UPDATE:Deluge Of Investment-Grade Bonds Floods New-Issues Market

September 07 2010 - 3:05PM

Dow Jones News

A deluge of new investment-grade bonds flooded the market

Tuesday, with Dell Inc. (DELL), Home Depot Inc. (HD) and other

top-rated companies issuing more than $9 billion in debt--exceeding

the total of $5.35 billion in all of September last year.

Companies were able to take advantage of low interest rates

because investors had few savory alternatives: Stock market

volatility spiked on renewed concern about the health of Europe's

biggest banks and yields on money markets and government debt are

plumbing record lows.

"Interest rates are low, we got past the payroll numbers on

Friday and everyone is chasing yields," said Patrick Sporl, a

senior portfolio manager at American Beacon Advisors in Fort Worth,

Texas.

Tuesday was especially busy because this week--the first after

the unofficial end of summer--includes two holidays: Labor Day on

Monday and Rosh Hashanah, the Jewish New Year starting Wednesday at

sundown. "The calendar is such that we have a lot of deals," Sporl

said. In a holiday-shortened week, he added, issuers are keen to

sell bonds sooner rather than later.

Dell was selling a $1.5 billion deal, as were the Canadian

Imperial Bank of Commerce (CM) and the insurer AON Corp. (AON).

Home Depot was selling $1 billion of debt, its first bond sale

since 2006, as were Medco Health Solutions Inc. (MHS) and

International CCE Inc., the soft-drinks bottler.

France Telecom (FTE, FTE.FR) was in the market with a $750

million five-year note; Allergan Inc. (AGN) with a $650 million

10-year note; Hospira Inc. (HSP) with a $500 million 30-year bond;

and Burlington Northern Santa Fe (BNI), with a $500 million

note.

Societe General and Province of Ontario had benchmark notes,

Health Care Reit Inc. (HCN) had a $450 million seven-year note and

Parker Hannifin (PH) had a $300 million note.

Canadian Imperial Bank of Commerce's three-year note has

launched, according to a person familiar with the matter, and is

due to price later Tuesday. It is rated Aa2/A+/AA- and launched at

75 basis points over Treasurys. Barclays Capital, Citigroup Inc.,

J.P. Morgan Chase & Co. and CIBC are leading the sale.

Dell's $1.5 billion three-part note has maturities of three,

five and 30 years. The $500 million three-year tranche launched at

70 basis points over Treasurys, the $700 million five-year tranche

launched at 90 basis points over Treasurys and the $300 million

30-year portion launched at 175 basis points over Treasurys. The

bond, joint led by Barclays Capital, Goldman Sachs and Morgan

Stanley, will price later Tuesday.

International CCE's $1 billion bond has launched, according to a

person familiar with the matter.

The 10-year $525 million tranche launched at 100 basis points

over Treasurys and the five-year $475 million portion launched at

80 basis points over Treasurys. The bond will price later

Tuesday.

Meanwhile, France Telecom's $750 million bond has priced,

according to a person familiar with the matter.

The bond sold at 82 basis points over Treasurys, to yield

2.238%.

-By Anusha Shrivastava, Dow Jones Newswires; 212-416-2227;

anusha.shrivastava@dowjones.com

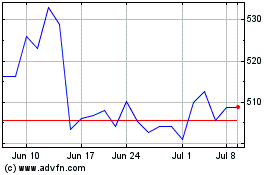

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From May 2024 to Jun 2024

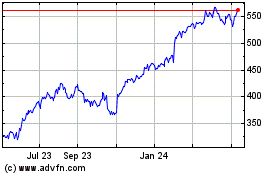

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From Jun 2023 to Jun 2024