.

General sales and administrative expenses, including restructuring

charges, are not allocated to our business segments as these costs

are managed at the corporate level. North American Retail Grocery

net sales for the fourth quarter increased by 8.6% from $232.8

million to $252.8 million compared to the same quarter last year

primarily due to the acquisition of E.D. Smith and higher average

selling prices. Excluding the acquisition, net sales increased 3.1%

as pricing more than offset volume declines resulting from lower

sales of branded baby food and discontinuation of unprofitable

pickle volume. Partially offsetting the pickle and baby food

decreases were increased unit sales of salad dressing, soup, salsa,

sauces and jams. Direct operating income as a percent of sales

increased significantly from 12.0% to 13.9% due to the

rationalization of lower margin pickle customers, improved salad

dressing margins and lower transportation costs compared to 2007.

Food Away From Home segment sales were nearly flat to last year at

$69.3 million as the full quarter effect of the acquisition of E.D.

Smith offset declines in the USA region. Difficult economic

conditions have caused food consumption away from home to decrease,

however, a positive mix of quick serve, fast food customers and

increased sales of salsa mitigated the volume decrease to only 2.0%

excluding volume from E.D. Smith causing an overall decrease in

unit volumes. Overall direct operating income increased slightly to

11.3% of revenue from 10.6% last year as pricing and lower

transportation costs offset higher overall input costs. Industrial

and Export segment sales increased 11.0% from $68.5 million last

year to $76.1 million this year due to a combination of increased

volume of co-packed products and higher prices. Although pricing

was taken in all areas, the sales mix shift to lower margin co-pack

sales caused direct operating income to decrease to 11.7% of net

sales from 15.3% last year. GUIDANCE FOR 2009 We expect that 2009

will be a very good year for TreeHouse, with earnings increasing

11% to 14% to $1.80 to $1.85 per share before one-time items and

before considering potential acquisitions. We do recognize that it

will also be a year of major transition for the packaged foods

industry as rampant input cost inflation and volatility are

replaced by recession, credit crisis and consumer uncertainty. As

commodity and energy costs have settled, inflationary pressures

have given way to deflationary pressures to lower prices,

especially in product categories whose costs are largely determined

by agricultural inputs and petroleum. Additionally, grocery and

foodservice customers have already begun one-time adjustments to

their purchasing cycles to reduce their inventories, thereby

generating additional cash flow. With these factors in mind, we

expect an increase of 1% in sales revenue at TreeHouse as a

combination of pass through pricing in the industrial sector,

pickle category rationalization and a lower Canadian exchange rate

depress dollar sales. However, unit sales growth driven by our

product portfolio strategy and expanded distribution will more than

offset these revenue pressures, resulting in a small increase in

total revenues. Gross margins are expected to improve 100 basis

points or more as product mix shift, productivity gains and

procurement economics outweigh sluggish pricing and foreign

exchange swings. In aggregate, input costs should be flat as

reductions in grains, oils and energy offset increases in steel

cans, fruits and vegetables, and minor ingredients. This full year

guidance assumes first quarter earnings per share to be $0.35 to

$0.37 compared to $0.34 last year. The small improvement over last

year's first quarter earnings per share reflects the timing of

forward purchase contracts, and assumes that most of the benefit of

lower input costs will benefit the back half of the year.

Commenting on the outlook for 2009, Sam K. Reed said, "Over the

past year, we have demonstrated our ability to succeed under the

most adverse food industry conditions. We expect external cost

pressures to subside in 2009, thus allowing us to focus on real

growth, expanded distribution and productivity gains in the new

year. These same factors are the key drivers of our 11% to 14%

earnings growth forecast for 2009. We also believe that the

combination of working capital management and funds availability

under our existing line of credit will allow us to pursue further

acquisitions while other buyers are relegated to the sidelines or

burdened with higher costs of capital." COMPARISON OF ADJUSTED

INFORMATION TO GAAP INFORMATION The adjusted earnings per share

data contained in this press release reflect adjustments to

reported earnings per share data to eliminate the net expense or

net gain related to items identified in the above chart. This

information is provided in order to allow investors to make

meaningful comparisons of the Company's operating performance

between periods and to view the Company's business from the same

perspective as Company management. Because the Company cannot

predict the timing and amount of charges associated with

non-recurring items or facility closings and reorganizations,

management does not consider these costs when evaluating the

Company's performance, when making decisions regarding the

allocation of resources, in determining incentive compensation for

management, or in determining earnings estimates. These costs are

not recorded in any of the Company's operating segments. Adjusted

EBITDA represents net income before interest expense, income tax

expense, depreciation and amortization expense, and non-recurring

items. Adjusted EBITDA is a performance measure and liquidity

measure used by our management, and we believe is commonly reported

and widely used by investors and other interested parties, as a

measure of a company's operating performance and ability to incur

and service debt. This non-GAAP financial information is provided

as additional information for investors and is not in accordance

with or an alternative to GAAP. These non-GAAP measures may be

different from similar measures used by other companies. A full

reconciliation table between reported income from continuing

operations for the three and twelve month periods ended December

31, 2008 and December 31, 2007 calculated according to GAAP and

Adjusted EBITDA is attached. Conference Call Webcast A webcast to

discuss the Company's financial results will be held at 5:00 p.m.

(Eastern Time) today and may be accessed by visiting the "Investor

Overview" page through the "Investor Relations" menu of the

Company's website at http://www.treehousefoods.com/. About

TreeHouse Foods TreeHouse is a food manufacturer servicing

primarily the retail grocery and foodservice channels. Its products

include non-dairy powdered coffee creamer; canned soup, salad

dressings and sauces; salsa and Mexican sauces; jams and pie

fillings under the E.D. Smith brand name; pickles and related

products; infant feeding products; and other food products

including aseptic sauces, refrigerated salad dressings, and liquid

non-dairy creamer. TreeHouse believes it is the largest

manufacturer of pickles and non-dairy powdered creamer in the

United States and the largest manufacturer of private label salad

dressings in the United States and Canada based on sales volume.

FORWARD LOOKING STATEMENTS This press release contains

"forward-looking statements." Forward-looking statements include

all statements that do not relate solely to historical or current

facts, and can generally be identified by the use of words such as

"may," "should," "could," "expects," "seek to," "anticipates,"

"plans," "believes," "estimates," "intends," "predicts,"

"projects," "potential" or "continue" or the negative of such terms

and other comparable terminology. These statements are only

predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks,

uncertainties and other factors that may cause the Company or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievement expressed or implied

by these forward-looking statements. TreeHouse's Form 10-K for the

year ended December 31, 2007 and its subsequent quarterly reports

discuss some of the factors that could contribute to these

differences. You are cautioned not to unduly rely on such

forward-looking statements, which speak only as of the date made,

when evaluating the information presented in this presentation. The

Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statement contained herein, to reflect any change in its

expectations with regard thereto, or any other change in events,

conditions or circumstances on which any statement is based.

FINANCIAL INFORMATION TREEHOUSE FOODS, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share data) Three

Months Ended Twelve Months Ended December 31 December 31 2008 2007

2008 2007 (unaudited) (unaudited) Net sales $398,082 $370,936

$1,500,650 $1,157,902 Cost of sales 318,236 295,073 1,208,626

917,611 Gross profit 79,846 75,863 292,024 240,291 Operating

expenses: Selling and distribution 29,058 30,228 115,731 94,636

General and administrative 14,780 14,593 61,741 53,931 Other

operating expense (income), net 1,329 (106) 13,901 (415)

Amortization expense 3,180 3,269 13,526 7,195 Total operating

expenses 48,347 47,984 204,899 155,347 Operating income 31,499

27,879 87,125 84,944 Other (income) expense: Interest expense 5,838

9,186 27,614 22,036 Interest income - (54) (107) (112) Loss (gain)

on currency exchange 9,316 (3,270) 13,040 (3,270) Other, net 7,382

(235) 7,123 (235) Total other expense 22,536 5,627 47,670 18,419

Income from continuing operations before income taxes 8,963 22,252

39,455 66,525 Income taxes 1,836 7,974 10,895 24,873 Income from

continuing operations 7,127 14,278 28,560 41,652 Loss from

discontinued operations, net of tax (336) - (336) (30) $6,791

$14,278 $28,224 $41,622 Weighted average common shares: Basic

31,522 31,203 31,341 31,203 Diluted 31,679 31,340 31,469 31,351

Basic earnings per common share: Income from continuing operations

$0.23 $0.46 $0.91 $1.33 Loss from discontinued operations, net of

tax (0.01) - (0.01) - Net income $0.22 $0.46 $0.90 $1.33 Diluted

earnings per common share: Income from continuing operations $0.22

$0.46 $0.91 $1.33 Loss from discontinued operations, net of tax

(0.01) - (0.01) - Net income $0.21 $0.46 $0.90 $1.33 Supplemental

Information: Depreciation and Amortization 10,346 10,744 45,852

34,983 Expense under FAS123R, before tax 3,398 3,358 12,193 13,580

Segment Information: North American Retail Grocery Net Sales

252,768 232,771 917,102 663,506 Direct Operating Income 35,253

27,873 114,511 85,293 Direct Operating Income Percent 13.9% 12.0%

12.5% 12.9% Food Away From Home Net Sales 69,264 69,640 294,020

254,580 Direct Operating Income 7,798 7,396 32,133 28,320 Direct

Operating Income Percent 11.3% 10.6% 10.9% 11.1% Industrial and

Export Net Sales 76,050 68,525 289,528 239,816 Direct Operating

Income 8,871 10,517 33,473 32,703 Direct Operating Income Percent

11.7% 15.3% 11.6% 13.6% The following table reconciles our net

income to adjusted EBITDA for the three and twelve months ended

December 31, 2008 and 2007: TREEHOUSE FOODS, INC. RECONCILIATION OF

REPORTED EARNINGS TO ADJUSTED EBITDA (In thousands, except per

share data) Three Months Ended Twelve Months Ended December 31

December 31 2008 2007 2008 2007 (unaudited) (unaudited) Net income

as reported $6,791 $14,278 $28,224 $41,622 Interest expense 5,838

9,186 26,980 22,036 Interest income - (54) (107) (112) Income taxes

1,835 7,974 10,895 24,873 Loss from discontinued operations, net of

tax 336 - 336 30 Depreciation and amortization 10,346 10,744 45,852

34,983 Stock option expense 3,398 3,358 12,193 13,580 Gain on

foreign currency hedge transaction - (3,270) - (3,270) Acquisition

integration and accounting adjustments - 4,012 508 4,170 One time

factory costs associated with inventory reduction program 2,500

2,500 Revalue license agreement and other - - 634 - Loss on

intercompany note translation 5,925 - 9,135 - Swap mark to market

6,981 - 6,981 - Plant shut-down costs and asset sales of closed

facilities 805 - 12,905 (274) Adjusted EBITDA $44,755 $46,228

$157,036 $137,638

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations of TreeHouse Foods, Inc.,

+1-708-483-1300, Ext 1331 Web site: http://www.treehousefoods.com/

Copyright

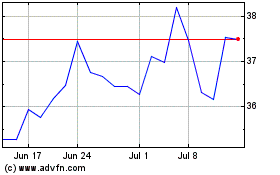

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

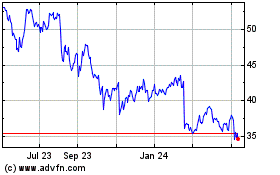

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024