The Hartford Target Retirement 2010 Fund

Summary Prospectus

Hartford Funds

March 1, 2014

|

Class

|

|

Ticker

|

|

A

|

|

HTTAX

|

|

R3

|

|

HTTRX

|

|

R4

|

|

HTTSX

|

|

R5

|

|

HTTTX

|

|

Y

|

|

HTTYX

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund, including the Fund’s daily net asset value, online at www.hartfordfunds.com/prospectuses.html. You can also get this information at no cost by calling 1-888-843-7824 or by sending an e-mail request to orders@mysummaryprospectus.com. The Fund’s prospectus dated March 1, 2014 and statement of additional information dated March 1, 2014 along with the financial statements included in the Fund’s most recent annual report to shareholders dated October 31, 2013 are incorporated by reference into this summary prospectus. The Fund’s statement of additional information and annual report may be obtained, free of charge, in the same manner as the Fund’s prospectus.

Investment Objective:

The Fund’s goal is to maximize total return and secondarily, to seek capital preservation.

YOUR EXPENSES.

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Hartford Funds. More information about these and other discounts is available from your financial professional and in the “Sales Charge Reductions and Waivers” section beginning on page 28 of the Fund’s statutory prospectus and the “Purchase and Redemption of Shares” section beginning on page 161 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

|

|

|

Share Classes

|

|

|

|

|

A

|

|

R3

|

|

R4

|

|

R5

|

|

Y

|

|

|

Maximum sales charge (load) imposed on purchases as a percentage of offering price

|

|

5.50%

|

|

None

|

|

None

|

|

None

|

|

None

|

|

|

Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is less)

|

|

None (under $1 million invested)(1)

|

|

None

|

|

None

|

|

None

|

|

None

|

|

|

Exchange fees

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

A

|

|

R3(4)

|

|

R4(4)

|

|

R5(4)

|

|

Y

|

|

|

Management fees

|

|

0.15

|

%

|

0.15

|

%

|

0.15

|

%

|

0.15

|

%

|

0.15

|

%

|

|

Distribution and service (12b-1) fees

|

|

0.25

|

%

|

0.50

|

%

|

0.25

|

%

|

None

|

|

None

|

|

|

Other expenses

|

|

0.29

|

%

|

0.38

|

%

|

0.33

|

%

|

0.28

|

%

|

0.17

|

%

|

|

Acquired Fund fees and expenses

|

|

0.69

|

%

|

0.69

|

%

|

0.69

|

%

|

0.69

|

%

|

0.69

|

%

|

|

Total annual fund operating expenses(2)

|

|

1.38

|

%

|

1.72

|

%

|

1.42

|

%

|

1.12

|

%

|

1.01

|

%

|

|

Fee waiver and/or expense reimbursement(3)

|

|

0.38

|

%

|

0.42

|

%

|

0.42

|

%

|

0.32

|

%

|

0.21

|

%

|

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement(3)

|

|

1.00

|

%

|

1.30

|

%

|

1.00

|

%

|

0.80

|

%

|

0.80

|

%

|

(1)

For investments over $1 million, a 1.00% maximum deferred sales charge may apply.

(2)

“Total annual fund operating expenses” do not correlate to the ratio of expenses to average net assets that is disclosed in the Fund’s annual report in the financial highlights table, which reflects the operating expenses of the Fund and does not include Acquired Fund fees and expenses.

(3)

Hartford Funds Management Company, LLC (the “Investment Manager”) has contractually agreed to reimburse expenses (exclusive of taxes, interest expenses, brokerage commissions and extraordinary expenses) to the extent necessary to maintain total annual fund operating expenses as follows: 1.00% (Class A), 1.30% (Class R3), 1.00% (Class R4), 0.80% (Class R5) and 0.80% (Class Y). In addition, Hartford Administrative Services Company (“HASCO”), the Fund’s transfer agent, has contractually agreed to reimburse any portion of the transfer agency fees over 0.30% of the average daily net assets per fiscal year for all classes. Each contractual arrangement will remain in effect until February 28, 2015, and shall renew automatically for one-year terms thereafter unless the Investment Manager or HASCO, respectively, provides written notice of termination prior to the start of the next term or upon approval of the Board of Directors of the Fund.

2

(4)

Other expenses include an administrative services fee paid by the Fund for third party recordkeeping that is payable as a percentage of net assets in the amount of up to: 0.20% (Class R3), 0.15% (Class R4) and 0.10% (Class R5).

EXAMPLE.

The examples below are intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The examples assume that:

·

Your investment has a 5% return each year

·

The Fund’s operating expenses remain the same

·

You reinvest all dividends and distributions

·

You pay any deferred sales charge due for the applicable period.

Your actual costs may be higher or lower. Based on these assumptions, for every $10,000 invested, you would pay the following expenses if you sell all of your shares at the end of each time period indicated:

|

Share Classes

|

|

Year 1

|

|

Year 3

|

|

Year 5

|

|

Year 10

|

|

|

A

|

|

$

|

646

|

|

$

|

928

|

|

$

|

1,229

|

|

$

|

2,085

|

|

|

R3

|

|

$

|

132

|

|

$

|

501

|

|

$

|

894

|

|

$

|

1,995

|

|

|

R4

|

|

$

|

102

|

|

$

|

408

|

|

$

|

736

|

|

$

|

1,666

|

|

|

R5

|

|

$

|

82

|

|

$

|

324

|

|

$

|

586

|

|

$

|

1,335

|

|

|

Y

|

|

$

|

82

|

|

$

|

301

|

|

$

|

537

|

|

$

|

1,217

|

|

You would pay the following expenses if you did not redeem your shares:

|

Share Classes

|

|

Year 1

|

|

Year 3

|

|

Year 5

|

|

Year 10

|

|

|

A

|

|

$

|

646

|

|

$

|

928

|

|

$

|

1,229

|

|

$

|

2,085

|

|

|

R3

|

|

$

|

132

|

|

$

|

501

|

|

$

|

894

|

|

$

|

1,995

|

|

|

R4

|

|

$

|

102

|

|

$

|

408

|

|

$

|

736

|

|

$

|

1,666

|

|

|

R5

|

|

$

|

82

|

|

$

|

324

|

|

$

|

586

|

|

$

|

1,335

|

|

|

Y

|

|

$

|

82

|

|

$

|

301

|

|

$

|

537

|

|

$

|

1,217

|

|

Portfolio Turnover.

The Fund will not incur transaction costs, such as commissions, when it buys and sells shares of Hartford Funds (or “turns over” its portfolio). The Fund pays transaction costs, such as commissions, when it buys and sells other securities. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 21% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGY.

The Fund is designed for investors who plan to retire close to the year 2010, and who desire a portfolio that becomes increasingly conservative for approximately 15 years after retirement. The Fund seeks to achieve its goal by investing in a diversified combination of other Hartford Funds and may also invest in one or more unaffiliated money market funds (together the “Underlying Funds”) as well as certain exchange-traded funds (“ETFs”) and/or exchange-traded notes (“ETNs”) through an asset allocation strategy implemented by the sub-adviser, Wellington Management Company, LLP (“Wellington Management”). Under normal market conditions, Wellington Management adjusts the Fund’s investments to achieve approximately 40% of assets in equity instruments and equity funds and approximately 60% of assets in fixed income

3

instruments and fixed income funds, although these percentages may increase or decrease from time to time by up to 10%. After its target retirement date (2010), the Fund will gradually reach its most conservative allocation of approximately 28% in equity instruments and equity funds and 72% in fixed income instruments and fixed income funds approximately 15 years after the date indicated in the Fund’s name. The Fund may also invest in Underlying Funds, ETFs or ETNs that allocate to alternative asset classes, including inflation protected investments and commodities, as well as in cash and cash equivalents.

The Underlying Funds in which the Fund may invest generally represent the following fund types: equity, fixed income, inflation linked, cash or cash equivalents and diversifier funds that can invest in fixed income instruments, equity instruments and/or alternate assets classes.

GLIDE PATH ILLUSTRATION.

As discussed above, over time the Fund’s allocation to asset classes and Underlying Funds will change according to a predetermined “glide path” as shown in the following chart. The Fund’s current glide path asset allocation is based on its target date, which is the year in the name of the Fund. The glide path illustration shows the Fund’s expected target strategic asset allocation to each category, Underlying Fixed Income, Underlying Equity, Underlying Inflation Protected, Underlying Diversifier Funds and cash, and how the allocation changes over time. The glide path illustration shows how the Fund’s asset mix is designed to become more conservative—both prior to and after retirement—as time elapses. Although the glide path is meant to reduce the Fund’s potential volatility as retirement approaches, the Fund is not designed for a lump sum redemption at the retirement date. The Fund does not guarantee a particular level of income and Wellington Management may choose to modify the target asset allocation of the glide path itself from time to time.

4

Wellington Management may make tactical allocation adjustments around the glide path, which means that Wellington Management may vary the Fund’s actual asset allocation exposures from the glide path’s long-term targets based on Wellington Management’s views of perceived risks and opportunities. Wellington Management’s tactical allocations are not expected to vary from the target allocations by more than plus or minus 10%. The allocations shown in the chart do not reflect Wellington Management’s tactical allocation adjustments.

MAIN RISKS.

The primary risks of investing in the Fund are described below. When you sell your shares they may be worth more or less than what you paid for them, which means that you could lose money as a result of your investment.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

As with any fund, there is no guarantee that the Fund will achieve its goal. For more information regarding risks and investment matters please see “Additional Information Regarding Risks and Investment Strategies” in the Fund’s statutory prospectus.

Target Date Fund Risk

— An investment in the Fund is not guaranteed, and you may experience losses, including losses near, at or after the target retirement year. There is no guarantee that the Fund will provide adequate income at and through your retirement.

Target Date Allocation Risk

- The Fund is designed to provide portfolio asset allocation that becomes increasingly focused on fixed income investments and decreasingly focused on equity investments as the target retirement year approaches. Therefore, the farther away the Fund is from its target year, the higher the percentage of equity investments it will hold and the more aggressive its

5

investment strategy and volatile its portfolio may be considered. Conversely, the closer the Fund is to its target year, the higher the percentage of fixed income investments it will hold, generally providing a more conservative investment approach.

Fund of Funds Risk

- The Fund invests primarily in the Underlying Funds, and the Fund’s investment performance is directly related to the investment performance of the Underlying Funds it holds. The ability of the Fund to meet its investment objective is directly related to the ability of the Underlying Funds to meet their objectives as well as the sub-adviser’s allocation among those Underlying Funds.

The Fund is also subject to the risks associated with the Underlying Funds in proportion to its investment and changes in the value of the Underlying Funds may have a significant effect on the net asset value of the Fund. The risks of the underlying equity funds include risks specific to their strategies, such as small-cap stock risk, value or growth orientation risk, derivatives risk and foreign investments risk, among others, as well as risks related to the equity markets in general. The risks of the underlying fixed income funds include credit risk, derivatives risk, foreign investments risk, interest rate risk and liquidity risk. By investing in the Fund, you will indirectly bear fees and expenses charged by the Underlying Funds, in addition to the Fund’s direct fees and expenses.

Investment Strategy Risk

- The risk that, if the sub-adviser’s investment strategy does not perform as expected, the Fund could underperform its peers or lose money. There is no guarantee that the Fund’s investment objective will be achieved.

Market Risk

— Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Securities may decline in value due to the activities and financial prospects of individual companies or to general market and economic movements and trends.

The Fund is subject to certain other risks, which are described in the Fund’s statutory prospectus.

PAST PERFORMANCE.

The performance information below indicates the risks of investing in the Fund. Keep in mind that past performance does not indicate future results. Updated performance information is available at www.hartfordfunds.com.

The returns:

·

Assume reinvestment of all dividends and distributions

·

Include the Fund’s performance when the Fund’s portfolio pursued a modified strategy and was managed by a previous sub-adviser

·

Would be lower if the Fund’s operating expenses had not been limited.

The bar chart:

·

Shows how the Fund’s total return has varied from year to year

·

Does not include the effect of sales charges. If sales charges were reflected in the bar chart, returns would have been lower

6

·

Shows the returns of the Fund’s Class A shares. Because all of the Fund’s shares are invested in the same portfolio of securities, returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Total returns by calendar year (excludes sales charges)

Highest/Lowest quarterly results during the periods shown in the bar chart were:

Highest

13.56% (2nd quarter, 2009)

Lowest

-15.57% (4th quarter, 2008)

AVERAGE ANNUAL RETURNS.

The table below shows returns for the Fund over time compared to those of two broad-based market indices. After-tax returns, which are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes, are shown only for Class A shares and will vary for other classes. Returns prior to the inception date of certain classes of shares may reflect returns of another class of shares. For more information regarding returns see the “Performance Notes” section in the Fund’s statutory prospectus.

Actual after-tax returns, which depend on an investor’s particular tax situation, may differ from those shown and are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

7

Average annual total returns for periods ending December 31, 2013

(including sales charges)

|

|

|

|

|

|

|

Lifetime

|

|

|

Share Classes

|

|

1 Year

|

|

5 Years

|

|

(since 09/30/05)

|

|

|

Class A - Return Before Taxes

|

|

0.86

|

%

|

10.31

|

%

|

4.03

|

%

|

|

- After Taxes on Distributions

|

|

-0.81

|

%

|

9.22

|

%

|

2.64

|

%

|

|

- After Taxes on Distributions and Sale of Fund Shares

|

|

1.31

|

%

|

7.98

|

%

|

2.73

|

%

|

|

Share Classes

(Return Before Taxes)

|

|

|

|

|

|

|

|

|

Class R3

|

|

6.50

|

%

|

11.39

|

%

|

4.58

|

%

|

|

Class R4

|

|

6.76

|

%

|

11.71

|

%

|

4.86

|

%

|

|

Class R5

|

|

6.94

|

%

|

11.78

|

%

|

4.97

|

%

|

|

Class Y

|

|

6.96

|

%

|

11.77

|

%

|

4.98

|

%

|

|

Barclays U.S. Aggregate Bond Index

(reflects no deduction for fees, expenses or taxes)

|

|

-2.02

|

%

|

4.44

|

%

|

4.76

|

%

|

|

MSCI All Country World Index

(reflects no deduction for fees, expenses or taxes)

|

|

23.44

|

%

|

15.53

|

%

|

6.55

|

%

|

MANAGEMENT.

The Fund’s investment manager is Hartford Funds Management Company, LLC. The Fund’s sub-adviser is Wellington Management.

|

Portfolio Manager

|

|

Title

|

|

Involved with

Fund Since

|

|

Rick A. Wurster, CFA, CMT

|

|

Vice President and Asset Allocation Portfolio Manager

|

|

2012

|

|

|

|

|

|

|

|

Stephen A. Gorman, CFA

|

|

Vice President, Director, Tactical Asset Allocation, Asset Allocation Strategies Group and Portfolio Manager

|

|

2012

|

8

PURCHASE AND SALE OF FUND SHARES

. Not all share classes are available for all investors. Minimum investment amounts may be waived for certain accounts.

|

Share Classes

|

|

Minimum Initial

Investment

|

|

Minimum

Subsequent

Investment

|

|

|

Class A

|

|

$2,000 for all accounts except:

$250, if establishing an Automatic Investment Plan (“AIP”), with recurring monthly investments of at least $50

|

|

$

|

50

|

|

|

|

|

|

|

|

|

|

Class R3, Class R4 and Class R5

|

|

No minimum initial investment

Offered primarily to employer-sponsored retirement plans

|

|

None

|

|

|

|

|

|

|

|

|

|

Class Y

|

|

$250,000

Offered primarily to certain institutional investors and certain employer-sponsored retirement plans

|

|

None

|

|

|

|

|

|

|

|

|

|

For more information, please see the “How To Buy And Sell Shares” section of the Fund’s statutory prospectus.

You may sell your shares of the Fund on those days when the New York Stock Exchange is open, typically Monday through Friday. You may sell your shares on the web at www.hartfordfunds.com, by phone by calling 1-888-843-7824, by electronic funds transfer, or by wire. In certain circumstances you will need to write to Hartford Funds, P.O. Box 55022, Boston, MA 02205-5022 to request to sell your shares. For overnight mail, please send the request to Hartford Funds, 30 Dan Road, Suite 55022, Canton, MA 02021-2809.

TAX INFORMATION.

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES.

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

9

MFSUM-TR10_030114

March 1, 2014

12

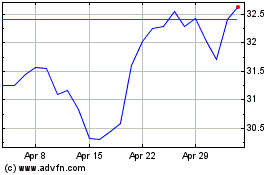

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Nov 2023 to Nov 2024