TreeHouse Foods, Inc. Reports First Quarter Results, Updates 2006 Guidance for Acquisition of Soup and Infant Feeding Businesse

May 11 2006 - 8:00AM

PR Newswire (US)

WESTCHESTER, Ill., May 11 /PRNewswire-FirstCall/ -- TreeHouse

Foods, Inc. (NYSE:THS) today announced that income from continuing

operations was $0.24 per diluted share for the quarter ended March

31, 2006, compared to $0.37 per diluted share in the first quarter

of 2005. Results for the 2006 quarter include $0.10 per share of

expense recognized under Statement of Financial Accounting

Standards No. 123R, Share-Based Payment, and $0.02 relating to the

previously announced closure of the La Junta, CO pickle factory.

Net sales for the first quarter of 2006 totaled $172.7 million, an

increase of 3.8% over the first quarter of 2005. Pickle revenues

increased slightly due to the acquisition of the Oxford Foods book

of business, while both non-dairy powdered creamer and other

product sales grew 3.5% and 10.9%, respectively. Gross margin for

the first quarter was 23.4% compared to 22.7% last year as the

combination of targeted price increases and internal cost controls

offset higher energy costs. Operating expenses increased from $19.7

million during the first quarter of 2005 to $28.3 million due in

part to share based compensation expense of $4.8 million and plant

shutdown costs of $0.9 million. The remaining increase in operating

expense relates to the TreeHouse corporate infrastructure and

public company expenses which were not in the comparable period

last year, along with investing in a new operating management team

to integrate the recently acquired soup and infant feeding

businesses ("SIF"). Commenting on the first quarter results, Sam K.

Reed, Chairman and CEO, said, "We are pleased with our first

quarter performance, especially in light of the challenges our

industry faces with higher energy costs. We have sharpened our

focus on driving internal efficiencies, and we saw the benefits of

these programs in our gross margins. We also made investments in

our management team to ensure the integration of the soup and

infant feeding businesses goes as smoothly as possible." SEGMENT

RESULTS Pickle segment net sales for the first quarter increased by

approximately $0.9 million due to both higher pricing and increased

volumes from the acquired book of business from Oxford Foods. These

increases offset a baseline volume reduction of 5.8% led by a

decline in non-strategic regional brands. Adjusted gross margins in

the pickle segment improved from 14.0% to 16.0%. Adjusted gross

margin is gross profit less delivery and commission costs and is

TreeHouse's measure of segment performance. The improved margins

were the result of pricing and internal operating efficiencies that

offset significant year over year increases in container, natural

gas, corn syrup and sweeteners costs. Powder segment sales

increased $2.3 million or 3.5% in the first quarter as pricing

gains offset a small decrease in overall volume. The lower volume

was due to a warmer than usual winter, resulting in decreased

coffee consumption. Adjusted gross margins in the powder segment

increased from 17.4% to 19.7% due to improved internal efficiencies

and price increases. ACQUISITION OF SOUP & INFANT FEEDING

BUSINESSES The company completed its acquisition of the soup and

infant feeding businesses from Del Monte Foods, Inc. on April 24,

2006. The purchase price was $268.0 million plus approximately $7.0

million for working capital. The SIF businesses are expected to

generate $325.0 million in revenue on an annual basis, including

revenue from various co-packing arrangements. On an annualized

basis, SIF will generate approximately $0.10 per share in

additional net income, before the expected costs of $0.04 per share

relating to the integration of SIF into our Bay Valley Foods

operating unit. The acquisition was funded by drawing down

approximately $250 million under the company's $400 million

unsecured revolving credit agreement. The company is currently in

discussions with various banks regarding financing alternatives

that would lock in interest rates on a portion of the drawn funds

and increase total available funds for future acquisitions. The

results of SIF will be consolidated into TreeHouse effective with

the acquisition date. Therefore the full year results of TreeHouse

will include only eight months of the SIF business. We expect that

the eight month results of SIF, after considering the one-time

integration costs and seasonality of the business, will result in

an increase in total earnings per share compared to our previously

released 2006 guidance for TreeHouse of $0.05 per share. OUTLOOK

FOR THE REMAINDER OF 2006 "We are pleased with the revenue

increases in the first quarter of 2006, but we expect there will be

pressure on input costs and pricing as we move into the key selling

season for pickles," said Reed. "Rising energy prices are a risk to

our business environment, but we will continue to drive internal

efficiencies to offset these and other input cost increases to

improve our operating margins. We are optimistic that we can strike

the right balance between price and volume, and our internal

efficiencies will balance out the risk of higher input costs. As

such, we are maintaining our full year guidance of net income per

share on our base business of $0.81 to $0.86 per share and adding

$0.05 per share for the soup and infant feeding businesses,

resulting in a new range of $0.86 to $0.91 for 2006." Conference

Call Webcast A webcast to discuss the company's financial results

will be held at 10:00 a.m. (Eastern Daylight Time) today and may be

accessed by visiting the "Webcast" section of the company website

at http://www.treehousefoods.com/ . About TreeHouse Foods TreeHouse

is a food manufacturer servicing primarily the retail grocery and

foodservice channels. Its products include pickles and related

products; non-dairy powdered coffee creamer; private label soup and

infant feeding products, and other food products including aseptic

sauces, refrigerated salad dressings, and liquid non-dairy creamer.

TreeHouse believes it is the largest manufacturer of pickles and

non-dairy powdered creamer in the United States based on sales

volume. FORWARD-LOOKING STATEMENTS This press release contains

"forward-looking statements." Forward-looking statements include

all statements that do not relate solely to historical or current

facts, and can generally be identified by the use of words such as

"may," "should," "could," "expects," "seek to," "anticipates,"

"plans," "believes," "estimates," "intends," "predicts,"

"projects," "potential" or "continue" or the negative of such terms

and other comparable terminology. These statements are only

predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks,

uncertainties and other factors that may cause the company or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievement expressed or implied

by these forward-looking statements. TreeHouse's Form 10-K for the

year ended December 31, 2005 discusses some of the factors that

could contribute to these differences. You are cautioned not to

unduly rely on such forward-looking statements, which speak only as

of the date made, when evaluation the information presented in this

presentation. The company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, to reflect any change

in its expectations with regard thereto, or any other change in

events, conditions or circumstances on which any statement is

based. FINANCIAL INFORMATION TREEHOUSE FOODS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) Three Months Ended March 31 2006 2005 (unaudited) Net sales

$172,724 $166,375 Cost of sales 132,334 128,531 Gross profit 40,390

37,844 Operating expenses: Selling and distribution 14,050 14,105

General and administrative 13,769 3,721 Management fee paid to Dean

Foods - 1,470 Amortization expense 464 414 Total operating expenses

28,283 19,710 Operating income 12,107 18,134 Other (income)

expense: Interest expense, net 161 193 Other (income) expense, net

- (61) Total other (income) expense 161 132 Income from continuing

operations before income taxes 11,946 18,002 Income taxes 4,540

6,620 Income from continuing operations 7,406 11,382 Loss from

discontinued operations, net of tax (7) (339) Net income $7,399

$11,043 Weighted average common shares: Basic 31,088 30,801 Diluted

31,190 31,060 Basic earnings per common share: Income from

continuing operations $0.24 $0.37 Loss from discontinued

operations, net of tax (0.00) (0.01) Net income $0.24 $0.36 Diluted

earnings per common share: Income from continuing operations $0.24

$0.37 Loss from discontinued operations, net of tax (0.00) (0.01)

Net income $0.24 $0.36 Supplemental Information: Depreciation and

Amortization 4,515 4,131 Expense under FAS123R, before tax 4,815 -

Segment Information: Pickle Segment Net Sales 74,141 73,205

Adjusted Gross Margin 11,833 10,251 Adjusted Gross Margin Percent

16.0% 14.0% Powder Segment Net Sales 66,838 64,549 Adjusted Gross

Margin 13,159 11,203 Adjusted Gross Margin Percent 19.7% 17.4%

http://www.newscom.com/cgi-bin/prnh/20050726/CGTREELOGO

http://photoarchive.ap.org/ DATASOURCE: TreeHouse Foods, Inc.

CONTACT: Investor Relations of TreeHouse Foods, Inc.,

+1-708-483-1300 ext 1344 Web site: http://www.treehousefoods.com/

Copyright

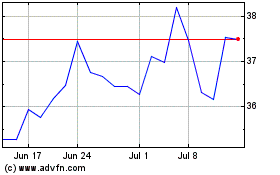

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jun 2024 to Jul 2024

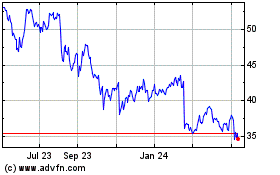

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Jul 2023 to Jul 2024