UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission file number: 001-38751

Tencent Music Entertainment Group

(Exact Name of Registrant as Specified in Its

Charter)

Unit 3, Building D, Kexing Science Park

Kejizhongsan Avenue, Hi-Tech Park, Nanshan District

Shenzhen, 518057, the People’s

Republic of China

Tel: +86-755-8601 3388

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

| |

|

|

| Exhibit No. |

|

Description |

| |

|

| 99.1 |

|

Press Release

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Tencent Music Entertainment Group |

| |

|

|

|

| Date: |

May 13,

2024 |

|

By: |

|

/s/ Min Hu |

| |

|

|

|

Name: Min Hu |

| |

|

|

|

Title: Chief Financial Officer |

Exhibit 99.1

Tencent Music

Entertainment Group Announces First Quarter 2024 Unaudited Financial Results and Annual Dividend Plan

SHENZHEN, China, May 13, 2024 /PRNewswire/ --Tencent

Music Entertainment Group (“TME,” or the “Company”) (NYSE: TME and HKEX: 1698), the leading online music and audio

entertainment platform in China, today announced its unaudited financial results for the first quarter ended March 31, 2024 and declared

its annual cash dividend for the year ended December 31, 2023.

First Quarter 2024 Financial Highlights

| · | Total revenues were RMB6.77 billion (US$937

million), representing a 3.4% year-over-year decrease, mainly due to the decline in revenues from social entertainment services and others,

which was partially mitigated by strong year-over-year growth in revenues from online music services. |

| · | Revenues from music subscriptions were

RMB3.62 billion (US$501 million), representing 39.2% year-over-year growth. The number of paying users increased by 20.2% year-over-year

to 113.5 million. On a sequential basis, the number of paying users grew by 6.8 million, the largest quarter-over-quarter net increase

to date. |

| · | Net profit was RMB1.53

billion (US$212 million), growing 27.5% year-over-year. Net profit attributable to equity holders of the Company was RMB1.42 billion

(US$197 million), growing 23.9% year-over-year. Non-IFRS net profit1 was RMB1.81 billion (US$251 million), representing

23.9% year-over-year growth. Non-IFRS net profit attributable to equity holders of the Company1 was RMB1.70 billion

(US$236 million), representing 20.8% year-over-year growth. |

| · | Diluted earnings per ADS was RMB0.91 (US$0.13),

up from RMB0.73 in the same period of 2023. |

| · | Total cash, cash equivalents

and term deposits as of March 31, 2024 were RMB34.18

billion (US$4.73 billion). |

| · | An annual cash dividend for the year ended

December 31, 2023 to be paid to shareholders as of the record date will be approximately US$210 million. |

Mr. Cussion Pang, Executive Chairman of TME, commented,

“We kicked off 2024 with impressive results. Online music continued to grow robustly, registering record-high net adds of 6.8 million

music subscribers with healthy ARPPU for the first quarter. Our focus on high-quality growth also yielded solid net profit margin expansion.

By broadening content and introducing more tailored platform offerings that resonate deeply with users, we continue to strengthen our

vibrancy and competitiveness in this dynamic industry.”

Mr. Ross Liang, CEO of TME, continued, “Drawing

on our extensive industry experience and capitalizing on the Chinese New Year seasonality, our effective marketing campaigns led to higher-than-expected

first-quarter music subscriber growth. Meanwhile, we are pleased to see a steady user base recovery thanks to our optimized operations

efforts. Through enhanced algorithms, product features and AIGC applications, we are consistently creating more compelling music experiences

that deepen users’ engagement on our platform.”

First Quarter 2024 Operational Highlights

1 Non-IFRS

net profit and non-IFRS net profit attributable to equity holders of the Company were arrived at after excluding the combined effect

of amortization of intangible assets and other assets arising from business acquisitions or combinations, share-based compensation expenses,

net losses/gains from investments, and related income tax effects.

| |

1Q24 |

1Q23 |

YoY % |

| MAUs – online music (million) |

578 |

592 |

(2.4%) |

| Mobile MAUs – social entertainment (million) |

97 |

136 |

(28.7%) |

| Paying users – online music (million) |

113.5 |

94.4 |

20.2% |

| Paying users – social entertainment (million) |

8.0 |

7.1 |

12.7% |

| Monthly ARPPU – online music (RMB) |

10.6 |

9.2 |

15.2% |

| Monthly ARPPU – social entertainment (RMB) |

73.4 |

164.5 |

(55.4%) |

Expanded licensed and original content offerings

to cater to evolving user preferences, setting new music consumption trends.

| · | Reinforced partnerships with record labels to

broaden our music library’s comprehensiveness and popularity. 1) Renewed cooperation with Time Fengjun Entertainment, featuring

30-day head-start privileges on new songs and adding Dolby Atmos upgrades for popular idol groups such as TFBOYS. 2) Renewed partnership

with HIM International Music to bring users iconic C-pop content. We also capitalized on our AI capabilities to bolster audience interaction

and sing-alongs, amplifying artists’ reach. |

| · | Created an increasing number of blockbuster songs

through original content production. 1) Produced high-quality original soundtracks for trending TV dramas The Legend of Shen Li

and In Blossom, gaining over 150 million streams on our platform. 2) With a keen grasp of popular trends, we partnered with strategic

artists and indie musicians to create widely celebrated songs on social media, such as RIVER FLOW by TIA RAY and What I Anticipate

Is Not Snow by Zhang Miaoge. |

Innovative features fostered faster personal

music asset accumulation on our platform, leading to better user engagement and greater high-potential user discovery.

| · | Introduced large audio models to increase music

promotion accuracy and a new AI Assistant to make music discovery more fun, engaging and convenient. |

| · | Launched a new rewards program and a series of

interactive features including themed song-guessing contests and subscriber badges to invigorate music consumption and increase user stickiness. |

| · | Capitalized on Chinese New Year with targeted

multi-channel promotions, attracting a larger-than-expected number of paying users; established a new partnership with Xiaomi SU7 and

conducted holiday-themed activities to boost in-car music consumption. |

| · | Hosted QQMUSIC DIANFENG AWARDS, an annual trendsetting

online-merge-offline music event catering to the younger demographic, to reinforce our core user base. |

First Quarter 2024 Financial Review

Total revenues decreased by RMB236 million,

or 3.4%, to RMB6.77 billion (US$937 million) from RMB7.00 billion in the same period of 2023.

| · | Revenues from online music services delivered

a strong year-over-year increase of 43.0% to RMB5.01 billion (US$693 million) from RMB3.50 billion in the same period of 2023. The increase

was driven by solid growth in music subscription revenues, supplemented by growth in revenue from advertising services. Revenues from

music subscriptions were RMB3.62 billion (US$501 million), representing 39.2% year-over-year growth compared with RMB2.60 billion in the

same period of 2023. This rapid growth was driven by further expansion |

in the online music paying user base

and healthy ARPPU. The number of online music paying users increased by 20.2% year-over-year to 113.5 million, with a monthly ARPPU of

RMB10.6 in the first quarter of 2024. The increase in the number of paying users was primarily due to increased users’ willingness

to pay for appealing membership privileges, expanded content, and attractive interactive features. We also optimized promotion campaigns

during Chinese New Year to attract more paying users. The year-over-year increase in revenues from advertising was primarily due to our

more diversified product portfolio and innovative ad formats, which were well-received by advertisers.

| · | Revenues from social entertainment services

and others decreased by 49.7% to RMB1.76 billion (US$244 million) from RMB3.50 billion in the same period of 2023. The continued decrease

was mainly the result of adjustments to certain live-streaming interactive functions and more stringent compliance procedures we implemented

beginning in the second quarter of 2023, as well as increased competition with other platforms. |

Cost of revenues decreased by 14.8% year-over-year

to RMB4.00 billion (US$554 million), mainly due to decreased revenues from social entertainment services with a lower revenue sharing

ratio that led to less revenue sharing fees, partially offset by increased content costs of royalties and payment channel fees.

Gross margin increased to 40.9% from 33.1%

in the same period of 2023, primarily due to strong revenue growth from music subscriptions and advertising services, and the ramp-up

of our own content.

Total operating expenses decreased by 7.6%

year-over-year to RMB1.14 billion (US$157 million). Operating expenses as a percentage of total revenues decrease to 16.8% from 17.5%

in the same period of 2023.

| · | Selling and marketing expenses were RMB187 million

(US$26 million), representing an 11.8% year-over-year decrease, mainly due to overall optimized promotion efforts. |

| · | General and administrative expenses were RMB949

million (US$131 million), representing a 6.7% year-over-year decrease. This decrease was primarily due to reduced employee-related expenses. |

Driven by improved operating efficiency and effective

cost controls, our operating profit grew to RMB1.96 billion (US$271 million) in the first quarter of 2024, representing an increase

of 41.9% year-over-year.

The effective tax rate for the first quarter of

2024 was 19.9% compared with 12.2% in the same period of 2023. The increase in the effective tax rate was mainly driven by the accrual

of withholding income tax of RMB107 million (US$15 million) in the first quarter of 2024. Additionally, changes in preferential tax rates

for certain entities also impacted our effective tax rate.

For the first quarter of 2024, net profit was

RMB1.53 billion (US$212 million) and net profit attributable to equity holders of the Company was RMB1.42 billion (US$197 million).

Non-IFRS net profit was RMB1.81 billion (US$251 million) and non-IFRS net profit attributable to equity holders of the Company

was RMB1.70 billion (US$236 million). Please refer to the section in this press release titled “Non-IFRS Financial Measure”

for details.

Basic and diluted earnings per American Depositary

Shares (“ADS”) for the first quarter of 2024 were RMB0.92 (US$0.13) and RMB0.91 (US$0.13), respectively; non-IFRS basic

and diluted earnings per ADS were RMB1.11 (US$0.15) and RMB1.09 (US$0.15), respectively. The Company had weighted averages of 1.54

billion basic and 1.56 billion diluted ADSs outstanding, respectively. Each ADS represents two of the Company’s Class A ordinary

shares.

As of March 31, 2024, the combined balance of the

Company’s cash, cash equivalents and term deposits amounted to RMB34.18 billion (US$4.73 billion), compared with RMB32.22

billion as of December 31, 2023.

Share Repurchase Program

Under the US$500 million Share Repurchase

Program announced on March 21, 2023, as of March 31, 2024, we had repurchased 32.2 million ADSs in the open market with cash

for a total consideration of US$235.5 million.

Annual Dividend Policy and Declaration of 2023

Dividend

On May 11, 2024, the Company’s board of directors

adopted an annual cash dividend policy, under which the Company may choose to declare and distribute a cash dividend each year in accordance

with the memorandum and articles of association of the Company and applicable laws and regulations. Under the policy, the Company’s

board of directors determines whether to make dividend distributions and the amount of such distributions in any particular year, depending

on the Company's operations and earnings, cash flow, financial condition, and other relevant factors.

Accordingly, on the same day, for the fiscal year

of 2023, the Company’s board of directors declared a cash dividend of US$0.0685 per ordinary share, or US$0.1370 per ADS, to holders

of record of ordinary shares and ADSs as of the close of business on May 31, 2024. The aggregate amount of cash dividends to be paid will

be approximately US$210 million and is expected to be paid on or around June 21, 2024 and on or around June 27, 2024 for holders of ordinary

shares and holders of ADSs, respectively. Holders of the Company’s ADSs will receive the cash dividends through the depositary,

The Bank of New York Mellon, subject to the terms of the deposit agreement.

Social Responsibilities

We cooperated with Tencent Charity for the third

consecutive year on our themed program to raise autism awareness, “If Music Has a Shape.” This year, more than 60 renowned

artists and groups from China and abroad shared songs in support of children with autism. We then hosted an art exhibition featuring artwork

by children with autism inspired by these musical works, leveraging multimedia to amplify our heart-felt message and boost music’s

social value.

Exchange Rate

This announcement contains translations of certain

RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to USD were made at the rate of RMB7.2203 to US$1.00, the noon buying rate in effect on March 29, 2024, in the

H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could

be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages are calculated

using the numbers presented in the financial statements contained in this earnings release.

Non-IFRS Financial Measure

The Company uses non-IFRS net profit for the period,

which is a non-IFRS financial measure, in evaluating its operating results and for financial and operational decision-making purposes.

TME believes that non-IFRS net profit helps identify underlying trends in the Company’s business that could otherwise be distorted

by the effect of certain expenses that the Company includes in its profit for the period. TME believes that non-IFRS net profit for the

period provides useful information about its results of operations, enhances the overall understanding of its past performance and future

prospects and allows for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

Non-IFRS net profit for the period should not be

considered in isolation or construed as an alternative to operating profit, net profit for the period or any other measure of performance

or as an indicator of its operating performance. Investors are encouraged to review non-IFRS net profit for the period and the reconciliation

to its most directly comparable IFRS measure. Non-IFRS net profit for the period presented here may not be comparable to similarly titled

measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness

as comparative measures to the Company’s data. TME encourages investors and others to review its financial information in its entirety

and not rely on a single financial measure.

Non-IFRS net profit for the period represents profit

for the period excluding amortization of intangible and other assets arising from business acquisitions or combinations, share-based compensation

expenses, net losses/gains from investments and related income tax effects.

Please see the “Unaudited Non-IFRS Financial

Measure” included in this press release for a full reconciliation of non-IFRS net profit for the period to its net profit for the

period.

About Tencent Music Entertainment

Tencent Music Entertainment Group (NYSE: TME and

HKEX: 1698) is the leading online music and audio entertainment platform in China, operating the country’s highly popular and innovative

music apps: QQ Music, Kugou Music, Kuwo Music and WeSing. TME’s mission is to create endless possibilities with music and technology.

TME’s platform comprises online music, online audio, online karaoke, music-centric live streaming and online concert services, enabling

music fans to discover, listen, sing, watch, perform and socialize around music. For more information, please visit ir.tencentmusic.com.

Safe Harbor Statement

This press release contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to

differ materially from those contained in any forward-looking statement. In some cases, forward-looking statements can be identified by

words or phrases such as “may,” “will,” “expect,” “anticipate,” “target,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. Further information regarding these and other risks, uncertainties or factors

is included in the Company’s filings with the SEC and the HKEX. All information provided in this press release is as of the date

of this press release, and the Company does not undertake any duty to update such information, except as required under applicable law.

Investor Relations Contact

Tencent Music Entertainment Group

ir@tencentmusic.com

+86 (755) 8601-3388 ext. 818415

SOURCE Tencent Music Entertainment Group

| TENCENT MUSIC

ENTERTAINMENT GROUP |

|

|

|

|

|

|

|

| CONSOLIDATED INCOME STATEMENTS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Three

Months Ended March 31 |

| |

|

|

2023 |

|

2024 |

| |

|

|

RMB |

|

RMB |

|

US$ |

| |

|

|

Unaudited |

|

Unaudited |

|

Unaudited |

| |

|

|

(in

millions, except per share data) |

| Revenues |

|

|

|

|

|

|

|

| Online music services |

|

|

3,501 |

|

5,007 |

|

693 |

| Social entertainment

services and others |

|

|

3,503 |

|

1,761 |

|

244 |

| |

|

|

7,004 |

|

6,768 |

|

937 |

| Cost of revenues |

|

|

(4,689) |

|

(3,997) |

|

(554) |

| Gross

profit |

|

|

2,315 |

|

2,771 |

|

384 |

| |

|

|

|

|

|

|

|

| Selling and marketing

expenses |

|

|

(212) |

|

(187) |

|

(26) |

| General and administrative

expenses |

|

|

(1,017) |

|

(949) |

|

(131) |

| Total operating expenses |

|

|

(1,229) |

|

(1,136) |

|

(157) |

| Interest income |

|

|

237 |

|

278 |

|

39 |

| Other gains, net |

|

|

58 |

|

46 |

|

6 |

| Operating

profit |

|

|

1,381 |

|

1,959 |

|

271 |

| |

|

|

|

|

|

|

|

| Share of net profit/(loss)

of investments accounted for using equity method |

|

|

20 |

|

(18) |

|

(2) |

| Finance cost |

|

|

(34) |

|

(30) |

|

(4) |

| Profit

before income tax |

|

|

1,367 |

|

1,911 |

|

265 |

| |

|

|

|

|

|

|

|

| Income tax expense |

|

|

(167) |

|

(381) |

|

(53) |

| Profit

for the period |

|

|

1,200 |

|

1,530 |

|

212 |

| |

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

| Equity holders of the

Company |

|

|

1,148 |

|

1,422 |

|

197 |

| Non-controlling interests |

|

|

52 |

|

108 |

|

15 |

| |

|

|

|

|

|

|

|

| Earnings

per share for Class A and Class B ordinary shares |

|

|

|

|

|

|

|

| Basic |

|

|

0.37 |

|

0.46 |

|

0.06 |

| Diluted |

|

|

0.36 |

|

0.46 |

|

0.06 |

| |

|

|

|

|

|

|

|

| Earnings

per ADS (2 Class A shares equal to 1 ADS) |

|

|

|

|

|

|

|

| Basic |

|

|

0.74 |

|

0.92 |

|

0.13 |

| Diluted |

|

|

0.73 |

|

0.91 |

|

0.13 |

| |

|

|

|

|

|

|

|

| Shares

used in earnings per Class A and Class B ordinary share computation: |

|

|

|

|

|

|

|

| Basic |

|

|

3,120,690,738 |

|

3,081,992,364 |

|

3,081,992,364 |

| Diluted |

|

|

3,165,297,869 |

|

3,123,242,656 |

|

3,123,242,656 |

| |

|

|

|

|

|

|

|

| ADS

used in earnings per ADS computation |

|

|

|

|

|

|

|

| Basic |

|

|

1,560,345,369 |

|

1,540,996,182 |

|

1,540,996,182 |

| Diluted |

|

|

1,582,648,934 |

|

1,561,621,328 |

|

1,561,621,328 |

| TENCENT MUSIC

ENTERTAINMENT GROUP |

|

|

|

|

|

|

|

| UNAUDITED NON-IFRS

FINANCIAL MEASURE |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

Three

Months Ended March 31 |

| |

|

|

2023 |

|

2024 |

| |

|

|

RMB |

|

RMB |

|

US$ |

| |

|

|

Unaudited |

|

Unaudited |

|

Unaudited |

| |

|

|

(in

millions, except per share data) |

| Profit

for the period |

|

|

1,200 |

|

1,530 |

|

212 |

| Adjustments: |

|

|

|

|

|

|

|

| Amortization of intangible

and other assets arising from business acquisitions or combinations* |

|

|

117 |

|

118 |

|

16 |

| Share-based compensation |

|

|

202 |

|

193 |

|

27 |

| (Gains)/losses from

investments** |

|

|

(17) |

|

37 |

|

5 |

| Income tax effects*** |

|

|

(39) |

|

(66) |

|

(9) |

| Non-IFRS

Net Profit |

|

|

1,463 |

|

1,812 |

|

251 |

| |

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

| Equity holders of the

Company |

|

|

1,411 |

|

1,704 |

|

236 |

| Non-controlling interests |

|

|

52 |

|

108 |

|

15 |

| |

|

|

|

|

|

|

|

| Earnings

per share for Class A and Class B ordinary shares |

|

|

|

|

|

|

|

| Basic |

|

|

0.45 |

|

0.55 |

|

0.08 |

| Diluted |

|

|

0.45 |

|

0.55 |

|

0.08 |

| |

|

|

|

|

|

|

|

| Earnings

per ADS (2 Class A shares equal to 1 ADS) |

|

|

|

|

|

|

|

| Basic |

|

|

0.90 |

|

1.11 |

|

0.15 |

| Diluted |

|

|

0.89 |

|

1.09 |

|

0.15 |

| |

|

|

|

|

|

|

|

| Shares

used in earnings per Class A and Class B ordinary share computation: |

|

|

|

|

|

|

|

| Basic |

|

|

3,120,690,738 |

|

3,081,992,364 |

|

3,081,992,364 |

| Diluted |

|

|

3,165,297,869 |

|

3,123,242,656 |

|

3,123,242,656 |

| |

|

|

|

|

|

|

|

| ADS

used in earnings per ADS computation |

|

|

|

|

|

|

|

| Basic |

|

|

1,560,345,369 |

|

1,540,996,182 |

|

1,540,996,182 |

| Diluted |

|

|

1,582,648,934 |

|

1,561,621,328 |

|

1,561,621,328 |

| |

|

|

|

|

|

|

|

| * Represents the

amortization of identifiable assets, including intangible assets such as domain name, trademark, copyrights, supplier resources,

corporate customer relationships and non-compete agreement etc., and fair value adjustment on music content (i.e., signed contracts

obtained for the rights to access to the music contents for which the amount was amortized over the contract period), resulting from

business acquisitions or combination. |

| ** Including the

net gains.losses on deemed disposals/disposals of investments, fair value changes arising from investments, impairment provision

of investments and other expenses in relation to equity transactions of investments. |

| *** Represents

the income tax effects of Non-IFRS adjustments. |

| TENCENT MUSIC

ENTERTAINMENT GROUP |

|

|

|

|

|

| CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

As

at December 31, 2023 |

|

As

at March 31, 2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| |

|

Audited |

|

Unaudited |

|

Unaudited |

| |

|

(in

millions) |

| ASSETS |

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

| Property,

plant and equipment |

|

490 |

|

526 |

|

73 |

| Land

use rights |

|

2,437 |

|

2,419 |

|

335 |

| Right-of-use

assets |

|

367 |

|

317 |

|

44 |

| Intangible

assets |

|

2,032 |

|

2,023 |

|

280 |

| Goodwill |

|

19,542 |

|

19,567 |

|

2,710 |

| Investments

accounted for using equity method |

|

4,274 |

|

4,277 |

|

592 |

| Financial

assets at fair value through other comprehensive income |

6,540 |

|

8,791 |

|

1,218 |

| Other

investments |

|

307 |

|

327 |

|

45 |

| Prepayments,

deposits and other assets |

|

540 |

|

437 |

|

61 |

| Deferred

tax assets |

|

352 |

|

360 |

|

50 |

| Term

deposits |

|

8,719 |

|

7,589 |

|

1,051 |

| |

|

45,600 |

|

46,633 |

|

6,459 |

| |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| Inventories |

|

8 |

|

11 |

|

2 |

| Accounts

receivable |

|

2,918 |

|

2,808 |

|

389 |

| Prepayments,

deposits and other assets |

|

3,438 |

|

3,068 |

|

425 |

| Other

investments |

|

37 |

|

37 |

|

5 |

| Term

deposits |

|

9,937 |

|

16,370 |

|

2,267 |

| Restricted

Cash |

|

31 |

|

31 |

|

4 |

| Cash

and cash equivalents |

|

13,567 |

|

10,218 |

|

1,415 |

| |

|

29,936 |

|

32,543 |

|

4,507 |

| |

|

|

|

|

|

|

| Total

assets |

|

75,536 |

|

79,176 |

|

10,966 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

| Equity

attributable to equity holders of the Company |

|

|

|

|

|

|

| Share

capital |

|

2 |

|

2 |

|

0 |

| Additional

paid-in capital |

|

36,576 |

|

36,559 |

|

5,063 |

| Shares

held for share award schemes |

|

(302) |

|

(327) |

|

(45) |

| Treasury

shares |

|

(6,996) |

|

(7,196) |

|

(997) |

| Other

reserves |

|

9,658 |

|

11,887 |

|

1,646 |

| Retained

earnings |

|

16,969 |

|

18,391 |

|

2,547 |

| |

|

55,907 |

|

59,316 |

|

8,215 |

| Non-controlling

interests |

|

1,295 |

|

1,439 |

|

199 |

| |

|

|

|

|

|

|

| Total

equity |

|

57,202 |

|

60,755 |

|

8,414 |

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

| Notes

payables |

|

5,636 |

|

5,647 |

|

782 |

| Deferred

tax liabilities |

|

239 |

|

174 |

|

24 |

| Lease

liabilities |

|

297 |

|

257 |

|

36 |

| Deferred

revenue |

|

148 |

|

156 |

|

22 |

| |

|

6,320 |

|

6,234 |

|

863 |

| |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Accounts

payable |

|

5,006 |

|

5,493 |

|

761 |

| Other

payables and other liabilities |

|

3,472 |

|

2,936 |

|

407 |

| Current

tax liabilities |

|

567 |

|

670 |

|

93 |

| Lease

liabilities |

|

115 |

|

97 |

|

13 |

| Deferred

revenue |

|

2,854 |

|

2,991 |

|

414 |

| |

|

12,014 |

|

12,187 |

|

1,688 |

| |

|

|

|

|

|

|

| Total

liabilities |

|

18,334 |

|

18,421 |

|

2,551 |

| |

|

|

|

|

|

|

| Total

equity and liabilities |

|

75,536 |

|

79,176 |

|

10,966 |

| TENCENT MUSIC

ENTERTAINMENT GROUP |

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

| |

|

|

|

|

|

|

| |

|

Three

Months Ended March 31 |

| |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| |

|

Unaudited |

|

Unaudited |

|

Unaudited |

| |

|

(in

millions) |

| |

|

|

|

|

|

|

| Net cash provided by operating activities |

|

1,852 |

|

2,686 |

|

372 |

| Net cash provided by/(used in) investing activities |

|

811 |

|

(5,498) |

|

(761) |

| Net cash used in financing activities |

|

(80) |

|

(522) |

|

(72) |

| Net increase/(decrease) in cash and cash equivalents |

|

2,583 |

|

(3,334) |

|

(462) |

| Cash and cash equivalents at beginning of the period |

|

9,555 |

|

13,567 |

|

1,879 |

| Exchange differences on cash and cash equivalents |

|

(9) |

|

(15) |

|

(2) |

| Cash and cash equivalents at end of the period |

|

12,129 |

|

10,218 |

|

1,415 |

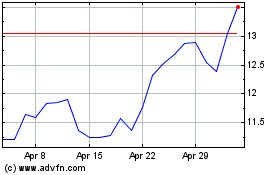

Tencent Music Entertainm... (NYSE:TME)

Historical Stock Chart

From Apr 2024 to May 2024

Tencent Music Entertainm... (NYSE:TME)

Historical Stock Chart

From May 2023 to May 2024