Tenet Hikes Notes Issue - Analyst Blog

November 07 2011 - 11:06AM

Zacks

On Friday, Tenet Healthcare Corporation (THC)

announced an increase in the issue size of its senior secured

notes, due 2018, to $900 million from $750 million, as announced

earlier the same day. The notes will be issued through private

placement and will carry an annual interest rate of 6.25%.

The proceeds of the issue is likely to be used for part

repayment of the principal, premium and interest on the 9% senior

secured notes due in 2015, which had an outstanding principal of

$714 million, as on September 30, 2011. Any surplus amount will be

used to repurchase other outstanding senior notes or for other

corporate purposes.

The new notes will be ranked equal to Tenet’s existing 9% senior

secured notes, 10% senior secured notes and 8.875% senior secured

notes and will be guaranteed and secured by Tenet’s capital and

ownership stock of the company’s certain subsidiaries.

Prior to the upsizing, Moody’s Investor Service assigned a debt

rating of “B1” to the notes, which is below investment grade.

Meanwhile Standard & Poor’s assigned a “BB-” issue-level

rating, with a recovery rating of “1”, which indicates a high

recovery rate for lenders in case of a default.

As the issue has not been registered by Tenet under the

Securities Act of 1933 or any state securities laws, the notes are

being issued only to qualified institutional buyers and people

living outside the U.S., who are not U.S. citizens. As per the

requirements of the Securities Act, the notes cannot be sold within

the U.S. or to any U.S. person, except pursuant to an

exemption.

We believe the issue will be beneficial to Tenet as the

subsequent repayment of 9% senior secured notes will significantly

reduce interest payments. Although total debt of the company will

also increase, the new debt will mature much after

the old notes do, thereby improving the company’s maturity

profile.

Tenet reported third-quarter income from continuing operations,

net of tax of $16 million or 4 cents per share, beating the Zacks

Consensus Estimate of one cent and operating loss of $14 million or

one cent per share in the prior-year quarter. The company competes

with HCA Inc. (HCA) and Community Health

Systems Inc. (CYH).

On Friday, the shares of Tenet closed at $4.86, down 3.19%, on

the New York Stock Exchange. The company carries a Zacks #3 Rank,

which implies a short-term Hold rating.

COMMNTY HLTH SY (CYH): Free Stock Analysis Report

HCA HOLDINGS (HCA): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

Zacks Investment Research

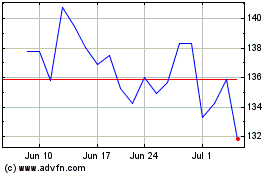

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From May 2024 to Jun 2024

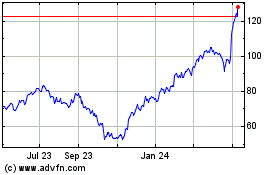

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2023 to Jun 2024