UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 6-K

_________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: May 9, 2024

Commission file number 1-33867

_________________________

TEEKAY TANKERS LTD.

(Exact name of Registrant as specified in its charter)

_________________________

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

(Address of principal executive office)

_________________________

| | |

| Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. |

Form 20-F ý Form 40-F ¨ |

|

|

|

|

Item 1 — Information Contained in this Form 6-K Report

Attached as Exhibit 1 is a copy of an announcement of Teekay Tankers Ltd. dated May 9, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| TEEKAY TANKERS LTD. |

| |

| Date: May 9, 2024 | By: | | /s/ Stewart Andrade |

| | | Stewart Andrade

Chief Financial Officer

(Principal Financial and Accounting Officer) |

TEEKAY TANKERS LTD. REPORTS

FIRST QUARTER 2024 RESULTS

Highlights

•Reported GAAP net income of $144.8 million, or $4.23 per share; and adjusted net income(1) of $132.3 million, or $3.86 per share, in the first quarter of 2024 (excluding items listed in Appendix A to this release).

•In March 2024, completed the previously-announced repurchase of eight vessels under sale-leaseback arrangements for a total of $137.0 million; after completing this repurchase, the Company is debt free(2).

•The Company declared a cash dividend of $0.25 per share for the quarter ended March 31, 2024. In addition, the Company declared a special dividend of $2.00 per share. Including these dividends, Teekay Tankers has declared a cumulative $4.25 per share in dividends since updating its capital allocation plan in second quarter of 2023.

Hamilton, Bermuda, May 9, 2024 - Teekay Tankers Ltd. (Teekay Tankers or the Company) (NYSE: TNK) today reported the Company's results for the quarter ended March 31, 2024:

Consolidated Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (in thousands of U.S. dollars, except per share data) | March 31,

2024 | December 31,

2023 | March 31,

2023 | | | |

| (unaudited) | (unaudited) | (unaudited) | | | |

| GAAP FINANCIAL COMPARISON | | | | | | | | | | | |

| Total revenues | 338,343 | | | 313,291 | | | 394,657 | | | | | | | |

| Income from operations | 139,241 | | | 112,913 | | | 181,851 | | | | | | | |

| Net income | 144,771 | | | 111,694 | | | 169,368 | | | | | | | |

| Earnings per share - basic | 4.23 | | | 3.27 | | | 4.97 | | | | | | | |

| | | | | | | | | | | |

| NON-GAAP FINANCIAL COMPARISON | | | | | | | | | | |

Adjusted EBITDA (1) | 150,939 | | | 127,181 | | | 205,795 | | | | | | | |

Adjusted net income (1) | 132,347 | | | 99,545 | | | 174,918 | | | | | | | |

Adjusted earnings per share - basic (1) | 3.86 | | | 2.91 | | | 5.13 | | | | | | | |

Net cash (debt) (3) | 370,423 | | | 226,343 | | | (181,869) | | | | | | | |

(1) These are non-GAAP financial measures. Please refer to "Definitions and Non-GAAP Financial Measures" and the Appendices to this release for definitions of these terms and reconciliations of these non-GAAP financial measures as used in this release to the most directly comparable financial measures under United States generally accepted accounting principles (GAAP).

(2) The Company's share of debt in its 50/50 non-consolidated joint venture, which owns one Very Large Crude Carrier (VLCC), is $9.8 million as of March 31, 2024.

(3) Net cash (debt) is a non-GAAP financial measure and represents (a) cash and cash equivalents and restricted cash, less (b) short-term debt, current and long-term debt and current and long-term obligations related to finance leases.

1

Teekay Tankers Ltd. Investor Relations E-mail: TeekayTankers@IGBIR.com www.teekaytankers.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

First Quarter of 2024 Compared to Fourth Quarter of 2023

GAAP net income and non-GAAP adjusted net income for the first quarter of 2024 increased compared to the fourth quarter of 2023, primarily due to higher average spot tanker rates, partially offset by the sale of two vessels during the fourth quarter of 2023 and the first quarter of 2024. GAAP net income in the first quarter of 2024 included a $11.6 million gain from the sale of one vessel, while the fourth quarter of 2023 included a $10.4 million gain from the sale of one vessel.

First Quarter of 2024 Compared to First Quarter of 2023

GAAP net income and non-GAAP adjusted net income for the first quarter of 2024 decreased compared to the same period of the prior year, primarily due to lower average spot tanker rates and the sale of two vessels between the fourth quarter of 2023 and the first quarter of 2024, partially offset by lower interest expense resulting from lower overall finance lease obligation balances and higher interest income. In addition, GAAP net income in the first quarter of 2024 included a $11.6 million gain from the sale of one vessel.

CEO Commentary

“Throughout the first quarter of 2024, mid-size tankers have continued to be the greatest beneficiaries of the current tanker market environment, with strong rates reflecting the sustained tightness of supply and demand across Suezmax, Aframax, and LR2 tankers,” commented Kevin Mackay, Teekay Tankers’ President and Chief Executive Officer. “Global oil demand continues to increase, vessel deliveries are expected to be historically low over the coming years, and heightened geopolitical tensions continue to extend voyage lengths. These factors, combined with a lack of shipyard capacity to deliver any significant volume of tankers before mid-2027, and the emergence of new trade flows specific to Aframax tankers from the opening of the Trans Mountain Expansion (TMX) in Vancouver, make us optimistic about market conditions for mid-size tankers through at least the medium-term.”

"We continue to execute on our balanced capital allocation plan and have recently completed the repurchase of eight vessels from their sale-leaseback arrangements, reaching a major milestone by becoming debt free(1). As we continue to prioritize balance sheet strength to enable fleet rejuvenation, our Board of Directors have also approved a special cash dividend of $2.00 per share in addition to our fixed quarterly dividend for a combined cash dividend of $2.25 per share."

(1) The Company's share of debt in its 50/50 non-consolidated joint venture, which owns one Very Large Crude Carrier (VLCC), is $9.8 million as of March 31, 2024.

Summary of Recent Events

In February 2024, the Company completed the previously-announced sale of a 2004-built Aframax vessel for gross proceeds of $23.5 million and recorded a gain on sale of $11.6 million.

In March 2024, the Company completed the previously-announced repurchase of eight vessels under sale-leaseback arrangements for a total of $137.0 million. The vessels were repurchased with cash balances and are currently unencumbered. The Company is debt free(1) after completing the repurchase.

The Company's Board of Directors declared a fixed quarterly cash dividend in the amount of $0.25 per outstanding share of common stock for the quarter ended March 31, 2024. In addition, the Board of Directors declared a special cash dividend of $2.00 per common share. These dividends are payable on May 31, 2024 to all of Teekay Tankers' shareholders of record on May 21, 2024.

Tanker Market

Mid-size crude tanker spot rates strengthened during the first quarter of 2024 due to a combination of firm tanker tonne-mile demand, limited fleet supply growth, and seasonal weather delays. Geopolitical events linked to the conflict in Ukraine and instability in the Middle East added to spot rate volatility by disrupting seaborne trade patterns and increasing average voyage distances during the quarter. These factors have continued to support spot tanker rates during the second quarter of 2024 to date, with rates remaining at firm levels.

The global economy continues to show signs of resilience and global oil demand is projected to grow by 1.5 mb/d in both 2024 and 2025 as per the average of forecasts from the International Energy Agency (IEA), the U.S. Energy Information Administration (EIA) and OPEC. The majority of oil supply growth in 2024 is expected to come from non-OPEC+ countries in the Atlantic basin led by the United States, Brazil, Guyana, and Canada. The commissioning of the Trans Mountain Pipeline expansion, which is expected to bring an additional 590,000 barrels of oil per day to the port of Vancouver, Canada from the second quarter of 2024, should also be a positive development for mid-size tanker demand. The Vancouver terminal is restricted to Aframax tankers and is relatively far from the main Aframax trade lanes, thereby increasing the tonne-mile impact.

Geopolitical events continue to shape seaborne oil flows and have led to trade disruption and greater voyage distances in recent months. Ongoing attacks on merchant shipping in the Red Sea have led to an increasing number of vessels taking the much longer route around the Cape of Good Hope (COGH) instead of the Suez Canal, creating significant additional tonne-mile demand. This has been most evident in the LR2 market, with European diesel and other refined product imports from the Middle East and India predominantly sailing via the COGH since the start of the year and giving rise to a very firm and volatile LR2 spot market. Crude oil movements have also been impacted, which has strengthened mid-size crude tanker rates.

In recent weeks, Ukraine has increased its attacks on Russian oil infrastructure, including several refineries. This has led to a decrease in Russian refining capacity which has freed up more crude oil for export, with Russian crude oil exports on a rising trend since the start of the year and reaching a six month high in April 2024. While Teekay Tankers does not transport Russian oil, an increase in Russian crude oil exports impacts the wider tanker market by increasing tonne-mile demand for mid-size tankers given that almost all Russian crude now flows long-haul to India and China on Aframax and Suezmax vessels.

(1) The Company's share of debt in its 50/50 non-consolidated joint venture, which owns one Very Large Crude Carrier (VLCC), is $9.8 million as of March 31, 2024.

Fleet supply fundamentals continue to look positive, despite an increase in the pace of new tanker orders in recent months. Just 2.4 million deadweight (mdwt) of new tankers were delivered into the fleet during the first quarter of 2024, which is the lowest delivery total for a first quarter since 1989. Deliveries are expected to remain very low through the remainder of the year, and we expect tanker fleet growth will be close to zero in 2024. Looking further ahead, we believe the combination of a small orderbook, an aging tanker fleet, and a lack of shipyard capacity until mid-2027 should ensure that fleet growth remains low over the next two to three years.

In summary, the Company retains a positive view of the tanker market due to a combination of strong tanker tonne-mile demand growth and low tanker fleet supply growth, with geopolitical factors and resultant trade disruption likely adding to tanker spot rate volatility in both the near and medium term.

Operating Results

The following table highlights the operating performance of the Company’s time-charter vessels and spot vessels trading in revenue sharing arrangements (RSAs), on voyage charters and in full service lightering, in each case measured in net revenues(1) per revenue day(2), or time-charter equivalent (TCE) rates, before off-hire bunker expenses:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | |

| March 31, 2024 | December 31, 2023 | March 31, 2023 | | | |

| Time Charter-Out Fleet | | | | | | | | | | | |

Suezmax revenue days | 91 | | 92 | | 90 | | | | | | |

| Suezmax TCE per revenue day | $37,512 | | $37,513 | | $37,513 | | | | | | |

Aframax / LR2 revenue days | 32 | | 92 | | 107 | | | | | | |

| Aframax / LR2 TCE per revenue day | $47,337 | | $47,288 | | $32,418 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| Spot Fleet | | | | | | | | | | | |

Suezmax revenue days | 2,248 | | 2,153 | | 2,249 | | | | | | |

Suezmax spot TCE per revenue day (3) | $47,349 | | $37,041 | | $55,891 | | | | | | |

Aframax / LR2 revenue days | 2,157 | | 2,276 | | 1,971 | | | | | | |

Aframax / LR2 spot TCE per revenue day (4) | $48,754 | | $44,545 | | $67,346 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Fleet | | | | | | | | | | | |

Suezmax revenue days | 2,339 | | 2,245 | | 2,339 | | | | | | |

| Suezmax TCE per revenue day | $46,969 | | $37,060 | | $55,184 | | | | | | |

Aframax / LR2 revenue days | 2,189 | | 2,368 | | 2,078 | | | | | | |

| Aframax / LR2 TCE per revenue day | $48,733 | | $44,652 | | $65,548 | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Net revenues is a non-GAAP financial measure. Please refer to "Definitions and Non-GAAP Financial Measures" for a definition of this term and Appendix C to this release for a reconciliation of this non-GAAP financial measure as used in this release to the most directly comparable financial measure under GAAP.

(2) Revenue days are the total number of calendar days the Company's vessels were in its possession during a period, less the total number of off-hire days during the period associated with major repairs or modifications, dry dockings or special or intermediate surveys. Consequently, revenue days represent the total number of days available for the vessel to earn revenue. Idle days, which are days when the vessel is available to earn revenue but is not employed, are included in revenue days.

(3) Includes Suezmax vessels trading in the Teekay Suezmax RSA and non-RSA voyage charters.

(4) Includes Aframax and LR2 vessels trading in the Teekay Aframax RSA, non-RSA voyage charters and full service lightering voyages.

Second Quarter of 2024 Spot Tanker Performance Update

The following table presents Teekay Tankers’ TCE rates booked to-date in the second quarter of 2024 for its spot-traded fleet only, together with the percentage of total revenue days currently fixed for the second quarter:

| | | | | | | | |

| Second Quarter 2024 To-Date Spot Tanker Rates |

| TCE Rates Per Day | % Fixed |

| Suezmax | $45,100 | 59% |

Aframax / LR2 (1) | $43,900 | 54% |

(1) Rates and percentage booked to date include Aframax RSA and non-RSA voyage charters and full service lightering for all Aframax and LR2 vessels, whether trading in the clean or dirty spot market.

Teekay Tankers Fleet

The following table summarizes the Company’s fleet as of May 1, 2024:

| | | | | | | | | | | |

| Owned

Vessels | Chartered-in Vessels | Total |

| Fixed-rate: | | | |

Suezmax Tanker(1) | — | 1 | 1 |

| | | |

| | | |

| Total Fixed-Rate Fleet | — | 1 | 1 |

| Spot-rate: | | | |

| Suezmax Tankers | 25 | — | 25 |

Aframax Tankers / LR2 Product Tankers(2) | 17 | 7 | 24 |

| | | |

VLCC Tanker(3) | 1 | — | 1 |

| Total Spot Fleet | 43 | 7 | 50 |

| Total Tanker Fleet | 43 | 8 | 51 |

| STS Support Vessels | — | 2 | 2 |

| Total Teekay Tankers Fleet | 43 | 10 | 53 |

(1) Includes one Suezmax tanker with a charter-in contract that is scheduled to expire in June 2027 with an option to extend for one additional year.

(2) Includes seven Aframax / LR2 tankers with charter-in contracts that are scheduled to expire in July 2024, August 2024, November 2024, March 2025, February 2026, and January 2030, three of which have options to extend for one additional year, and one of which has options to extend for up to three years.

(3) The Company’s ownership interest in this vessel is 50 percent.

Liquidity Update

As at March 31, 2024, the Company had total liquidity of $691.5 million (comprised of $369.7 million in cash and cash equivalents and $321.8 million in undrawn capacity from its credit facility), compared to total liquidity of $687.1 million as at December 31, 2023. The increase of $4.4 million in liquidity compared to the prior quarter is primarily due to positive net operating cash flow and net proceeds received from the sale of one Aframax / LR2 vessel, partially offset by the repurchase of eight tankers that were previously under sale-leaseback arrangements and cash dividends paid on our common shares.

Conference Call

The Company plans to host a conference call on Thursday, May 9, 2024 at 11:00 a.m. (ET) to discuss its results for the first quarter of 2024. All shareholders and interested parties are invited to listen to the live conference call by choosing from the following options:

•By dialing 1(800) 239-9838 or 1(323) 794-2551, if outside of North America, and quoting conference ID code 9558829.

•By accessing the webcast, which will be available on Teekay Tankers’ website at www.teekay.com (the archive will remain on the website for a period of one year).

An accompanying First Quarter of 2024 Earnings Presentation will also be available at www.teekay.com in advance of the conference call start time.

About Teekay Tankers

Teekay Tankers has a fleet of 42 double-hull tankers (including 25 Suezmax tankers and 17 Aframax / LR2 tankers), and also has eight time chartered-in tankers. Teekay Tankers’ vessels are typically employed through a mix of spot tanker market trading and short- or medium-term fixed-rate time charter contracts. Teekay Tankers also owns a Very Large Crude Carrier (VLCC) through a 50 percent-owned joint venture. In addition, Teekay Tankers owns a ship-to-ship transfer business that performs full service lightering and lightering support operations in the U.S. Gulf and Caribbean. Teekay Tankers was formed in December 2007 by Teekay Corporation as part of its strategy to expand its oil tanker business.

Teekay Tankers’ Class A common stock trades on the New York Stock Exchange under the symbol “TNK.”

For Investor Relations enquiries contact:

E-mail: TeekayTankers@IGBIR.com

Definitions and Non-GAAP Financial Measures

This release includes various financial measures that are non-GAAP financial measures as defined under the rules of the Securities and Exchange Commission (SEC). These non-GAAP financial measures, which include Adjusted Net Income, Adjusted EBITDA, and Net Revenues, are intended to provide additional information and should not be considered substitutes for measures of performance prepared in accordance with GAAP. In addition, these measures do not have standardized definitions across companies, and therefore may not be comparable to similar measures presented by other companies. These non-GAAP measures are used by management, and the Company believes that these supplemental metrics assist investors and other users of its financial reports in comparing financial and operating performance of the Company across reporting periods and with other companies.

Non-GAAP Financial Measures

Adjusted net income excludes certain items of income or loss from GAAP net income that are typically excluded by securities analysts in their published estimates of the Company’s financial results. The Company believes that certain investors use this information to evaluate the Company’s financial performance, as does management. Please refer to Appendix A of this release for a reconciliation of this non-GAAP financial measure to net income, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Adjusted EBITDA represents EBITDA (i.e. net income before interest, taxes, and depreciation and amortization) adjusted to exclude certain items whose timing or amount cannot be reasonably estimated in advance or that are not considered representative of core operating performance. Such adjustments include foreign exchange gains and losses, write-downs of assets, gains and losses on sale of assets, unrealized credit loss adjustments, unrealized gains and losses on derivative instruments, realized gains or losses on derivative instruments resulting from amendments or terminations of the underlying instruments, equity income or loss from unconsolidated joint ventures and any write-offs and certain other income or expenses. Adjusted EBITDA also excludes realized gains or losses on interest rate swaps (as management, in assessing the Company's performance, views these gains or losses as an element of interest expense). Adjusted EBITDA is a non-GAAP financial measure used by certain investors and management to measure the operational performance of companies. Please refer to Appendix B of this release for a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Net revenues represents income from operations before vessel operating expenses, time-charter hire expenses, depreciation and amortization, general and administrative expenses, gain or loss on sale and write-down of assets, and restructuring charges. Since the amount of voyage expenses the Company incurs for a particular charter depends on the type of the charter, the Company includes these costs in net revenues to improve the comparability between periods of reported revenues that are generated by the different types of charters and contracts. The Company principally uses net revenues, a non-GAAP financial measure, because the Company believes it provides more meaningful information about the deployment of the Company's vessels and their performance than does income from operations, the most directly comparable financial measure under GAAP. Please refer to Appendix C of this release for a reconciliation of this non-GAAP financial measure to income from operations, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Teekay Tankers Ltd.

Summary Consolidated Statements of Income

(in thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | December 31, | March 31, | | | | |

| | 2024 | 2023 | 2023 | | | | |

| | (unaudited) | (unaudited) | (unaudited) | | | | |

| | | | | | | | |

Voyage charter revenues (1) | 328,941 | | 302,003 | | 384,744 | | | | | |

| Time-charter revenues | 5,123 | | 8,025 | | 7,010 | | | | | |

Other revenues (2) | 4,279 | | 3,263 | | 2,903 | | | | | |

| Total revenues | 338,343 | | 313,291 | | 394,657 | | | | | |

| | | | | | | | | |

Voyage expenses (1) | (116,531) | | (118,828) | | (124,187) | | | | | |

| Vessel operating expenses | (37,495) | | (36,612) | | (38,182) | | | | | |

| Time-charter hire expenses | (19,516) | | (19,822) | | (12,945) | | | | | |

| Depreciation and amortization | (23,318) | | (24,627) | | (23,975) | | | | | |

| General and administrative expenses | (13,843) | | (10,849) | | (12,269) | | | | | |

Gain on sale of vessels (3) | 11,601 | | 10,360 | | — | | | | | |

| Restructuring charges | — | | — | | (1,248) | | | | | |

| Income from operations | 139,241 | | 112,913 | | 181,851 | | | | | |

| | | | | | | | |

| Interest expense | (4,866) | | (4,141) | | (11,218) | | | | | |

| Interest income | 5,474 | | 3,058 | | 2,230 | | | | | |

Realized and unrealized loss

on derivative instruments | — | | — | | (98) | | | | | |

Equity income (4) | 1,368 | | 516 | | 1,130 | | | | | |

| Other (expense) income | (779) | | 965 | | (2,245) | | | | | |

| Net income before income tax | 140,438 | | 113,311 | | 171,650 | | | | | |

| | | | | | | |

| Income tax recovery (expense) | 4,333 | | (1,617) | | (2,282) | | | | | |

| Net income | 144,771 | | 111,694 | | 169,368 | | | | | |

| | | | | | | | |

| Earnings per share attributable | | | | | | | |

| | to shareholders of Teekay Tankers | | | | | | | |

| | - Basic | 4.23 | | 3.27 | | 4.97 | | | | | |

| | - Diluted | 4.18 | | 3.23 | | 4.90 | | | | | |

| - Cash dividends declared | 0.25 | | 0.25 | | — | | | | | |

| | | | | | | | | |

| | | | | | | | |

| Weighted-average number of total common | | | | | | |

| | shares outstanding | | | | | | | |

| | - Basic (5) | 34,261,903 | | 34,203,138 | | 34,092,504 | | | | | |

| | - Diluted | 34,649,190 | | 34,613,345 | | 34,540,269 | | | | | |

| | | | | | | | |

| Number of outstanding shares of common | | | | | | |

| stock at the end of the period | 34,257,659 | | 34,093,108 | | 33,958,982 | | | | | |

(1)Voyage charter revenues include revenues earned from full service lightering activities. Voyage expenses include certain costs associated with full service lightering activities, which include: short-term in-charter expenses, bunker fuel expenses and other port expenses totaling $7.1 million, $10.3 million and $15.2 million for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively.

(2)Other revenues include lightering support revenue, revenue earned from the Company's responsibilities in employing the vessels subject to the RSAs, and bunker commissions earned.

(3)Gain on sale of vessels for the three months ended March 31, 2024 includes a gain of $11.6 million relating to one Aframax / LR2 tanker, which was sold in February 2024. Gain on sale of vessels for the three months ended December 31, 2023 includes a gain of $10.4 million relating to one Aframax / LR2 tanker, which was sold in December 2023.

(4)Equity income relates to the Company’s 50 percent interest in the High-Q Investments Ltd. (High-Q) joint venture, which owns one VLCC tanker.

(5)Includes common shares related to non-forfeitable stock-based compensation.

Teekay Tankers Ltd.

Summary Consolidated Balance Sheets

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | |

| As at | | As at |

| March 31, | | December 31, |

| 2024 | | 2023 |

| (unaudited) | | (unaudited) |

| ASSETS | | | | | | |

| Cash and cash equivalents | 369,744 | | | | 365,251 | |

| Restricted cash | 679 | | | | 691 | |

| Accounts receivable | 92,515 | | | | 99,940 | |

| Bunker and lube oil inventory | 54,868 | | | | 53,219 | |

| Prepaid expenses | 11,671 | | | | 12,332 | |

| Accrued revenue and other current assets | 86,262 | | | | 70,156 | |

Assets held for sale (1) | 36,505 | | | | 11,910 | |

| Total current assets | 652,244 | | | | 613,499 | |

| | | | | | |

| Vessels and equipment – net | 1,099,967 | | | | 929,237 | |

| Vessels related to finance leases – net | — | | | | 228,973 | |

| Operating lease right-of-use assets | 65,870 | | | | 76,314 | |

| Investment in and advances to equity-accounted joint venture | 17,098 | | | | 15,731 | |

| Other non-current assets | 6,105 | | | | 6,656 | |

| Intangible assets – net | 1,844 | | | | 658 | |

| Goodwill | 2,426 | | | | 2,426 | |

| Total assets | 1,845,554 | | | | 1,873,494 | |

| | | | | | |

| LIABILITIES AND EQUITY | | | | | | |

| Accounts payable and accrued liabilities | 60,580 | | | | 73,587 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Current obligations related to finance leases | — | | | | 20,517 | |

| Current portion of operating lease liabilities | 30,802 | | | | 35,882 | |

| | | | | | |

| Due to affiliates | 4,365 | | | | 5,013 | |

| Other current liabilities | 3,417 | | | | 4,289 | |

| Total current liabilities | 99,164 | | | | 139,288 | |

| | | | | | |

| Long-term obligations related to finance leases | — | | | | 119,082 | |

| Long-term operating lease liabilities | 35,068 | | | | 40,432 | |

| Other long-term liabilities | 46,055 | | | | 48,907 | |

| Equity | 1,665,267 | | | | 1,525,785 | |

| Total liabilities and equity | 1,845,554 | | | | 1,873,494 | |

| | | | | | |

Net cash (2) | 370,423 | | | | 226,343 | |

(1)Assets held for sale at March 31, 2024 includes one Suezmax tanker and one Aframax / LR2 tanker. Assets held for sale at December 31, 2023 includes one Aframax / LR2 tanker, which was sold in February 2024 for gross proceeds of $23.5 million.

(2)Net cash is a non-GAAP financial measure and represents (a) cash and cash equivalents and restricted cash, less (b) short-term debt, current and long-term debt and current and long-term obligations related to finance leases.

Teekay Tankers Ltd.

Summary Consolidated Statements of Cash Flows

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, | March 31, |

| | 2024 | 2023 |

| | (unaudited) | (unaudited) |

| Cash, cash equivalents and restricted cash provided by (used for) | | | | |

| OPERATING ACTIVITIES | | | | |

| Net income | 144,771 | | | 169,368 | | |

| Non-cash items: | | | | |

| Depreciation and amortization | 23,318 | | | 23,975 | | |

| Gain on sale of vessel | (11,601) | | | — | | |

| Unrealized loss on derivative instruments | — | | | 584 | | |

| Equity income | (1,368) | | | (1,130) | | |

| Income tax (recovery) expense | (4,595) | | | 1,781 | | |

| Other | 3,445 | | | 3,152 | | |

| Change in operating assets and liabilities | (23,591) | | | (28,946) | | |

| Expenditures for dry docking | (721) | | | (1,465) | | |

| Net operating cash flow | 129,658 | | | 167,319 | | |

| | | | |

| FINANCING ACTIVITIES | | | | |

| Proceeds from short-term debt | — | | | 25,000 | | |

| Prepayments of short-term debt | — | | | (25,000) | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Scheduled repayments of obligations related to finance leases | (5,213) | | | (13,397) | | |

| Prepayment of obligations related to finance leases | (136,955) | | | (164,252) | | |

| Issuance of common stock upon exercise of stock options | 2,786 | | | — | | |

| | | | |

| Cash dividends paid | (8,560) | | | — | | |

| Other | (90) | | | — | | |

| Net financing cash flow | (148,032) | | | (177,649) | | |

| | | | |

| INVESTING ACTIVITIES | | | | |

| Proceeds from sale of vessel | 23,425 | | | — | | |

| Expenditures for vessels and equipment | (570) | | | (442) | | |

| | | | |

| | | | |

| Net investing cash flow | 22,855 | | | (442) | | |

| | | | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 4,481 | | | (10,772) | | |

| Cash, cash equivalents and restricted cash, beginning of the period | 365,942 | | | 187,361 | | |

| Cash, cash equivalents and restricted cash, end of the period | 370,423 | | | 176,589 | | |

Teekay Tankers Ltd.

Appendix A - Reconciliation of Non-GAAP Financial Measures

Adjusted Net Income

(in thousands of U.S. dollars, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31,

2024 | December 31,

2023 | March 31,

2023 |

| | | (unaudited) | (unaudited) | (unaudited) |

| | | $ | $ Per Share(1) | $ | $ Per Share(1) | $ | $ Per Share(1) |

| Net income - GAAP basis | 144,771 | | | $4.23 | | | 111,694 | | | $3.27 | | | 169,368 | | | $4.97 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Add (subtract) specific items affecting net income: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Gain on sale of vessels | (11,601) | | | ($0.34) | | | (10,360) | | | ($0.31) | | | — | | | — | | |

| Unrealized loss on derivative instruments (2) | — | | | — | | | — | | | — | | | 584 | | | $0.02 | | |

| | Other (3) | (823) | | | ($0.03) | | | (1,789) | | | ($0.05) | | | 4,966 | | | $0.14 | | |

| Total adjustments | (12,424) | | | ($0.37) | | | (12,149) | | | ($0.36) | | | 5,550 | | | $0.16 | | |

| Adjusted net income attributable to | | | | | | | | | | | | |

| | shareholders of Teekay Tankers | 132,347 | | | $3.86 | | | 99,545 | | | $2.91 | | | 174,918 | | | $5.13 | | |

(1)Basic per share amounts.

(2)Reflects unrealized gains or losses due to the changes in the mark-to-market value of derivative instruments that are not designated as hedges for accounting purposes, including unrealized gains or losses on interest rate swaps and forward freight agreements.

(3)The amount recorded for the three months ended March 31, 2024 primarily relates to an adjustment to income tax accruals of prior years, the premium paid as part of the exercise of early purchase options and capitalized financing costs which were written off in relation to the repurchase of eight sale-leaseback vessels. The amount recorded for the three months ended December 31, 2023 primarily relates to the settlement of a legal claim. The amount recorded for the three months ended March 31, 2023 primarily relates to the premium paid as part of the exercise of early purchase options and capitalized financing costs which were written off in relation to the repurchase of nine sale-leaseback vessels, restructuring charges, and foreign exchange losses.

Teekay Tankers Ltd.

Appendix B - Reconciliation of Non-GAAP Financial Measures

Total Adjusted EBITDA

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31,

2024 | December 31,

2023 | March 31,

2023 |

| (unaudited) | (unaudited) | (unaudited) |

| Net income - GAAP basis | 144,771 | | | 111,694 | | | 169,368 | | |

| Depreciation and amortization | 23,318 | | | 24,627 | | | 23,975 | | |

| Net interest (income) expense | (608) | | | 1,083 | | | 8,988 | | |

| Income tax (recovery) expense | (4,333) | | | 1,617 | | | 2,282 | | |

| EBITDA | 163,148 | | | 139,021 | | | 204,613 | | |

| | | | | | |

| Add (subtract) specific items affecting EBITDA: | | | | | | |

| Gain on sale of vessels | (11,601) | | | (10,360) | | | — | | |

| Realized gain on interest rate swap | — | | | — | | | (496) | | |

| | | | | | |

| Unrealized loss on derivative instruments | — | | | — | | | 584 | | |

| Equity income | (1,368) | | | (516) | | | (1,130) | | |

Other (1) | 760 | | | (964) | | | 2,224 | | |

| Adjusted EBITDA | 150,939 | | | 127,181 | | | 205,795 | | |

(1) The amount recorded for the three months ended March 31, 2024 primarily relates to the premium paid as part of the exercise of early purchase options in relation to the repurchase of eight sale-leaseback vessels and foreign exchange gains. The amount recorded for the three months ended December 31, 2023 primarily relates to the settlement of a legal claim and foreign exchange losses. The amount recorded for the three months ended March 31, 2023 primarily relates to the premium paid as part of the exercise of early purchase options in relation to the repurchase of nine sale-leaseback vessels and foreign exchange losses.

Teekay Tankers Ltd.

Appendix C - Reconciliation of Non-GAAP Financial Measures

Net Revenues

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | March 31,

2024 | December 31,

2023 | March 31,

2023 |

| | (unaudited) | (unaudited) | (unaudited) |

| Income from operations - GAAP basis | 139,241 | | | 112,913 | | | 181,851 | | |

| | | | | | | |

| Add (subtract) specific items affecting income from operations: | | | | |

| Vessel operating expenses | 37,495 | | | 36,612 | | | 38,182 | | |

| Time-charter hire expenses | 19,516 | | | 19,822 | | | 12,945 | | |

| Depreciation and amortization | 23,318 | | | 24,627 | | | 23,975 | | |

| General and administrative expenses | 13,843 | | | 10,849 | | | 12,269 | | |

| Gain on sale of vessels | (11,601) | | | (10,360) | | | — | | |

| Restructuring charges | — | | | — | | | 1,248 | | |

| Total adjustments | 82,571 | | | 81,550 | | | 88,619 | | |

| Net revenues | 221,812 | | | 194,463 | | | 270,470 | | |

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. All statements included in this report, other than statements of historical fact, are forward-looking statements. When used in this report, the words "expect", "believe", "anticipate", "plan", "intend", "estimate", "may", "will" or similar words are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only as of the date hereof and are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Forward-looking statements contained in this release include, among others, statements regarding: the timing of and our expectations regarding the impact of the commissioning of the previously-announced expansion of the Trans Mountain Pipeline, including the development of potential trading opportunities, the impact on existing tanker utilization and potential additional tanker demand; the Company's capital allocation plan, including its ability to position itself to pursue the priorities of fleet reinvestment and returning capital to shareholders, including through quarterly cash dividends; the timing of payments of cash dividends; any future dividends; management's expectations regarding the global economic outlook as well as global oil demand and supply, and the various contributing factors thereto and impact thereof; geopolitical events and the impact thereof on our industry, our business and on the tanker rate environment; management's view of the strength of the tanker market and tanker rate environment, and the Company's ability to benefit from current tanker market conditions, create shareholder value and prioritize its capital allocation initiatives; crude oil and refined product tanker market fundamentals; forecasts of worldwide tanker fleet growth or contraction, vessel scrapping levels, and newbuilding tanker orders, including the factors contributing thereto and the timing thereof, and the Company’s general outlook on tanker supply and demand fundamentals; the Company's expectations regarding tanker charter-in contracts, including the timing of commencement, expiry or extensions thereof; and the Company's liquidity and market position.

The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: potential changes to or termination of the Company's capital allocation plan or dividend policy; the declaration by the Company's Board of Directors of any future cash dividends on the Company's common shares; the Company's available cash and the levels of its capital needs; changes in the Company's liquidity and financial leverage; changes in tanker rates, including spot tanker market rate fluctuations, and in oil prices; changes in the production of, or demand for, oil or refined products and for tankers; changes in trading patterns affecting overall vessel tonnage requirements; non-OPEC+ and OPEC+ production and supply levels; the impact of geopolitical tensions and conflicts, including the Hamas-Israel war and Russia's invasion of Ukraine, and changes in global economic conditions; greater or less than anticipated levels of tanker newbuilding orders and deliveries and greater or less than anticipated rates of tanker scrapping; the potential for early termination of charter contracts on existing vessels in the Company's fleet; the inability of charterers to make future charter payments; delays of vessel deliveries; changes in applicable industry laws and regulations and the timing of implementation of new laws and regulations and the impact of such changes, including the recent inclusion of the maritime industry in the European Union's Emissions Trading System; increased costs; and other factors discussed in Teekay Tankers’ filings from time to time with the United States Securities and Exchange Commission, including its Annual Report on Form 20-F for the fiscal year ended December 31, 2023. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

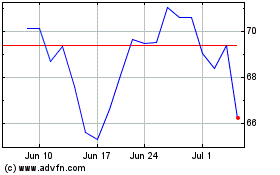

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From Apr 2024 to May 2024

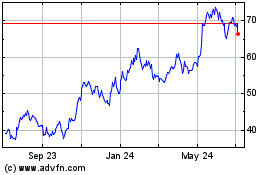

Teekay Tankers (NYSE:TNK)

Historical Stock Chart

From May 2023 to May 2024