Range Resources' Drilling Success - Analyst Blog

March 15 2012 - 11:30AM

Zacks

With the completion of drilling at the Smith 2 and Albrecht 1

wells, Range Resources Corp. (RRC) witnessed

operational success at the North Chapman Ranch Field, onshore

Texas.

Range Resources, which holds approximate 20% to 25% interest in

the prospect, drilled the Smith 2 well about 1,350 feet southeast

of the Smith 1 discovery well. Soon after, moving more toward the

southeast of Smith 2 (almost 1,500 feet), the Albrecht 1 was

drilled that confirmed traces of the Howell Hight reservoir. The

exploration of these wells expanded Range’s Proved Reserves in the

region.

The Smith 2 well’s initial flow rates, coming from the uppermost

pay zone, touched more than 3 million cubic feet of gas and 125

barrels of oil. The company stated that this is one of four

principle pay zones in the well.

Range Resources plans to carry on work to eradicate all the

plugs below the upper pay zone and join the lower pay zones. This

will enable the well to accomplish maximum rate and recovery.

Following the drilling of four wells in the field, management

expects that more than 80% of the structural closure at the Howell

Hight reservoir will come under the proved and probable (2P)

category.

Although Range Resources is currently evaluating the reserve

potential of the North Chapman Ranch, it will provide the final

figure upon the start-up of the Albrecht 1 well. This well is

slated to be completed and fracture stimulated within the next four

to six weeks.

Net production and cash flow from the project is expected to

improve by more than 200% from the current levels, once the Smith 2

and Albrecht 1 wells come online.

We are maintaining a long-term Neutral recommendation on Range

Resources, reflecting its well-diversified asset portfolio,

impressive cost structure and high production growth target. These

positives are somewhat shadowed by the volatile natural gas prices,

inflationary industry situations and operational disturbances.

Range Resources, which competes with EQT

Corporation (EQT), SM Energy

Company (SM) and Ultra Petroleum

Corp. (UPL), holds a Zacks #3 Rank that translates

into a Hold rating for a period of one to three months.

EQT CORP (EQT): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

SM ENERGY CO (SM): Free Stock Analysis Report

ULTRA PETRO CP (UPL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

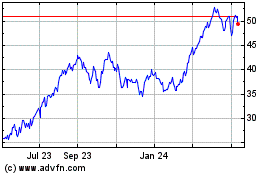

SM Energy (NYSE:SM)

Historical Stock Chart

From Jun 2024 to Jul 2024

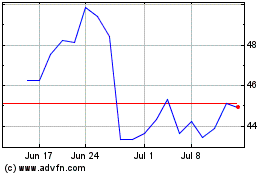

SM Energy (NYSE:SM)

Historical Stock Chart

From Jul 2023 to Jul 2024