UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 6-K

_________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Date of Report: May 9, 2024

Commission file number 1-12874

_________________________

TEEKAY CORPORATION

(Exact name of Registrant as specified in its charter)

_________________________

4th Floor, Belvedere Building

69 Pitts Bay Road

Hamilton, HM 08 Bermuda

(Address of principal executive offices)

_________________________

| | |

| Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. |

Form 20-F ý Form 40- F ¨ |

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Item 1 — Information Contained in this Form 6-K Report

Attached as Exhibit 1 is a copy of an announcement of Teekay Corporation dated May 9, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| TEEKAY CORPORATION |

| |

| Date: May 9, 2024 | By: | | /s/ Brody Speers |

| | | Brody Speers

Vice President, Finance & Treasurer (Principal Financial and Accounting Officer) |

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

TEEKAY CORPORATION REPORTS

FIRST QUARTER 2024 RESULTS

Highlights

•GAAP net income attributable to shareholders of Teekay of $54.6 million, or $0.59 per share, and adjusted net income attributable to shareholders of Teekay(1) of $41.0 million, or $0.44 per share, in the first quarter of 2024 (excluding items listed in Appendix A to this release).

•Tanker market remains firm with Teekay Tankers securing second quarter 2024 to-date average spot rates of $45,100 per day for its Suezmax fleet and $43,900 per day for its Aframax fleet, respectively.

•In line with Teekay Tankers' fixed dividend policy, Teekay Tankers declared a quarterly cash dividend of $0.25 per common share for the quarter ended March 31, 2024. In addition, Teekay Tankers declared a special dividend of $2.00 per common share, for a combined dividend of $2.25 per common share, payable in May 2024.

Hamilton, Bermuda, May 9, 2024 - Teekay Corporation (Teekay or the Company) (NYSE:TK) today reported results for the three months ended March 31, 2024. These results include the Company’s publicly-listed consolidated subsidiary, Teekay Tankers Ltd. (Teekay Tankers) (NYSE:TNK), and all remaining subsidiaries and equity-accounted investments. Teekay, together with its subsidiaries other than Teekay Tankers, is referred to in this release as Teekay Parent. Please refer to the first quarter of 2024 earnings release of Teekay Tankers, which is available on Teekay's website at www.teekay.com, for additional information on Teekay Tankers' results.

Financial Summary

| | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | December 31, | March 31, | | |

| (in thousands of U.S. dollars, except per share amounts) | 2024 | 2023 | 2023 | | |

| (unaudited) | (unaudited) | (unaudited) | | |

| TEEKAY CORPORATION CONSOLIDATED | | | | |

| GAAP FINANCIAL COMPARISON | | | | |

| Revenues | 365,050 | 339,192 | 418,701 | | |

| Income from vessel operations | 140,478 | 112,967 | 179,837 | | |

| Net income attributable to the shareholders of Teekay | 54,636 | 35,382 | 48,763 | | |

Earnings per common share of Teekay(1) | 0.59 | 0.38 | 0.49 | | |

| NON-GAAP FINANCIAL COMPARISON | | | |

Adjusted EBITDA (2) | 152,195 | 127,234 | 203,802 | | |

Adjusted net income attributable to shareholders of Teekay (2) | 41,014 | 31,891 | 51,017 | | |

Adjusted net earnings per share attributable to shareholders of Teekay (1)(2) | 0.44 | 0.35 | 0.52 | | |

| | As at | As at | As at | | |

| | March 31, | December 31, | March 31, | | |

| (in thousands of U.S. dollars, except number of shares) | 2024 | 2023 | 2023 | | |

| (unaudited) | (unaudited) | (unaudited) | | |

| TEEKAY PARENT | | | | |

Net cash (3) | 291,341 | 287,433 | 291,020 | | |

Market value of investment in Teekay Tankers (4) | 572,113 | 489,445 | 414,803 | | |

| Number of outstanding shares of common stock at end of period | 91,378,415 | 91,006,182 | 96,027,318 | | |

| | | | | |

| | | | | |

| | | | | |

(1)Basic per share amounts.

(2)These are non-GAAP financial measures. Please refer to “Definitions and Non-GAAP Financial Measures” and the Appendices to this release for definitions of these terms and reconciliations of these non-GAAP financial measures as used in this release to the most directly comparable financial measures under United States generally accepted accounting principles (GAAP).

(3)Teekay Parent's net cash as of March 31, 2024 includes cash and cash equivalents and short-term investments. Teekay Parent's net cash position increased compared to December 31, 2023, primarily due to cash dividends of $2.4 million received from Teekay Tankers, changes in working capital balances, and cash flow generated during the three months ended March 31, 2024. As at March 31, 2024, Teekay Parent's remaining floating production storage and offloading unit (FPSO) recycling costs are estimated to be approximately $3.1 million, which are expected to be paid through mid-2024.

1

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

(4)As at March 31, 2024, December 31, 2023, and March 31, 2023, Teekay Parent owned 9.8 million, 9.8 million, and 9.7 million Teekay Tankers Class A and B common shares, respectively, and, as of such dates, the closing prices of Teekay Tankers Class A common shares were $58.41 per share, $49.97 per share, and $42.93 per share, respectively.

CEO Commentary

“After achieving our highest annual adjusted net income in the last 15 years in 2023, Teekay continued to earn strong results in the first quarter of 2024,” commented Kenneth Hvid, Teekay’s President and CEO. “The performance at Teekay Tankers was again driven by the resilience of the spot tanker market, which benefited from increased global oil demand, firm tonne-mile demand and limited fleet supply growth.”

“During the quarter, Teekay Tankers also achieved another major milestone by becoming debt free(1), and sold a 2004-built Aframax tanker for gross proceeds of $23.5 million, realizing a gain on the sale of $11.6 million. Looking ahead to the second quarter of 2024, spot tanker rates have remained firm, with bookings to-date averaging $45,100 per day for Suezmax vessels and $43,900 for Aframax vessels. With our spot market exposure and leading position in mid-size tankers, we believe we are well positioned to continue benefiting from strong tanker market fundamentals.”

“Lastly, Teekay Tankers is executing on its balanced capital allocation plan, which includes building financial strength to act on future investment opportunities, while also selling some of their older vessels and returning capital to shareholders. In addition to its annual fixed quarterly dividend of $0.25 per share, Teekay Tankers today declared a special dividend of $2.00 per share for a total dividend of $2.25 per share, of which Teekay Parent’s portion will be approximately $22.0 million.”

(1) Teekay Tankers' share of debt in its 50/50 non-consolidated joint venture, which owns one Very Large Crude Carrier (VLCC), is $9.8 million as of March 31, 2024.

2

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Summary of Results

The Company's GAAP net income attributable to shareholders of Teekay increased for the first quarter of 2024 compared to the same quarter of the prior year, primarily due to gains relating to the sale of a vessel by Teekay Tankers, partially offset by lower earnings from Teekay Tankers primarily as a result of lower spot tanker rates.

The Company’s adjusted net income attributable to shareholders of Teekay(1) decreased in the first quarter of 2024 compared to the same quarter of the prior year, due to lower earnings from Teekay Tankers primarily as a result of lower spot tanker rates.

The following table highlights the operating performance of Teekay Tankers' vessels trading in revenue sharing arrangements (RSAs), voyage charters and full-service lightering, in each case measured in net revenues(a) per revenue day(b), or time-charter equivalent (TCE) rates, before off-hire bunker expenses:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | |

| March 31, 2024(b) | December 31, 2023(b) | March 31, 2023(b) | | | |

| Suezmax revenue days | 2,248 | | | 2,153 | | | 2,249 | | | | | | | |

Suezmax spot TCE per revenue day (b) | $47,349 | | $37,041 | | $55,891 | | | | | | |

| Aframax / LR2 revenue days | 2,157 | | | 2,276 | | | 1,971 | | | | | | | |

Aframax / LR2 spot TCE per revenue day (b) | $48,754 | | $44,545 | | $67,346 | | | | | | |

| | | | | | | | | | | |

(a) Net revenues is a non-GAAP financial measure. Please refer to "Definitions and Non-GAAP Financial Measures" for a definition of this term.

(b) Revenue days are the total number of calendar days Teekay Tankers' vessels were in its possession during a period, less the total number of off-hire days during the period associated with major repairs or modifications, dry dockings or special or intermediate surveys. Consequently, revenue days represent the total number of days available for the vessel to earn revenue. Idle days, which are days when the vessel is available to earn revenue but is not employed, are included in revenue days.

Please refer to Teekay Tankers' first quarter of 2024 earnings release for additional information about its financial results.

(1) This is a non-GAAP financial measure. Please refer to "Definitions and Non-GAAP Financial Measures" and the Appendices to this release for a definition of this term and a reconciliation of this non-GAAP financial measure as used in this release to the most directly comparable financial measures under GAAP.

3

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Summary of Recent Events

Teekay Tankers

In February 2024, Teekay Tankers completed the previously-announced sale of a 2004-built Aframax vessel for gross proceeds of $23.5 million and recorded a gain on sale of $11.6 million.

In March 2024, Teekay Tankers completed the previously-announced repurchase of eight vessels under sale-leaseback arrangements for a total of $137.0 million. The vessels were repurchased with cash balances and are currently unencumbered. Teekay Tankers is debt free(1) after completing the repurchase.

Teekay Tankers' Board of Directors declared a fixed quarterly cash dividend in the amount of $0.25 per outstanding share of common stock for the quarter ended March 31, 2024. In addition, the Teekay Tankers Board of Directors declared a special cash dividend of $2.00 per common share. These dividends are payable on May 31, 2024 to all of Teekay Tankers' shareholders of record on May 21, 2024.

The following table presents Teekay Tankers’ TCE rates booked to date in the second quarter of 2024 for its spot-traded fleet, together with the percentage of total revenue days currently fixed for the second quarter:

| | | | | | | | |

| Second Quarter 2024 To-Date Spot Tanker Rates |

| TCE Rates Per Day | % Fixed |

| Suezmax | $45,100 | 59% |

Aframax / LR2 (2) | $43,900 | 54% |

(1) Teekay Tankers' share of debt in its 50/50 non-consolidated joint venture, which owns one VLCC, is $9.8 million as of March 31, 2024.

(2) Rates and percentage booked to date include Aframax RSA and non-RSA voyage charters and full-service lightering for all Aframax and LR2 vessels, whether trading in the clean or dirty spot market.

Please refer to Teekay Tankers' first quarter of 2024 earnings release for additional information about recent developments of Teekay Tankers.

4

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

About Teekay

Teekay is a leading provider of international crude oil marine transportation and other marine services. Teekay provides these services directly and through its controlling ownership interest in Teekay Tankers Ltd. (NYSE: TNK), one of the world’s largest owners and operators of mid-sized crude tankers. The consolidated Teekay entities manage and operate approximately 64 conventional tankers and other marine assets, including vessels operated for the Australian government. With offices in 8 countries and approximately 2,200 seagoing and shore-based employees, Teekay provides a comprehensive set of marine services to the world’s leading energy companies.

Teekay’s common stock is listed on the New York Stock Exchange where it trades under the symbol “TK”.

For Investor Relations enquiries contact:

E-mail: investor.relations@teekay.com

Website: www.teekay.com

5

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Definitions and Non-GAAP Financial Measures

This release includes various financial measures that are non-GAAP financial measures as defined under the rules of the Securities and Exchange Commission (SEC). These non-GAAP financial measures, which include Adjusted Net Income Attributable to Shareholders of Teekay, Adjusted EBITDA and Net Revenues, are intended to provide additional information and should not be considered substitutes for measures of performance prepared in accordance with GAAP. In addition, these measures do not have standardized meanings across companies, and therefore may not be comparable to similar measures presented by other companies. The Company believes that certain investors use this information to evaluate the Company’s financial performance, as does management.

Non-GAAP Financial Measures

Adjusted Net Income Attributable to Shareholders of Teekay excludes certain items of income or loss from GAAP net income that are typically excluded by securities analysts in their published estimates of the Company’s financial results. The Company believes that certain investors use this information to evaluate the Company’s financial performance, as does management. Please refer to Appendix A of this release for a reconciliation of this non-GAAP financial measure to net income, the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Adjusted EBITDA represents EBITDA (i.e., net income before interest, taxes, and depreciation and amortization), adjusted to exclude certain items the timing or amount of which cannot be reasonably estimated in advance or that are not considered representative of core operating performance. Such adjustments include foreign currency exchange gains and losses, write-downs and/or gains and losses on sale of operating assets, unrealized gains and losses on derivative instruments, equity income (loss), and other income or loss. Adjusted EBITDA also excludes realized gains or losses on interest rate swaps (as management, in assessing the Company's performance, views these gains or losses as an element of interest expense), and realized gains or losses on interest rate swaps resulting from amendments or terminations of underlying instruments.

Adjusted EBITDA is a non-GAAP financial measure used by certain investors and management to measure the operational performance of companies. Please refer to Appendix C of this release for reconciliation of Adjusted EBITDA to net income, which is the most directly comparable GAAP measure reflected in the Company’s consolidated financial statements.

Net Revenues represents income from vessel operations before vessel operating expenses, time-charter hire expenses, depreciation and amortization, general and administrative expenses, gain on sale and write-down of assets, and restructuring charges. Since the amount of voyage expenses the Company incurs for a particular charter depends on the type of the charter, the Company includes these costs in Net Revenues to improve the comparability between periods of reported revenues that are generated by the different types of charters and contracts. The Company principally uses Net Revenues, a non-GAAP financial measure, because the Company believes it provides more meaningful information about the deployment of the Company's vessels and their performance than does income from vessel operations, the most directly comparable financial measure under GAAP.

6

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Summary Consolidated Statements of Income

(in thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | |

| Three Months Ended | |

| March 31, | December 31, | March 31, | | |

| 2024 | 2023 | 2023 | | |

| (unaudited) | (unaudited) | (unaudited) | | |

| | | | | |

| Revenues | 365,050 | 339,192 | 418,701 | | |

| Voyage expenses | (116,531) | (118,828) | (124,187) | | |

| Vessel operating expenses | (60,010) | (61,184) | (60,922) | | |

| Time-charter hire expenses | (19,516) | (19,822) | (12,945) | | |

| Depreciation and amortization | (23,318) | (24,627) | (23,975) | | |

| General and administrative expenses | (16,798) | (12,124) | (15,216) | | |

| Gain on sale of assets | 11,601 | 10,360 | — | | |

| Restructuring charges | — | — | (1,619) | | |

| Income from vessel operations | 140,478 | 112,967 | 179,837 | | |

| | | | | |

| Interest expense | (4,897) | (4,215) | (11,377) | | |

| Interest income | 9,035 | 7,122 | 5,588 | | |

| | | | | |

| Equity income | 1,368 | 516 | 1,130 | | |

| Income tax expense | 2,847 | (2,579) | (2,601) | | |

| Other – net | (1,068) | 1,166 | (2,664) | | |

| Net income | 147,763 | 114,977 | 169,913 | | |

| Net income attributable to non-controlling interests | (93,127) | (79,595) | (121,150) | | |

| Net income attributable to the shareholders of Teekay Corporation | 54,636 | 35,382 | 48,763 | | |

Earnings per common share(1) of Teekay Corporation | | | | | |

–Basic | $ | 0.59 | $ | 0.38 | $ | 0.49 | | |

–Diluted | $ | 0.57 | $ | 0.37 | $ | 0.48 | | |

Weighted-average number of common shares outstanding(1) | | | | | |

–Basic | 92,802,278 | 92,332,045 | 98,521,611 | | |

–Diluted | 95,034,041 | 94,571,844 | 100,476,663 | | |

(1)Weighted-average number of common shares outstanding includes common shares related to non-forfeitable stock-based compensation.

7

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Summary Consolidated Balance Sheets

(in thousands of U.S. dollars)

| | | | | | | | | | | | |

| | As at March 31, | | As at December 31, |

| | 2024 | | 2023 |

| | (unaudited) | | (unaudited) |

| ASSETS | | | |

| Cash and cash equivalents - Teekay Parent | 180,948 | | 114,829 |

| Cash and cash equivalents - Teekay Tankers | 369,744 | | 365,251 |

Short-term investments - Teekay Parent (1) | 110,393 | | 172,604 |

| Assets held for sale | 36,505 | | 11,910 |

| Accounts receivable | 109,075 | | 117,794 |

| Bunker and lube oil inventory | 54,868 | | 53,219 |

| Accrued revenue and other current assets | 101,499 | | 85,650 |

| Restricted cash - Teekay Tankers | 679 | | 691 |

| Vessels and equipment - Teekay Tankers | 1,099,967 | | 1,158,210 |

| Operating lease right-of-use assets | 65,870 | | 76,314 |

| Net investment in and loans to equity-accounted investment | 17,098 | | 15,731 |

| Other non-current assets | 28,009 | | 24,435 |

| Total Assets | 2,174,655 | | 2,196,638 |

| LIABILITIES AND EQUITY | | | |

| Accounts payable and other current liabilities | 99,594 | | 116,422 |

| Current portion of long-term debt and finance leases - Teekay Tankers | — | | 20,517 |

| Long-term debt and finance leases - Teekay Tankers | — | | 119,082 |

| Operating lease liabilities | 65,870 | | 76,314 |

| Other long-term liabilities | 63,133 | | 63,957 |

| Equity: | | | |

| Non-controlling interests | 1,159,723 | | 1,068,068 |

| Shareholders of Teekay | 786,335 | | 732,278 |

| Total Liabilities and Equity | 2,174,655 | | 2,196,638 |

| | | | |

Net cash - Teekay Parent (2) | 291,341 | | 287,433 |

Net cash - Teekay Tankers (2) | 370,423 | | 226,343 |

(1)Short-term investments - Teekay Parent includes various bank term deposits and short-term debt securities issued by the United States government that have initial maturity dates of more than three months but less than one year from the origination date.

(2)Net cash is a non-GAAP financial measure and represents (a) cash and cash equivalents, and, if applicable, restricted cash and short-term investments, less (b) current portion of long-term debt and current obligations related to finance leases, and long-term debt and long-term obligations related to finance leases

8

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Summary Consolidated Statements of Cash Flows

(in thousands of U.S. dollars)

| | | | | | | | |

| Three Months Ended |

| March 31, |

| 2024 | 2023 |

| (unaudited) | (unaudited) |

| Cash, cash equivalents and restricted cash provided by (used for) | | |

| OPERATING ACTIVITIES | | |

| Net income | 147,763 | 169,913 |

| Non-cash and non-operating items: | | |

| Depreciation and amortization | 23,318 | 23,975 |

| | |

| Gain on sale of assets | (11,601) | — |

| | |

| | |

| Other | (1,756) | 7,765 |

| | |

| Change in other operating assets and liabilities | (26,600) | (44,755) |

| | |

| Expenditures for dry docking | (721) | (1,465) |

| Net operating cash flow | 130,403 | 155,433 |

| FINANCING ACTIVITIES | | |

| | |

| | |

| Scheduled repayments of long-term debt | — | (21,184) |

| Proceeds from short-term debt | — | 25,000 |

| Prepayments of short-term debt | — | (25,000) |

| | |

| Prepayment of obligations related to finance leases | (136,955) | (164,252) |

| Scheduled repayments of obligations related to finance leases | (5,213) | (13,397) |

| | |

| Distributions from subsidiaries to non-controlling interests | (6,111) | — |

| Issuance of common stock upon exercise of stock options by Teekay Tankers | 2,786 | — |

| Repurchase of Teekay Corporation common shares | (86) | (14,845) |

| Other financing activities | 710 | (410) |

| Net financing cash flow | (144,869) | (214,088) |

| INVESTING ACTIVITIES | | |

| Proceeds from sale of vessels and equipment | 23,425 | — |

| Expenditures for vessels and equipment | (570) | (442) |

| Maturity of short-term investments | 62,211 | 1,748 |

| | |

| Net investing cash flow | 85,066 | 1,306 |

| Increase (decrease) in cash, cash equivalents and restricted cash | 70,600 | (57,349) |

| Cash, cash equivalents and restricted cash, beginning of the period | 480,771 | 316,706 |

| Cash, cash equivalents and restricted cash, end of the period | 551,371 | 259,357 |

9

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Appendix A - Reconciliation of Non-GAAP Financial Measures

Adjusted Net Income Attributable to Shareholders of Teekay

(in thousands of U.S. dollars, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, | December 31, | March 31, |

| | 2024 | 2023 | 2023 |

| | (unaudited) | (unaudited) | (unaudited) |

| | | | $ Per | | $ Per | | $ Per |

| | | $ | Share(1) | $ | Share(1) | $ | Share(1) |

| Net income – GAAP basis | 147,763 | | 114,977 | | 169,913 | |

| Adjust for: Net income attributable to | | | | | | |

| non-controlling interests | (93,127) | | (79,595) | | (121,150) | |

| | | | | | |

| Net income attributable to | | | | | | |

| shareholders of Teekay | 54,636 | 0.59 | 35,382 | 0.38 | 48,763 | 0.49 |

| (Subtract) add specific items affecting net income | | | | | | |

| | Unrealized losses from derivative instruments | — | — | — | — | 584 | 0.01 |

| | | | | | | |

| | | | | | | |

| Gain on sale of assets | (11,601) | (0.13) | (10,360) | (0.11) | — | — |

| | Restructuring charges, net of recoveries | — | — | — | — | 1,619 | 0.02 |

| | | | | | | |

| Income tax expense | (3,303) | (0.04) | — | — | — | — |

| | Other - net(2) | 2,480 | 0.03 | (1,789) | (0.02) | 4,022 | 0.04 |

| | Non-controlling interests’ share of items above(3) | (1,198) | (0.01) | 8,658 | 0.09 | (3,971) | (0.04) |

| Total adjustments | (13,622) | (0.15) | (3,491) | (0.04) | 2,254 | 0.02 |

| Adjusted net income attributable to | | | | | | |

| | shareholders of Teekay | 41,014 | 0.44 | 31,891 | 0.35 | 51,017 | 0.52 |

(1)Basic per share amounts.

(2)Includes premium related to early termination and write-off of prepaid lease financing costs due to the repurchase of eight sale-leaseback vessels during the three months ended March 31, 2024. The three months ended December 31, 2023 includes proceeds related to the settlement of a legal claim. The three months ended March 31, 2023 includes costs related to the early termination of certain obligations related to finance leases.

(3)Items affecting net income attributable to shareholders of Teekay include items from the Company’s consolidated non-wholly-owned subsidiaries. The specific items affecting net income are analyzed to determine whether any of the amounts originated from a consolidated non-wholly-owned subsidiary. Each amount that originates from a consolidated non-wholly-owned subsidiary is multiplied by the non-controlling interests’ percentage share in this subsidiary to determine the non-controlling interests’ share of the amount. The amount identified as “Non-controlling interests’ share of items above” in the table above is the cumulative amount of the non-controlling interests’ proportionate share of items listed in the table. It includes a deferred drop down gain of $10.1 million associated with Teekay Tankers’ gain on sale of an Aframax vessel during the quarter ended March 31, 2024.

10

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Appendix B - Supplemental Financial Information

Summary Statement of Income for the Three Months Ended

March 31, 2024

(in thousands of U.S. dollars)

(unaudited)

| | | | | | | | | | | | | | | | | |

| | | Teekay | Teekay | Consolidation | Total |

| | | Tankers | Parent | Adjustments(1) | |

| | | | | | |

Revenues | 338,343 | 26,707 | — | 365,050 |

| | | | | |

Voyage expenses | (116,531) | — | — | (116,531) |

Vessel operating expenses | (37,495) | (22,515) | — | (60,010) |

Time-charter hire expense | (19,516) | — | — | (19,516) |

Depreciation and amortization | (23,318) | — | — | (23,318) |

| General and administrative expenses | (13,843) | (2,955) | — | (16,798) |

| Gain on sale of assets | 11,601 | — | — | 11,601 |

| | | |

Income from vessel operations (2) | 139,241 | 1,237 | — | 140,478 |

| | | | |

Interest expense | (4,866) | (31) | — | (4,897) |

Interest income | 5,474 | 3,561 | — | 9,035 |

| | | | |

| | | | | |

| Equity income | 1,368 | — | — | 1,368 |

Equity in income of subsidiaries (3) | — | 41,591 | (41,591) | — |

| Income tax recovery (expense) | 4,333 | (1,486) | — | 2,847 |

| | | | |

| Other - net | (779) | (289) | — | (1,068) |

| Net income | 144,771 | 44,583 | (41,591) | 147,763 |

| | | | |

| Net income attributable to | | | | |

| | non-controlling interests (4) | — | 10,053 | (103,180) | (93,127) |

| Net income attributable | | | | |

| to shareholders | | | | |

| | of publicly-listed entities | 144,771 | 54,636 | (144,771) | 54,636 |

(1)Consolidation Adjustments column includes adjustments which eliminate transactions between Teekay Tankers and Teekay Parent.

(2)In addition to the income from vessel operations earned by Teekay Parent, it also receives cash distributions from its consolidated publicly-traded subsidiary, Teekay Tankers. During the three months ended March 31, 2024, Teekay Parent received cash distributions of $2.4 million from Teekay Tankers.

(3)Teekay Corporation’s proportionate share of the net income of its publicly-traded subsidiary, Teekay Tankers.

(4)Net income attributable to non-controlling interests represents the public’s share of the net income of Teekay’s publicly-traded subsidiary, Teekay Tankers.

11

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Teekay Corporation

Appendix C - Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA

(in thousands of U.S. dollars)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, | December 31, | March 31, |

| | | 2024 | 2023 | 2023 |

| | (unaudited) | (unaudited) | (unaudited) |

| Net income | 147,763 | 114,977 | 169,913 |

| Depreciation and amortization | 23,318 | 24,627 | 23,975 |

| Net interest (income) expense | (4,138) | (2,907) | 5,789 |

| Income tax (recovery) expense | (2,847) | 2,579 | 2,601 |

| EBITDA | 164,096 | 139,276 | 202,278 |

| Specific income statement items affecting EBITDA: | | | |

| Gain on sale of assets | (11,601) | (10,360) | — |

| Realized gains from interest rate swaps | — | — | (496) |

| Unrealized losses from derivative instruments | — | — | 584 |

| Equity income | (1,368) | (516) | (1,130) |

| | | | |

| Other - net | 1,068 | (1,166) | 2,566 |

| Adjusted EBITDA | 152,195 | 127,234 | 203,802 |

12

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. All statements included in this release, other than statements of historical fact, are forward-looking statements. When used in this release, the words “expect,” “believe,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will” or similar words are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only as of the date hereof and are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Forward-looking statements contained in this release include, among others, statements regarding: the timing of payments of cash dividends by Teekay Tankers; management's expectations regarding the spot tanker market and rates and the Teekay Group's ability to benefit from strong tanker market fundamentals; and the estimates and anticipated payment schedule of Teekay Parent's remaining FPSO decommissioning and recycling costs.

The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: payment by Teekay Tankers of its declared cash dividends; changes in tanker market fundamentals or spot rates; and any unexpected complications or delays in fulfilling Teekay Parent's remaining FPSO decommissioning and recycling obligations; and other factors discussed in Teekay’s filings from time to time with the SEC, including its Annual Report on Form 20-F for the fiscal year ended December 31, 2023. Teekay expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Teekay’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

13

Teekay Corporation Investor Relations Tel: +1 604 609 2963 www.teekay.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

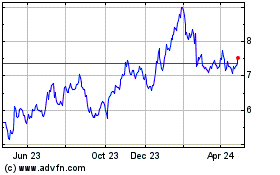

Teekay (NYSE:TK)

Historical Stock Chart

From Apr 2024 to May 2024

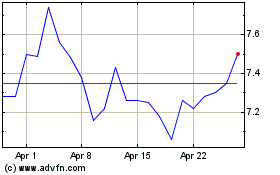

Teekay (NYSE:TK)

Historical Stock Chart

From May 2023 to May 2024