S&P Global Launches $7 Billion Accelerated Stock Buyback

March 02 2022 - 9:06AM

Dow Jones News

By Colin Kellaher

S&P Global Inc. on Wednesday said it plans to buy back $7

billion worth of stock through accelerated repurchase agreements

with Citibank N.A., Goldman Sachs & Co. and Mizuho Markets

Americas LLC.

The New York financial-data giant said it expects an initial

delivery of more than 15.2 million shares, with final settlement

expected in the third quarter.

S&P, which completed its $44 billion acquisition of IHS

Markit on Monday, has about 363 million shares outstanding and

sports a market capitalization of roughly $133 billion based on

Tuesday's closing price of $390.58.

The company, which didn't buy back any shares last year due to

the pending IHS deal, has said it plans to repurchase $12 billion

worth of stock under accelerated agreements this year.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

March 02, 2022 08:51 ET (13:51 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

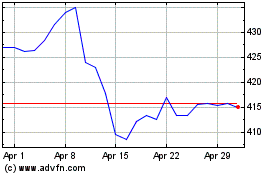

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

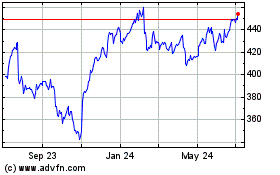

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Jul 2023 to Jul 2024