Current Report Filing (8-k)

March 02 2022 - 8:00AM

Edgar (US Regulatory)

0000064040FALSE00000640402022-03-022022-03-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 2, 2022

S&P Global Inc.

(Exact Name of Registrant as specified in its charter)

| | | | | | | | |

| New York | 1-1023 | 13-1026995 |

| (State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employer Identification No.) |

55 Water Street, New York, New York 10041

(Address of Principal Executive Offices) (Zip Code)

(212) 438-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | |

| Title of each class | Trading Symbol | Name of Exchange on which registered | | |

| Common stock (par value $1.00 per share) | SPGI | New York Stock Exchange | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On March 1, 2022, S&P Global Inc. (the “Company”) entered into a master confirmation (each a "Master Confirmation") and a supplemental confirmation (together with the related Master Confirmation, an "ASR Agreement"), with each of Citibank, N.A. (“Citibank”), Goldman Sachs & Co. LLC ("Goldman Sachs") and Mizuho Markets Americas LLC ("Mizuho") to repurchase an aggregate of $7.0 billion of the Company’s common stock (the "Accelerated Share Repurchase").

Under the terms of the ASR Agreements, at inception, the Company will make a payment of approximately $2.33 billion to each of Citibank, Goldman Sachs and Mizuho, and the Company will receive an initial share delivery of approximately 5.08 million shares of the Company’s common stock from each of Citibank, Goldman Sachs and Mizuho. In the aggregate, the Company will receive approximately 15.23 million shares of the Company's common stock. The exact number of shares of the Company’s common stock that the Company will repurchase under the ASR Agreements will be based generally on the average of the daily volume-weighted average prices of the Company’s common stock during the calculation period for each ASR Agreement, less a discount, and subject to adjustments pursuant to the terms and conditions of each ASR Agreement. At final settlement of the ASR Agreements, under certain circumstances, Citibank, Goldman Sachs and/or Mizuho may be required to deliver additional shares of the Company’s common stock to the Company, or, under certain circumstances, the Company may be required to make a cash payment or deliver shares of the Company’s common stock to Citibank, Goldman Sachs and/or Mizuho. Final settlement of the ASR Agreements is expected to occur during the third quarter of 2022.

Each ASR Agreement contains the principal terms and provisions governing the Accelerated Share Repurchase customary for agreements of this type, including, among others, the mechanisms used to determine the number of shares of the Company’s common stock that will be delivered, the required timing of delivery of such shares, the circumstances under which any of Citibank, Goldman Sachs or Mizuho is permitted to make adjustments to the terms of the ASR Agreements, various acknowledgments, representations and warranties made by the parties to one another, and the circumstances under which the ASR Agreements may be terminated early.

The foregoing description of the ASR Agreements is a summary and is qualified in its entirety by reference to the ASR Agreements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is furnished with this report:

Exhibit Number

(104) Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 8-K Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | S&P Global Inc. |

| | |

| | | /s/ | Alma Rosa Montanez | |

| | | By: | Alma Rosa Montanez |

| | | | Assistant Corporate Secretary & Chief Corporate Counsel |

| | | | |

Dated: March 2, 2022

INDEX TO EXHIBITS

Exhibit Number

(104) Cover Page Interactive Data File (embedded within the Inline XBRL document)

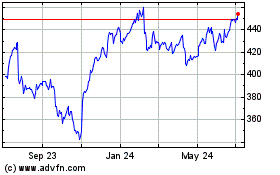

S&P Global (NYSE:SPGI)

Historical Stock Chart

From May 2024 to Jun 2024

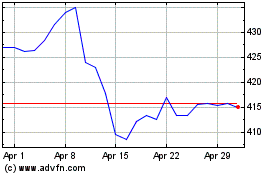

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Jun 2023 to Jun 2024