Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 13 2024 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | |

| | |

Filed by the Registrant ☒ | | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☐ | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

Squarespace, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

This Schedule 14A relates solely to preliminary communications made prior to furnishing security holders of Squarespace, Inc. (the “Company”) with a definitive proxy statement and a transaction statement on Schedule 13E-3 related to a proposed transaction in which Spaceship Group MergerCo, Inc. (“Merger Sub”), a wholly owned subsidiary of Spaceship Purchaser, Inc., an affiliate of Permira Advisers (“Parent”), will be merged with and into the Company, with the Company being the surviving corporation (the “Transaction”), upon the terms and subject to the conditions set forth in the Agreement and Plan of Merger, dated May 13, 2024, among the Company, Parent and Merger Sub.

This Schedule 14A filing consists of the following documents relating to the Proposed Transaction:

| | | | | | | | | | | |

| | • | | Squarespace Announces $6.9B Go-Private Transaction with Permira. |

* * *

Squarespace Announces $6.9B Go-Private Transaction with Permira.

Team -

I’m writing to share exciting news. This morning, we announced that Squarespace has entered into a definitive agreement to go private in an all-cash transaction valued at approximately $6.9 billion based on a share price of $44 per share. The firm leading this transaction is Permira, a respected global private equity firm that has a substantial portfolio of growth technology companies. They’ve backed many software and e-commerce companies you may be familiar with, including Zendesk, Klarna, Carta, LegalZoom, Magento, and The Knot. General Atlantic, Accel and I are also major investors in the go-private transaction, and I am excited to welcome our new partner, and to continue working with our existing ones, as we move forward.

Permira, which has a track record of backing growth at internet, e-commerce and payments software companies, recognized the opportunity we have in front of us and is investing at a price that provides shareholders a meaningful premium. This transaction represents a belief in the future of Squarespace – and also recognition that, while we are performing well, we feel that we continue to be undervalued in the public market. We have an exciting story to play out with respect to our shift to our commerce products, and we will be able to do that more easily in a private setting.

This transaction does not change the day-to-day management of Squarespace – I will continue to lead the Company as CEO and the leadership team will remain in place. It will be business as usual for our day-to-day operations. We will continue to pursue the same narrative that we have done over the past 3 years while public – profitable growth at scale. It is this narrative that I, alongside our new and existing investors, continue to believe is the right one for us moving forward.

It is a remarkable achievement to have General Atlantic, Accel and Permira - all world class tech investors - willing to pay a meaningful premium on market price and do so on the thesis that our existing team and operating model will deliver a strong return on investment in the future. Accel and General Atlantic are our longest term shareholders, and they continue to believe, even after each being investors for over a decade, there is a meaningful upside opportunity if we continue to execute on our plan.

For employees, after closing, vested equity awards will be converted into cash awards based on the deal price at $44 and unvested equity awards will be paid out in cash in accordance with your existing vesting schedule, subject to continued employment on the applicable vesting dates. In addition, we will adopt a new long-term incentive compensation plan after closing to align employees with our shared goal of achieving a multiple of our existing value over the coming years. It is our intent that this program – should we reach our goals – will provide a premium above what would have been reached if we stayed public. Details of this program will be shared as we get closer to closing.

We will hold a virtual all hands meeting in a few hours to answer questions. A calendar invite will follow this email. While there may be questions that we cannot answer right away, we will share what we can at this time. Until we close the deal, which we expect to do by the fourth quarter of 2024, Squarespace will remain a publicly-traded company.

Outside parties may inquire about the transaction. If anyone reaches out to you with questions, please refer them to [***].

Thank you for your continued dedication and for the work you all do on behalf of our customers every day. I couldn’t be more excited about the future of Squarespace and am looking forward to our next milestones.

Anthony

Cautionary Statement Regarding Forward-Looking Statements

This Schedule 14A includes certain “forward-looking statements” within the meaning of, and subject to the safe harbor created by, the federal securities laws, including statements related to the proposed merger of the Company with an affiliate of Permira Advisers (the “Transaction”), including financial estimates and statements as to the expected timing, completion and effects of the Transaction. These forward-looking statements are based on the Company’s current expectations, estimates and projections regarding, among other things, the expected date of closing of the Transaction and the potential benefits thereof, its business and industry, management’s beliefs and certain assumptions made by the Company, all of which are subject to change. Forward-looking statements often contain words such as “expect,” “anticipate,” “intend,” “aims,” “plan,” “believe,” “could,” “seek,” “see,” “will,” “may,” “would,” “might,” “considered,” “potential,” “estimate,” “continue,” “likely,” “expect,” “target” or similar expressions or the negatives of these words or other comparable terminology that convey uncertainty of future events or outcomes. By their nature, forward-looking statements address matters that involve risks and uncertainties because they relate to events and depend upon future circumstances that may or may not occur, such as the consummation of the Transaction and the anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the completion of the Transaction on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, and the satisfaction of other conditions to the completion of the Transaction; (ii) the ability of affiliates of Permira to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the Transaction; (iii) potential litigation relating to the Transaction that could be instituted against Permira, the Company or their respective directors, managers or officers, including the effects of any outcomes related thereto; (iv) the risk that disruptions from the Transaction will harm the Company’s business, including current plans and operations; (v) the ability of the Company to retain and hire key personnel; (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transaction; (vii) continued availability of capital and financing and rating agency actions; (viii) legislative, regulatory and economic developments affecting the Company’s business; (ix) general economic and market developments and conditions; (x) potential business uncertainty, including changes to existing business relationships, during the pendency of the Transaction that could affect the Company’s financial performance; (xi) certain restrictions during the pendency of the Transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; (xii) unpredictability and severity of catastrophic events, including but not limited to acts of terrorism, pandemics, outbreaks of war or hostilities, as well as the Company’s response to any of the aforementioned factors; (xiii) significant transaction costs associated with the Transaction; (xiv) the possibility that the Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (xv) the occurrence of any event, change or other circumstance that could give rise to the termination of the Transaction, including in circumstances requiring the Company to pay a termination fee or other expenses; (xvi) competitive responses to the Transaction; (xvii) the risks and uncertainties pertaining to the Company’s business, including those set forth in Part I, Item 1A of the Company’s most recent Annual Report on Form 10-K and Part II, Item 1A of the Company’s subsequent Quarterly Reports on Form 10-Q, as such risk factors may be amended, supplemented or superseded from time to time by other reports filed by the Company with the SEC; and (xviii) the risks and uncertainties that

will be described in the Proxy Statement available from the sources indicated below. These risks, as well as other risks associated with the Transaction, will be more fully discussed in the Proxy Statement. While the list of factors presented here is, and the list of factors to be presented in the Proxy Statement will be, considered representative, no such list should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material impact on the Company’s financial condition, results of operations, credit rating or liquidity. These forward-looking statements speak only as of the date they are made, and the Company does not undertake to and specifically disclaims any obligation to publicly release the results of any updates or revisions to these forward-looking statements that may be made to reflect future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Important Additional Information and Where to Find It

In connection with the Transaction, the Company will file with the SEC a Proxy Statement on Schedule 14A (the “Proxy Statement”), the definitive version of which will be sent or provided to Company stockholders. The Company and affiliates of the Company intend to jointly file a transaction statement on Schedule 13E-3 (the “Schedule 13E-3”). The Company may also file other documents with the SEC regarding the Transaction. This Schedule 14A is not a substitute for the Proxy Statement, the Schedule 13E-3 or any other document which the Company may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, THE SCHEDULE 13E-3 AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement, Schedule 13E-3 and other documents (when they become available) that are filed or will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov, the Company’s website at https://investors.squarespace.com or by contacting the Company’s Investor Relations Team at investors@squarespace.com.

The Transaction will be implemented solely pursuant to the Merger Agreement dated as of May 13, 2024, among the Company, Parent, and Merger Sub, which contains the full terms and conditions of the Transaction.

Participants in the Solicitation

The Company, its directors and officers and other employees may be deemed to be participants in the solicitation of proxies from the Company's stockholders in connection with the Transaction, including, but not limited to, Andrew Braccia, Michael Fleisher, Jonathan Klein, Liza Landsman, Anton Levy, Neela Montgomery and Anthony Casalena. Additional information regarding the identity of the participants, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement and other materials to be filed with the SEC in connection with the Transaction (if and when they become available). Information relating to the foregoing can also be found in the "Compensation Discussion & Analysis," "Security Ownership of Certain Beneficial Owners and Management" and "Proposal 1 - Election of Directors" sections in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 22, 2024 (the “Annual Meeting Proxy Statement”). To the extent holdings of securities by potential participants (or the identity of such participants) have changed since the information printed in the Annual Meeting Proxy Statement, such information has been or will be reflected on the Company’s Statements of Change in Ownership on Forms 3 and 4 filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

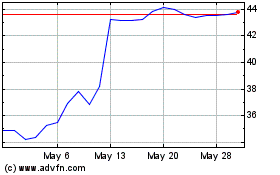

Squarespace (NYSE:SQSP)

Historical Stock Chart

From Apr 2024 to May 2024

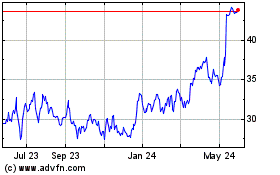

Squarespace (NYSE:SQSP)

Historical Stock Chart

From May 2023 to May 2024