Smith International, Inc. (NYSE: SII) today announced first

quarter income from continuing operations of $46.5 million, or

$0.19 per diluted share, excluding pre-tax charges of $23.0 million

and $16.5 million related to the Venezuelan currency devaluation

and transaction related costs, respectively. Reported net income

for the first quarter was $11.5 million, or $0.05 per diluted

share, on revenue of $2.14 billion. On a comparative basis, first

quarter 2009 earnings from continuing operations, after excluding

charges, were $114.5 million, or $0.52 per diluted share, on

revenue of $2.41 billion, while in the fourth quarter of 2009,

earnings from continuing operations were $20.1 million, or

$0.09 per diluted share, on revenue of $1.98 billion.

Increased drilling activity in the North American market was the

primary driver of the improved results and was broad-based,

resulting in revenue increases in nearly all of the Company’s lines

of business. Smith’s oilfield-related businesses contributed a 22%

sequential improvement in North America revenue. M-I SWACO gained

23% while Smith Oilfield improved by 21% sequentially. Driving the

quarterly revenue gains in Smith Oilfield segment were drill bits

and motors, as well as higher revenue from the cased-hole wireline

and borehole enlargement services. The Distribution segment

contributed significantly to the sequential improvement in both

revenue and operating income as it continues to experience higher

volume in its energy sector operations and better margins in part

reflecting more favorable LIFO inventory cost impact.

Consolidated revenue increased $154.0 million, or 8 percent,

from the fourth quarter of 2009, while the M-I SWACO worldwide rig

count increased by 10%. Nearly all of the sequential revenue

increase was generated in North America, influenced by a higher

level of onshore drilling and completion activity. Outside of North

America, revenue was in line with the December 2009 quarter

compared to a 2% sequential increase in rig activity.

Inventory balances were relatively unchanged as compared to the

prior quarter reflecting increased inventories in M-I SWACO offset

by reductions in Distribution. Receivables increased by

approximately $126.5 million owing to the higher activity and

revenue level. The Company generated $53.0 million of operating

cash flow in the first quarter as compared to $367.2 million in the

prior quarter.

The Company deployed $370.1 million of cash during the quarter

to reduce debt and $29.8 million to pay dividends. An additional

$82.8 million and $8.8 million were invested in the Company for net

capital expenditures and acquisitions during the quarter,

respectively. Total debt was reduced during the quarter to

$1.8 billion.

As a result of the more favorable industry environment, the

Company has increased its capital expenditure expectation for the

year by approximately 15%. The Company indicated that further

capital expenditure increases throughout the year are likely and

will be implemented in accordance with the terms of the merger

agreement between the Company and Schlumberger.

Smith International, Inc. is a leading supplier of premium

products and services to the oil and gas exploration and production

industry. The Company employs over 22,000 full-time personnel and

operates in over 80 countries around the world.

Certain comments contained in this news release concerning among

other things, the Company’s outlook, financial projections and

business strategies constitute “forward-looking statements” within

the meaning of the federal securities laws. Whenever possible, the

Company has identified these forward-looking statements by words

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“project,” “should” and similar terms. The forward-looking

statements are based upon management’s current expectations and

beliefs and, although these statements are based upon reasonable

assumptions, actual results might differ materially from expected

results due to a variety of risk factors including, but not limited

to, satisfaction of the closing conditions to the merger between

the Company and Schlumberger, the risk that the contemplated merger

does not occur, negative effects from the pendency of the merger,

the ability to successfully integrate the merged businesses and to

realize expected synergies, the risk that we will not be able to

retain key employees, expenses of the merger, overall demand for

and pricing of the Company’s products and services, general

economic and business conditions, the level of oil and natural gas

exploration and development activities, our global operations and

global economic conditions and activity, political stability of

oil-producing countries, finding and development costs of

operations, decline and depletion rates for oil and natural gas

wells, seasonal weather conditions, industry conditions, including

IP infringement litigation, and changes in and the costs of

compliance with laws or regulations, many of which are beyond the

control of the Company and other risks and uncertainties detailed

in our most recent form 10-K and other filings that the Company

makes with the Securities and Exchange Commission. The Company

assumes no obligation to update publicly any forward-looking

statements whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures. The Company reports its financial

results in accordance with generally accepted accounting principles

(“GAAP”). However, management believes that certain non-GAAP

performance measures and ratios utilized for internal analysis

provide financial statement users meaningful comparisons between

current and prior period results, as well as important information

regarding performance trends. Certain information discussed in this

press release could be considered non-GAAP measures. See the

Supplementary Data – Schedule III in this release for the

corresponding reconciliations to GAAP financial measures for the

three-month periods ended March 31, 2010 and 2009 and December 31,

2009. Non-GAAP financial measures should be viewed in addition to,

and not as an alternative for, the Company's reported results.

Financial highlights follow:

SMITH

INTERNATIONAL, INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended March 31, December 31, 2010

2009 2009

Revenue

$

2,137,811

$

2,411,479

$

1,983,767

Costs and expenses: Costs of revenue 1,546,631

1,719,177 1,454,759 Selling, general and administrative expenses

466,301 450,624

406,206

Total costs and expenses

2,012,932

2,169,801

1,860,965

Operating income 124,879 241,678 122,802

Interest expense 37,722 27,524 39,471 Interest income

(678 ) (358 ) (842 )

Income before income taxes and

noncontrolling interests

87,835

214,512

84,173

Income tax provision 41,239

70,318 23,157 Net income

46,596 144,194 61,016

Noncontrolling interests in net

income of subsidiaries

35,055

47,259

40,903

Net income attributable to

Smith

$

11,541

$

96,935

$

20,113

Earnings per share attributable to Smith: Basic

$ 0.05 $ 0.44 $ 0.09

Diluted $ 0.05 $ 0.44 $ 0.09

Weighted average shares outstanding:

Basic

248,360 219,301

231,500 Diluted 249,761

219,603 232,763

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(In thousands)

(Unaudited)

March 31,

2010

December 31,

2009

Current Assets: Cash and cash equivalents $ 547,775 $

988,346 Receivables, net 1,917,994 1,791,498 Inventories, net

1,823,950 1,820,355 Other current assets

216,440

215,037 Total current assets

4,506,159

4,815,236 Property, Plant and Equipment, net 1,921,950

1,923,465 Goodwill and Other Assets

3,974,603

4,000,714 Total assets

$ 10,402,712 $ 10,739,415

Current Liabilities: Short-term borrowings $ 486,360 $

358,768 Accounts payable 666,422 589,748 Other current liabilities

442,140

462,273 Total current liabilities

1,594,922

1,410,789 Long-Term Debt

1,316,589 1,814,254 Other Long-Term Liabilities 658,472

684,442 Stockholders’ Equity

6,832,729

6,829,930 Total liabilities and stockholders’ equity

$ 10,402,712

$ 10,739,415

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

I

(In thousands)

(Unaudited)

Three Months Ended March 31, December 31,

2010 2009

2009

REVENUE DATA

Consolidated: United States $ 838,432 $ 1,089,540 $ 743,802

Canada

227,713

192,284

167,197 North America

1,066,145

1,281,824 910,999

Latin America 270,809 276,107 267,825 Europe/Africa

541,454 539,815 533,672 Middle East/Asia

259,403 313,733

271,271

Non-North America

1,071,666

1,129,655

1,072,768

Total

$ 2,137,811

$ 2,411,479

$ 1,983,767

Non-Distribution:

North America

$ 634,694

$ 736,234 $

520,703 Latin America 267,170 270,565 262,925

Europe/Africa 530,835 528,728 525,721 Middle East/Asia

253,322

306,210

264,333 Non-North America

1,051,327

1,105,503

1,052,979

Total

$ 1,686,021

$ 1,841,737

$ 1,573,682

SEGMENT

DATA Revenue: M-I SWACO $ 1,111,190 $ 1,159,337 $

1,057,353 Smith Oilfield

574,831

682,400

516,329

Subtotal

1,686,021

1,841,737

1,573,682

Distribution

451,790

569,742

410,085

Total

$ 2,137,811

$ 2,411,479 $

1,983,767

Operating Income: M-I SWACO $

120,404 $ 147,508 $ 129,205 Smith Oilfield

56,548 105,765

39,058

Subtotal

176,952

253,273

168,263

Distribution

4,702

15,521

(18,729 )

General corporate

(56,775 )

(27,116 )

(26,732 )

Total

$ 124,879

$ 241,678

$ 122,802

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

II

(In thousands)

(Unaudited)

Three Months Ended March 31, December 31,

2010

2009 2009

OTHER

DATA(a) Operating Income: Smith ownership

interest $ 76,718 $ 180,264 $ 72,723 Noncontrolling ownership

interest 48,161

61,414

50,079 Total

$ 124,879 $ 241,678

$ 122,802

Depreciation

and Amortization: Smith ownership interest $ 79,790 $ 78,434 $

78,230 Noncontrolling ownership interest

14,294

12,661 13,522

Total $ 94,084

$ 91,095 $

91,752

Gross Capital Spending: Smith ownership

interest $ 85,333 $ 85,762 $ 99,054 Noncontrolling ownership

interest 10,847

11,339

16,906 Total

$ 96,180 $ 97,101

$ 115,960

Net Capital

Spending (b): Smith ownership interest $ 73,033 $

64,429 $ 80,661 Noncontrolling ownership interest

9,809

10,275

12,565 Total $ 82,842

$ 74,704

$ 93,226

NOTE (a): The Company

derives a significant portion of its revenue and earnings from M-I

SWACO and other majority-owned operations. Consolidated operating

income, depreciation and amortization and capital spending amounts

have been separated between the Company’s portion and the

noncontrolling interests’ portion in order to aid in analyzing the

Company’s financial results.

NOTE (b): Net

capital spending reflects the impact of proceeds from lost-in-hole

and fixed asset equipment sales.

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

III

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share

data)

(Unaudited)

Three Months Ended March 31, December 31,

2010 2009 2009

Operating Income:

GAAP Consolidated Basis $ 124,879 $ 241,678 $ 122,802

Add Back Charges: M-I SWACO 12,809 19,301 - Smith

Oilfield - 12,359 - Distribution - 651 - General

Corporate 26,722 2,481 -

Non-GAAP Consolidated

Basis $ 164,410 $

276,470 $ 122,802

Net Income Attributable to

Smith:

GAAP Consolidated Basis $ 11,541 $ 96,935 $ 20,113

Add Back Charges: Venezuelan currency devaluation 19,709 - -

Transaction-related costs 15,298 - -

Severance-related and facility

closure costs

-

15,985

-

Derivative contract-related loss - 1,612 -

Non-GAAP Consolidated Basis

$ 46,548 $ 114,532 $ 20,113

Diluted Earnings per

Share:

GAAP Consolidated Basis $ 0.05 $ 0.44 $ 0.09

Add

Back Charges: M-I SWACO 0.04 0.03 - Smith Oilfield -

0.04 - Distribution - - - General Corporate 0.10 0.01

-

Non-GAAP Consolidated Basis

$ 0.19 $ 0.52 $

0.09

NOTE: Management believes

that it is important to highlight certain charges included within

operating income to assist financial statement users with

comparisons between current and prior periods. During the

three-month period ended March 31, 2010, the Company incurred a

$23.0 million charge associated with the revaluation of its

Venezuelan Bolivar Fuertes denominated net asset position.

Additionally, in the period, the Company incurred $15.4 million in

expenses associated with the proposed combination of the Company

and Schlumberger and $1.1 million in other business combination

related charges. During the three-month period ended March 31,

2009, the Company incurred $32.3 million in severance-related

charges and a $2.5 million loss on an interest rate derivative

contract.

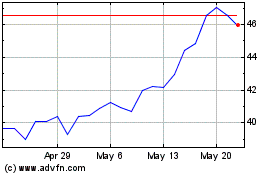

Sprott (NYSE:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024