Smith International, Inc. (NYSE:SII) today announced second

quarter income from continuing operations of $32.1 million, or

$0.15 per diluted share, after excluding a $7.7 million after-tax

charge related to severance and other cost reduction efforts.

Reported results for the second quarter of 2009 totaled $24.4

million, or $0.11 cents per diluted share, on revenues of $1.94

billion. On a comparative basis, second quarter 2008 earnings from

continuing operations totaled $183.3 million on revenues of $2.49

billion, while first quarter 2009 earnings from continuing

operations, net of charges, totaled $114.5 million on revenues of

$2.41 billion.

The second quarter financial performance reflects reductions in

North American exploration and production spending attributable to

unfavorable natural gas fundamentals. Moreover, lower activity

levels have contributed to excess industry capacity in the U.S.

land drilling market – leading to higher discounting in a number of

the Company’s product and service offerings. These factors,

combined with the seasonal drilling downturn in Canada, had a

significant impact on the quarter’s results.

Consolidated revenues declined 19 percent from the March 2009

period, which compares to a 25 percent reduction in global

drilling activity. The revenue decrease was concentrated in the

Western Hemisphere market driven by a 31 percent reduction in the

U.S. land rig count and, to a lesser extent, the annual break-up in

Canada and offshore activity declines in Mexico. Eastern Hemisphere

revenues fell five percent from the March period influenced by the

timing of offshore projects in the West Africa region. On

year-on-year basis, after adjusting for the retained W-H Energy

operations, pro forma revenues declined 30 percent versus a 36

percent decline in comparable activity levels.

Commenting on the results, Chief Executive Officer, John

Yearwood stated, “Our second quarter results reflect the

unprecedented collapse in North American drilling activity which

has led to lower volumes and a very competitive pricing

environment. While we believe it’s unlikely that natural gas

fundamentals will support U.S. activity growth in the back half of

2009, we do believe pricing in our oilfield-related product lines

has stabilized. During the quarter we spent a considerable amount

of effort right-sizing our U.S. operations while simultaneously

expanding our business base in selected markets by offering new

technology and providing superior drilling performance. I am very

pleased with the overwhelming customer acceptance of our

proprietary i-DRILL drilling optimization offering, the start of

Pathfinder operations in three new countries and the improved

drilling performance from our recently commercialized ONYX drill

bit cutter technology.”

Margaret Dorman, Chief Financial Officer, added, “The North

American business mix combined with higher debt costs contributed

to the sequential decline in profitability levels. Margins in our

oilfield-related operations slipped 370 basis points on a

sequential quarter basis, translating into decremental margins of

34 percent. While profitability levels in our Eastern Hemisphere

operations held up relatively well last quarter, supported by the

performance of the M-I SWACO operations – lower volumes and weak

pricing in the U.S. market influenced the overall margins. Our

working capital performance showed improvement in the second

quarter, contributing to just over $300 million of free cash

generation. Excess cash was used to repay outstanding borrowings

reducing our leverage ratio to 28.9 percent at June 30, 2009.”

M-I SWACO segment revenues were $1.01 billion for the second

quarter of 2009, a 13 percent decrease on a sequential basis and 21

percent below the prior year period. Just over half of the

sequential quarter revenue reduction was reported in the segment’s

North American operations – influenced by lower U.S. land-based

activity, a 24 percent decline in U.S. offshore business levels and

the seasonal downturn in Canadian drilling. Revenues in markets

outside North America fell eight percent below the March quarter

impacted by the timing of offshore projects in West Africa and the

decline in offshore drilling activity in Mexico.

Smith Oilfield segment revenues were $520.5 million for the

three months ended June 30, 2009 - 24 percent lower on a sequential

quarter basis and, due to the addition of the W-H operations, 12

percent below the amounts reported in the prior year quarter. The

reported sequential period revenue decrease was concentrated in

North America – as the lower number of land-based drilling programs

impacted demand for tubular products as well as high-margin drill

bits, directional services and other drilling-related product

offerings. Additionally, increased competitive pricing pressure in

the U.S. market impacted the sequential revenue comparison. Smith

Oilfield revenues outside North America were seven percent below

the March quarter driven by lower sales volumes in the Middle East

and West African markets.

The Distribution segment’s second quarter revenues were $410.8

million, 28 percent below the March 2009 quarter and 33 percent

lower on a year-on-year basis. Approximately two-thirds of the

revenue decline from the prior period resulted from lower customer

demand and, to a lesser extent, market pricing for line pipe in the

U.S. market. The Distribution segment’s reported decline in sales

also reflects the effect of the Canadian spring break-up and the

reduction in U.S. land-based drilling projects on maintenance,

repair and operating (“MRO”) product sales.

Smith International, Inc. is one of the largest global providers

of products and services used by operators during the drilling,

completion and production phases of oil and natural gas development

activities. The Company will host a conference call today beginning

at 10:00 a.m. Central to review the quarterly results. Participants

may join the conference call by dialing (800) 233-1182 and

requesting the Smith International call hosted by John Yearwood. A

replay of the conference call will also be available through

Tuesday, August 4, 2009, by dialing (888) 843-8996 and entering

conference call identification number “24933950”.

Certain comments contained in this news release and today’s

scheduled conference call concerning among other things, our

outlook, financial projections and business strategies of the

Company constitute “forward-looking statements” within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

Whenever possible, the Company has identified these forward-looking

statements by words such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “project,” “should” and similar terms. The

forward-looking statements are based upon management’s expectations

and beliefs and, although these statements are based upon

reasonable assumptions, actual results might differ materially from

expected results due to a variety of factors including, but not

limited to, overall demand for and pricing of the Company’s

products and services, general economic and business conditions,

the level of oil and natural gas exploration and development

activities, global economic growth and activity, political

stability of oil-producing countries, finding and development costs

of operations, decline and depletion rates for oil and natural gas

wells, seasonal weather conditions, industry conditions, and

changes in laws or regulations, many of which are beyond the

control of the Company. The Company assumes no obligation to update

publicly any forward-looking statements whether as a result of new

information, future events or otherwise. For a discussion of

additional risks and uncertainties that could impact the Company’s

results, review the Smith International, Inc. Annual Report on Form

10-K for the year ended December 31, 2008 and other filings of the

Company with the Securities and Exchange Commission.

Non-GAAP Financial Measures. The Company reports its financial

results in accordance with generally accepted accounting principles

(“GAAP”). However, management believes that certain non-GAAP

performance measures and ratios utilized for internal analysis

provide financial statement users meaningful comparisons between

current and prior period results, as well as important information

regarding performance trends. Certain information discussed in this

press release and in the scheduled conference call could be

considered non-GAAP measures. See the Supplementary Data – Schedule

III in this release for the corresponding reconciliations to GAAP

financial measures for the three-month periods ended June 30, 2009

and March 31, 2009 and the six-month period ended June 30, 2009.

Non-GAAP financial measures should be viewed in addition to, and

not as an alternative for, the Company's reported results.

Financial highlights follow:

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Three Months Ended June 30, March 31, 2009

2008 2009

Revenues

$

1,944,289

$

2,494,158

$

2,411,479

Costs and expenses: Costs of revenues 1,415,259

1,686,706 1,719,177 Selling, general and administrative expenses

395,726 417,685

450,624

Total costs and expenses

1,810,985

2,104,391

2,169,801

Operating income 133,304 389,767 241,678

Interest expense 42,803 16,244 27,524 Interest income (729 )

(752 ) (358 )

Income before income taxes and

noncontrolling interests

91,230

374,275

214,512

Income tax provision 27,957

121,555 70,318 Net income 63,273

252,720 144,194

Noncontrolling interests in net

income of subsidiaries

38,887

69,447

47,259

Net income attributable to

Smith

$

24,386

$

183,273

$

96,935

Earnings per share attributable to Smith: Basic $

0.11 $ 0.91 $ 0.44 Diluted $

0.11 $ 0.91 $ 0.44

Weighted average shares outstanding: Basic 219,307

200,938 219,201 Diluted

220,245 202,284

219,603

SMITH INTERNATIONAL,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

Six Months Ended June 30, 2009 2008

Revenues

$

4,355,768

$

4,865,156

Costs and expenses: Costs of revenues 3,134,436

3,276,220 Selling, general and administrative expenses

846,350 820,362

Total costs and expenses

3,980,786

4,096,582

Operating income 374,982 768,574 Interest

expense 70,327 32,545 Interest income (1,087 )

(1,648 )

Income before income taxes and

noncontrolling interests

305,742

737,677

Income tax provision 98,275

238,846 Net income 207,467 498,831

Noncontrolling interests in net

income of subsidiaries

86,146

140,567

Net income attributable to

Smith

$

121,321

$

358,264

Earnings per share attributable to Smith: Basic $

0.55 $ 1.78 Diluted $ 0.55 $

1.77 Weighted average shares outstanding: Basic

219,254 200,873 Diluted

219,925 202,169

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30,

2009

December 31,

2008

Current Assets: Cash and cash equivalents $ 224,184 $

162,508 Receivables, net 1,740,161 2,253,477 Inventories, net

2,120,929 2,367,166 Other current assets 241,130

303,233 Total current assets 4,326,404

5,086,384 Property, Plant and Equipment, net

1,866,301 1,844,036 Goodwill and Other Assets

3,915,938 3,885,804 Total assets $ 10,108,643

$ 10,816,224 Current Liabilities: Short-term

borrowings $ 404,885 $ 1,366,296 Accounts payable 598,924 979,000

Other current liabilities 389,383

588,136 Total current liabilities 1,393,192

2,933,432 Long-Term Debt 2,051,474 1,440,525

Other Long-Term Liabilities 613,733 581,958

Stockholders’ Equity(a)

6,050,244 5,860,309

Total liabilities and stockholders’ equity $

10,108,643 $ 10,816,224

NOTE (a): Due to the

adoption of Statement of Financial Accounting Standards (“SFAS”)

No. 160,cumulative undistributed earnings related to noncontrolling

interests in consolidated subsidiaries(formerly referred to as

minority interests) is now reflected as a component of

stockholders’ equity.The December 31, 2008 information has also

been recast to reflect the adoption of SFAS No. 160.

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

I

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended June 30, March 31, June

30, 2009 2008 2009

2009 2008

REVENUE

DATA

Consolidated:

United States $ 772,535 $ 1,145,960 $ 1,089,540 $ 1,862,075 $

2,158,639 Canada 133,612 146,453

192,284 325,896

380,878 North America 906,147

1,292,413 1,281,824

2,187,971 2,539,517

Latin America 227,499 244,543 276,107 503,606 471,520

Europe/Africa 510,689 646,527 539,815 1,050,504 1,243,019 Middle

East/Asia 299,954 310,675

313,733 613,687

611,100 Non-North America 1,038,142

1,201,745 1,129,655

2,167,797 2,325,639

Total

$ 1,944,289 $ 2,494,158 $

2,411,479 $ 4,355,768 $ 4,865,156

Non-Distribution:

North America $ 518,725 $

708,807 $ 736,234 $ 1,254,959

$ 1,418,090 Latin America 223,820 237,597

270,565 494,385 457,878 Europe/Africa 498,734 629,139 528,728

1,027,462 1,209,328 Middle East/Asia 292,204

303,027 306,210

598,414 596,201 Non-North

America 1,014,758 1,169,763

1,105,503 2,120,261

2,263,407

Total $ 1,533,483 $

1,878,570 $ 1,841,737 $ 3,375,220

$ 3,681,497

SEGMENT DATA (b)

Revenues: M-I SWACO $ 1,013,016 $ 1,285,754 $

1,159,337 $ 2,172,353 $ 2,514,183 Smith Oilfield

520,467 592,816 682,400

1,202,867 1,167,314

Subtotal

1,533,483 1,878,570

1,841,737 3,375,220

3,681,497

Distribution

410,806 615,588

569,742 980,548

1,183,659

Total $ 1,944,289 $ 2,494,158 $

2,411,479 $ 4,355,768 $ 4,865,156

Operating Income: M-I SWACO $ 121,325 $

212,294 $ 147,508 $ 268,833 $ 420,092 Smith Oilfield

47,622 162,864 105,765

153,387 325,870

Subtotal

168,947 375,158

253,273 422,220 745,962

Distribution (9,799 ) 36,518

15,521 5,722

66,402

General corporate (25,844 ) (21,909 ) (27,116 ) (52,960 )

(43,790 )

Total

$ 133,304 $ 389,767 $ 241,678

$ 374,982 $ 768,574

NOTE (b): During

2008, the Company revised its segment reporting in connection with

the inclusion of the W-H Energy Services operations to reflect

three segments: M-I SWACO, Smith Oilfield and Distribution. In

connection with this change, the Company no longer allocates

corporate costs to the operating segments. All periods shown have

been recast to conform to the current segment reporting

structure.

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

II

(In thousands)

(Unaudited)

Three Months Ended Six Months Ended June 30,

March 31, June 30, 2009 2008 2009

2009 2008

OTHER DATA(c)

Operating Income: Smith ownership interest $ 85,825 $

305,104 $ 180,264 $ 266,089 $ 597,574 Noncontrolling ownership

interest 47,479 84,663

61,414 108,893 171,000 Total $

133,304 $ 389,767 $ 241,678 $ 374,982 $

768,574

Depreciation and Amortization: Smith

ownership interest $ 78,596 $ 39,533 $ 78,434 $ 157,030 $ 80,010

Noncontrolling ownership interest 13,116

12,285 12,661 25,777

24,409 Total $ 91,712 $ 51,818 $ 91,095

$ 182,807 $ 104,419

Gross Capital

Spending: Smith ownership interest $ 62,542 $ 67,995 $ 85,762 $

148,304 $ 125,726 Noncontrolling ownership interest

10,087 20,979 11,339

21,426 37,278 Total $ 72,629 $ 88,974

$ 97,101 $ 169,730 $ 163,004

Net Capital

Spending(d):

Smith ownership interest $ 47,020 $ 56,478 $ 64,429 $ 111,449 $

101,133 Noncontrolling ownership interest 9,305

20,680 10,275 19,580

35,681 Total $ 56,325 $ 77,158 $

74,704 $ 131,029 $ 136,814

NOTE (c): The Company

derives a significant portion of its revenues and earnings from M-I

SWACO and other majority-owned operations. Consolidated operating

income, depreciation and amortization and capital spending amounts

have been separated between the Company’s portion and the

noncontrolling interests’ portion in order to aid in analyzing the

Company’s financial results.

NOTE (d): Net

capital spending reflects the impact of proceeds from lost-in-hole

and fixed asset equipment sales.

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA – SCHEDULE

III

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share

data)

(Unaudited)

Operating Income Diluted Earnings per

Share

Three Months Ended

Six Months Ended

Three Months Ended

Six Months Ended June 30, March 31, June 30, June 30,

March 31, June 30, 2009 2009

2009 2009 2009

2009

GAAP Consolidated Basis $ 133,304

$ 241,678 $ 374,982 $ 0.11 $ 0.44 $ 0.55

Add Back

Charges: M-I SWACO 2,983 19,301 22,284 0.01 0.03 0.04

Smith Oilfield 8,593 12,359 20,952 0.03 0.04 0.06

Distribution 1,265 651 1,916 - - 0.01 General Corporate 160

2,481 2,641 - 0.01 0.01

Non-GAAP Consolidated

Basis $ 146,305 $ 276,470 $ 422,775

$ 0.15 $ 0.52 $ 0.67

NOTE: Management believes

that it is important to highlight certain charges included within

operating income to assist financial statement users with

comparisons between current and prior period

results. During the three-month periods ended June 30,

2009 and March 31, 2009, the Company incurred severance-related

costs of approximately $12.5 million and $31.0 million,

respectively, primarily reflecting reductions in North American

personnel levels. The three-month periods ended June 30,

2009 and March 31, 2009 include other non-recurring costs of $0.5

million and $3.8 million, respectively, associated with facility

closures and derivative-related contract losses. The

above costs were included within selling, general and

administrative expenses. There were no charges in the

comparable 2008 periods.

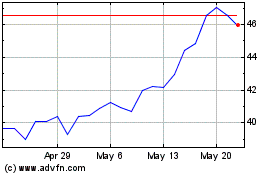

Sprott (NYSE:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024