Smith International, Inc. (NYSE: SII) today announced first

quarter earnings of $96.9 million, or $0.44 per diluted share, on

revenues of $2.41 billion. The results include a $34.8 million

charge, primarily reflecting employee separation costs associated

with a 14 percent reduction in North American personnel levels.

After excluding the impact of the charge, the Company reported

income from continuing operations of $114.5 million, or $0.52 per

diluted share.

Reflecting a sharp decline in drilling activity associated with

the global economic slowdown, first quarter 2009 earnings from

continuing operations declined 35 percent from the year-ago period

in which the Company�s net income totaled $175.0 million, or 87

cents per diluted share. The results compare to fourth quarter 2008

earnings from continuing operations of $218.6 million, or $1.00 per

diluted share, which has been adjusted to exclude the impact of a

derivative contract-related loss. The sequential quarter earnings

deterioration was driven by a 34 percent reduction in North

American activity levels and, to a lesser extent, the sale of

certain non-core W-H Energy operations which contributed after-tax

earnings of $9.6 million, or five cents per diluted share, in the

December 2008 period.

Consolidated revenues were two percent above the prior year

period and 21 percent lower on a sequential quarter basis. The

revenue growth over the prior year stemmed from the addition of the

W-H Energy operations which masked the decline in North American

business volumes. From a pro forma perspective, revenues were seven

percent below the March 2008 period � comparing favorably to the 16

percent reduction in related activity levels. Sequentially, the

majority of the revenue decline was concentrated in North America

driven by weakened demand for line pipe and other tubular products,

reduced sales in the Distribution segment�s upstream customer base

and lower volumes and pricing across a number of oilfield-related

product and service offerings. Revenues outside North America

decreased nine percent from the December period influenced by

reduced sales volumes in the Former Soviet Union (�FSU�) and, to a

lesser extent, a decline in offshore activity levels in the North

Sea region.

Commenting on the results, Chief Executive Officer, John

Yearwood stated, �We believe the North American business

environment will continue to be challenging until natural gas

fundamentals support more favorable commodity prices for our

customers. With this in mind, we have responded quickly to the

unprecedented rate of decline in drilling activity by reducing our

workforce, minimizing discretionary spending, re-negotiating

product input pricing and eliminating non-essential capital

investment while successfully expanding our capabilities to provide

performance-focused drilling solutions. We believe fundamentals

should improve over the coming quarters, which provide a favorable

long-term outlook for our industry � and our business in particular

� as customers seek to enhance the value of their upstream spending

programs.�

Margaret Dorman, Chief Financial Officer, added, �We�re pleased

with the overall operating results, especially after considering

the severe contraction in global activity levels experienced during

the quarter. Adjusted operating margins for our oilfield operations

declined to 15.5 percent in the period � 370 basis points below the

December quarter reflecting sequential decremental margins of 36

percent. The financial position of the Company improved during the

quarter, reflecting the successful refinancing of the W-H bridge

loan borrowings and continuing focus on working capital

management.�

The M-I SWACO segment�s first quarter revenues totaled $1.16

billion, 11 percent below the December 2008 quarter and six percent

lower on a year-on-year basis. Deepwater revenue volumes, which

grew nine percent over the December period influenced by increased

demand for premium fluid offerings in the Latin America region,

impacted the sequential revenue comparison. On a sequential quarter

basis, reduced activity in several key land-based markets,

including the United States and the Former Soviet Union, combined

with seasonal weakness in the North Sea contributed to the

period-to-period decline.

Smith Oilfield segment revenues were $682.4 million for the

three months ended March 2009 - 29 percent lower on a sequential

quarter basis and, due to the addition of the W-H operations, 19

percent above the amounts reported in the prior year period. The

sequential revenue decline was concentrated in the North American

market impacted by the 34 percent reduction in activity levels and

the sale of certain W-H business operations. Excluding the impact

of the divested operations, revenues declined 22 percent on a

sequential quarter basis. The period-to-period decline reflects

lower drill bit volumes, reduced demand for directional, tubular

and other downhole service offerings as well as modest pricing

erosion in the U.S. market.

The Distribution segment reported revenues of $569.7 million for

the first quarter of 2009, a 28 percent decrease from the December

period and comparable with the prior year quarter. The sequential

revenue decline was reported in the North American energy sector

operations reflecting reduced upstream capital project spending for

line pipe products and associated pricing weakness. Additionally,

energy sector sales volumes were adversely impacted by the drop in

North American completion activity during the quarter resulting in

lower customer spending for maintenance, repair and operating

(�MRO�) supplies.

Smith International, Inc. is one of the largest global providers

of products and services used by operators during the drilling,

completion and production phases of oil and natural gas development

activities. The Company will host a conference call today beginning

at 10:00 a.m. Central to review the quarterly results. Participants

may join the conference call by dialing (800) 233-1182 and

requesting the Smith International call hosted by John Yearwood. A

replay of the conference call will also be available through

Monday, May 4, 2009, by dialing (888) 843-8996 and entering

conference call identification number 24232560.

Certain comments contained in this news release and today�s

scheduled conference call concerning among other things, our

outlook, financial projections and business strategies of the

Company constitute �forward-looking statements� within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

Whenever possible, the Company has identified these forward-looking

statements by words such as �anticipate,� �believe,� �could,�

�estimate,� �expect,� �project,� �should� and similar terms. The

forward-looking statements are based upon management�s expectations

and beliefs and, although these statements are based upon

reasonable assumptions, actual results might differ materially from

expected results due to a variety of factors including, but not

limited to, overall demand for and pricing of the Company�s

products and services, general economic and business conditions,

the level of oil and natural gas exploration and development

activities, global economic growth and activity, political

stability of oil-producing countries, finding and development costs

of operations, decline and depletion rates for oil and natural gas

wells, seasonal weather conditions, industry conditions, and

changes in laws or regulations, many of which are beyond the

control of the Company. The Company assumes no obligation to update

publicly any forward-looking statements whether as a result of new

information, future events or otherwise. For a discussion of

additional risks and uncertainties that could impact the Company�s

results, review the Smith International, Inc. Annual Report on Form

10-K for the year ended December 31, 2008 and other filings of the

Company with the Securities and Exchange Commission.

Non-GAAP Financial Measures. The Company reports its financial

results in accordance with generally accepted accounting principles

(�GAAP�). However, management believes that certain non-GAAP

performance measures and ratios utilized for internal analysis

provide financial statement users meaningful comparisons between

current and prior period results, as well as important information

regarding performance trends. Certain information discussed in this

press release and in the scheduled conference call could be

considered non-GAAP measures. See the Supplementary Data � Schedule

III in this release for the corresponding reconciliations to GAAP

financial measures for the three-month periods ended March 31, 2009

and 2008 and the three-month period ended December 31, 2008.

Non-GAAP financial measures should be viewed in addition to, and

not as an alternative for, the Company's reported results.

Financial highlights follow:

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(In thousands, except per share

data)

(Unaudited)

� � Three Months Ended March 31, � December 31, � � 2009 � 2008 �

2008

Revenues

$

2,411,479

�

$

2,370,998

$

3,056,371

� Costs and expenses: Costs of revenues 1,719,177 1,589,514

2,123,189 Selling, general and administrative expenses � � 450,624

� � 402,677 � � 502,425

Total costs and expenses

� �

2,169,801

� �

1,992,191

� �

2,625,614

� Operating income 241,678 378,807 430,757 � Interest expense

27,524 16,301 33,051 Interest income � � (358) � � (896) � � (994)

� Income before income taxes and

noncontrolling interests

214,512

363,402

398,700

� Income tax provision � � 70,318 � � 117,291 � � 130,281 � Net

income 144,194 246,111 268,419 � Noncontrolling interests in net

income

of subsidiaries

� �

47,259

� �

71,120

� �

69,242

Net income attributable to

Smith

�

$

96,935

�

$

174,991

�

$

199,177

� Earnings per share attributable to Smith: Basic � $ 0.44 � $ 0.87

� $ 0.91 Diluted � $ 0.44 � $ 0.87 � $ 0.91 � Weighted average

shares outstanding: Basic � � 219,201 � � 200,808 � � 218,853

Diluted � � 219,603 � � 201,942 � � 219,687 �

SMITH INTERNATIONAL,

INC.

CONSOLIDATED CONDENSED BALANCE

SHEETS

(In thousands)

(Unaudited)

� � � March 31,

2009

� December 31,

2008

� � � Current Assets: Cash and cash equivalents $ 201,509 $ 162,508

Receivables, net 2,088,837 2,253,477 Inventories, net 2,291,600

2,367,166 Other current assets � � 240,670 � � 303,233 Total

current assets � � 4,822,616 � � 5,086,384 � Property, Plant and

Equipment, net 1,850,724 1,844,036 � Goodwill and Other Assets � �

3,897,802 � � 3,885,804 Total assets � $ 10,571,142 � $ 10,816,224

� � Current Liabilities: Short-term borrowings $ 365,377 $

1,366,296 Accounts payable 771,225 979,000 Other current

liabilities � � 433,157 � � 588,136 Total current liabilities � �

1,569,759 � � 2,933,432 � Long-Term Debt 2,375,720 1,440,525 �

Other Long-Term Liabilities 617,285 581,958 � Stockholders�

Equity

(a) 6,008,378 5,860,309 � � � � � � � Total

liabilities and stockholders� equity � $ 10,571,142 � $ 10,816,224

�

NOTE (a): Due to the

adoption of Statement of Financial Accounting Standards (�SFAS�)

No. 160, cumulative undistributed earnings related to

noncontrolling interests in consolidated subsidiaries (formerly

referred to as minority interests) is now reflected as a component

of stockholders� equity. The December 31, 2008 information has also

been recast to reflect the adoption of SFAS No. 160.

�

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA � SCHEDULE

I

(In thousands)

(Unaudited)

� � Three Months Ended March 31, � December 31, � � � 2009 � � �

2008 � � 2008

REVENUE DATA � � �

Consolidated: United

States $ 1,089,540 $ 1,012,679 $ 1,586,913 Canada � � 192,284 � � �

234,425 � � � � 227,989 � North America � � 1,281,824 � � �

1,247,104 � � � � 1,814,902 � � Latin America 276,107 226,977

255,203 Europe/Africa 539,815 596,492 630,233 Middle East/Asia � �

313,733 � � � 300,425 � � � � 356,033 � Non-North America � �

1,129,655 � � � 1,123,894 � � � � 1,241,469 � � � � � � � � � � � �

� � � Total � $ 2,411,479 � � $ 2,370,998 � � � $ 3,056,371 � �

Non-Distribution: � � � � � � � North America � $ 736,234 �

� $ 709,283 � � � $ 1,049,465 � � Latin America 270,565 220,281

248,952 Europe/Africa 528,728 580,189 614,825 Middle East/Asia � �

306,210 � � � 293,174 � � � � 348,958 � Non-North America � �

1,105,503 � � � 1,093,644 � � � � 1,212,735 � � � � � � � � � � � �

� � � Total � $ 1,841,737 � � $ 1,802,927 � � � $ 2,262,200 � �

SEGMENT DATA(b) �

Revenues: M-I SWACO $

1,159,337 $ 1,228,429 $ 1,304,883 Smith Oilfield � � 682,400 � � �

574,498 � � � � 957,317 � Subtotal � � 1,841,737 � � � 1,802,927 �

� � � 2,262,200 � � � � � � � � � � � � � � � Distribution � �

569,742 � � � 568,071 � � � � 794,171 � � � � � � � � � � � � � � �

Total � $ 2,411,479 � � $ 2,370,998 � � � $ 3,056,371 � �

Operating Income: M-I SWACO $ 147,508 $ 207,798 $ 202,539

Smith Oilfield � � 105,765 � � � 163,006 � � � � 232,788 � Subtotal

� � 253,273 � � � 370,804 � � � � 435,327 � � � � � � � � � � � � �

� �

Distribution

� � 15,521 � � � 29,884 � � � � 52,042 � � � � � � � � � � � � � �

� General corporate � � (27,116 ) � � (21,881 ) � � � (56,612 ) � �

� � � � � � � � � � � � Total � $ 241,678 � � $ 378,807 � � � $

430,757 � �

NOTE (b): During

2008, the Company revised its segment reporting in connection with

the inclusion of the W-H Energy Services operations to reflect

three segments: M-I SWACO, Smith Oilfield and Distribution. In

connection with this change, the Company no longer allocates

corporate costs to the operating segments. All periods shown have

been recast to conform to the current segment reporting

structure.

�

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA � SCHEDULE

II

(In thousands)

(Unaudited)

� Three Months Ended March 31, � December 31, � � 2009 � 2008 �

2008

OTHER DATA(c) � � �

Operating Income:

Smith ownership interest $ 180,264 $ 292,470 $ 345,273

Noncontrolling ownership interest � � 61,414 � � 86,337 � � �

85,484 Total � $ 241,678 � $ 378,807 � � $ 430,757 �

Depreciation and Amortization: Smith ownership interest $

78,434 $ 40,477 $ 76,432 Noncontrolling ownership interest � �

12,661 � � 12,124 � � � 13,263 Total � $ 91,095 � $ 52,601 � � $

89,695 �

Gross Capital Spending: Smith ownership interest $

85,762 $ 57,731 $ 145,036 Noncontrolling ownership interest � �

11,339 � � 16,299 � � � 30,025 Total � $ 97,101 � $ 74,030 � � $

175,061 �

Net Capital Spending (d): Smith

ownership interest $ 64,429 $ 44,655 $ 117,927 Noncontrolling

ownership interest � � 10,275 � � 15,001 � � � 29,106 Total � $

74,704 � $ 59,656 � � $ 147,033 �

NOTE (c): The Company

derives a significant portion of its revenues and earnings from M-I

SWACO and other majority-owned operations. Consolidated operating

income, depreciation and amortization and capital spending amounts

have been separated between the Company�s portion and the

noncontrolling interests� portion in order to aid in analyzing the

Company�s financial results.

�

NOTE (d): Net

capital spending reflects the impact of proceeds from lost-in-hole

and fixed asset equipment sales.

�

SMITH INTERNATIONAL,

INC.

SUPPLEMENTARY DATA � SCHEDULE

III

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share

data)

(Unaudited)

� �

Operating Income �

Diluted Earnings per Share

Three Months Ended

Three Months Ended

March 31, � December 31, March 31, � December 31, � � 2009 � 2008 �

2008 � 2009 � 2008 � 2008 � �

GAAP Consolidated Basis $

241,678 $ 378,807 $ 430,757 $ 0.44 $ 0.87 $ 0.91 �

M-I

SWACO: Employee severance-related costs 18,009 - - 0.03

-

-

Facility closure-related costs 1,292 - -

*

-

-

�

Smith Oilfield: Employee severance-related costs 12,359 -

- 0.04

-

-

�

Distribution: Employee severance-related costs 651 - -

*

-

-

�

General Corporate: Derivative contract-related loss 2,481

- 29,881 0.01

-

0.09 � � � � � � � � � � � � �

Non-GAAP Consolidated Basis �

$ 276,470 � $ 378,807 � $ 460,638 � $ 0.52 � $ 0.87 � $ 1.00 �

* Not meaningful

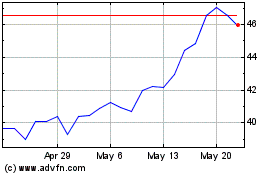

Sprott (NYSE:SII)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sprott (NYSE:SII)

Historical Stock Chart

From Jul 2023 to Jul 2024