Tenet Misses on Both Lines - Analyst Blog

February 28 2012 - 9:17AM

Zacks

Tenet Healthcare Corp. (THC) reported

fourth-quarter 2011 income from continuing operations of 10 cents

per share, lagging the Zacks Consensus Estimate of 13 cents but

surpassing the prior-year quarter earnings of 8 cents per share.

Operating income for the quarter declined to $42 million from $43

million in the year-ago quarter.

The improvement in earnings on a yearly basis was attributed to

growth in revenues arising from higher admissions, outpatient

visits and surgeries. However, this was partly offset by the rise

in operating expenses.

Operating income for both the reported quarter and the year-ago

quarter excludes loss from early extinguishment of debt, litigation

and investigation costs and valuation tax adjustments. Including

the non-recurring items, Tenet’s net loss was $76.0 million or 17

cents per share in the reported quarter, deteriorating

significantly from the net income of $74.0 million or 14 cents per

share in the prior-year quarter.

Net operating revenues stood at $2.23 billion, up 5.4% from

$2.11 billion in the prior-year quarter. However, reported revenues

lagged the Zacks Consensus Estimate of $2.40 billion.

During the reported quarter, Tenet’s net patient revenues per

adjusted admission increased 2.3% on a year-over-year basis to

$11,633, primarily due to improved terms of commercial managed care

contracts, partially offset by an adverse shift in payer mix.

Admissions inched up 0.3% during the quarter, while paying

admissions remained flat. Additionally, outpatient visits budged up

0.3% and adjusted admissions crept up 1.3% year over year.

Tenet incurred $2.08 billion in operating expenses during the

reported quarter, compared with $1.95 billion in the prior-year

quarter. Bad debt expense declined 2.6% to $185 million from $190

million in the fourth quarter of 2010.

Tenet posted adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA) of $294 million in the

reported quarter, up 4.6% from $281 million in the prior-year

quarter. Adjusted EBITDA margin was 13.2% compared with 13.3% in

the year-ago quarter.

Full-Year 2011 Highlights

For full-year 2011, Tenet reported operating income of 39 cents

per share, missing the Zacks Consensus Estimate of 41 cents but

ahead of the year-ago level of 30 cents. Operating income increased

to $206 million from $177 million in 2010.

Tenet’s net operating revenue amounted to $8.85 billion in 2011,

lagging the Zacks Consensus Estimate of $9.6 billion but 4.6%

higher than $8.47 billion reported in 2010. Moreover, adjusted

EBITDA grew 9.0% year over year to $1.15 billion in 2011.

Additionally, total expenses increased to $8.20 billion from

$7.83 billion in 2010, while net income was $58.0 million compared

with $1.12 billion in 2010.

Financial Position

Tenet exited 2011 with cash and cash equivalents of $113

million, down from $185 million as of September 30, 2011. The

decrease in cash was the result of $178 million spent on buying

back 40.3 million shares and $28 million for acquiring five

outpatient centers and some assets related to acquired physician

practices. Tenet’s capital expenditures were $177 million in the

quarter, compared with $196 million in the prior-year quarter.

During 2011, Tenet repurchased 75.8 million shares at an average

price of $4.94 totaling $374 million under its $400 million share

repurchase program announced in May last year. The company

exhausted the $400 million repurchase authorization in January 2012

by buying back 81.1 million shares from May 2011 to January 2012

for $4.94 per share.

Net cash generated from operating activities in 2011 was $497

million, against $472 million in 2010. As of December 31, 2011,

total assets of Tenet were $8.46 billion and shareholders’ equity

was $1.42 billion.

Outlook

Tenet raised its guidance for adjusted EBITDA to $1.225–1.350

billion for 2012 and affirmed its 2013 adjusted EBITDA guidance

range of $1.75–2.25 billion.

Peer Take

Universal Health Services Inc. (UHS), a rival

of Tenet, declared its fourth-quarter earnings of 91 cents per

share, at par with the Zacks Consensus Estimate but soaring past

the year-ago earnings of 58 cents.

Another competitor, HCA Holdings Inc. (HCA)

reported net income of 94 cents per share in the fourth quarter of

2011, beating the Zacks Consensus estimate of 76 cents and year-ago

earnings of 65 cents.

Tenet carries a Zacks #3 Rank, implying a short-term Hold

rating, with no clear directional pressure in the near term.

Considering the fundamentals, we maintain our long-term ‘Neutral’

recommendation on the shares.

HCA HOLDINGS (HCA): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

UNIVL HLTH SVCS (UHS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

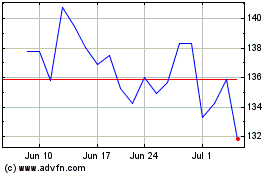

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From May 2024 to Jun 2024

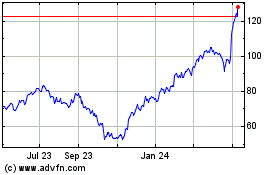

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2023 to Jun 2024