High Profit Makers: Industrial Goods Sector and Great Investment Ideas

March 05 2010 - 8:54AM

Marketwired

The biggest gains during the previous month came from companies in

the industrial goods sector. Operational efficiency and

profitability along the entire industrial chain is enhanced in many

corporations which have adopted global corporate strategies. "Most

companies belonging to this sector are highfliers; it takes a great

deal to track its monthly trends across the market. Chasing these

companies today will lead to great investment ideas and will

provide new opportunities on stocks you have in your portfolio."

says Rothman Research analyst Mathew Collier.

Recent reports conducted by leading research firm

www.rothmanresearch.com shows developments on two major Industrial

Goods companies - Owens Corning (NYSE: OC) and Weyerhaeuser Co.

(NYSE: WY). These studies show interesting results which can guide

investors in tracking great entry points to these companies.

* These research are available for free to members who sign up

now to

http://www.rothmanresearch.com/article/oc/23154/Mar-05-2010.html or

http://www.rothmanresearch.com/article/wy/23155/Mar-05-2010.html

*

Owens Corning is a producer of glass fiber

reinforcements and other materials for composites and of

residential and commercial building materials. It is a market

leader in insulation. The Company operates in two business

segments: composites, which include the Company's reinforcements

and downstream businesses, and building materials, which includes

its insulation, roofing and other businesses. Its products range

from glass fiber used to reinforce composite materials for

transportation, electronics, marine, infrastructure, wind-energy

and other markets to insulation, roofing and manufactured stone

veneer for residential, commercial and industrial applications.

During the year ended December 31, 2009, the company's

composites and building materials business segments accounted for

approximately 33% and 67% of total net sales. Owens Corning

achieved outstanding fourth-quarter results led by record earnings

in their Roofing business. The company demonstrated impressive

ability to grow margins during a challenging demand environment.

For more information, visit our web site at

http://www.rothmanresearch.com/index.php?id=6&name=Register

Weyerhaeuser Co. is once among the most

diversified firms in the forest product industry, with product

lines spanning paper, packaging, and lumber, Weyerhaeuser is on a

dramatically different path after management's strategic shift. Not

long after shedding its paper business, the company cut another

branch from its corporate tree, selling its packaging business to

erstwhile competitor International Paper IP.

The end game probably entails operation as a timber real estate

investment trust in order to take advantage of associated tax

benefits. The company announced that its Cellulose Fibers business

segment has successfully introduced a new grade of Kraft pulp for

specific segments of the cellulose derivatives market.

Weyerhaeuser Co. and Mitsubishi Corporation signed a Strategic

Memorandum of Understanding (MOU) to explore the possibilities of

collaborating in the biomass-to-energy business.

*Free downloadable reports of the intensive research is

available by signing up now for free at

http://www.rothmanresearch.com/index.php?id=6&name=Register

*

Companies looking for additional media or

advertising services can call Blue Chip IR at

1-917-267-8836

About Rothman Research

Rothman Research brings independent company and sector research

together, utilizing top financial advisors and investment tactics

to provide you with a clear picture of investment

opportunities.

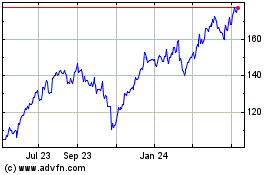

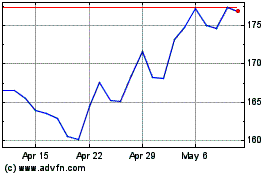

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jul 2024 to Jul 2024

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jul 2023 to Jul 2024