Additional Proxy Soliciting Materials (definitive) (defa14a)

March 14 2022 - 6:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

| ☐ |

|

Preliminary Proxy Statement |

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ☐ |

|

Definitive Proxy Statement |

|

|

| ☐ |

|

Definitive Additional Materials |

|

|

| ☒ |

|

Soliciting Material under §240.14a-12 |

SOUTHWEST GAS HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

CENTURI SEPARATION

FAQ

Are you definitely going to separate Centuri? How certain is this?

•As we announced on March 1, 2022, our Board of Directors unanimously decided to separate Centuri.

•We are moving forward expeditiously to complete the separation because this is the optimal time to create two strong, independent companies.

•We expect the separation will be completed within 9 to 12 months from the announcement of the separation on March 1, 2022.

What does “separation” mean?

•It means that we are separating our regulated and

unregulated businesses to create two strong, independent companies.

•While the final structure of the separation has not been determined, it will be effected

with the goal of maximizing value for Southwest Gas stockholders.

•We will provide an update on the separation within 45 to 60 days from the announcement of

the separation on March 1, 2022.

•Following the separation process, Centuri will be an independent company and Southwest Gas will not have a continuing

ownership interest in Centuri.

How did the Board and management team arrive at the decision to separate Centuri?

•As a Board and management team, we have been open to the possibility that a separation could ultimately be the best way to unlock the value of Centuri, and that of the

remainder of Southwest Gas, and as a result, we have taken actions to prepare Centuri to succeed as a standalone company.

•With Centuri nearly doubling its

revenue over the last four years and poised for continued growth as a standalone platform, and with the acquisition of Riggs Distler, the Board and management team concluded that now is the time to separate Centuri and unlock value.

How are you going to separate Centuri?

•We currently expect the foundation of the

separation structure to be a tax-free spin-off in which stockholders would receive a prorated dividend of Centuri shares.

What is the most likely form of separation (e.g., sale, spin, RMT)?

•The separation will

be effected with the goal of maximizing value for Southwest Gas stockholders, and we will provide an update on the separation within 45 to 60 days from the announcement of the separation on March 1, 2022.

Will the separation be a complete separation or will Holdings continue to retain an ownership position in that business?

•Following the separation process, Centuri will be an independent company and Southwest Gas will not have an ownership interest in Centuri.

How are you going to finance MountainWest? •We are actively

evaluating a range of financing options to determine what is in the best interest of all our stockholders. We will share additional details once we have determined the optimal financing plan.

What is the quantified reduced equity need for MoutainWest financing as a result of the separation?

•The timing of the decision on MountainWest financing is separate and distinct from our decision to separate Centuri.

When will we hear more about financing for MountainWest? •When we announced the MountainWest transaction, we put in place a 364-day

term loan commitment, and we continue to plan to issue equity and debt to replace the term loan. •With the separation of Centuri, we will have the flexibility to meaningfully reduce future equity financing needs, including with respect to

MountainWest. Subject to ongoing discussions with our rating agencies, this expectation is based on the enhanced consolidated risk position of our business segments post separation.

Does Southwest Gas Holdings plan on reducing its overall dividend upon the separation of Centuri? •No, we do not plan on reducing our dividend to stockholders in conjunction

with the planned separation of the Centuri business unit. •The separation is expected to be structured so that stockholders of Southwest Gas would benefit from the same overall dividend payment as immediately before the separation.

Will Centuri pay a dividend? •As separate companies, Southwest Gas and Centuri will each have tailored capital structures and financial policies appropriate for each

company’s business. •We will provide additional detail regarding the separation in due course.

How to Find Further Information This communication does

not constitute a solicitation of any vote or approval in connection with the 2022 annual meeting of stockholders of Southwest Gas Holdings, Inc. (the “Company”) (the “Annual Meeting”). In connection with the Annual Meeting, the

Company has filed a preliminary proxy statement and will file a definitive proxy statement with the U.S. Securities and Exchange Commission (“SEC”), which the Company will furnish, with any other relevant information or documents, to its

stockholders in connection with the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, WE URGE STOCKHOLDERS TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND WHITE PROXY CARD AND OTHER DOCUMENTS WHEN SUCH INFORMATION

IS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE ANNUAL MEETING. The proposals for the Annual Meeting will be made solely through the

definitive proxy statement. In addition, a copy of the definitive proxy statement (when it becomes available) may be obtained free of charge from www.swgasholdings.com/proxymaterials. Security holders also will be able to obtain, free of charge,

copies of the proxy statement and any other documents filed by Company with the SEC in connection with the Annual Meeting at the SEC’s website at http://www.sec.gov, and at the Company’s website at www. swgasholdings.com.

Important Information for Investors and Stockholders

This communication does not constitute an

offer to buy or solicitation of an offer to sell any securities. In response to the tender offer for the shares of the Company commenced by IEP Utility Holdings LLC and Icahn Enterprises Holdings L.P., the Company has filed a

solicitation/recommendation statement on Schedule 14D-9 with the SEC. INVESTORS AND STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS ARE URGED TO READ THE SOLICITATION/RECOMMENDATION STATEMENT AND OTHER DOCUMENTS FILED

WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a free copy of these documents free of charge at the SEC’s website at www.sec.gov, and at the Company’s website

at www.swgasholdings.com. In addition, copies of these materials may be requested from the Company’s information agent, Innisfree M&A Incorporated, toll-free at (877) 825-8621.

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, without limitation, statements regarding Southwest Gas Holdings, Inc. (the “Company”) and the

Company’s expectations or intentions regarding the future. These forward-looking statements can often be identified by the use of words such as “will”, “predict”, “continue”, “forecast”,

“expect”, “believe”, “anticipate”, “outlook”, “could”, “target”, “project”, “intend”, “plan”, “seek”, “estimate”, “should”,

“may” and “assume”, as well as variations of such words and similar expressions referring to the future, and include (without limitation) statements regarding expectations with respect to a separation of Centuri, the future

performance of Centuri, Southwest Gas’s dividend ratios and Southwest Gas’s future performance. A number of important factors affecting the business and financial results of the Company could cause actual results to differ materially from

those stated in the forward-looking statements. These factors include, but are not limited to, the timing and amount of rate relief, changes in rate design, customer growth rates, the effects of regulation/deregulation, tax reform and related

regulatory decisions, the impacts of construction activity at Centuri, whether we will separate Centuri within the anticipated timeframe and the impact to our results of operations and financial position from the separation, the potential for, and

the impact of, a credit rating downgrade, the costs to integrate MountainWest, future earnings trends, inflation, sufficiency of labor markets and similar resources, seasonal patterns, the cost and management attention of ongoing litigation that the

Company is currently engaged in, the effects of the pending tender offer and proxy contest brought by Carl Icahn and his affiliates, and the impacts of stock market volatility. In addition, the Company can provide no assurance that its discussions

about future operating margin, operating income, COLI earnings, interest expense, and capital expenditures of the natural gas distribution segment will occur. Likewise, the Company can provide no assurance that discussions regarding utility

infrastructure services segment revenues, EBITDA as a percentage of revenue, and interest expense will transpire, nor assurance regarding acquisitions or their impacts, including management’s plans or expectations related thereto, including

with regard to Riggs Distler or MountainWest. Factors that could cause actual results to differ also include (without limitation) those discussed under the heading “Risk Factors” in Southwest Gas Holdings, Inc.’s most recent Annual

Report on Form 10-K and in the Company’s and Southwest Gas Corporation’s current and periodic reports, including our Quarterly Reports on Form 10-Q, filed from

time to time with the SEC. The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its Web site or otherwise. The Company does not assume any obligation to update the

forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise. Participants in the Solicitation

The directors and officers of the Company may be deemed to be participants in the solicitation of proxies in connection with the Annual Meeting. Information regarding the

Company’s directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC and its most

recent definitive Proxy Statement on Schedule 14A filed with the SEC. Additional information regarding the interests of such potential participants is or will be included in the proxy statement for the Annual Meeting and other relevant materials to

be filed with the SEC, when they become available.

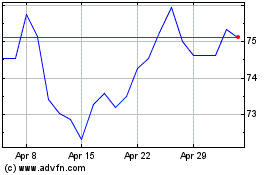

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Sep 2024 to Oct 2024

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Oct 2023 to Oct 2024