Home Depot's $1 Billion Bond Priced - Source

September 07 2010 - 4:02PM

Dow Jones News

Home Depot Inc.'s (HD) $1 billion bond has priced, according to

a person familiar with the deal.

The $500 million 10-year tranche sold at 135 basis points over

Treasurys to yield 2.626% and the $500 million 30-year tranche sold

at 175 basis points over Treasurys to yield 3.67%, the person

said.

Burlington Northern Santa Fe LLC's $750 million two-part bond

has also priced, according to a person familiar with the

matter.

The $250 million 10-year tranche sold at 100 basis points over

Treasurys to yield 3.616% and the $500 million 30-year part sold at

140 basis points over Treasurys to yield 5.074%.

These bonds are some of several new investment-grade bonds

flooding the market Tuesday, with Dell Inc. (DELL) and other

top-rated companies issuing more than $9 billion in debt--exceeding

the total of $5.35 billion in all of September last year.

Companies were able to take advantage of low interest rates

because investors had few savory alternatives: stock market

volatility spiked on renewed concern about the health of Europe's

biggest banks and yields on money markets and government debt are

plumbing record lows.

"Interest rates are low, we got past the payroll numbers on

Friday and everyone is chasing yields," said Patrick Sporl, a

senior portfolio manager at American Beacon Advisors in Fort Worth,

Texas.

Tuesday was especially busy because this week--the first after

the unofficial end of summer--includes two holidays: Labor Day on

Monday and Rosh Hashana, the Jewish New Year, starting Wednesday at

sundown. "The calendar is such that we have a lot of deals," Sporl

said. In a holiday-shortened week, he added, issuers are keen to

sell bonds sooner rather than later.

Dell was selling a $1.5 billion deal, as were the Canadian

Imperial Bank of Commerce (CM, CM.T) and insurer AON Corp. (AON).

Home Depot's sale was its first bond sale since 2006, Medco Health

Solutions Inc. (MHS) and soft-drinks bottler International CCE both

were also selling $1 billion in debt.

Canadian Imperial Bank of Commerce's three-year note has

launched, according to a person familiar with the matter, and is

due to price later Tuesday. It is rated Aa2/A+/AA- and launched at

75 basis points over Treasurys. Barclays Capital, Citigroup Inc.,

JP Morgan Chase & Co. and CIBC are leading the sale.

International CCE's $1 billion bond has also launched, according

to a person familiar with the matter. The 10-year $525 million

tranche launched at 100 basis points over Treasurys and the

five-year $475 million portion launched at 80 basis points over

Treasurys. The bond will price later Tuesday.

Also Tuesday, France Telecom's $750 million bond has priced,

according to a person familiar with the matter.

The bond sold at 82 basis points over Treasurys, to yield

2.238%.

Allergan Inc. (AGN) was in the market with a $650 million

10-year note and Hospira Inc. (HSP) with a $500 million 30-year

bond.

Societe General (SCGLY, GLE.FR) and Province of Ontario had

benchmark notes, Health Care REIT Inc. (HCN) had a $450 million

seven-year note and Parker Hannifin Corp. (PH) had a $300 million

note.

-By Anusha Shrivastava, Dow Jones Newswires; 212-416-2227;

anusha.shrivastava@dowjones.com

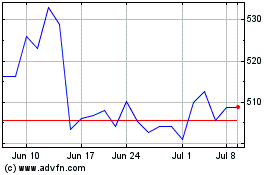

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From May 2024 to Jun 2024

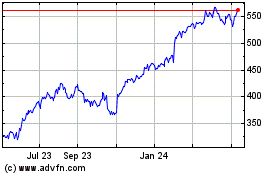

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From Jun 2023 to Jun 2024