Smith International, Inc. (NYSE: SII) announced second quarter

income from continuing operations of $71.7 million, or $0.29 per

diluted share, excluding net after-tax charges. Reported net income

for the second quarter of 2010 was $65.1 million, or $0.26 cents

per diluted share, on revenues of $2.30 billion. The impact of

current quarter charges for transaction costs associated with the

proposed merger with Schlumberger and Venezuela currency-related

losses were partially offset by a remeasurement gain reported in

connection with the purchase of the remaining 65 percent interest

in @Balance B.V.

On a comparable basis, second quarter 2010 earnings from

continuing operations were more than double those of the second

quarter of 2009, which totaled $32.1 million on revenues of $1.94

billion. Sequential quarter earnings from continuing operations,

net of charges, increased 54 percent as compared to the $46.5

million on revenues of $2.14 billion reported for the first quarter

of 2010.

The Company’s financial performance in the second quarter of

2010 was favorably influenced by the continued expansion of U.S.

land drilling activity, which more than offset the impact of the

seasonal drilling downturn in Canada.

Consolidated revenues rose 7 percent on a sequential-quarter

basis and 18 percent from the comparable prior-year quarter. The

increase over the prior period was concentrated in the U.S. market

where revenues increased 19 percent as compared to the average M-I

SWACO rig count which rose 12 percent. Outside the United States,

significant growth reported in the Middle East/Asia region was

offset by the impact of the seasonal spring break up on Canadian

drilling activity and a moderate decrease in Latin America.

M-I SWACO segment revenues were $1.16 billion for the second

quarter of 2010, a 4 percent increase on a sequential basis and 14

percent above the prior-year period. The revenue growth was

concentrated in the Eastern Hemisphere, principally in Vietnam,

Indonesia, Malaysia and Kuwait. The impact of a 21 percent

sequential increase in land-based revenue in the United States was

partially offset by the seasonal decline in Canada, lower customer

spending in Latin America, and the impact of the deepwater drilling

moratorium in the Gulf of Mexico announced in May 2010.

Smith Oilfield segment revenue was $650.2 million for the three

months ended June 30, 2010, 13 percent higher on a

sequential-quarter basis and 25 percent above that reported in the

prior-year quarter. The majority of the increase was derived from

the United States where revenue grew by 24 percent sequentially and

29 percent as compared to the second quarter in the prior year. The

increase was across all product offerings and was particularly

strong in land-based activity. In addition, sequential quarter

revenue growth was reported in all other geographic areas except

for Canada, which fell due to the seasonal break-up period. Eastern

Hemisphere sales volumes were favorably affected by a higher demand

for drilling-related products and services as well as drill bit

tender deliveries with particularly strong performance in the North

Sea, Iraq and West Africa.

The Distribution segment’s second quarter revenues were $490.3

million, 9 percent above the March 2010 quarter and 19 percent

higher on a year-on-year basis. Project spending in the United

States for line pipe rose over 50 percent from the prior quarter

and, together with higher energy sector volumes, more than offset

the impact of lower seasonal activity levels from the Canadian

operations.

Improved profitability and continued focus on working capital

investment allowed the Company to generate $169.1 million in cash

flows from operations during the June 2010 quarter, while

continuing to moderately decrease its total debt. During the three

months ended June 30, 2010, the Company used cash flows from

operating activities together with $50.1 million of cash on-hand to

fund $112.0 million of net capital expenditures, $75.1 million in

acquisition-related investments and $29.8 million in dividends to

stockholders.

As indicated in the prior quarter and in response to a

continuing favorable industry environment, the Company has

increased its expected capital investment for the year, estimating

spending to range from $420 million to $450 million. The Company

stated that further capital expenditure increases throughout the

year are possible and would be implemented in accordance with the

terms of the merger agreement between the Company and Schlumberger

Limited.

The Company’s revenue attributable to the U.S. Gulf of Mexico

represented approximately 6 percent of its consolidated revenue for

the year ended December 31, 2009. The majority of revenues derived

from drilling operations are generally high-performance services

and products deployed in deepwater operations and, as such, the

Company continues to redeploy personnel and assets as appropriate

to minimize the near-term impact of the moratorium on its operating

results. For the third quarter of 2010, the Company expects a $0.04

to $0.06 per share unfavorable impact on earnings due to the

current drilling moratorium. At this time, Smith cannot predict

what further impact the Deepwater Horizon incident may have on the

regulation of offshore oil and gas exploration and development

activity, the cost or availability of insurance coverage to cover

the risks of such operations, or what actions may be taken by

customers of the Company or other industry participants in response

to the incident. Increased costs for the operations of the

Company’s customers in the U.S. Gulf of Mexico, along with

permitting delays, could affect the economics of currently planned

activity in the area and demand for their services. A prolonged

suspension of drilling activity in the U.S. Gulf of Mexico and

resulting new regulations could materially adversely affect the

Company's financial condition, results of operations or cash

flows.

As previously announced by the parties, the U.S. Department of

Justice and the European Commission have both cleared the proposed

merger of Smith and Schlumberger Limited without any conditions.

The closing of the proposed merger remains subject to approval by

Smith stockholders and the satisfaction or waiver of the other

closing conditions contained in the merger agreement between the

companies. The 2010 annual meeting of stockholders of Smith is

scheduled for August 24, 2010, at which meeting stockholders of

Smith will consider and vote upon matters including the proposed

adoption of the agreement and plan of merger between Smith and

Schlumberger. Subject to receipt of approval from Smith

stockholders, Schlumberger and Smith expect to close the merger on

August 27, 2010.

Smith International, Inc. is a leading supplier of premium

products and services to the oil and gas exploration and production

industry. The Company employs over 23,000 full-time personnel and

operates in over 80 countries around the world.

Certain comments contained in this news release concerning among

other things, the Company’s outlook, financial projections and

business strategies constitute “forward-looking statements” within

the meaning of the federal securities laws. Whenever possible, the

Company has identified these forward-looking statements by words

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“project,” “should” and similar terms. The forward-looking

statements are based upon management’s current expectations and

beliefs and, although these statements are based upon reasonable

assumptions, actual results might differ materially from expected

results due to a variety of risk factors including, but not limited

to, satisfaction of the closing conditions to the merger between

the Company and Schlumberger, the risk that the contemplated merger

does not occur, negative effects from the pendency of the merger,

the ability to successfully integrate the merged businesses and to

realize expected synergies, the risk that we will not be able to

retain key employees, expenses of the merger, overall demand for

and pricing of the Company’s products and services, general

economic and business conditions, the level of oil and natural gas

exploration and development activities, our global operations and

global economic conditions and activity, political stability of

oil-producing countries, finding and development costs of

operations, decline and depletion rates for oil and natural gas

wells, effects of changes in laws or regulations, including the

suspensions and potential drilling moratoriums in the Gulf of

Mexico, seasonal weather conditions, industry conditions, including

IP infringement litigation, and changes in and the costs of

compliance with laws or regulations, many of which are beyond the

control of the Company and other risks and uncertainties detailed

in our most recent form 10-K and other filings that the Company

makes with the Securities and Exchange Commission. The Company

assumes no obligation to update publicly any forward-looking

statements whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures. The Company reports its financial

results in accordance with generally accepted accounting principles

(“GAAP”). However, management believes that certain non-GAAP

performance measures and ratios utilized for internal analysis

provide financial statement users meaningful comparisons between

current and prior period results, as well as important information

regarding performance trends. Certain information discussed in this

press release could be considered non-GAAP measures. See the

Supplementary Data – Schedule III in this release for the

corresponding reconciliations to GAAP financial measures for the

three-month periods ended June 30, 2010 and 2009 and March 31,

2010, and the six-month periods ended June 30, 2010 and 2009.

Non-GAAP financial measures should be viewed in addition to, and

not as an alternative for, the Company's reported results.

Financial highlights follow:

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended June 30, March 31, 2010

2009 2010

Revenue

$

2,296,063

$

1,944,289

$

2,137,811

Costs and expenses: Costs of revenue 1,637,394

1,415,259 1,546,631 Selling, general and administrative expenses

467,216 395,726

466,301

Total costs and expenses

2,104,610

1,810,985

2,012,932

Operating income 191,453 133,304 124,879

Interest expense 36,917 42,803 37,722 Interest income (890 )

(729 ) (678 )

Income before income taxes and

noncontrolling

interests

155,426

91,230

87,835

Income tax provision 50,229

27,957 41,239 Net income 105,197

63,273 46,596

Noncontrolling interests in net

income

of subsidiaries

40,123

38,887

35,055

Net income attributable to

Smith

$

65,074

$

24,386

$

11,541

Earnings per share attributable to Smith: Basic $

0.26 $ 0.11 $ 0.05 Diluted $

0.26 $ 0.11 $ 0.05

Weighted average shares outstanding: Basic 248,539

219,307 248,360 Diluted

250,333 220,245

249,761

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Six Months Ended June 30, 2010 2009

Revenues

$

4,433,874

$

4,355,768

Costs and expenses: Costs of revenues 3,184,025

3,134,436 Selling, general and administrative expenses

933,517 846,350

Total costs and expenses

4,117,542

3,980,786

Operating income 316,332 374,982 Interest

expense 74,639 70,327 Interest income (1,568 )

(1,087 )

Income before income taxes and

noncontrolling

interests

243,261

305,742

Income tax provision 91,468

98,275 Net income 151,793 207,467

Noncontrolling interests in net

income

of subsidiaries

75,178

86,146

Net income attributable to

Smith

$

76,615

$

121,321

Earnings per share attributable to Smith: Basic $

0.31 $ 0.55 Diluted $ 0.31 $

0.55 Weighted average shares outstanding: Basic

248,450 219,254 Diluted

250,059 219,925

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30,

2010

December 31,

2009

Current Assets: Cash and cash equivalents $ 497,660 $

988,346 Receivables, net 1,930,784 1,791,498 Inventories, net

1,880,623 1,820,355 Other current assets

254,609 215,037 Total current assets

4,563,676 4,815,236 Property, Plant and

Equipment, net 1,972,242 1,923,465 Goodwill and Other Assets

4,044,813 4,000,714 Total assets

$ 10,580,731 $ 10,739,415

Current Liabilities: Short-term borrowings $ 316,549 $ 358,768

Accounts payable 693,556 589,748 Other current liabilities

541,951 462,273 Total current

liabilities 1,552,056 1,410,789

Long-Term Debt 1,481,927 1,814,254 Other Long-Term

Liabilities 655,045 684,442 Stockholders’ Equity

6,891,703 6,829,930 Total liabilities

and stockholders’ equity $ 10,580,731 $

10,739,415

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

I

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended June 30, March

31, June 30, 2010 2009 2010

2010 2009

REVENUE DATA Consolidated: United States $

995,703 $ 772,535 $ 838,432 $ 1,834,135 $ 1,862,075 Canada

177,344 133,612 227,713

405,057 325,896

North America 1,173,047 906,147

1,066,145 2,239,192

2,187,971 Latin America 261,762 227,499

270,809 532,571 503,606 Europe/Africa 558,782 510,689 541,454

1,100,236 1,050,504 Middle East/Asia 302,472

299,954 259,403

561,875 613,687 Non-North America

1,123,016 1,038,142

1,071,666 2,194,682

2,167,797

Total $ 2,296,063 $ 1,944,289 $

2,137,811 $ 4,433,874 $ 4,355,768

Non-Distribution:

North America $ 703,110 $ 518,725

$ 634,694 $ 1,337,804 $

1,254,959 Latin America 259,090 223,820 267,170

526,260 494,385 Europe/Africa 548,444 498,734 530,835 1,079,279

1,027,462 Middle East/Asia 295,107

292,204 253,322 548,429

598,414 Non-North America

1,102,641 1,014,758

1,051,327 2,153,968

2,120,261

Total $

1,805,751 $ 1,533,483 $ 1,686,021

$ 3,491,772 $ 3,375,220

SEGMENT DATA Revenues: M-I SWACO $ 1,155,600 $

1,013,016 $ 1,111,190 $ 2,266,790 $ 2,172,353 Smith Oilfield

650,151 520,467 574,831

1,224,982 1,202,867

Subtotal

1,805,751 1,533,483

1,686,021 3,491,772

3,375,220

Distribution 490,312 410,806

451,790 942,102

980,548

Total $ 2,296,063 $ 1,944,289 $

2,137,811 $ 4,433,874 $ 4,355,768

Operating Income: M-I SWACO $ 132,589 $

121,325 $ 120,404 $ 252,993 $ 268,833 Smith Oilfield 80,987

47,622 56,548

137,535 153,387

Subtotal 213,576

168,947 176,952

390,528 422,220

Distribution 13,599

(9,799 ) 4,702

18,301 5,722

General corporate (35,722 )

(25,844 ) (56,775 ) (92,497 )

(52,960 )

Total $ 191,453 $

133,304 $ 124,879 $ 316,332

$ 374,982

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

II

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended June 30, March

31, June 30, 2010 2009 2010 2010

2009

OTHER DATA(a) Operating

Income: Smith ownership interest $ 139,904 $ 85,825 $ 76,718 $

216,622 $ 266,089

Noncontrolling ownership

interest

51,549 47,479 48,161

99,710 108,893 Total $ 191,453 $

133,304 $ 124,879 $ 316,332 $ 374,982

Depreciation and Amortization: Smith ownership interest $

82,121 $ 78,596 $ 79,790 $ 161,911 $ 157,030 Noncontrolling

ownership interest 14,305 13,116

14,294 28,599 25,777 Total $ 96,426

$ 91,712 $ 94,084 $ 190,510 $ 182,807

Gross Capital Spending:

Smith ownership interest

$ 119,361 $ 62,542 $ 85,333 $ 204,694 $ 148,304 Noncontrolling

ownership interest 15,960 10,087

10,847 26,807 21,426 Total $ 135,321

$ 72,629 $ 96,180 $ 231,501 $ 169,730

Net Capital Spending (b): Smith

ownership interest $ 98,475 $ 47,020 $ 73,033 $ 171,508 $ 111,449

Noncontrolling ownership interest 13,505 9,305

9,809 23,314 19,580 Total

$ 111,980 $ 56,325 $ 82,842 $ 194,822 $

131,029

NOTE (a): The Company

derives a significant portion of its revenues and earnings from M-I

SWACO and other majority-owned operations. Consolidated operating

income, depreciation and amortization and capital spending amounts

have been separated between the Company’s portion and the

noncontrolling interests’ portion in order to aid in analyzing the

Company’s financial results.

NOTE (b): Net

capital spending reflects the impact of proceeds from lost-in-hole

and fixed asset equipment sales.

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

III

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share

data)

(Unaudited)

Three Months Ended Six Months Ended June 30, March

31, June 30, 2010 2009 2010 2010

2009

Operating Income : GAAP

Consolidated Basis $ 191,453 $ 133,304 $ 124,879 $ 316,332 $

374,982

Adjustments for Charges (Gains): M-I SWACO

8,058 2,983 12,809 20,867 22,284 Smith Oilfield - 8,593 - -

20,952 Distribution - 1,265 - - 1,916 General

Corporate 6,746 160 26,722 33,468 2,641

Non-GAAP Consolidated Basis $ 206,257

$ 146,305 $ 164,410 $ 370,667 $

422,775

Net

Income Attributable to Smith : GAAP Consolidated Basis $

65,074 $ 24,386 $ 11,541 $ 76,615 $ 121,321

Adjustments

for Charges (Gains): Transaction-related costs 17,661 - 15,298

32,959 - Venezuelan currency-related losses 6,340 - 19,709

26,049 - Gain on @Balance B.V. transaction (17,384 ) - -

(17,384 ) - Severance and restructuring costs - 7,677 - -

23,662

Market-to-market charge on

interest rate contract

-

-

-

-

1,612

Non-GAAP Consolidated

Basis $ 71,691 $ 32,063 $ 46,548 $

118,239 $ 146,595

Diluted Earnings per Share : GAAP

Consolidated Basis $ 0.26 $ 0.11 $ 0.05 $ 0.31 $ 0.55

Adjustments for Charges (Gains): M-I SWACO 0.02 0.01 0.04

0.06 0.04 Smith Oilfield - 0.03 - - 0.06 Distribution

- - - - 0.01 General Corporate 0.01 - 0.10 0.11 0.01

Non-GAAP Consolidated

Basis $ 0.29 $ 0.15

$ 0.19 $ 0.48

$ 0.67

NOTE: Management believes

that it is important to highlight certain charges and gains

included within operating income to assist financial statement

users with comparisons between current and prior periods. For the

three-month periods ended June 30, 2010 and March 31, 2010, the

Company incurred $23.0 million and $15.4 million, respectively, in

expenses associated with the proposed combination of the Company

and Schlumberger and $0.7 million and $1.1 million, respectively,

in other business combination related charges. During second

quarter 2010, the Venezuelan government modified its practices with

respect to certain U.S. dollar based billings indicating it would

settle such commitments at 2.6 rather than 4.3 Venezuelan Bolivar

Fuertes per U.S. dollar. This change reduced the U.S. dollar value

of receivables outstanding as of March 31, 2010, resulting in a

pre-tax loss of $11.9 million in the second quarter of 2010. In the

first quarter of 2010, the Company incurred $23.0 million in

charges associated with the revaluation of its Venezuelan Bolivar

Fuertes denominated net asset position. The Company recognized a

pre-tax gain of $20.8 million in the second quarter of 2010, as a

result of remeasuring its previously held equity interest in

@Balance. Amounts reported in the 2009 periods relate primarily to

employee severance associated with the reduction in U.S. personnel

levels.

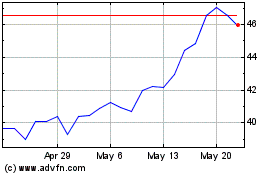

Sprott (NYSE:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024