Quanex Building Products Corporation (NYSE:NX)

(“Quanex” or the “Company”) today announced its results for the

three months ended July 31, 2024.

The Company reported the following selected

financial results:

|

|

|

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

($ in millions, except per share data) |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net Sales |

|

|

$280.3 |

|

$299.6 |

|

$785.7 |

|

$835.1 |

|

Gross Margin |

|

|

$70.9 |

|

$78.6 |

|

$188.6 |

|

$197.5 |

|

Gross Margin % |

|

|

25.3% |

|

26.2% |

|

24.0% |

|

23.7% |

|

Net Income |

|

|

$25.4 |

|

$31.7 |

|

$47.0 |

|

$55.1 |

|

Diluted EPS |

|

|

$0.77 |

|

$0.96 |

|

$1.42 |

|

$1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income |

|

|

$24.2 |

|

$31.9 |

|

$51.8 |

|

$59.7 |

|

Adjusted Diluted EPS |

|

|

$0.73 |

|

$0.97 |

|

$1.56 |

|

$1.81 |

|

Adjusted EBITDA |

|

|

$42.0 |

|

$48.5 |

|

$101.3 |

|

$108.8 |

|

Adjusted EBITDA Margin % |

|

|

15.0% |

|

16.2% |

|

12.9% |

|

13.0% |

| |

|

|

|

|

|

|

|

|

|

|

Cash Provided by Operating Activities |

|

|

$46.4 |

|

$64.1 |

|

$83.3 |

|

$102.6 |

|

Free Cash Flow |

|

|

$40.1 |

|

$56.7 |

|

$59.9 |

|

$80.1 |

(See Non-GAAP Terminology Definitions and Disclaimers section,

Non-GAAP Financial Measure Disclosure table, Selected Segment Data

table and reconciliation tables for additional information)

George Wilson, Chairman, President and Chief

Executive Officer, stated, “Overall, the results we reported for

the third quarter of 2024 were consistent with our expectations.

Consistent with the seasonality of our business, volumes increased

across all operating segments in the third quarter of this year

when compared to the second quarter. However, when compared to the

prior year, demand remained soft, but we believe the building

products industry will benefit from pent up demand once interest

rates start to trend lower and consumer confidence is restored. All

things considered, profitability for the quarter was as expected,

but due to the decrease in volumes, coupled with lower operating

leverage, margins declined year-over-year. Our continued focus on

cash flow and managing working capital enabled us to generate

approximately $40 million in free cash flow during the quarter.

“Looking ahead, work on integrating the recently

acquired Tyman business and creating something new and special

within the building products industry is in progress. Our internal

Integration Management Office team is executing on the plan to

capture the targeted synergies. In addition, we are working to

structure the organization in a manner that will enable us to

capitalize on existing commercial opportunities and tap into new

innovative solutions. We are excited about creating additional

value for our shareholders by realizing the anticipated synergies

related to this acquisition and building a stronger, more

profitable company over time.”

Third Quarter 2024 Results Summary

Quanex reported net sales of $280.3 million

during the three months ended July 31, 2024, which represents a

decrease of 6.4% compared to $299.6 million for the same period of

2023. The decrease was mostly attributable to softer market demand

across all operating segments. Quanex reported a 3.9% decrease in

net sales for the third quarter in its North American Fenestration

segment primarily due to lower volume. In its North American

Cabinet Components segment, the Company reported a decline of 7.1%

in net sales for the third quarter largely because of lower volume.

Excluding foreign exchange impact, Quanex realized a decrease in

net sales of 10.8% for the third quarter in its European

Fenestration segment mainly due to lower volume and pricing

pressure. (See Sales Analysis table for additional information)

The decrease in adjusted earnings for the three

months ended July 31, 2024 was largely attributable to decreased

operating leverage as a result of lower volumes related to softer

market demand combined with higher material costs in the Company’s

North American Fenestration and North American Cabinet Components

segments.

Balance Sheet Update

As of July 31, 2024, prior to the Tyman closing,

Quanex had total debt of $55.0 million (primarily finance leases)

and the Company was Net Debt free. As of July 31, 2024, the

Company’s LTM Net Income was $74.4 million and LTM Adjusted EBITDA

was $152.1 million. (See Non-GAAP Terminology Definitions and

Disclaimers section, Net Debt Reconciliation table and Last Twelve

Months Adjusted EBITDA Reconciliation table for additional

information)

Recent Events

As previously disclosed on August 1, 2024,

Quanex announced it had closed on its acquisition of Tyman,

creating a comprehensive solutions provider in the building

products industry. The transaction creates a larger, more

diversified supplier of components to OEMs; strengthens brand

leadership by adding Tyman’s highly recognizable brands with wide

customer bases; and enhances the combined company’s financial

profile with the goal of accelerating growth and increasing

profitability through greater scale and stronger cash flow. The

Company intends to complete approximately 50% of the integration

within the first 12 months and expects the acquisition to be

accretive to earnings within the first full year after closing.

Outlook

Mr. Wilson commented, “Since we closed on the

Tyman acquisition at the beginning of our fourth fiscal quarter,

prior guidance for 2024 is no longer valid. While we still feel

comfortable with the prior guidance for the legacy Quanex business,

we are simply layering in the contribution from the Tyman business

for the fourth quarter, which includes the impact related to

performing full physical inventory counts at every legacy Tyman

location prior to the end of our fiscal year. On a consolidated

basis, we now estimate net sales of $1.275 billion to $1.285

billion, which should result in $171 million to $176 million of

Adjusted EBITDA* in fiscal 2024.”

*When Quanex provides expectations for Adjusted

EBITDA on a forward-looking basis, a reconciliation of the

differences between the non-GAAP expectations and corresponding

GAAP measures is generally not available without unreasonable

effort. Certain items required for such a reconciliation are

outside of the Company’s control and/or cannot be reasonably

predicted or estimated, such as the provision for income taxes.

Conference Call and Webcast

Information

The Company has also scheduled a conference call

for Friday, September 6, 2024 at 11:00 a.m. ET (10:00 a.m. CT) to

discuss the release. A link to the live audio webcast will be

available on Quanex’s website at http://www.quanex.com in the

Investors section under Presentations & Events.

Participants can pre-register for the conference call using the

following link:

https://register.vevent.com/register/BI899b4025b8dc44e086b54362366d6727

Registered participants will receive an email containing

conference call details for dial-in options. To avoid delays, it is

recommended that participants dial into the conference call ten

minutes ahead of the scheduled start time. A replay will be

available for a limited time on the Company’s website at

http://www.quanex.com in the Investors section under Presentations

& Events.

About Quanex

Quanex is a global manufacturer with core

capabilities and broad applications across various end markets. The

Company currently collaborates and partners with leading OEMs to

provide innovative solutions in the window, door, vinyl fencing,

solar, refrigeration, custom mixing, building access and cabinetry

markets. Looking ahead, Quanex plans to leverage its material

science expertise and process engineering to expand into adjacent

markets.

For more information contact Scott Zuehlke,

Senior Vice President, Chief Financial Officer & Treasurer, at

713-877-5327 or scott.zuehlke@quanex.com.

Non-GAAP Terminology Definitions and

Disclaimers

Adjusted Net Income (defined as net income

further adjusted to exclude purchase price accounting inventory

step-ups, transaction costs, certain severance charges, gain/loss

on the sale of certain fixed assets, restructuring charges, asset

impairment charges, other net adjustments related to foreign

currency transaction gain/loss and effective tax rates reflecting

impacts of adjustments on a with and without basis) and Adjusted

EPS are non-GAAP financial measures that Quanex believes provide a

consistent basis for comparison between periods and more accurately

reflects operational performance, as they are not influenced by

certain income or expense items not affecting ongoing operations.

EBITDA (defined as net income or loss before interest, taxes,

depreciation and amortization and other, net), Adjusted EBITDA and

LTM Adjusted EBITDA (defined as EBITDA further adjusted to exclude

purchase price accounting inventory step-ups, transaction costs,

certain severance charges, gain/loss on the sale of certain fixed

assets, restructuring charges and asset impairment charges) are

non-GAAP financial measures that the Company uses to measure

operational performance and assist with financial decision-making.

Net Debt is defined as total debt (outstanding balance on the

revolving credit facility plus financial lease obligations) less

cash and cash equivalents. The leverage ratio of Net Debt to LTM

Adjusted EBITDA is a financial measure that the Company believes is

useful to investors and financial analysts in evaluating Quanex’s

leverage. In addition, with certain limited adjustments, this

leverage ratio is the basis for a key covenant in the Company’s

credit agreement.

Free Cash Flow is a non-GAAP measure calculated

using cash provided by operating activities less capital

expenditures. Quanex uses the Free Cash Flow metric to measure

operational and cash management performance and assist with

financial decision-making. Free Cash Flow is measured before

application of certain contractual commitments (including capital

lease obligations), and accordingly is not a true measure of the

Company’s residual cash flow available for discretionary

expenditures. Quanex believes Free Cash Flow is useful to investors

in understanding and evaluating the Company’s financial and cash

management performance.

Quanex believes that the presented non-GAAP

measures provide a consistent basis for comparison between periods

and will assist investors in understanding the Company’s financial

performance when comparing results to other investment

opportunities. The presented non-GAAP measures may not be the same

as those used by other companies. Quanex does not intend for this

information to be considered in isolation or as a substitute for

other measures prepared in accordance with U.S. GAAP.

Forward Looking Statements

Statements that use the words “estimated,”

“expect,” “could,” “should,” “believe,” “will,” “might,” or similar

words reflecting future expectations or beliefs are forward-looking

statements. The forward-looking statements include, but are not

limited to, the following: impacts from public health issues

(including pandemics) on the economy and the demand for Quanex’s

products, timing estimates or any other expectations related to the

Acquisition, the Company’s future operating results, future

financial condition, future uses of cash and other expenditures,

expenses and tax rates, expectations relating to Quanex’s industry,

and the Company’s future growth, including any guidance discussed

in this press release. The statements and guidance set forth in

this release are based on current expectations. Actual results or

events may differ materially from this release. For a complete

discussion of factors that may affect Quanex’s future performance,

please refer to the Company’s Annual Report on Form 10-K for the

fiscal year ended October 31, 2023, and the Company’s Quarterly

Reports on Form 10-Q under the sections entitled “Cautionary Note

Regarding Forward-Looking Statements” and “Risk Factors”. Any

forward-looking statements in this press release are made as of the

date hereof, and Quanex undertakes no obligation to update or

revise any forward-looking statements to reflect new information or

events.

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share data)(Unaudited) |

|

|

|

|

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

280,345 |

|

|

$ |

299,640 |

|

|

$ |

785,701 |

|

|

$ |

835,091 |

|

|

Cost of sales |

|

|

209,441 |

|

|

|

221,065 |

|

|

|

597,127 |

|

|

|

637,586 |

|

|

Selling, general and administrative |

|

|

36,509 |

|

|

|

30,516 |

|

|

|

103,579 |

|

|

|

94,631 |

|

|

Depreciation and amortization |

|

|

10,953 |

|

|

|

10,596 |

|

|

|

32,999 |

|

|

|

31,672 |

|

|

Operating income |

|

|

23,442 |

|

|

|

37,463 |

|

|

|

51,996 |

|

|

|

71,202 |

|

|

Interest expense |

|

|

(878 |

) |

|

|

(2,068 |

) |

|

|

(2,896 |

) |

|

|

(6,571 |

) |

|

Other, net |

|

|

9,474 |

|

|

|

402 |

|

|

|

10,520 |

|

|

|

591 |

|

|

Income before income taxes |

|

|

32,038 |

|

|

|

35,797 |

|

|

|

59,620 |

|

|

|

65,222 |

|

|

Income tax expense |

|

|

(6,688 |

) |

|

|

(4,099 |

) |

|

|

(12,644 |

) |

|

|

(10,103 |

) |

|

Net income |

|

$ |

25,350 |

|

|

$ |

31,698 |

|

|

$ |

46,976 |

|

|

$ |

55,119 |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share, basic |

|

$ |

0.77 |

|

|

$ |

0.97 |

|

|

$ |

1.43 |

|

|

$ |

1.68 |

|

|

Earnings per common share, diluted |

|

$ |

0.77 |

|

|

$ |

0.96 |

|

|

$ |

1.42 |

|

|

$ |

1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

|

32,876 |

|

|

|

32,716 |

|

|

|

32,857 |

|

|

|

32,841 |

|

|

Diluted |

|

|

33,106 |

|

|

|

32,919 |

|

|

|

33,087 |

|

|

|

33,031 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.08 |

|

|

$ |

0.08 |

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

|

|

|

QUANEX BUILDING PRODUCTS

CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands)(Unaudited) |

|

|

|

|

|

July 31, 2024 |

|

October 31, 2023 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

93,966 |

|

|

$ |

58,474 |

|

|

Accounts receivable, net |

|

|

87,554 |

|

|

|

97,311 |

|

|

Inventories |

|

|

99,127 |

|

|

|

97,959 |

|

|

Income taxes receivable |

|

|

1,447 |

|

|

|

8,298 |

|

|

Prepaid and other current assets |

|

|

19,305 |

|

|

|

11,558 |

|

|

Total current assets |

|

|

301,399 |

|

|

|

273,600 |

|

|

Property, plant and equipment, net |

|

|

251,890 |

|

|

|

250,664 |

|

|

Operating lease right-of-use assets |

|

|

63,642 |

|

|

|

46,620 |

|

|

Goodwill |

|

|

186,195 |

|

|

|

182,956 |

|

|

Intangible assets, net |

|

|

66,606 |

|

|

|

74,115 |

|

|

Other assets |

|

|

2,718 |

|

|

|

3,188 |

|

|

Total assets |

|

$ |

872,450 |

|

|

$ |

831,143 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

63,948 |

|

|

$ |

74,371 |

|

|

Accrued liabilities |

|

|

54,796 |

|

|

|

50,319 |

|

|

Income taxes payable |

|

|

- |

|

|

|

384 |

|

|

Current maturities of long-term debt |

|

|

2,690 |

|

|

|

2,365 |

|

|

Current operating lease liabilities |

|

|

6,435 |

|

|

|

7,224 |

|

|

Total current liabilities |

|

|

127,869 |

|

|

|

134,663 |

|

|

Long-term debt |

|

|

51,406 |

|

|

|

66,435 |

|

|

Noncurrent operating lease liabilities |

|

|

59,099 |

|

|

|

40,361 |

|

|

Deferred income taxes |

|

|

27,438 |

|

|

|

29,133 |

|

|

Other liabilities |

|

|

12,502 |

|

|

|

14,997 |

|

|

Total liabilities |

|

|

278,314 |

|

|

|

285,589 |

|

|

Stockholders’ equity: |

|

|

|

|

|

Common stock |

|

|

371 |

|

|

|

372 |

|

|

Additional paid-in-capital |

|

|

250,297 |

|

|

|

251,576 |

|

|

Retained earnings |

|

|

448,351 |

|

|

|

409,318 |

|

|

Accumulated other comprehensive loss |

|

|

(30,131 |

) |

|

|

(38,141 |

) |

|

Treasury stock at cost |

|

|

(74,752 |

) |

|

|

(77,571 |

) |

|

Total stockholders’ equity |

|

|

594,136 |

|

|

|

545,554 |

|

|

Total liabilities and stockholders' equity |

|

$ |

872,450 |

|

|

$ |

831,143 |

|

| |

|

|

|

|

|

QUANEX BUILDING PRODUCTS

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOW(In thousands)(Unaudited) |

|

|

|

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating activities: |

|

|

|

|

Net income |

$ |

46,976 |

|

|

$ |

55,119 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

|

32,999 |

|

|

|

31,672 |

|

|

Stock-based compensation |

|

2,159 |

|

|

|

1,828 |

|

|

Deferred income tax |

|

(2,321 |

) |

|

|

177 |

|

|

Gain on deal contingent foreign exchange forward currency

contract |

|

(9,200 |

) |

|

|

- |

|

|

Other, net |

|

886 |

|

|

|

2,423 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Decrease in accounts receivable |

|

11,114 |

|

|

|

9,918 |

|

|

(Increase) decrease in inventory |

|

(183 |

) |

|

|

23,864 |

|

|

Decrease (increase) in other current assets |

|

1,646 |

|

|

|

(439 |

) |

|

Decrease in accounts payable |

|

(9,634 |

) |

|

|

(15,471 |

) |

|

Increase (decrease) in accrued liabilities |

|

948 |

|

|

|

(5,152 |

) |

|

Decrease (increase) in income taxes receivable |

|

6,659 |

|

|

|

(3,534 |

) |

|

Increase in deferred pension benefits |

|

- |

|

|

|

22 |

|

|

Increase in other long-term liabilities |

|

707 |

|

|

|

609 |

|

|

Other, net |

|

577 |

|

|

|

1,523 |

|

|

Cash provided by operating activities |

|

83,333 |

|

|

|

102,559 |

|

|

Investing activities: |

|

|

|

|

Business acquisition |

|

- |

|

|

|

(91,302 |

) |

|

Capital expenditures |

|

(23,435 |

) |

|

|

(22,450 |

) |

|

Proceeds from disposition of capital assets |

|

115 |

|

|

|

183 |

|

|

Cash used for investing activities |

|

(23,320 |

) |

|

|

(113,569 |

) |

|

Financing activities: |

|

|

|

|

Borrowings under credit facilities |

|

- |

|

|

|

102,000 |

|

|

Repayments of credit facility borrowings |

|

(15,000 |

) |

|

|

(60,000 |

) |

|

Repayments of other long-term debt |

|

(1,893 |

) |

|

|

(1,954 |

) |

|

Common stock dividends paid |

|

(7,943 |

) |

|

|

(7,952 |

) |

|

Issuance of common stock |

|

573 |

|

|

|

753 |

|

|

Payroll tax paid to settle shares forfeited upon vesting of

stock |

|

(1,193 |

) |

|

|

(567 |

) |

|

Purchase of treasury stock |

|

- |

|

|

|

(5,593 |

) |

|

Cash (used for) provided by financing activities |

|

(25,456 |

) |

|

|

26,687 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

935 |

|

|

|

2,482 |

|

|

Increase in cash and cash equivalents |

|

35,492 |

|

|

|

18,159 |

|

|

Cash and cash equivalents at beginning of period |

|

58,474 |

|

|

|

55,093 |

|

|

Cash and cash equivalents at end of period |

$ |

93,966 |

|

|

$ |

73,252 |

|

| |

|

|

|

|

QUANEX BUILDING PRODUCTS CORPORATIONFREE

CASH FLOW AND NET DEBT RECONCILIATION(In

thousands)(Unaudited) |

|

|

|

The following table reconciles the Company's calculation of Free

Cash Flow, a non-GAAP measure, to its most directly comparable GAAP

measure. The Company defines Free Cash Flow as cash provided by

operating activities less capital expenditures. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash provided by operating activities |

|

|

$46,388 |

|

|

$64,099 |

|

|

$83,333 |

|

|

$102,559 |

|

|

Capital expenditures |

|

|

|

(6,252 |

) |

|

|

(7,376 |

) |

|

|

(23,435 |

) |

|

|

(22,450 |

) |

|

Free Cash Flow |

|

|

$40,136 |

|

|

$56,723 |

|

|

$59,898 |

|

|

$80,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table reconciles the Company's Net Debt which is

defined as total debt principal of the Company plus finance lease

obligations minus cash. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of July 31, |

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

Revolving credit facility |

|

|

$0 |

|

|

$55,000 |

|

|

|

|

|

|

Finance lease obligations (1) |

|

|

|

55,007 |

|

|

|

55,792 |

|

|

|

|

|

|

Total debt (2) |

|

|

|

55,007 |

|

|

|

110,792 |

|

|

|

|

|

|

Less: Cash and cash equivalents |

|

|

|

93,966 |

|

|

|

73,252 |

|

|

|

|

|

|

Net Debt |

|

|

|

($38,959 |

) |

|

$37,540 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

(1) Includes $50.7 million and $52.9 million in real estate lease

liabilities considered finance leases under U.S. GAAP as of July

31, 2024 and July 31, 2023, respectively. |

|

(2) Excludes outstanding letters of credit. |

| |

|

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS

CORPORATIONNON-GAAP FINANCIAL MEASURE

DISCLOSURELAST TWELVE MONTHS ADJUSTED EBITDA

RECONCILIATION(In thousands, except per share

data)(Unaudited) |

|

|

|

Reconciliation of Last Twelve Months Adjusted

EBITDA |

|

Three Months Ended July 31, 2024 |

|

Three Months Ended April 30, 2024 |

|

Three Months Ended January 31, 2024 |

|

Three Months Ended October 31, 2023 |

|

Total |

|

|

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Reconciliation |

|

Net income as reported |

|

$ |

25,350 |

|

|

$ |

15,377 |

|

|

$ |

6,249 |

|

|

$ |

27,382 |

|

|

$ |

74,358 |

|

|

Income tax expense |

|

|

6,688 |

|

|

|

4,314 |

|

|

|

1,642 |

|

|

|

4,442 |

|

|

|

17,086 |

|

|

Other, net |

|

|

(9,474 |

) |

|

|

(4 |

) |

|

|

(1,042 |

) |

|

|

6,110 |

|

|

|

(4,410 |

) |

|

Interest expense |

|

|

878 |

|

|

|

950 |

|

|

|

1,068 |

|

|

|

1,565 |

|

|

|

4,461 |

|

|

Depreciation and amortization |

|

|

10,953 |

|

|

|

10,894 |

|

|

|

11,152 |

|

|

|

11,194 |

|

|

|

44,193 |

|

|

EBITDA |

|

|

34,395 |

|

|

|

31,531 |

|

|

|

19,069 |

|

|

|

50,693 |

|

|

|

135,688 |

|

|

Cost of sales (1),(2) |

|

|

1,507 |

|

|

|

631 |

|

|

|

- |

|

|

|

(35 |

) |

|

|

2,103 |

|

|

Selling, general and administrative (1),(2),(3) |

|

|

6,133 |

|

|

|

7,862 |

|

|

|

205 |

|

|

|

109 |

|

|

|

14,309 |

|

|

Adjusted EBITDA |

|

$ |

42,035 |

|

|

$ |

40,024 |

|

|

$ |

19,274 |

|

|

$ |

50,767 |

|

|

$ |

152,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Expense related to plant closure. |

|

(2) Loss on damage to manufacturing facilities caused by

weather. |

|

(3) Transaction and advisory fees. |

|

|

|

|

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS

CORPORATIONNON-GAAP FINANCIAL MEASURE

DISCLOSURE(In thousands, except per share

data)(Unaudited) |

|

Reconciliation of Adjusted Net Income and Adjusted

EPS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedJuly 31, 2024 |

|

Three Months EndedJuly 31, 2023 |

|

Nine Months EndedJuly 31, 2024 |

|

Nine Months EndedJuly 31, 2023 |

|

|

|

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

Net Income |

|

Diluted EPS |

|

|

Net income as reported |

|

$ |

25,350 |

|

|

$ |

0.77 |

|

|

$ |

31,698 |

|

|

$ |

0.96 |

|

|

$ |

46,976 |

|

|

$ |

1.42 |

|

|

$ |

55,119 |

|

|

$ |

1.67 |

|

|

|

Net income reconciling items from below |

|

|

(1,199 |

) |

|

$ |

(0.04 |

) |

|

|

201 |

|

|

$ |

0.01 |

|

|

|

4,775 |

|

|

$ |

0.14 |

|

|

|

4,550 |

|

|

$ |

0.14 |

|

|

|

Adjusted net income and adjusted EPS |

|

$ |

24,151 |

|

|

$ |

0.73 |

|

|

$ |

31,899 |

|

|

$ |

0.97 |

|

|

$ |

51,751 |

|

|

$ |

1.56 |

|

|

$ |

59,669 |

|

|

$ |

1.81 |

|

|

|

Reconciliation of Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedJuly 31, 2024 |

|

Three Months EndedJuly 31, 2023 |

|

Nine Months EndedJuly 31, 2024 |

|

Nine Months EndedJuly 31, 2023 |

|

|

|

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

Reconciliation |

|

|

|

|

Net income as reported |

|

$ |

25,350 |

|

|

|

|

$ |

31,698 |

|

|

|

|

$ |

46,976 |

|

|

|

|

$ |

55,119 |

|

|

|

|

|

Income tax expense |

|

|

6,688 |

|

|

|

|

|

4,099 |

|

|

|

|

|

12,644 |

|

|

|

|

|

10,103 |

|

|

|

|

|

Other, net |

|

|

(9,474 |

) |

|

|

|

|

(402 |

) |

|

|

|

|

(10,520 |

) |

|

|

|

|

(591 |

) |

|

|

|

|

Interest expense |

|

|

878 |

|

|

|

|

|

2,068 |

|

|

|

|

|

2,896 |

|

|

|

|

|

6,571 |

|

|

|

|

|

Depreciation and amortization |

|

|

10,953 |

|

|

|

|

|

10,596 |

|

|

|

|

|

32,999 |

|

|

|

|

|

31,672 |

|

|

|

|

|

EBITDA |

|

|

34,395 |

|

|

|

|

|

48,059 |

|

|

|

|

|

84,995 |

|

|

|

|

|

102,874 |

|

|

|

|

|

EBITDA reconciling items from below |

|

|

7,640 |

|

|

|

|

|

395 |

|

|

|

|

|

16,338 |

|

|

|

|

|

5,954 |

|

|

|

|

|

Adjusted EBITDA |

|

$ |

42,035 |

|

|

|

|

$ |

48,454 |

|

|

|

|

$ |

101,333 |

|

|

|

|

$ |

108,828 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciling Items |

|

Three Months EndedJuly 31, 2024 |

|

Three Months EndedJuly 31, 2023 |

|

Nine Months EndedJuly 31, 2024 |

|

Nine Months EndedJuly 31, 2023 |

|

|

|

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

Income Statement |

|

Reconciling Items |

|

|

Net sales |

|

$ |

280,345 |

|

|

$ |

- |

|

|

$ |

299,640 |

|

|

$ |

- |

|

|

$ |

785,701 |

|

|

$ |

- |

|

|

$ |

835,091 |

|

|

$ |

- |

|

|

|

Cost of sales |

|

|

209,441 |

|

|

|

(1,507 |

) |

(1) |

|

221,065 |

|

|

|

- |

|

|

|

597,127 |

|

|

|

(2,138 |

) |

(1) |

|

637,586 |

|

|

|

(48 |

) |

(2) |

|

Selling, general and administrative |

|

|

36,509 |

|

|

|

(6,133 |

) |

(1),(3) |

|

30,516 |

|

|

|

(395 |

) |

(3) |

|

103,579 |

|

|

|

(14,200 |

) |

(1),(3) |

|

94,631 |

|

|

|

(5,906 |

) |

(2),(3) |

|

EBITDA |

|

|

34,395 |

|

|

|

7,640 |

|

|

|

48,059 |

|

|

|

395 |

|

|

|

84,995 |

|

|

|

16,338 |

|

|

|

102,874 |

|

|

|

5,954 |

|

|

|

Depreciation and amortization |

|

|

10,953 |

|

|

|

- |

|

|

|

10,596 |

|

|

|

- |

|

|

|

32,999 |

|

|

|

- |

|

|

|

31,672 |

|

|

|

- |

|

|

|

Operating income |

|

|

23,442 |

|

|

|

7,640 |

|

|

|

37,463 |

|

|

|

395 |

|

|

|

51,996 |

|

|

|

16,338 |

|

|

|

71,202 |

|

|

|

5,954 |

|

|

|

Interest expense |

|

|

(878 |

) |

|

|

- |

|

|

|

(2,068 |

) |

|

|

- |

|

|

|

(2,896 |

) |

|

|

- |

|

|

|

(6,571 |

) |

|

|

- |

|

|

|

Other, net |

|

|

9,474 |

|

|

|

(9,162 |

) |

(4) |

|

402 |

|

|

|

(126 |

) |

(4) |

|

10,520 |

|

|

|

(10,009 |

) |

(4) |

|

591 |

|

|

|

(36 |

) |

(4) |

|

Income before income taxes |

|

|

32,038 |

|

|

|

(1,522 |

) |

|

|

35,797 |

|

|

|

269 |

|

|

|

59,620 |

|

|

|

6,329 |

|

|

|

65,222 |

|

|

|

5,918 |

|

|

|

Income tax expense |

|

|

(6,688 |

) |

|

|

323 |

|

(5) |

|

(4,099 |

) |

|

|

(68 |

) |

(5) |

|

(12,644 |

) |

|

|

(1,554 |

) |

(5) |

|

(10,103 |

) |

|

|

(1,368 |

) |

(4) |

|

Net income |

|

$ |

25,350 |

|

|

$ |

(1,199 |

) |

|

$ |

31,698 |

|

|

$ |

201 |

|

|

$ |

46,976 |

|

|

$ |

4,775 |

|

|

$ |

55,119 |

|

|

$ |

4,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.77 |

|

|

|

|

$ |

0.96 |

|

|

|

|

$ |

1.42 |

|

|

|

|

$ |

1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Expense related to plant closure. |

|

|

(2) Loss on damage to manufacturing facilities caused by

weather. |

|

|

(3) Transaction and advisory fees. |

|

|

(4) Pension settlement (refund) expense, gain on foreign exchange

forward currency contract and foreign currency transaction losses

(gains). |

|

|

(5)Tax impact of net income reconciling items. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS

CORPORATIONSELECTED SEGMENT DATA(In

thousands)(Unaudited) |

|

|

|

This table provides gross margin, operating income (loss), EBITDA,

and Adjusted EBITDA by reportable segment. Non-operating expense

and income tax expense are not allocated to the reportable

segments. |

|

|

|

NA Fenestration |

|

EU Fenestration |

|

NA Cabinet Components |

|

Unallocated Corp & Other |

|

Total |

|

Three months ended July 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

170,258 |

|

|

$ |

59,617 |

|

|

$ |

51,448 |

|

|

$ |

(978 |

) |

|

$ |

280,345 |

|

|

Cost of sales |

|

|

130,301 |

|

|

|

36,930 |

|

|

|

42,911 |

|

|

|

(701 |

) |

|

|

209,441 |

|

|

Gross Margin |

|

|

39,957 |

|

|

|

22,687 |

|

|

|

8,537 |

|

|

|

(277 |

) |

|

|

70,904 |

|

|

Gross Margin % |

|

|

23.5 |

% |

|

|

38.1 |

% |

|

|

16.6 |

% |

|

|

|

|

25.3 |

% |

|

Selling, general and administrative (1) |

|

|

16,918 |

|

|

|

7,390 |

|

|

|

5,162 |

|

|

|

7,039 |

|

|

|

36,509 |

|

|

Depreciation and amortization |

|

|

5,194 |

|

|

|

2,609 |

|

|

|

3,093 |

|

|

|

57 |

|

|

|

10,953 |

|

|

Operating income (loss) |

|

|

17,845 |

|

|

|

12,688 |

|

|

|

282 |

|

|

|

(7,373 |

) |

|

|

23,442 |

|

|

Depreciation and amortization |

|

|

5,194 |

|

|

|

2,609 |

|

|

|

3,093 |

|

|

|

57 |

|

|

|

10,953 |

|

|

EBITDA |

|

|

23,039 |

|

|

|

15,297 |

|

|

|

3,375 |

|

|

|

(7,316 |

) |

|

|

34,395 |

|

|

Expense related to plant closure (Cost of sales) |

|

|

1,507 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,507 |

|

|

Expense related to plant closure (SG&A) |

|

|

125 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

125 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

6,008 |

|

|

|

6,008 |

|

|

Adjusted EBITDA |

|

$ |

24,671 |

|

|

$ |

15,297 |

|

|

$ |

3,375 |

|

|

$ |

(1,308 |

) |

|

$ |

42,035 |

|

|

Adjusted EBITDA Margin % |

|

|

14.5 |

% |

|

|

25.7 |

% |

|

|

6.6 |

% |

|

|

|

|

15.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

177,081 |

|

|

$ |

67,889 |

|

|

$ |

55,385 |

|

|

$ |

(715 |

) |

|

$ |

299,640 |

|

|

Cost of sales |

|

|

135,126 |

|

|

|

41,266 |

|

|

|

44,935 |

|

|

|

(262 |

) |

|

|

221,065 |

|

|

Gross Margin |

|

|

41,955 |

|

|

|

26,623 |

|

|

|

10,450 |

|

|

|

(453 |

) |

|

|

78,575 |

|

|

Gross Margin % |

|

|

23.7 |

% |

|

|

39.2 |

% |

|

|

18.9 |

% |

|

|

|

|

26.2 |

% |

|

Selling, general and administrative (1) |

|

|

14,254 |

|

|

|

8,039 |

|

|

|

5,095 |

|

|

|

3,128 |

|

|

|

30,516 |

|

|

Depreciation and amortization |

|

|

5,033 |

|

|

|

2,434 |

|

|

|

3,084 |

|

|

|

45 |

|

|

|

10,596 |

|

|

Operating income |

|

|

22,668 |

|

|

|

16,150 |

|

|

|

2,271 |

|

|

|

(3,626 |

) |

|

|

37,463 |

|

|

Depreciation and amortization |

|

|

5,033 |

|

|

|

2,434 |

|

|

|

3,084 |

|

|

|

45 |

|

|

|

10,596 |

|

|

EBITDA |

|

|

27,701 |

|

|

|

18,584 |

|

|

|

5,355 |

|

|

|

(3,581 |

) |

|

|

48,059 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

395 |

|

|

|

395 |

|

|

Adjusted EBITDA |

|

$ |

27,701 |

|

|

$ |

18,584 |

|

|

$ |

5,355 |

|

|

$ |

(3,186 |

) |

|

$ |

48,454 |

|

|

Adjusted EBITDA Margin % |

|

|

15.6 |

% |

|

|

27.4 |

% |

|

|

9.7 |

% |

|

|

|

|

16.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended July 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

478,027 |

|

|

$ |

165,637 |

|

|

$ |

145,663 |

|

|

$ |

(3,626 |

) |

|

$ |

785,701 |

|

|

Cost of sales |

|

|

370,930 |

|

|

|

104,327 |

|

|

|

124,278 |

|

|

|

(2,408 |

) |

|

|

597,127 |

|

|

Gross Margin |

|

|

107,097 |

|

|

|

61,310 |

|

|

|

21,385 |

|

|

|

(1,218 |

) |

|

|

188,574 |

|

|

Gross Margin % |

|

|

22.4 |

% |

|

|

37.0 |

% |

|

|

14.7 |

% |

|

|

|

|

24.0 |

% |

|

Selling, general and administrative (1) |

|

|

46,558 |

|

|

|

23,008 |

|

|

|

15,354 |

|

|

|

18,659 |

|

|

|

103,579 |

|

|

Depreciation and amortization |

|

|

15,887 |

|

|

|

7,705 |

|

|

|

9,240 |

|

|

|

167 |

|

|

|

32,999 |

|

|

Operating income (loss) |

|

|

44,652 |

|

|

|

30,597 |

|

|

|

(3,209 |

) |

|

|

(20,044 |

) |

|

|

51,996 |

|

|

Depreciation and amortization |

|

|

15,887 |

|

|

|

7,705 |

|

|

|

9,240 |

|

|

|

167 |

|

|

|

32,999 |

|

|

EBITDA |

|

|

60,539 |

|

|

|

38,302 |

|

|

|

6,031 |

|

|

|

(19,877 |

) |

|

|

84,995 |

|

|

Expense related to plant closure (Cost of sales) |

|

|

2,138 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,138 |

|

|

Expense related to plant closure (SG&A) |

|

|

1,103 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,103 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

13,097 |

|

|

|

13,097 |

|

|

Adjusted EBITDA |

|

$ |

63,780 |

|

|

$ |

38,302 |

|

|

$ |

6,031 |

|

|

$ |

(6,780 |

) |

|

$ |

101,333 |

|

|

Adjusted EBITDA Margin % |

|

|

13.3 |

% |

|

|

23.1 |

% |

|

|

4.1 |

% |

|

|

|

|

12.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Nine months ended July 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

487,036 |

|

|

$ |

186,604 |

|

|

$ |

163,577 |

|

|

$ |

(2,126 |

) |

|

$ |

835,091 |

|

|

Cost of sales |

|

|

382,315 |

|

|

|

119,421 |

|

|

|

136,722 |

|

|

|

(872 |

) |

|

|

637,586 |

|

|

Gross Margin |

|

|

104,721 |

|

|

|

67,183 |

|

|

|

26,855 |

|

|

|

(1,254 |

) |

|

|

197,505 |

|

|

Gross Margin % |

|

|

21.5 |

% |

|

|

36.0 |

% |

|

|

16.4 |

% |

|

|

|

|

23.7 |

% |

|

Selling, general and administrative (1) |

|

|

41,707 |

|

|

|

23,996 |

|

|

|

15,939 |

|

|

|

12,989 |

|

|

|

94,631 |

|

|

Depreciation and amortization |

|

|

15,328 |

|

|

|

7,135 |

|

|

|

8,988 |

|

|

|

221 |

|

|

|

31,672 |

|

|

Operating income (loss) |

|

|

47,686 |

|

|

|

36,052 |

|

|

|

1,928 |

|

|

|

(14,464 |

) |

|

|

71,202 |

|

|

Depreciation and amortization |

|

|

15,328 |

|

|

|

7,135 |

|

|

|

8,988 |

|

|

|

221 |

|

|

|

31,672 |

|

|

EBITDA |

|

|

63,014 |

|

|

|

43,187 |

|

|

|

10,916 |

|

|

|

(14,243 |

) |

|

|

102,874 |

|

|

Loss on damage to manufacturing facilities (Cost of sales) |

|

|

35 |

|

|

|

- |

|

|

|

13 |

|

|

|

- |

|

|

|

48 |

|

|

Loss on damage to manufacturing facilities (SG&A) |

|

|

- |

|

|

|

- |

|

|

|

200 |

|

|

|

- |

|

|

|

200 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,706 |

|

|

|

5,706 |

|

|

Adjusted EBITDA |

|

$ |

63,049 |

|

|

$ |

43,187 |

|

|

$ |

11,129 |

|

|

$ |

(8,537 |

) |

|

$ |

108,828 |

|

|

Adjusted EBITDA Margin % |

|

|

12.9 |

% |

|

|

23.1 |

% |

|

|

6.8 |

% |

|

|

|

|

13.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation expense for the three and

nine months ended July 31, 2024 of $1.3 million and $2.5 million,

respectively, and $5.3 million and $7.6 million for the comparable

prior year periods. |

| |

|

|

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS CORPORATIONSALES

ANALYSIS(In thousands)(Unaudited) |

|

|

| |

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

NA Fenestration: |

|

|

|

|

|

|

|

| |

United States - fenestration |

$ |

131,394 |

|

|

$ |

138,090 |

|

|

$ |

362,674 |

|

|

$ |

379,613 |

|

| |

International - fenestration |

|

6,950 |

|

|

|

8,542 |

|

|

|

20,559 |

|

|

|

22,019 |

|

| |

United States - non-fenestration |

|

27,873 |

|

|

|

26,423 |

|

|

|

81,196 |

|

|

|

73,823 |

|

| |

International - non-fenestration |

|

4,041 |

|

|

|

4,026 |

|

|

|

13,598 |

|

|

|

11,581 |

|

| |

|

$ |

170,258 |

|

|

$ |

177,081 |

|

|

$ |

478,027 |

|

|

$ |

487,036 |

|

|

EU Fenestration: (1) |

|

|

|

|

|

|

|

| |

International - fenestration |

$ |

50,551 |

|

|

$ |

51,752 |

|

|

$ |

139,270 |

|

|

$ |

142,009 |

|

| |

International - non-fenestration |

|

9,066 |

|

|

|

16,137 |

|

|

|

26,367 |

|

|

|

44,595 |

|

| |

|

$ |

59,617 |

|

|

$ |

67,889 |

|

|

$ |

165,637 |

|

|

$ |

186,604 |

|

|

NA Cabinet Components: |

|

|

|

|

|

|

|

|

|

United States - fenestration |

$ |

3,791 |

|

|

$ |

4,486 |

|

|

$ |

11,203 |

|

|

$ |

12,613 |

|

| |

United States - non-fenestration |

|

47,287 |

|

|

|

50,199 |

|

|

|

133,456 |

|

|

|

148,774 |

|

| |

International - non-fenestration |

|

370 |

|

|

|

700 |

|

|

|

1,004 |

|

|

|

2,190 |

|

| |

|

$ |

51,448 |

|

|

$ |

55,385 |

|

|

$ |

145,663 |

|

|

$ |

163,577 |

|

|

Unallocated Corporate & Other: |

|

|

|

|

|

|

|

| |

Eliminations |

$ |

(978 |

) |

|

$ |

(715 |

) |

|

$ |

(3,626 |

) |

|

$ |

(2,126 |

) |

| |

|

$ |

(978 |

) |

|

$ |

(715 |

) |

|

$ |

(3,626 |

) |

|

$ |

(2,126 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Sales |

$ |

280,345 |

|

|

$ |

299,640 |

|

|

$ |

785,701 |

|

|

$ |

835,091 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Reflects a decrease of $0.9 million and an increase $0.7

million in revenue associated with foreign currency exchange rate

impacts for the three and nine months ended July 31, 2024,

respectively. |

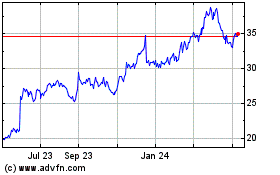

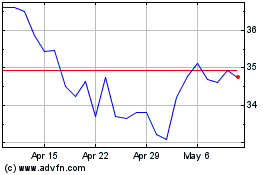

Quanex (NYSE:NX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quanex (NYSE:NX)

Historical Stock Chart

From Nov 2023 to Nov 2024