Tenet Downgraded to Neutral - Analyst Blog

January 12 2012 - 12:02PM

Zacks

We have downgraded our recommendation on Tenet

Healthcare Corp. (THC) to Neutral from Outperform on its

continuous high operating expenses, rising bad debt and expected

rise in collectibles in the upcoming quarters. High leverage amid

the poor global economic scenario is also keeping us on the

sidelines.

Since 2006, Tenet has been steadily generating growth in

operating revenues, mainly due to increases in the outpatient

visits, improvements in managed care pricing and a favorable shift

in managed care payer mix.

Last week, the company announced its adjusted earnings before

interest, taxes, depreciation and amortization (EBITDA) projection

of $1.2–1.3 billion for 2012, which is substantially higher than

2011’s guidance. The uptick is based on an expected upside from

cost reduction in 2012 through Tenet’s ongoing Medicare Performance

Initiative, an increase in its physician count and growth

projection in the company’s Conifer service business.

Moreover, Tenet has been steadily expanding its operating

capacity via acquisitions. During the fourth quarter of 2011, the

company completed the acquisition of CardioVascular Associates P.C.

Additionally, Tenet acquired various diagnostic imaging centers in

Georgia, Alabama, California, Florida, South Carolina and Tennessee

in 2011.

Going ahead, the company also intends to acquire hospitals and

other health care assets to increase the outpatient revenues, as

historically, the outpatient business has generated significantly

higher margins than other business lines.

However, on the downside, Tenet has been experiencing a high

level of operating expenses in the past few years. The impact of

industry-wide and company-specific challenges, including decreased

volumes, decreased demand for inpatient cardiac procedures and high

levels of bad debt, led to the rise of operating expenses.

Moreover, the high level of uncollectible accounts and rising

bad debts impelled the company to increase its provision for

doubtful debts substantially over the years. The company expects to

continue recording higher uncollectible accounts in the upcoming

quarters as well.

The Zacks Consensus Estimate for the fourth-quarter earnings is

pegged at 14 cents per share, up about 39% over the year-ago

quarter. For 2011, Tenet’s earnings are expected to be 42 cents per

share, growing about 2% from 2010.

Tenet competes with HCA Inc. (HCA) and

Community Health Systems Inc. (CYH). The company

carries a Zacks #3 Rank, which implies a short-term Hold’

rating.

COMMNTY HLTH SY (CYH): Free Stock Analysis Report

HCA HOLDINGS (HCA): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

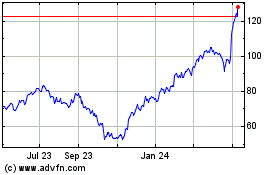

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2024 to Jul 2024

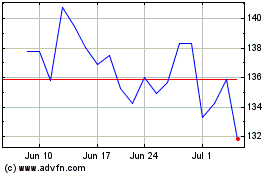

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jul 2023 to Jul 2024